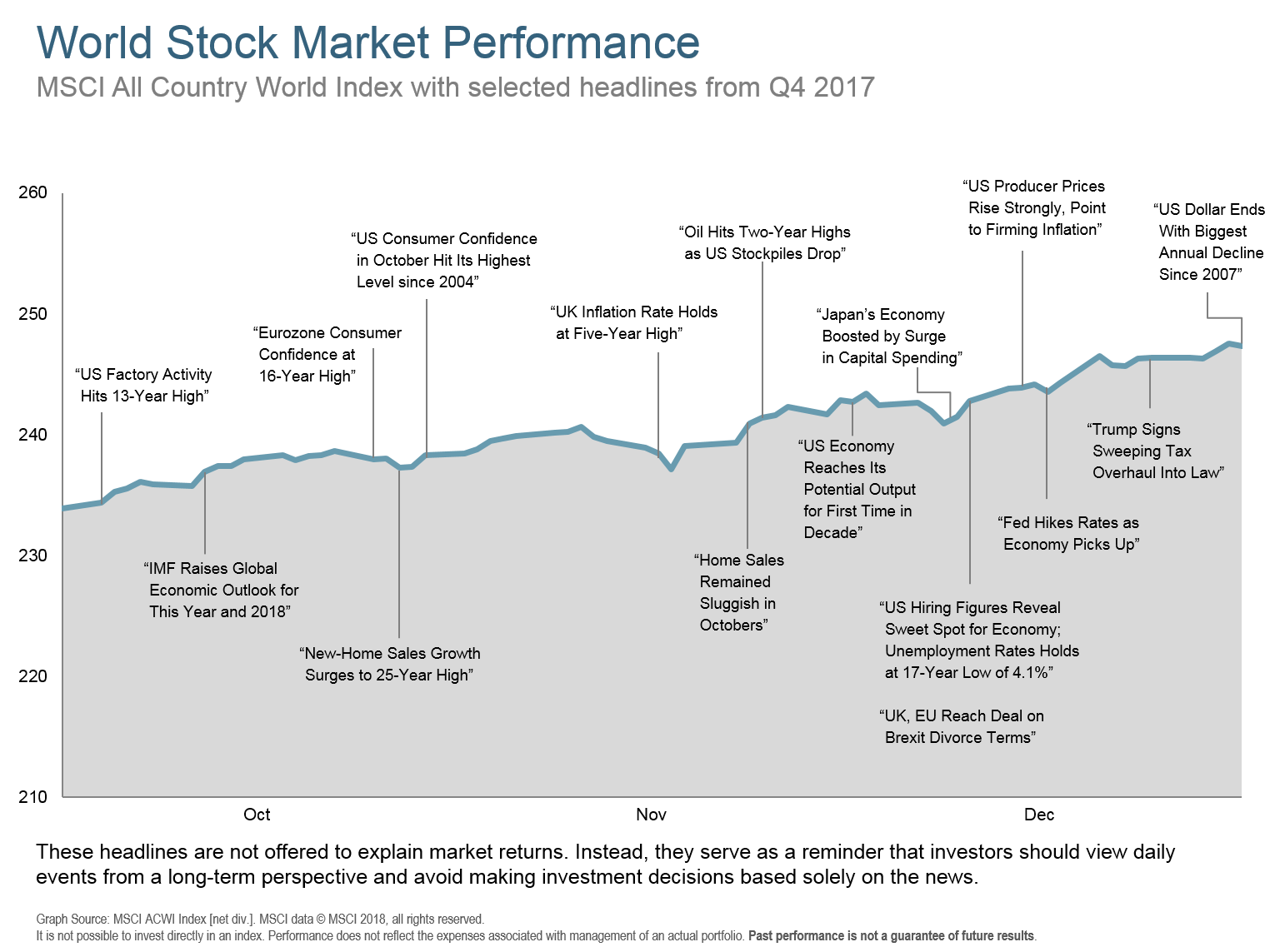

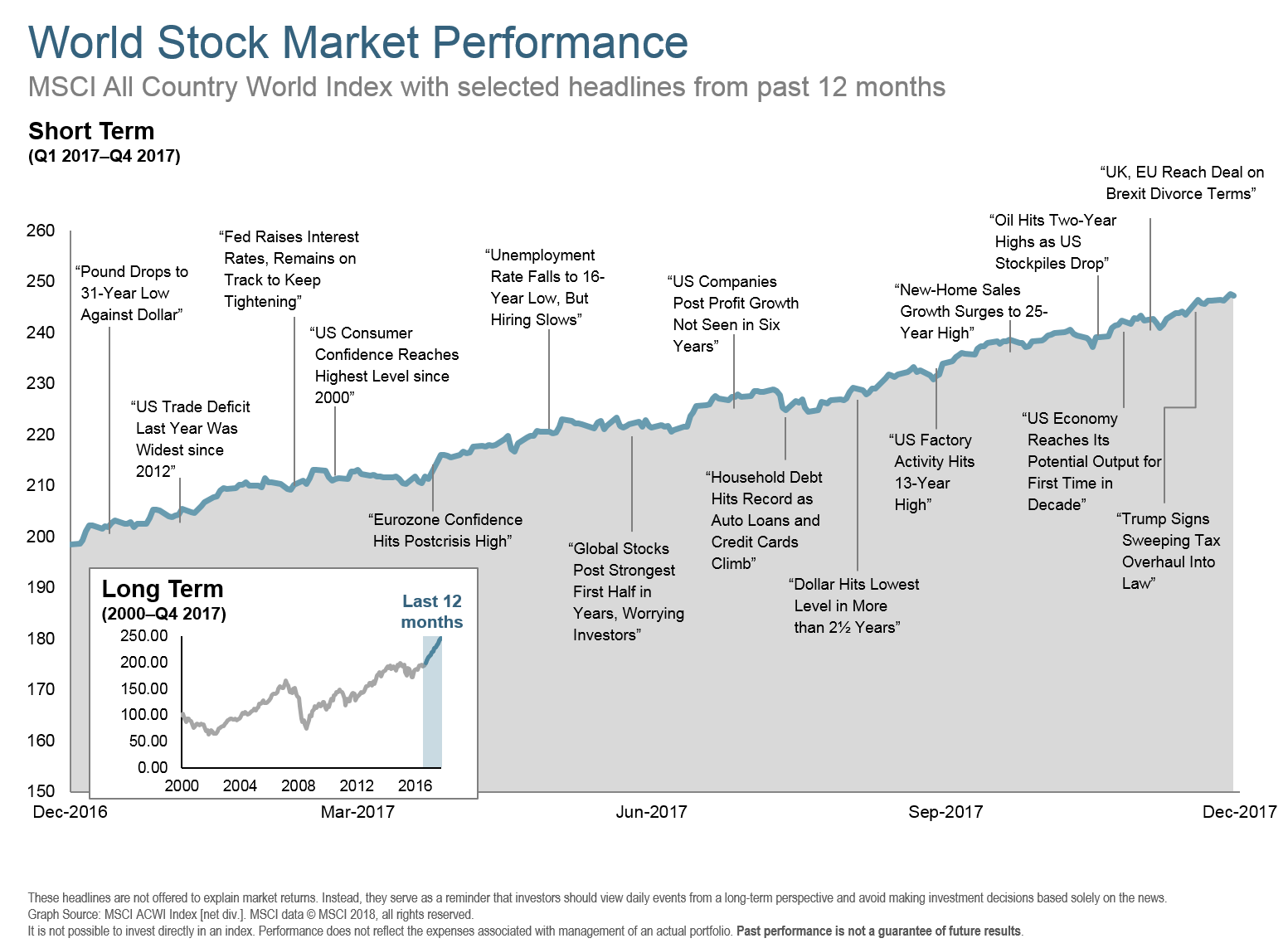

Last year, at this time, post election market gains were attributed to the prospects of a Republican controlled federal government busting through years of gridlock to reduce regulations, cut taxes, and maybe even launch some infrastructure projects (if walls count). The rally has seemingly continued non-stop, and Q4 of 2017 was no exception, even though the GOP couldn't seem to get much done until finally passing the Tax Cuts and Jobs Act in late December. Equity markets rallied in anticipation of the tax cuts, and have continued to melt up as low interest rates, low unemployment, low inflation, and now lower taxes have created a "just right" market environment.

