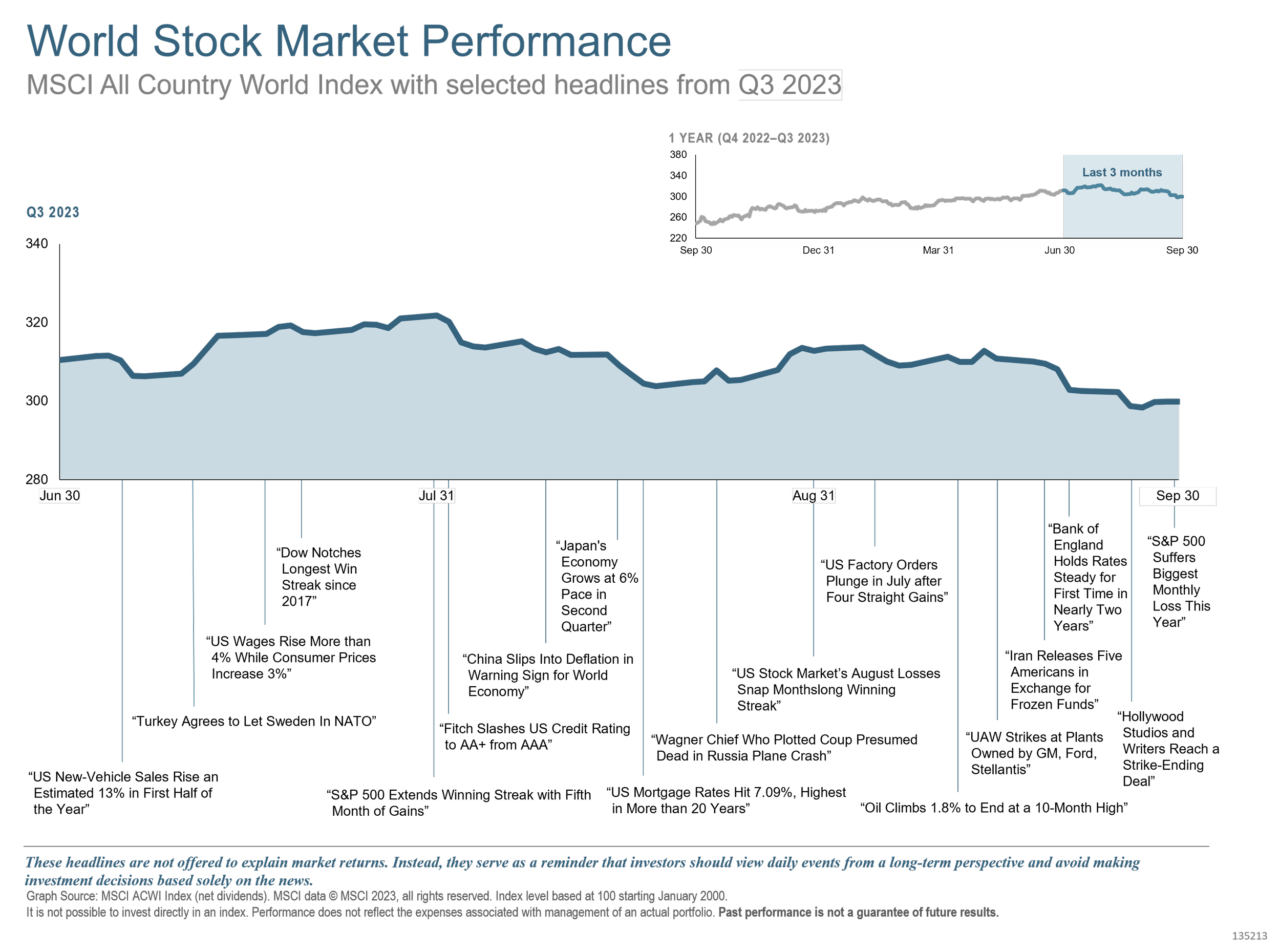

Global equities hit a stiff headwind in Q3 2023, with the MSCI All Country World IMI Index dipping -3.4%. Rising bond rates, mortgages over 7%, higher oil, plunging factory orders, Chinese deflation, and a UAW strike all contributed to a reversal of the winning streak we had experienced for much of 2023.

