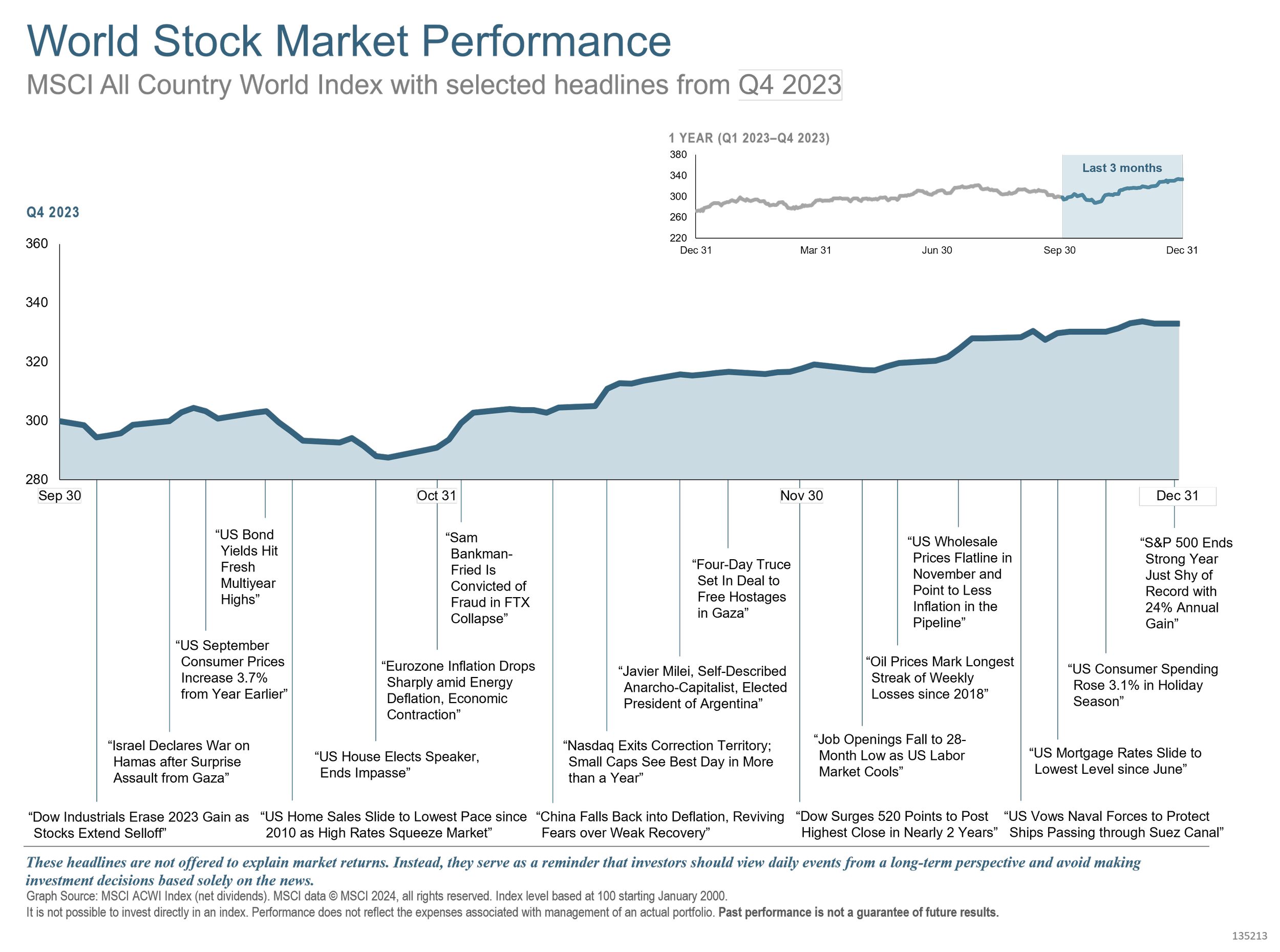

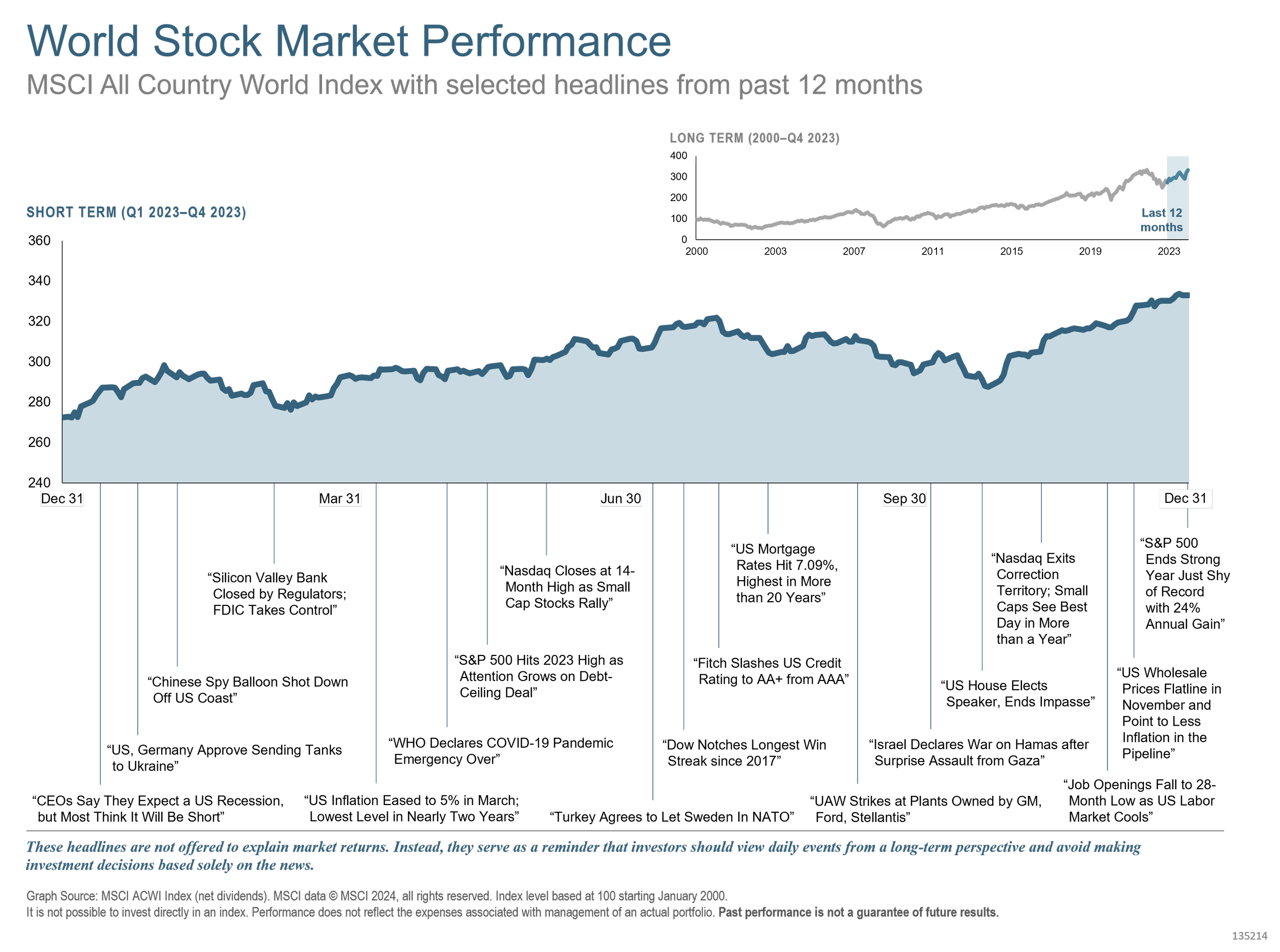

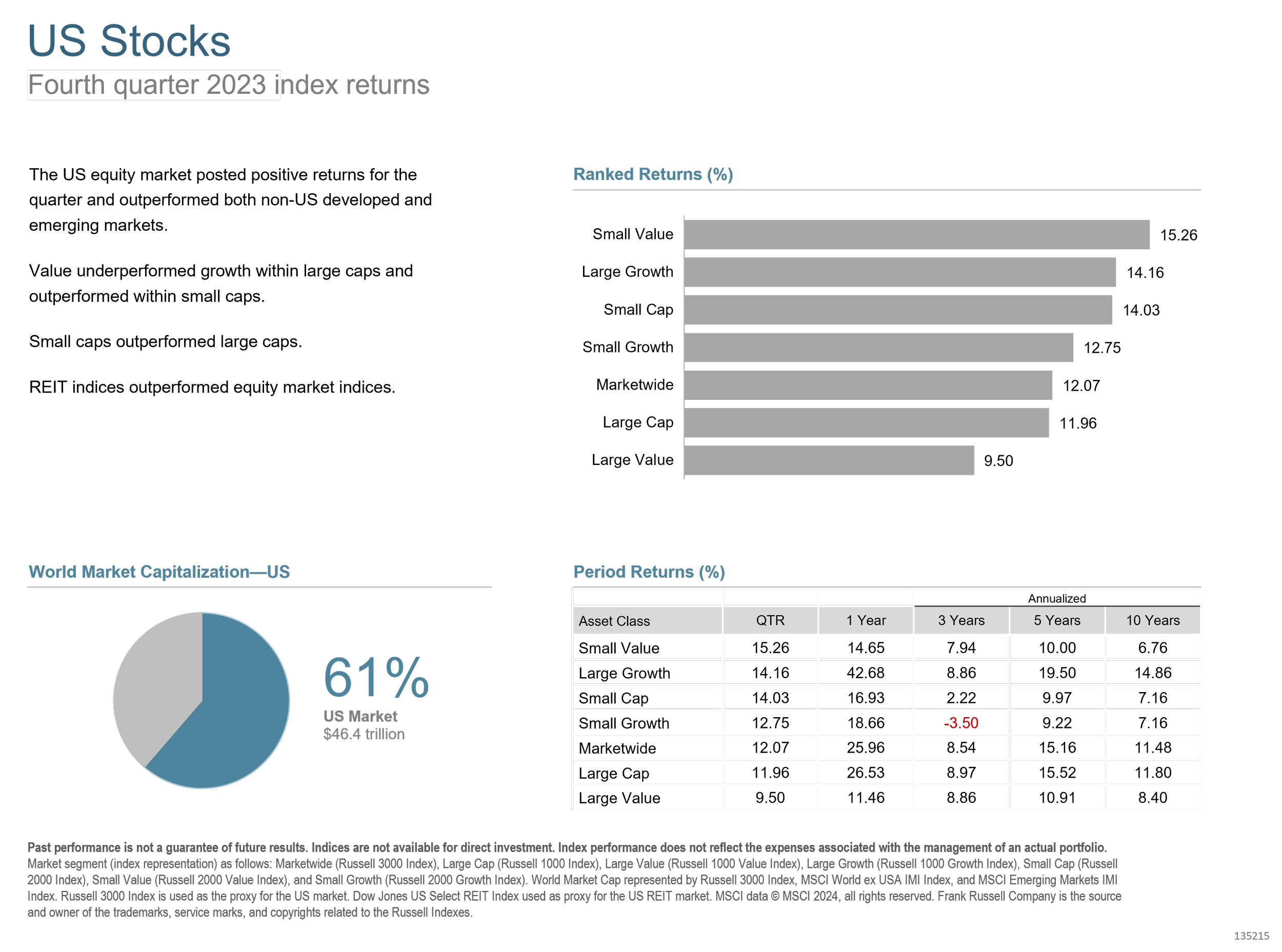

Q4, like much of 2023, defied many expectations. The Federal Reserve's efforts to combat rampant inflation through interest rate hikes have dominated headlines with predictions of a potential recession in the U.S. economy. However, the economy exhibited remarkable resilience, and as inflation gradually subsided, the Fed not only refrained from further tightening but began hinting at dropping rates soon. This unexpected turn of events led to a massive rally in U.S. stocks in Q4, with the total market index Russell 3000 up 12.07% in the quarter.

Economists who had initially forecast a recession started backtracking on their predictions, serving as a reminder that attempting to predict market trajectories is an inherently unreliable approach to investment. The US large company S&P 500 delivered impressive gains of 26.3% when considering total returns, defying expectations that it would be a lackluster year for U.S. stocks.