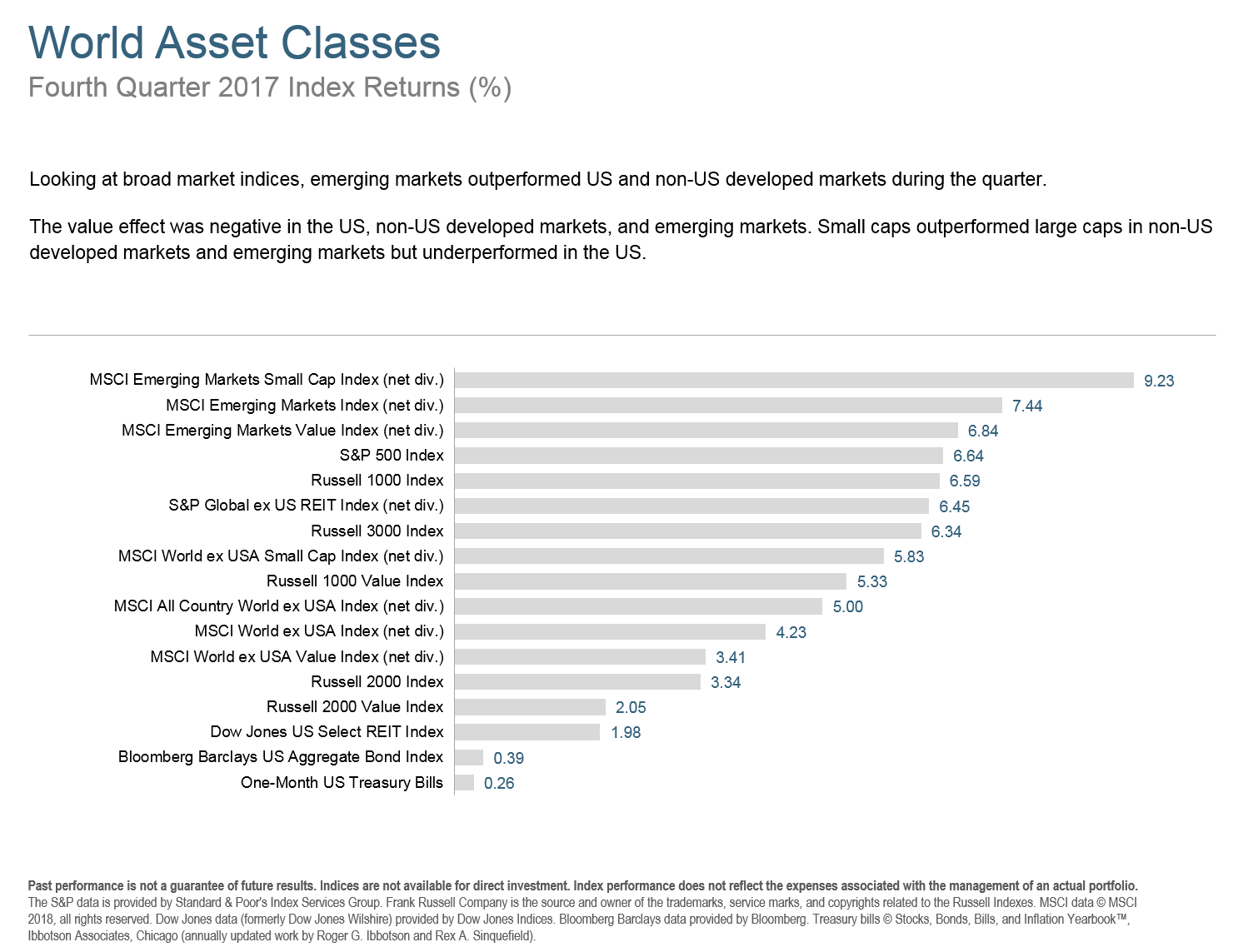

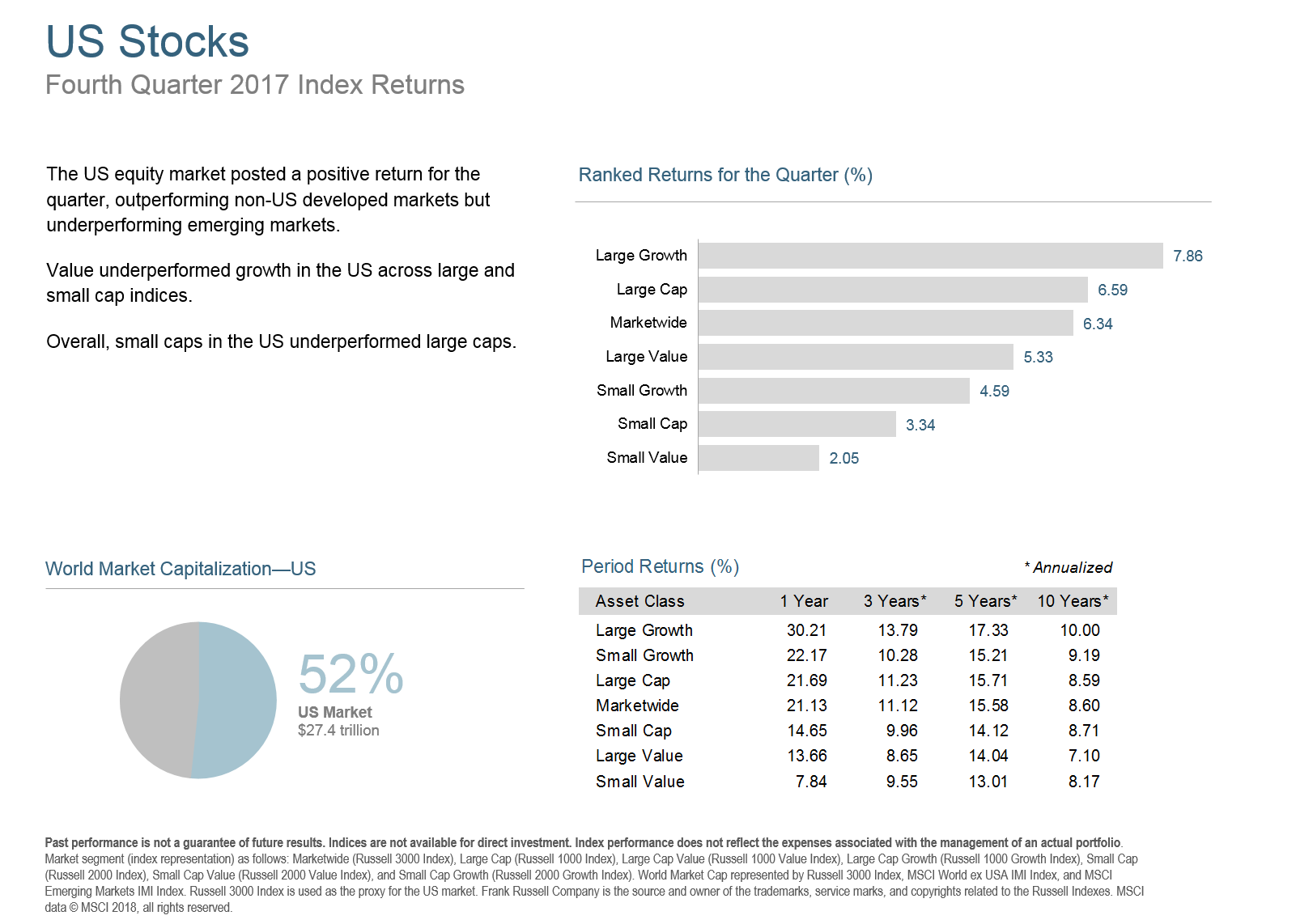

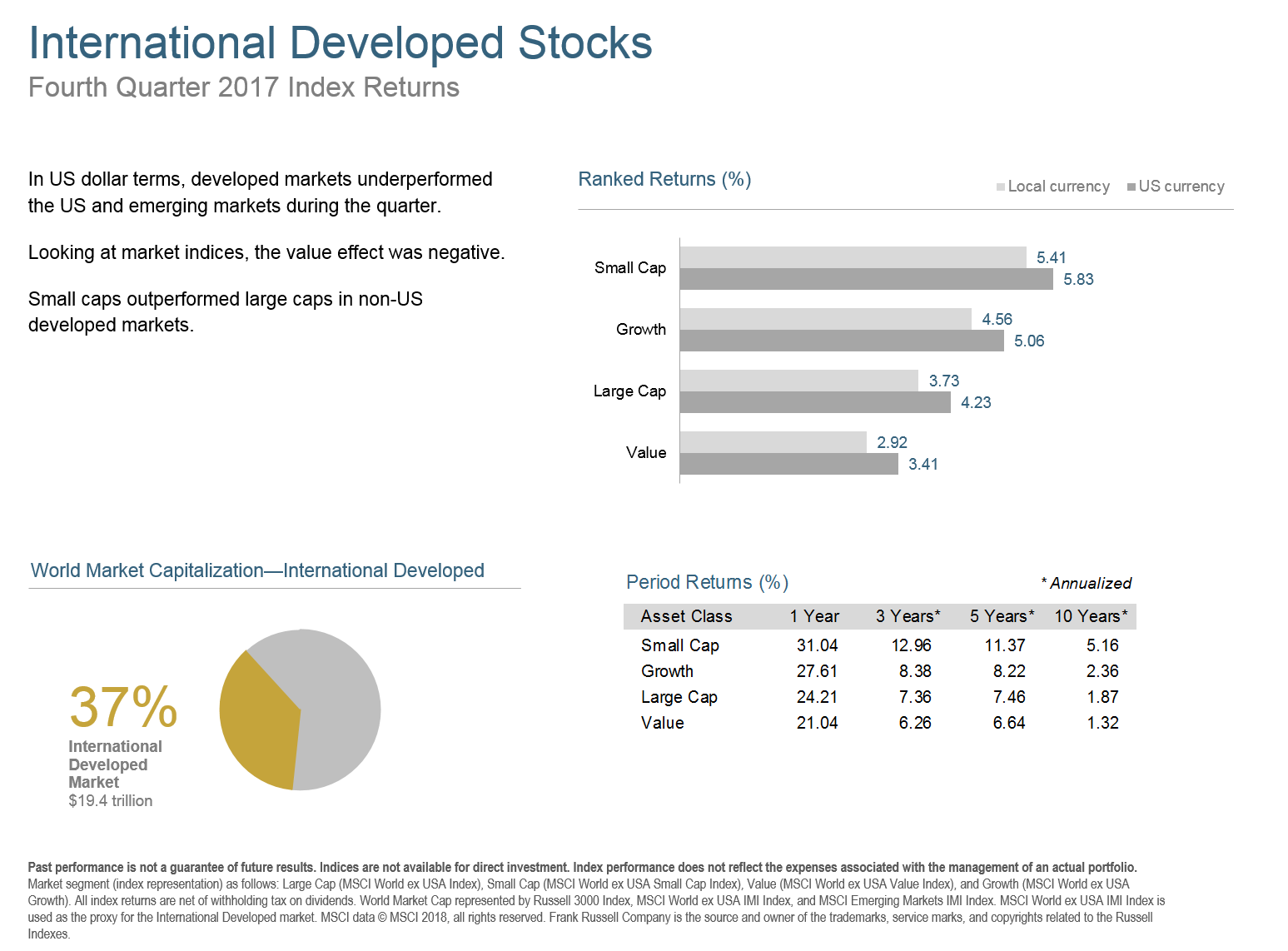