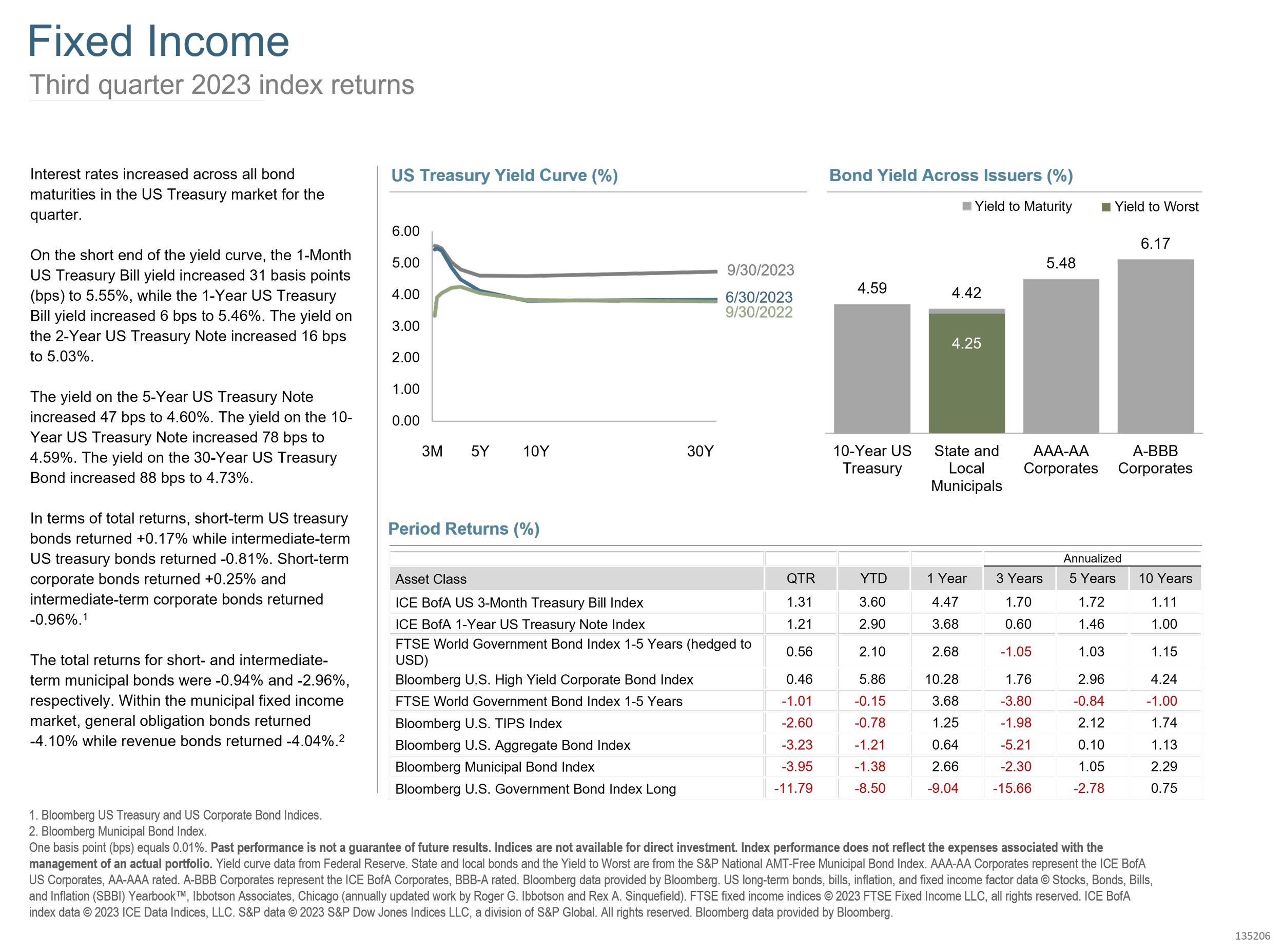

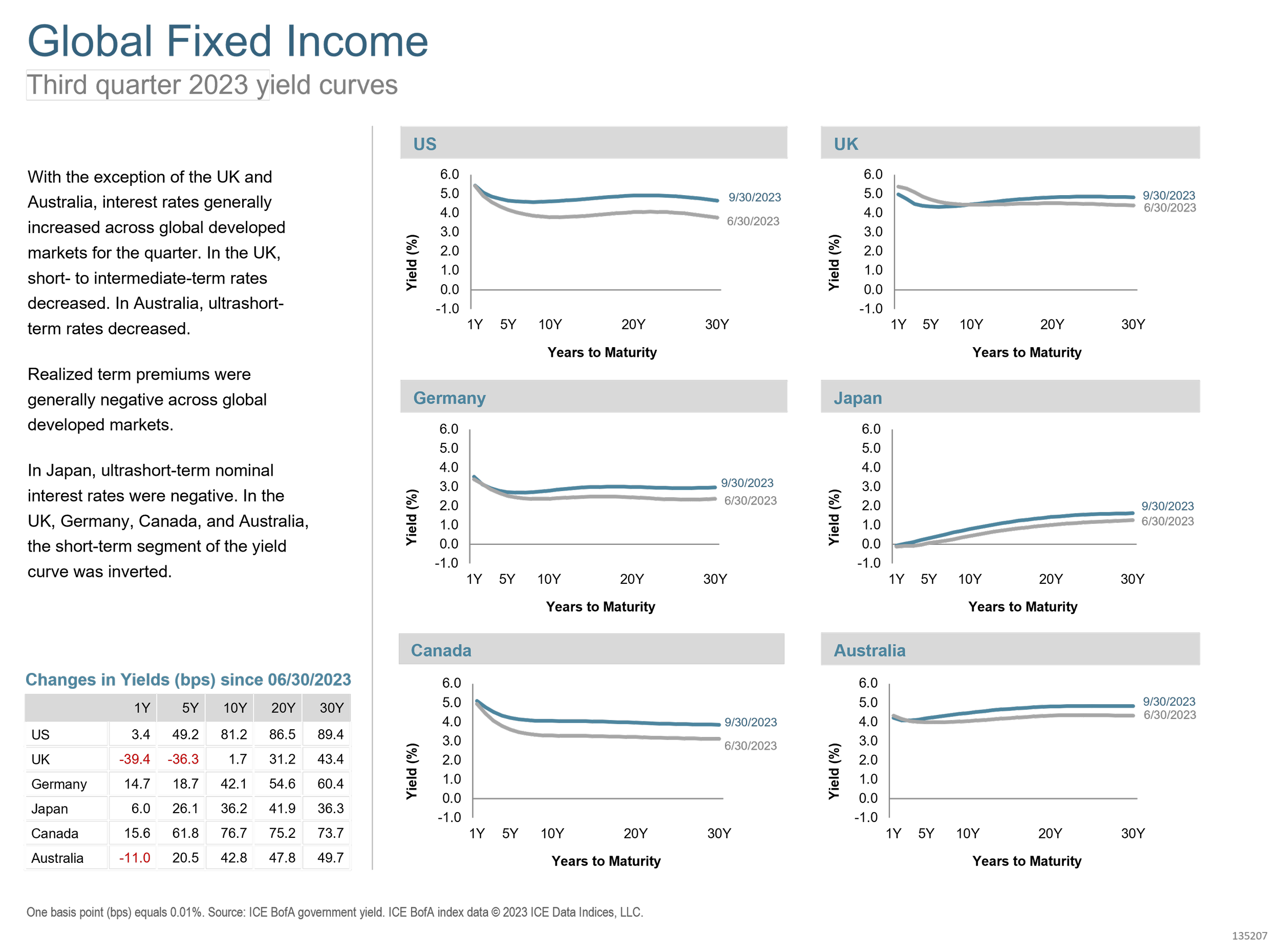

Perhaps some good news is that expectations for inflation in the US are now below 3%. The yield curve inversion (2-year interest rates higher than 10-year), historically a harbinger of economic slowdowns, has now hit a full year in duration. The