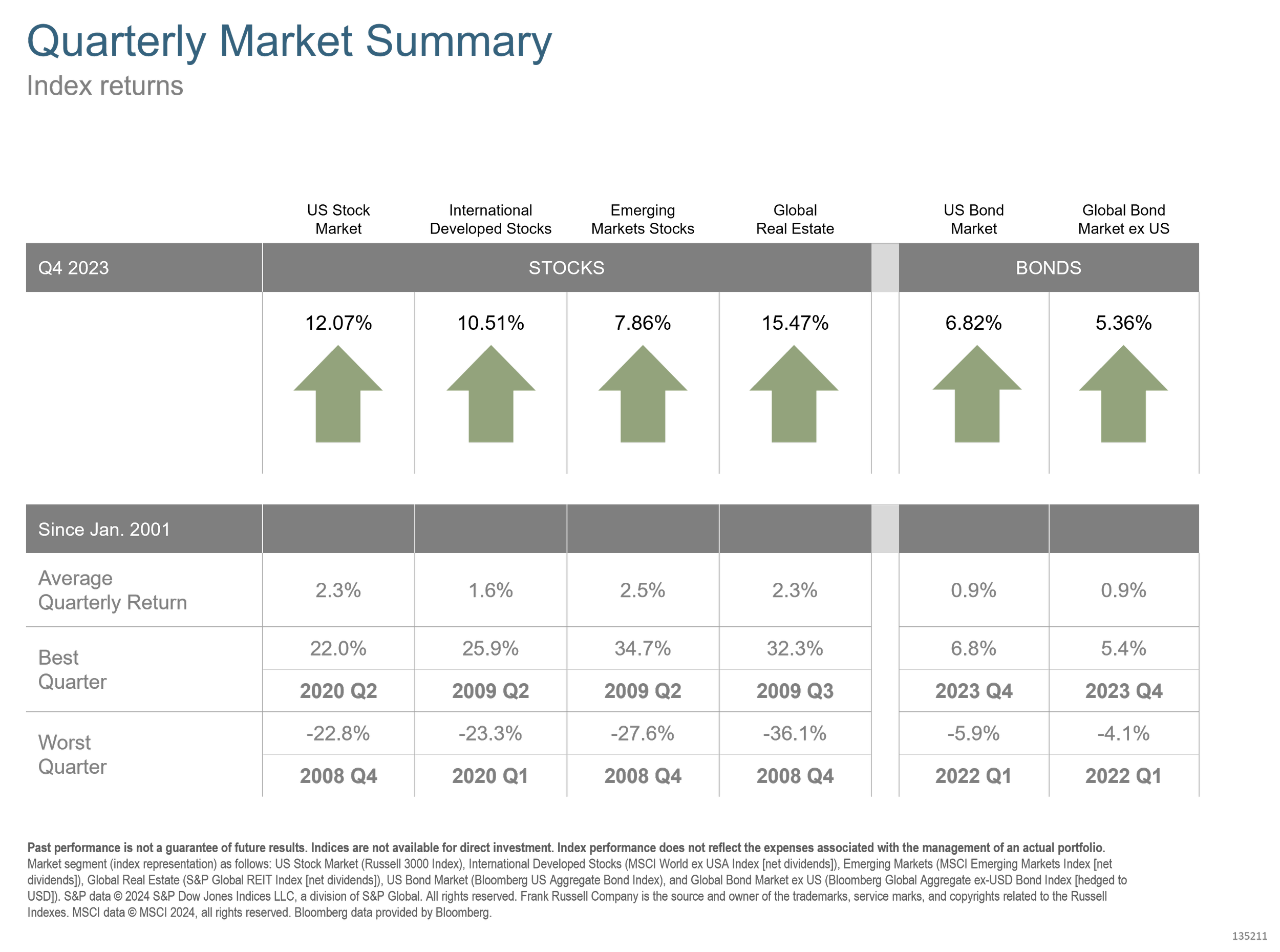

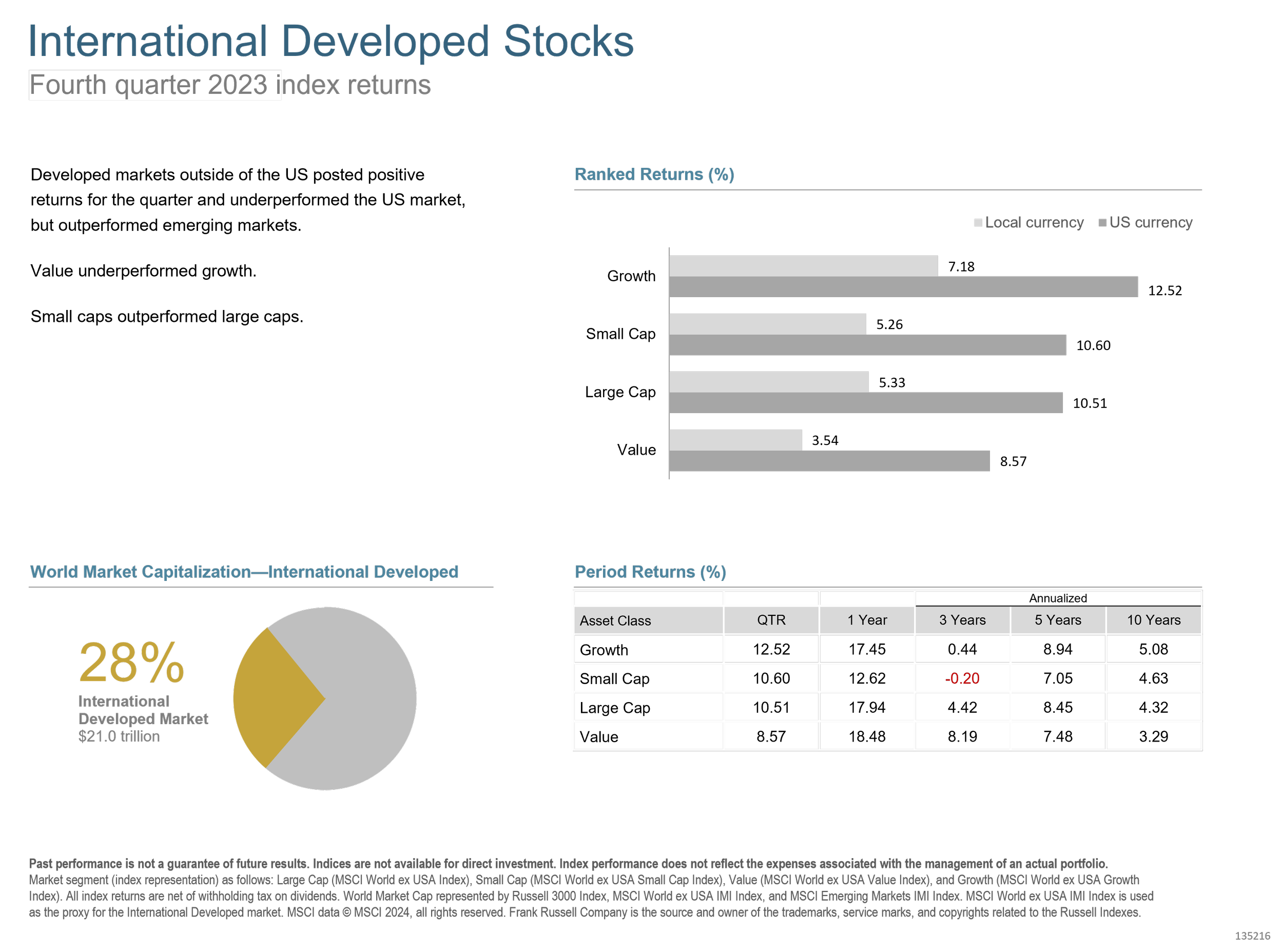

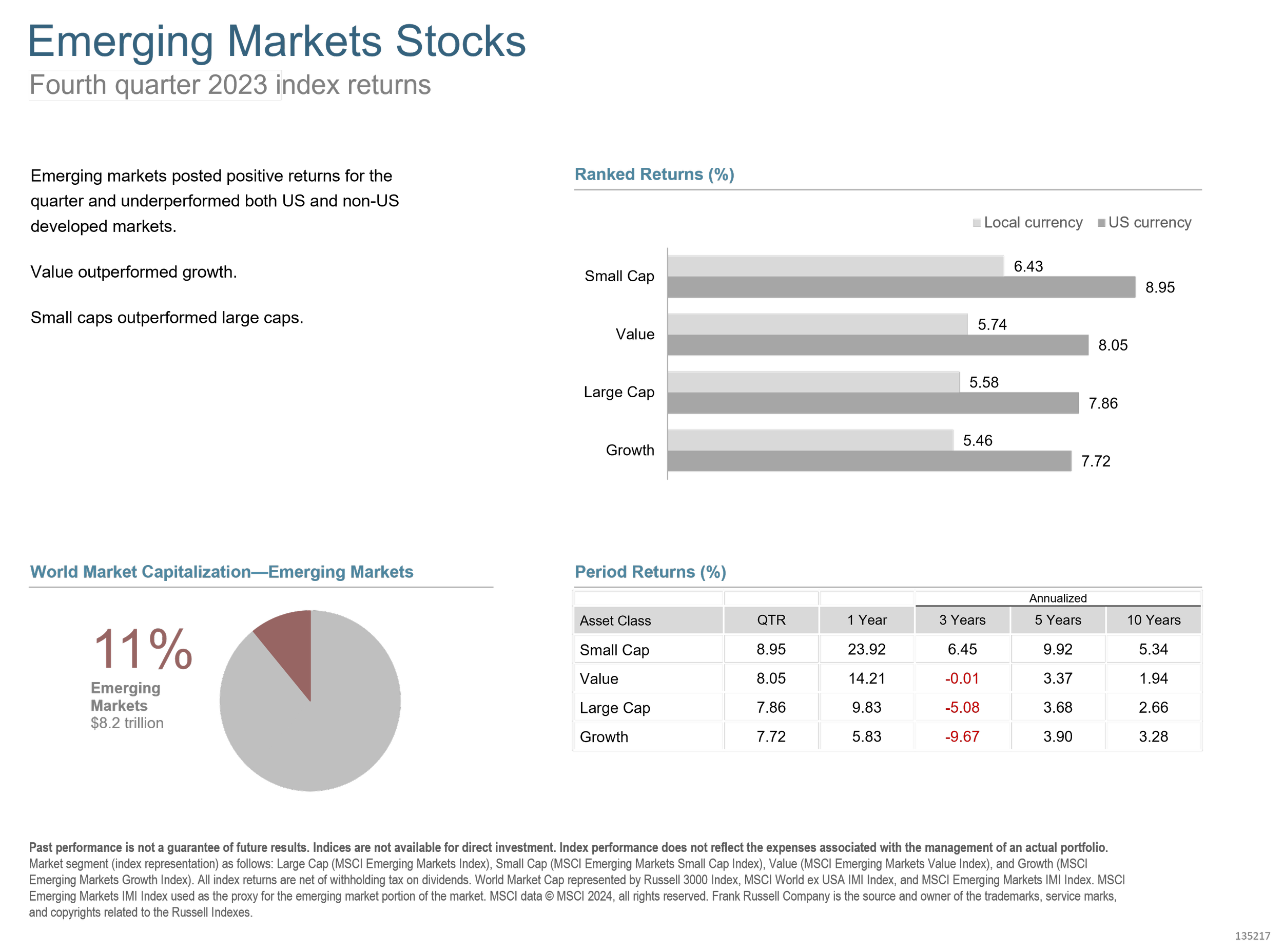

On the global stage, stock markets strongly rebounded from Q3’s swoon. Despite escalating geopolitical tensions, including ongoing conflict in Ukraine and new hostilities in the Middle East, equities, as gauged by the MSCI World Ex USA Index, recorded gains of 10.51%, while emerging markets experienced more modest growth, with the MSCI Emerging Markets Index posting an increase of 7.86%.

US inflation continued its descent from the peak reached in June 2022, when it hit a four-decade high of 9.1%. By November, the year-over-year increase in consumer prices had eased to 3.1%, a level that caught many by surprise, falling lower than their expectations.

After raising rates three times earlier in 2023, the Fed signaled its intention to maintain steady interest rates moving forward, even as inflation continued to exceed its 2% target.