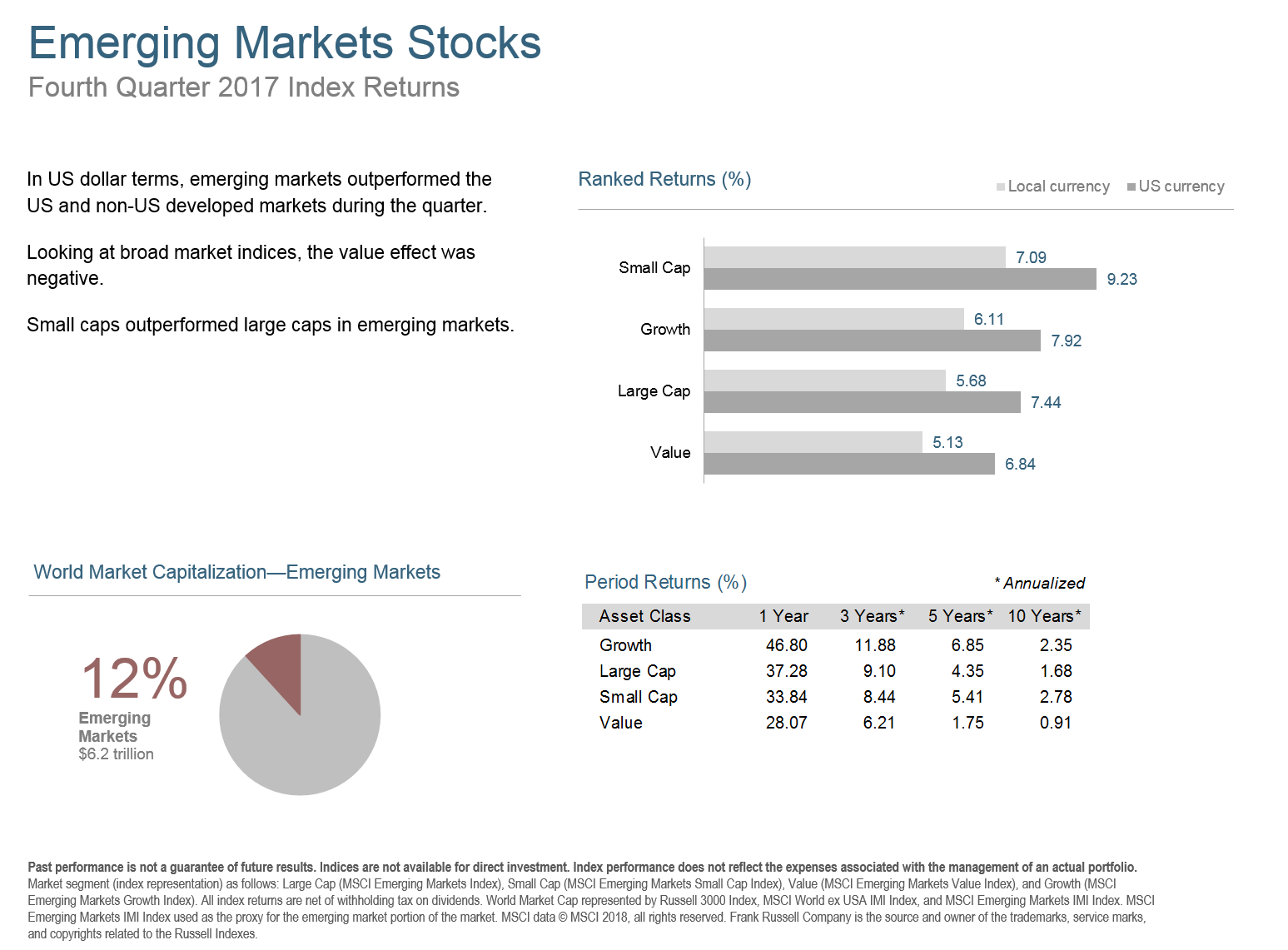

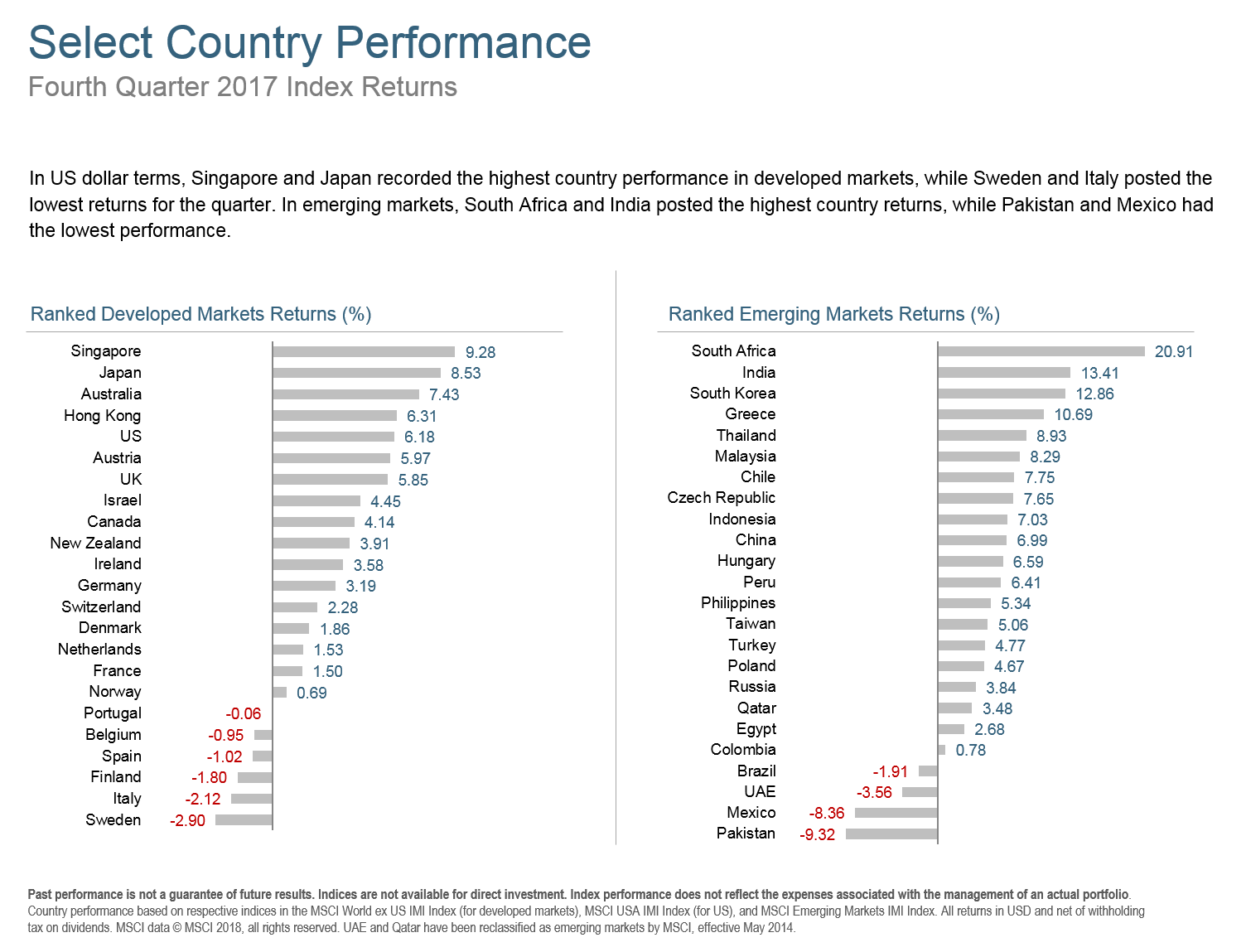

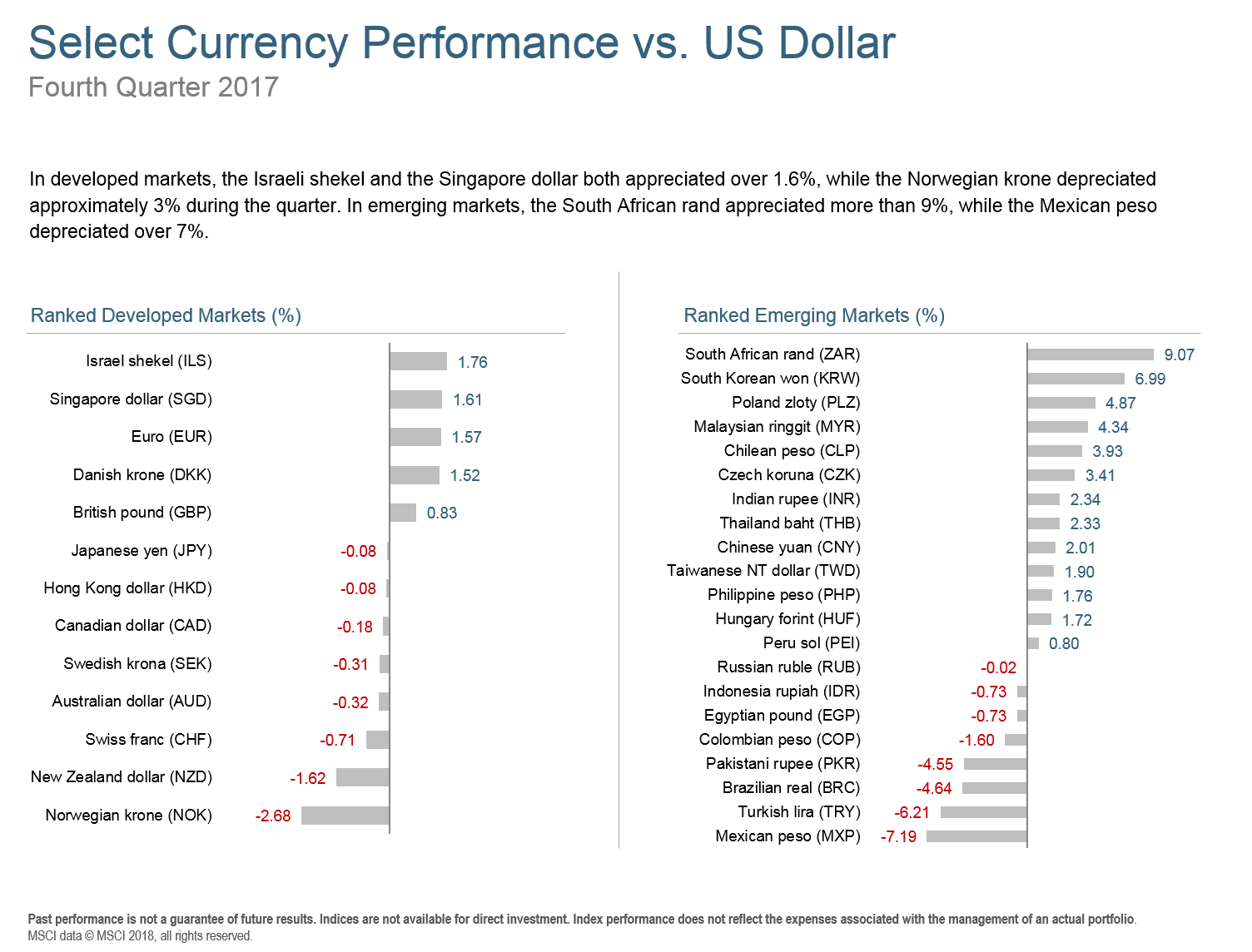

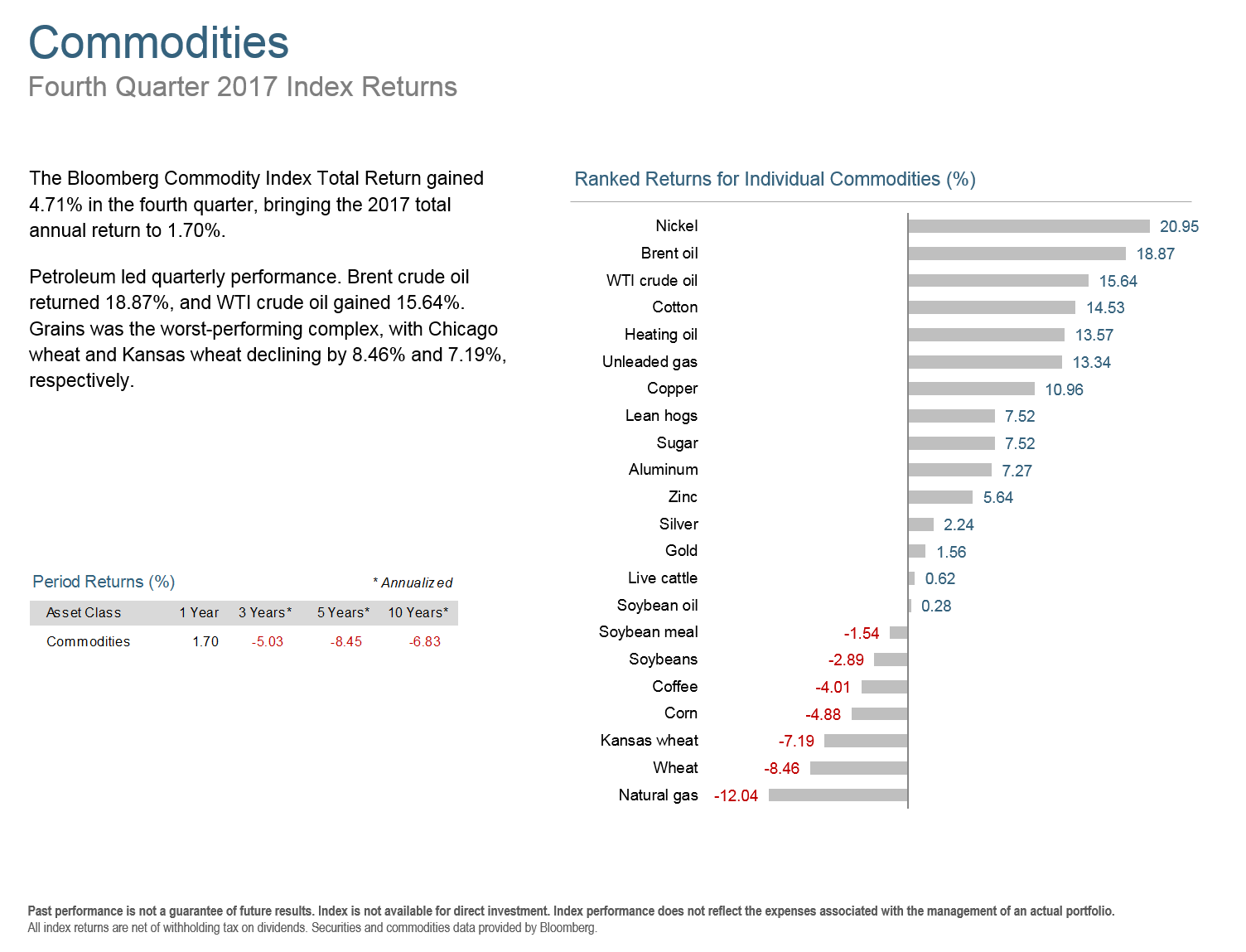

At this rate, the late-night comedians may have to stop joking about a certain person’s hair while Goldilocks continues to manage a tumultuous pot of not too hot and not too cold porridge. The Fed raised rates again in December, but US stocks hardly seemed to notice. Global equity markets also posted strong gains, with emerging markets leading the way. Commodities also sprung to life in Q4, with petroleum fueling the rise.