curve can normalize by either short rates falling or long rates rising. It appears the latter is the likely outcome, as the 10-year Treasury yield just hit a 16-year high. The question now is how high will they go?

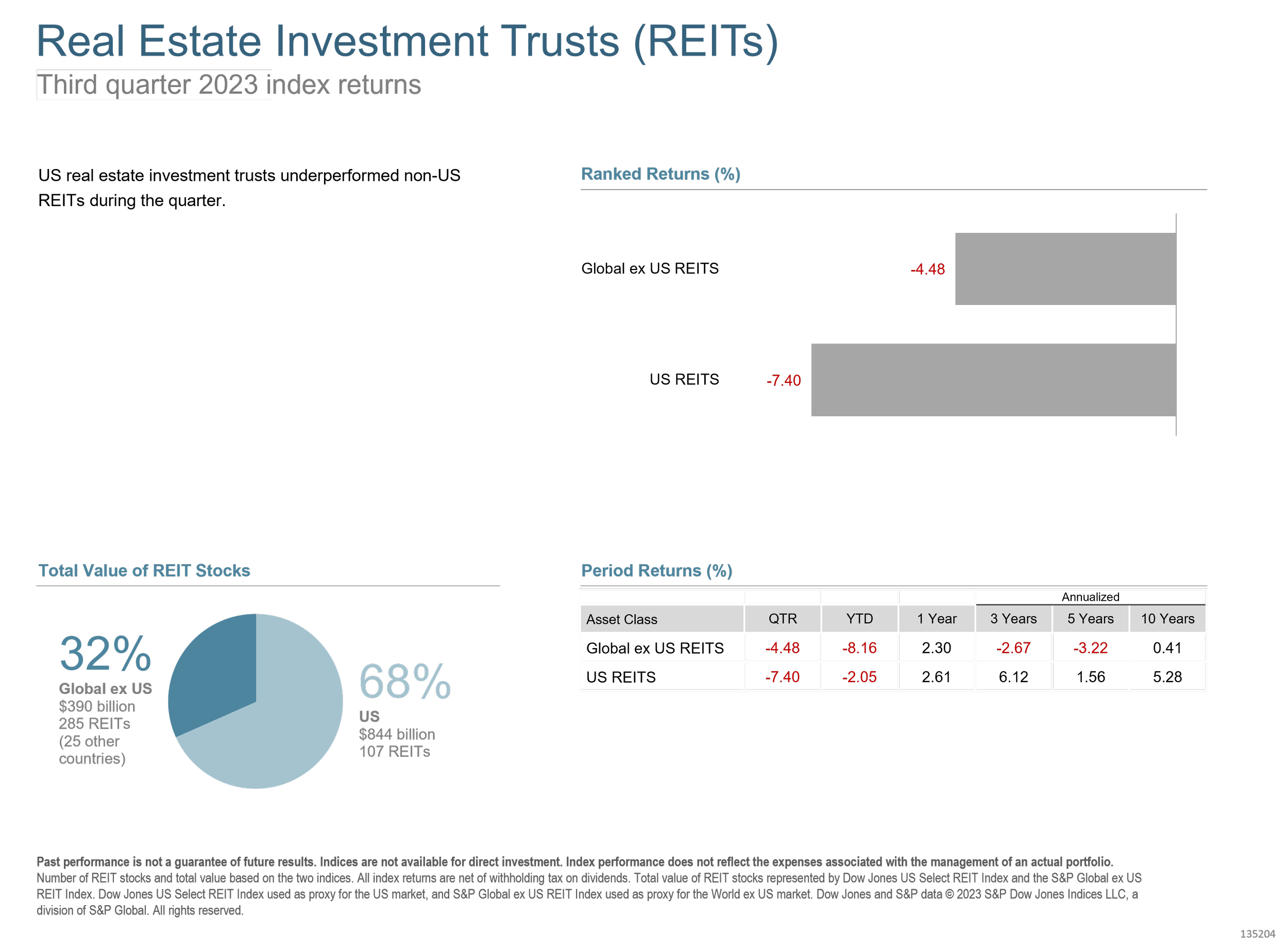

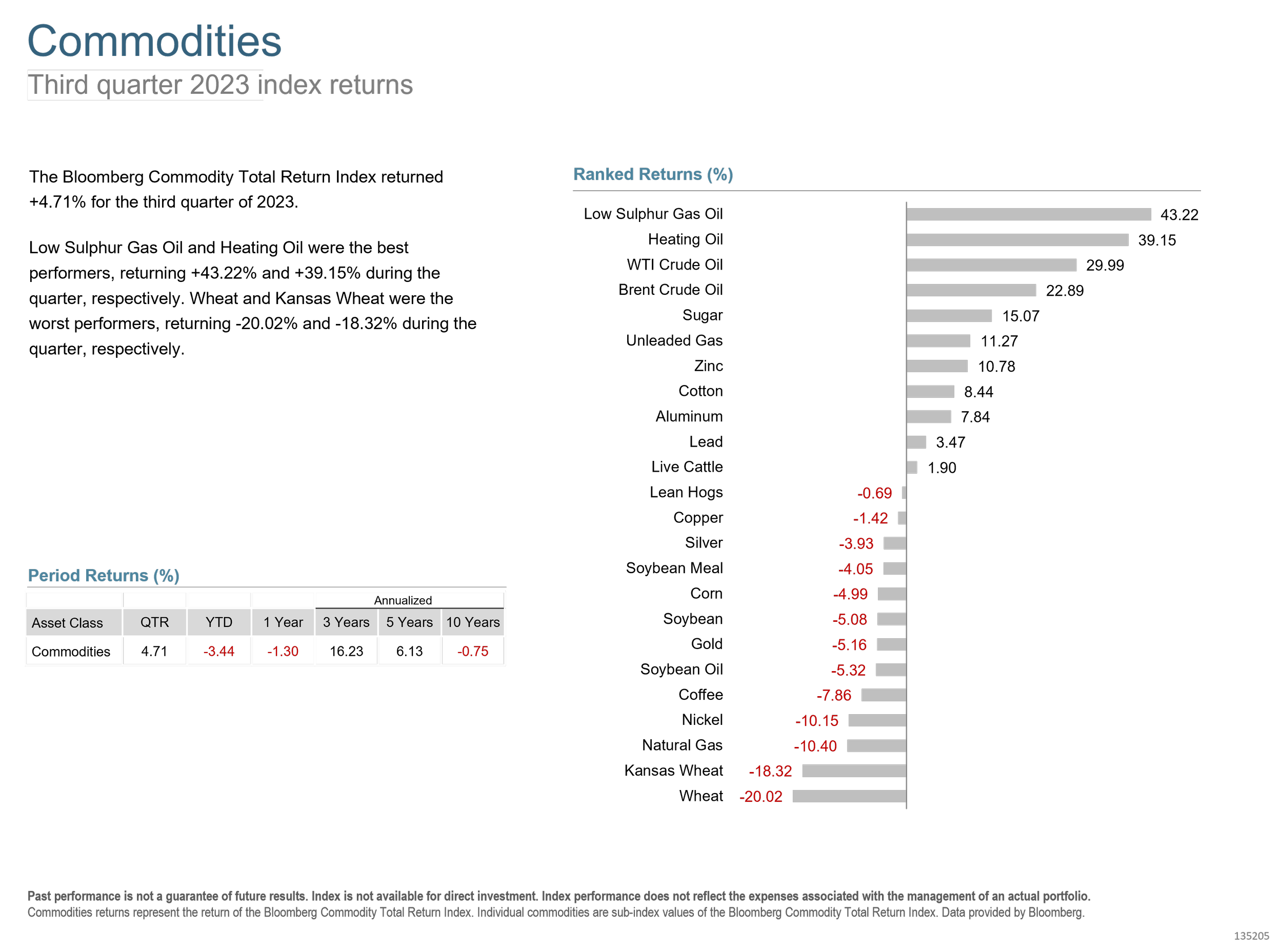