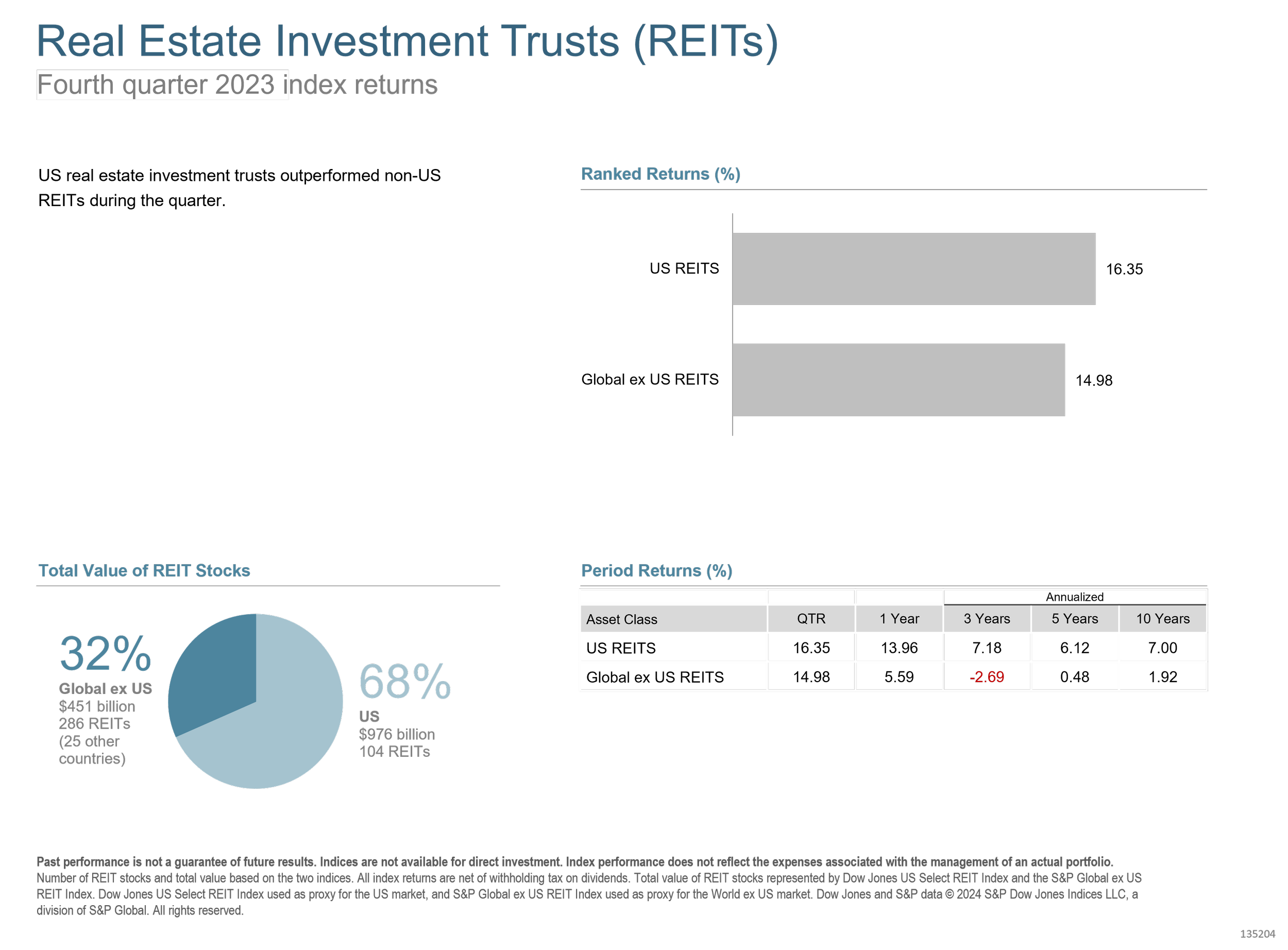

For the year, the real estate market experienced a slowdown due to the higher interest rates, impacting both home sales and new development activities. However, in Q4, US REITs were some of the strongest performers, with the Dow Jones US Select REIT Index posting a 16.35% return. It wasn’t limited to the US, however, as the S&P Global REIT Index was up 15.47% for the quarter.

The U.S. government managed to avoid a shutdown by passing a short-term funding deal in November. While the threat of a government shutdown often dominates headlines, its implications for investors tend to be limited. The specter of a potential government shutdown looms if a longer-term funding resolution isn't reached in early 2024. However, when it comes to stock returns, historical data indicates that a government shutdown doesn't necessarily result in poor performance for equities.

Q4, like much of 2023, was characterized by the remarkable performance of large US growth stocks, most notable the "Magnificent 7" of Amazon.com (AMZN), Apple (AAPL), Alphabet (GOOGL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA). But while large growth (Russell 1000 Growth Index) was up 14.16% in Q4, small value (Russell 2000 Value Index) was up 15.26%. Perhaps we are finally witnessing a broadening of what had been a fairly narrow rally for much of last year. If nothing else, 2023 illustrated the futility of trying to pick the winners in advance and why we believe owning the whole market gives us the best chance of capturing the stock market’s returns.