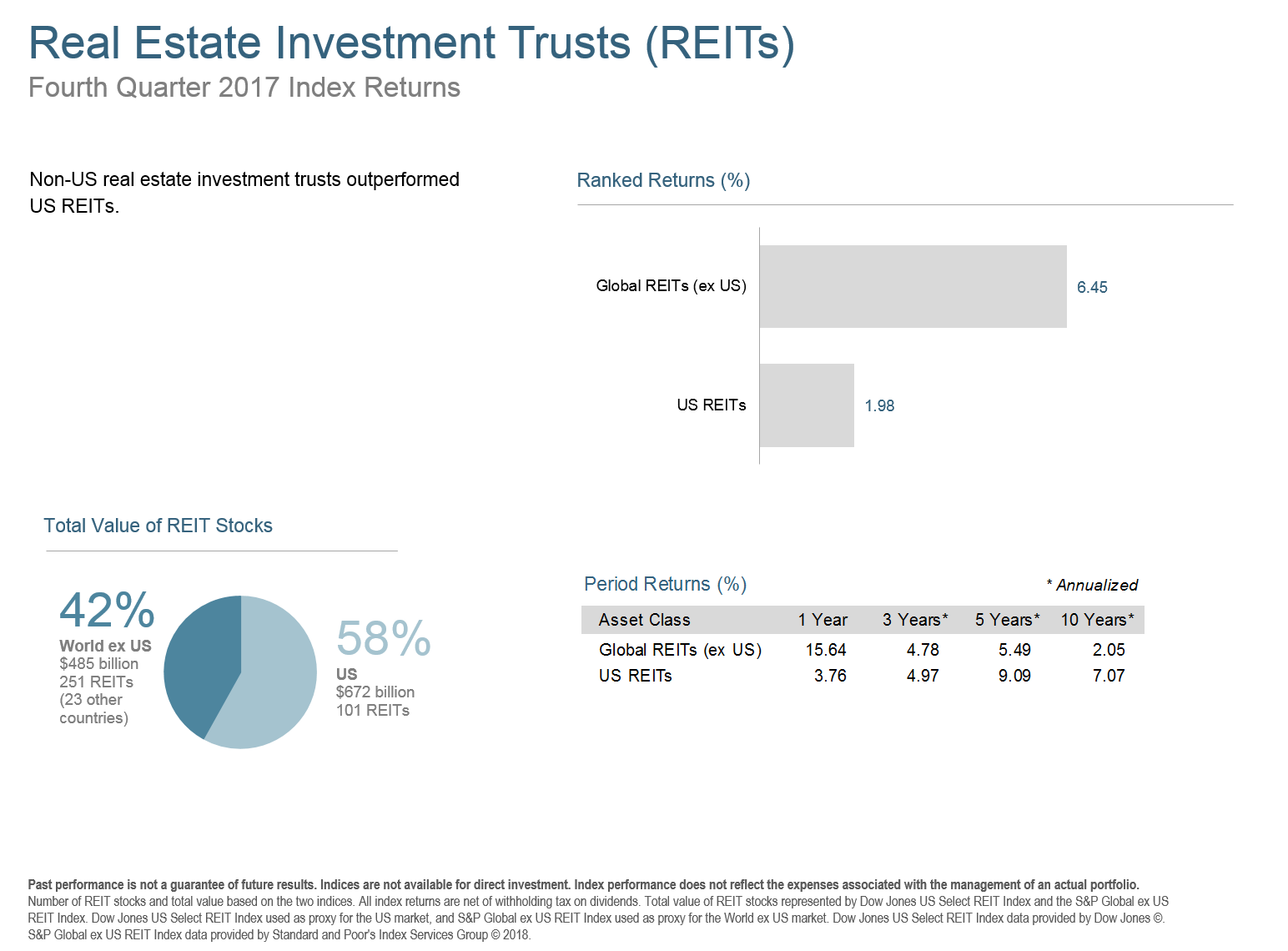

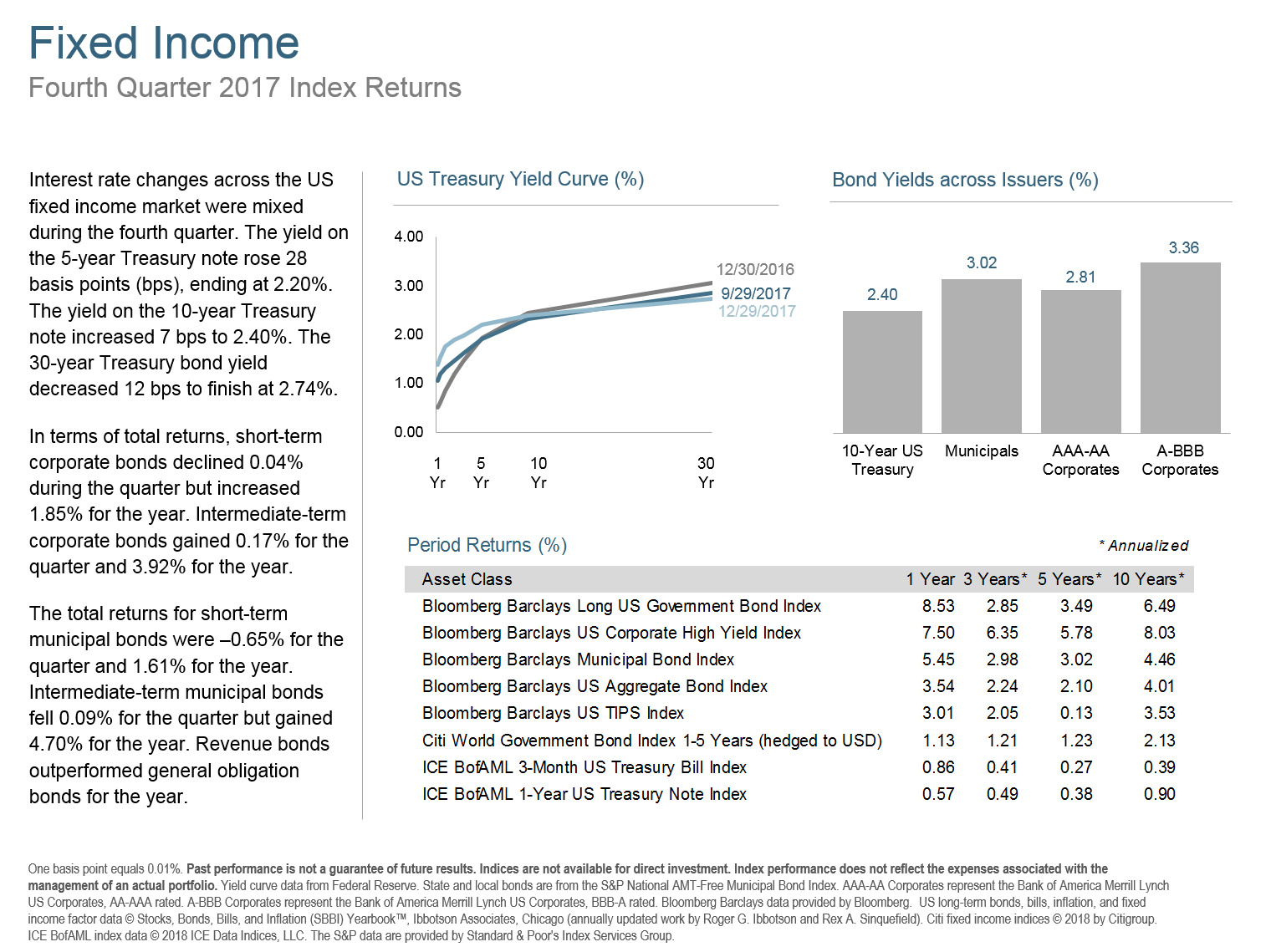

Even fixed income markets and REITs, normally the most sensitive to rising rates, managed to eke out gains, especially globally. Municipal bonds tended to lag corporate and government bonds though, at least partly due to the uncertainties of how tax reform would impact them.