The energy sector was the clear winner of the quarter. After a rather tepid start to 2023, the sector had an 11.5% return. On the other end, information technology, REITs, and utilities were all laggards. Notably, big tech like Apple took a -11.6% hit, and Microsoft wasn't far behind at -7.1%.

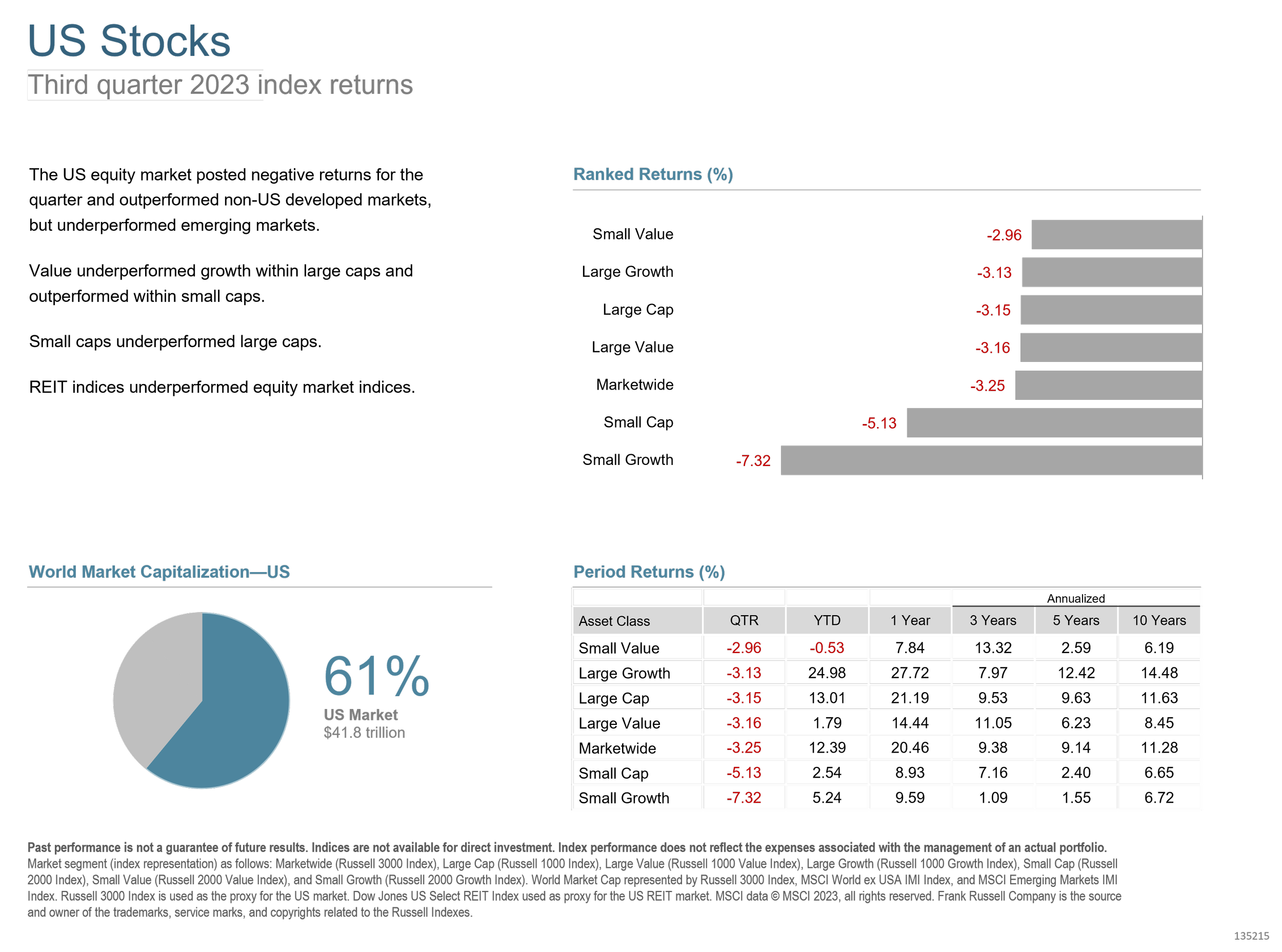