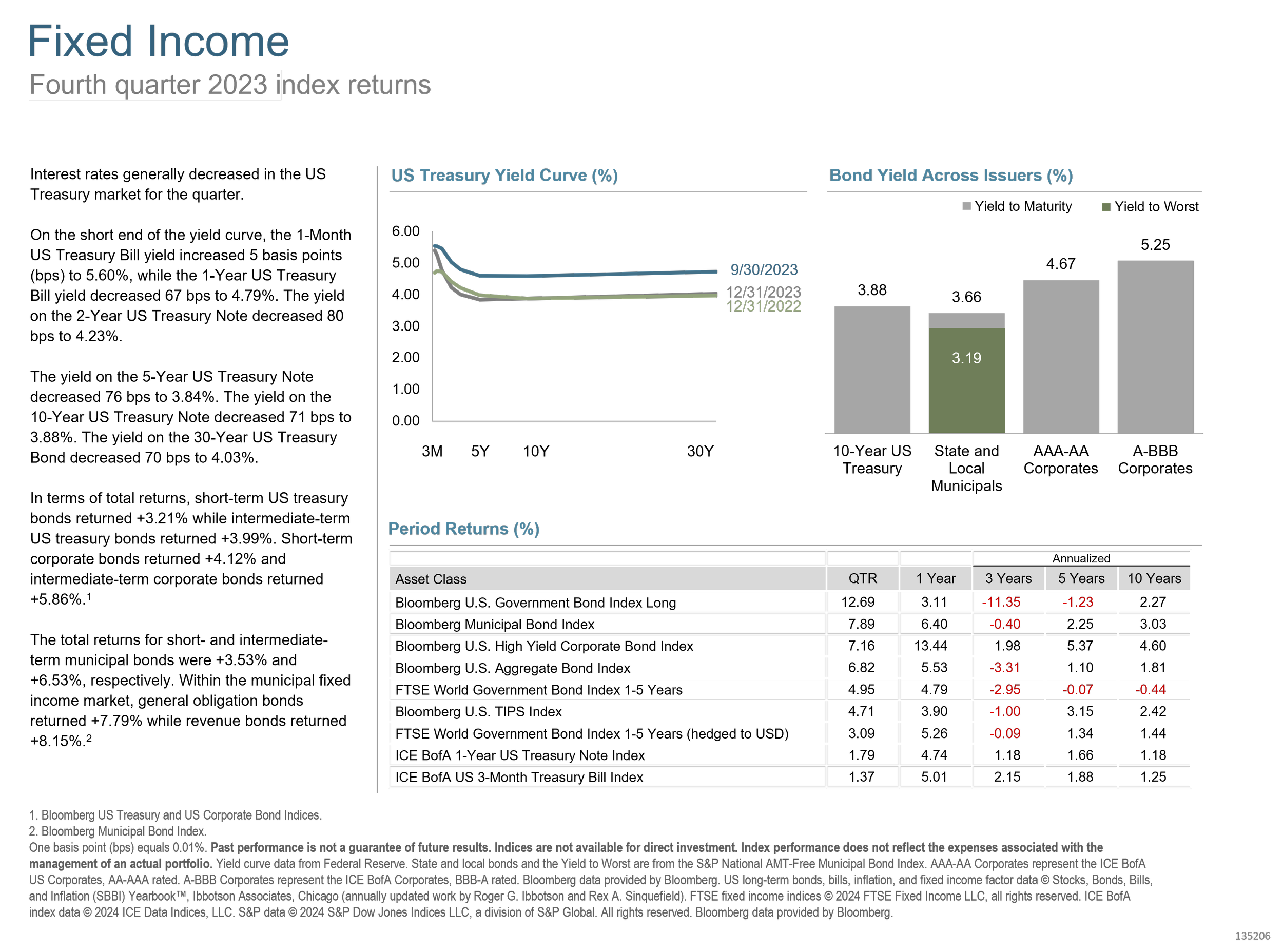

In the bond market, interest rates fell after peaking in October, leading to strong returns for both domestic and individual bonds. However, short-term yields continue to be higher than longer-term yields.

While many investors view yield curve inversion as a potential harbinger of recession or a stock market downturn, historical data from the U.S. and other major economies show that yield curve inversions have not consistently predicted stock market downturns.

The economic resilience witnessed in Q4 is contributing to an optimistic global outlook for 2024. However, as investors have experienced in the past year, the only certainty is the presence of numerous uncertainties. Multiple variables are at play in the markets for the upcoming year, ranging from ongoing conflicts in Ukraine and the Middle East to uncertainties regarding interest rates. Additionally, the forthcoming U.S. presidential election is almost certain to increase, well, uncertainty.

It's worth mentioning that the political party that secures the White House represents just one of many factors that investors take into account when valuing assets. Historical data indicates that, regardless of the party in power, stocks have generally exhibited upward trends during presidential terms. This historical perspective can offer reassurance, particularly when considering the challenges and perhaps futility associated with attempting to predict the events of 2024 or any given year.

This is why we advise our clients to plan for potential scenarios rather than attempting to forecast specific outcomes. Last year served as a vivid reminder of the importance of flexibility and adaptability in navigating the ever-changing landscape of financial markets.

If you would like to review your plan, get in touch. In the meantime, you can see the slides below for a visual review of Q4 2023.