Emerging Markets ended the year much as they began, on a tear. In the US, Large Cap stocks and Growth stocks were the star performers. The Russell 1000 Growth Index outpaced the overall Russell 3000 index by 1.52%, while logging a 5.81% difference over the Small Cap Russell 2000 Value index.

The “experts”, as always, will make predictions about what will come next. In just the past week, I’ve seen prominent fund managers and analysts predict imminent corrections and double-digit rallies. "What to do?" is a natural question to ask, but my response will be remarkably similar each time.

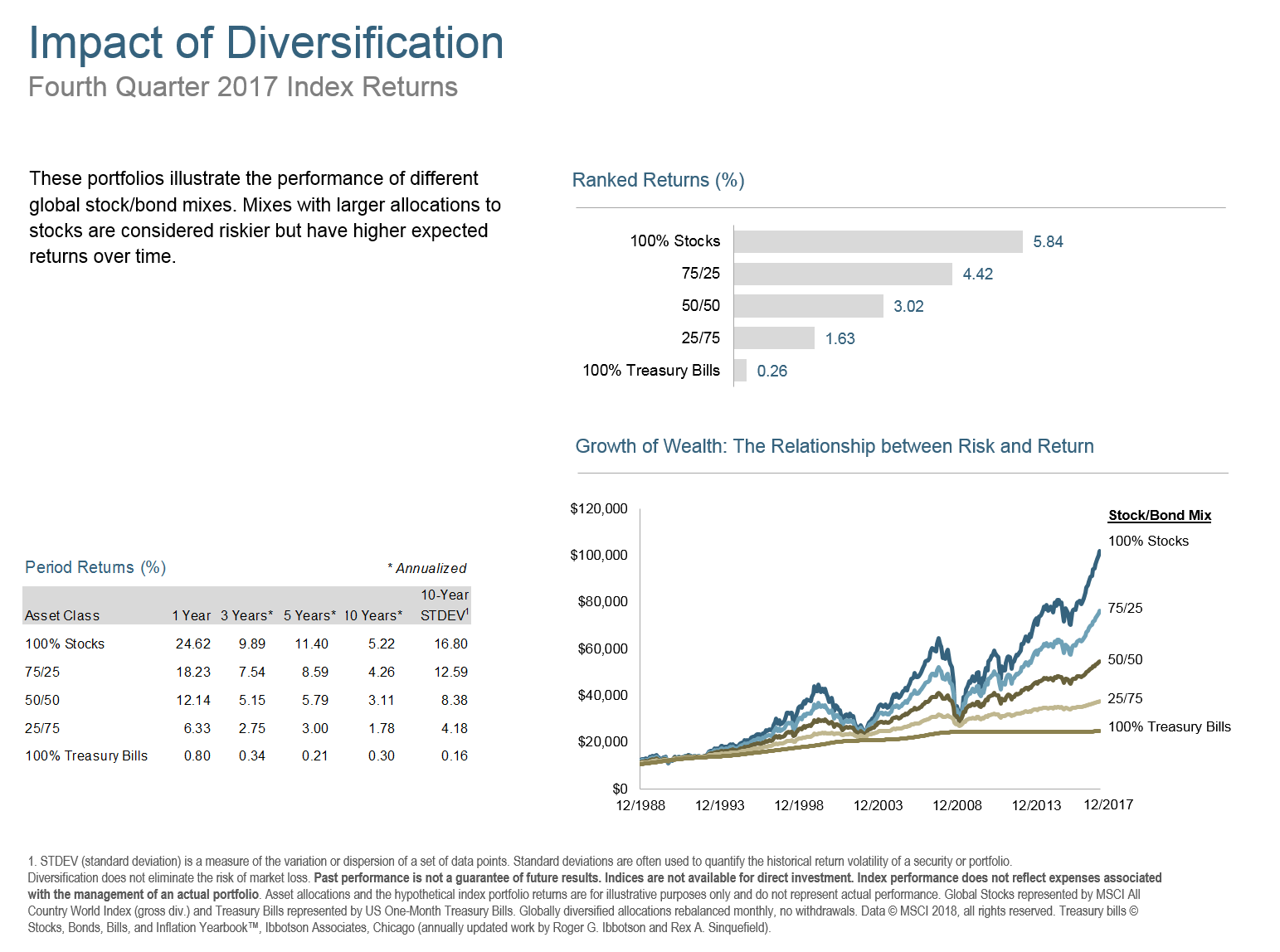

Confirm that your portfolio’s risk stance is consistent with your goals and timeframes. If your investments are now more aggressive than intended due to market gains, it may be time to sell some of your best performers and move those profits into the underrepresented portions of your mix. That probably means selling some of your stock holdings to buy lagging bonds, REITs, or commodities.

Will that guarantee better returns? No, it won’t. But to quote Nobel prize winning economist Harry Markowitz, when asked what his best tips about money were:

“I only have one piece of advice: Diversify. And if I had to offer a second piece of advice, it would be: Remember that the future will not necessarily be like the past. Therefore we should diversify.[i]”

Or you could follow Goldilocks' plan of filling up on all the free food and laying down in the bears' den to take a nap. If that doesn't sound like much of a plan, maybe you should get in touch.

The Q4 2017 Market Review consist of a dozen slides that summarize performance of a wide range of asset classes. Also, don’t miss 2017 Market Review, that similarly looks back on the entire year.