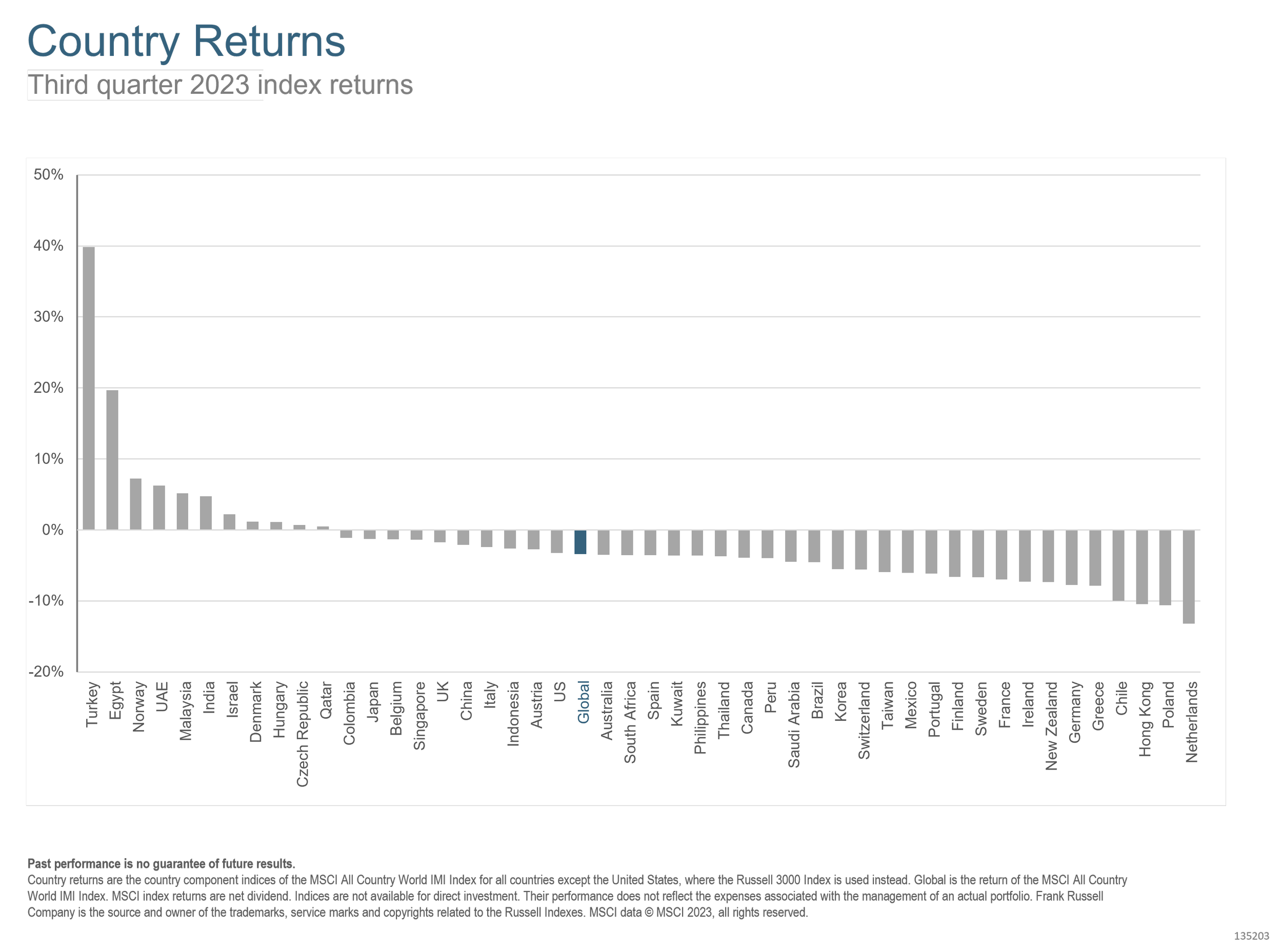

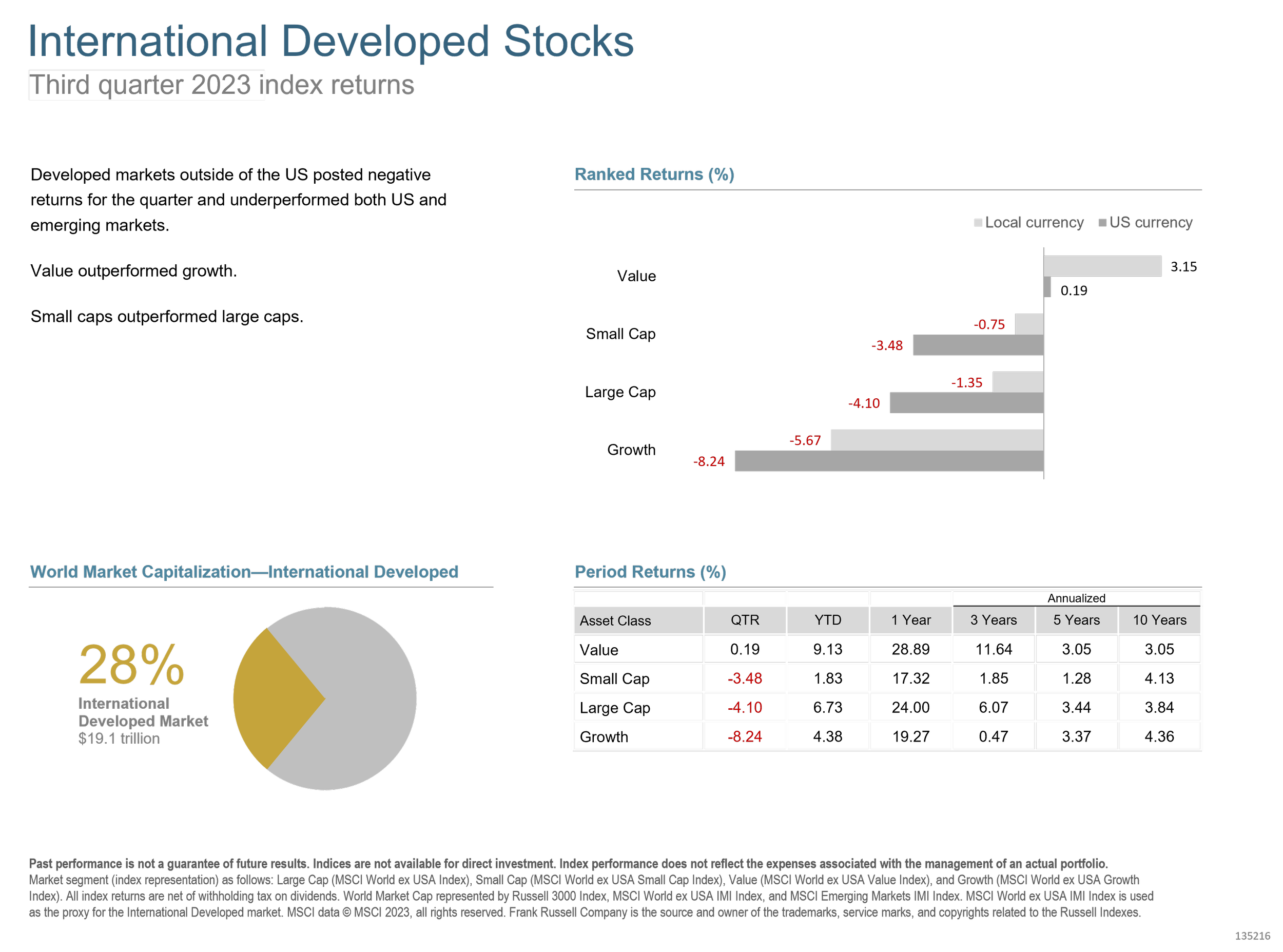

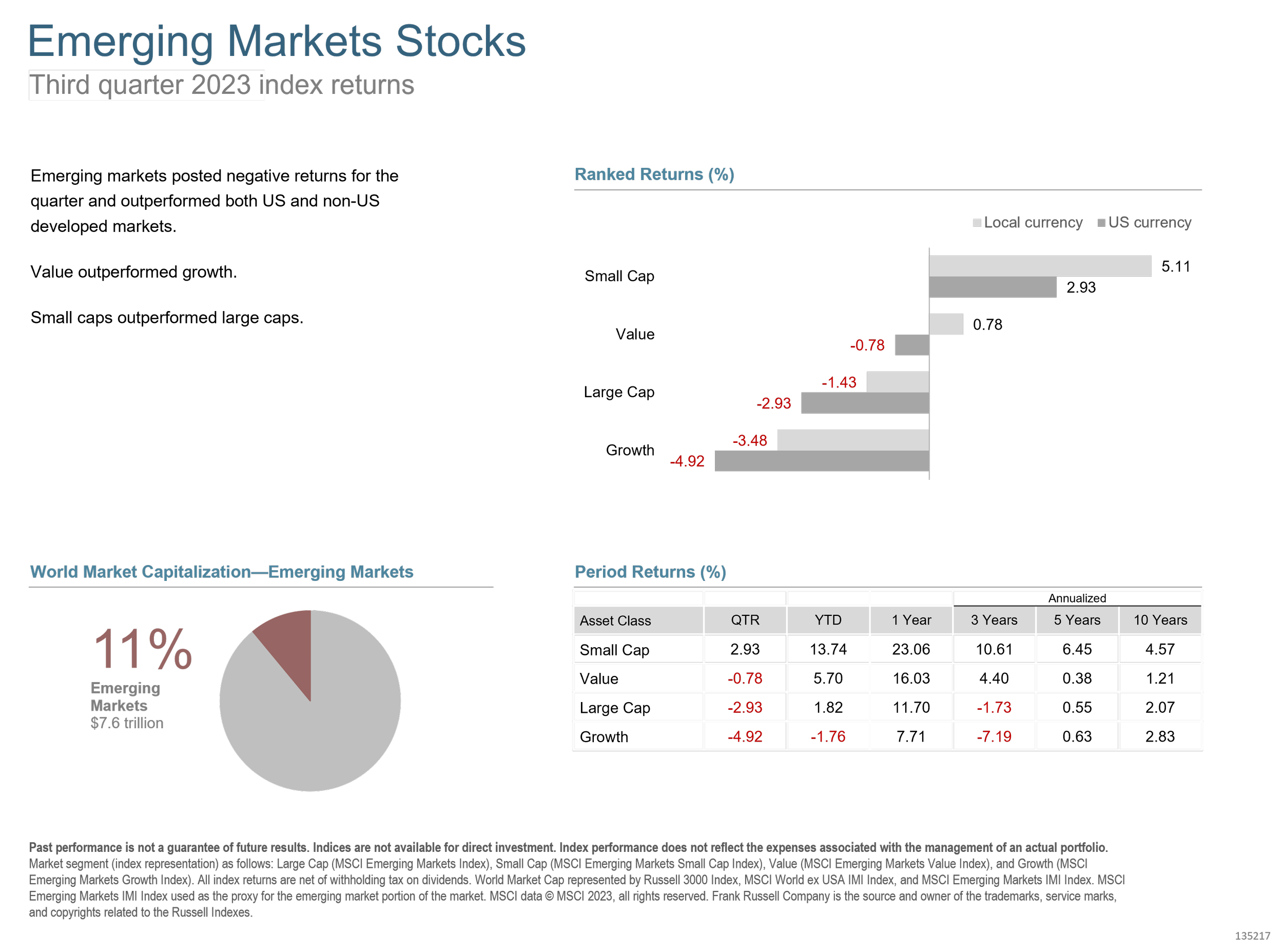

If you have an investment strategy that emphasizes value stocks, like we do at ATX Portfolio Advisors®, perhaps there was a silver lining in Q3. Value stocks outperformed growth stocks across multiple regions, be it the US, non-US developed zones, or emerging markets. In fact, the MSCI All Country World Value IMI Index edged past its growth counterpart by a notable 3.1%.

Rising interest rates are once again shining the spotlight on banks that may have losses in their bond holdings. That is why we continue to recommend tactical steps such as keeping balances at banks below FDIC limits and investing cash directly in other instruments like US Savings Bonds, Treasury Bills, and money markets to increase yields (currently > 5%) and limit your exposure to the risk of your bank failing. As always, we should use our investment plans to inform the real impact of the risks we are taking, as it helps to tune out the noise that current headlines always create, allowing us to focus on time-tested principles to avoid making shortsighted missteps.

If you would like to review your plan, get in touch. In the meantime, you can see the slides below for a visual review of Q3 2023.