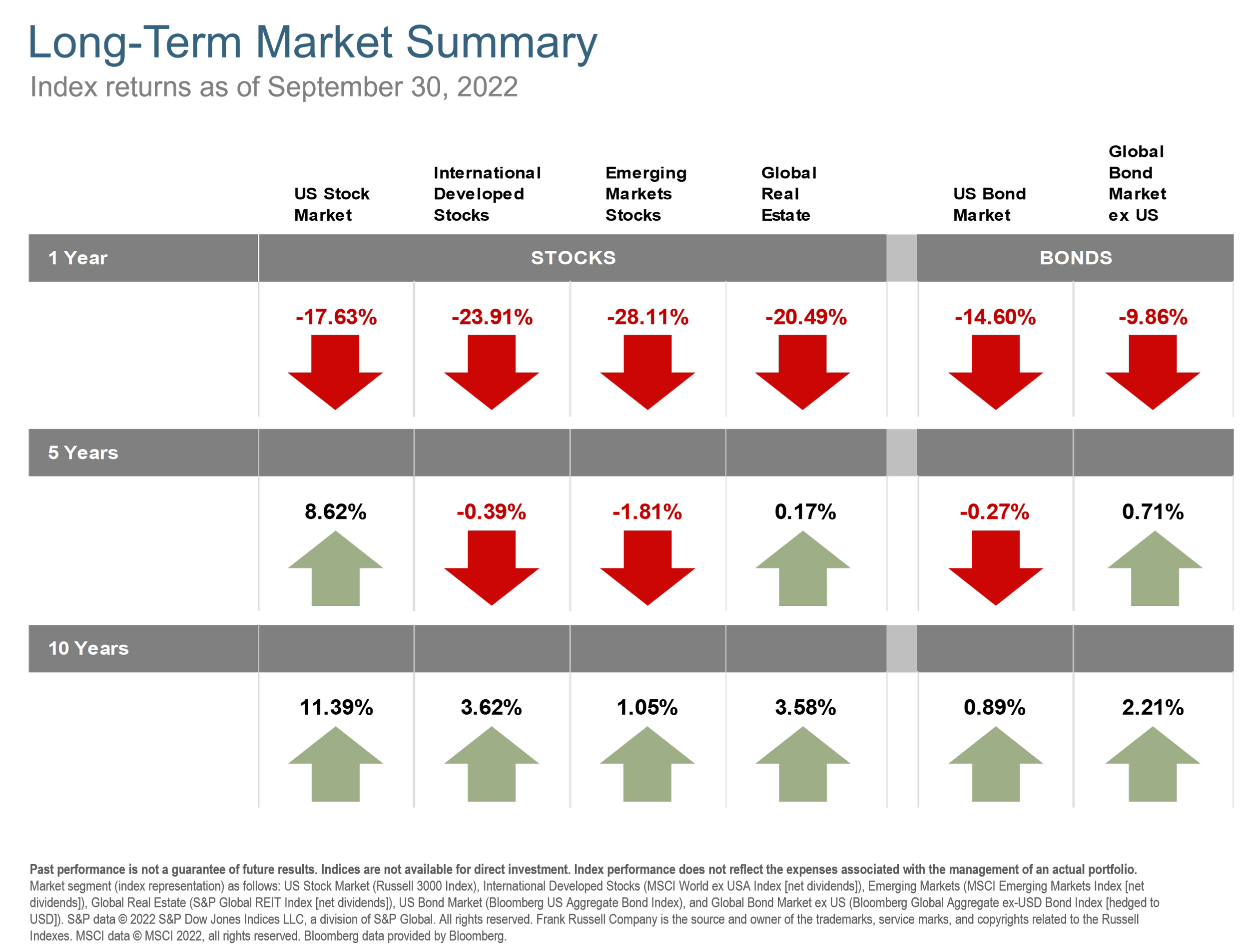

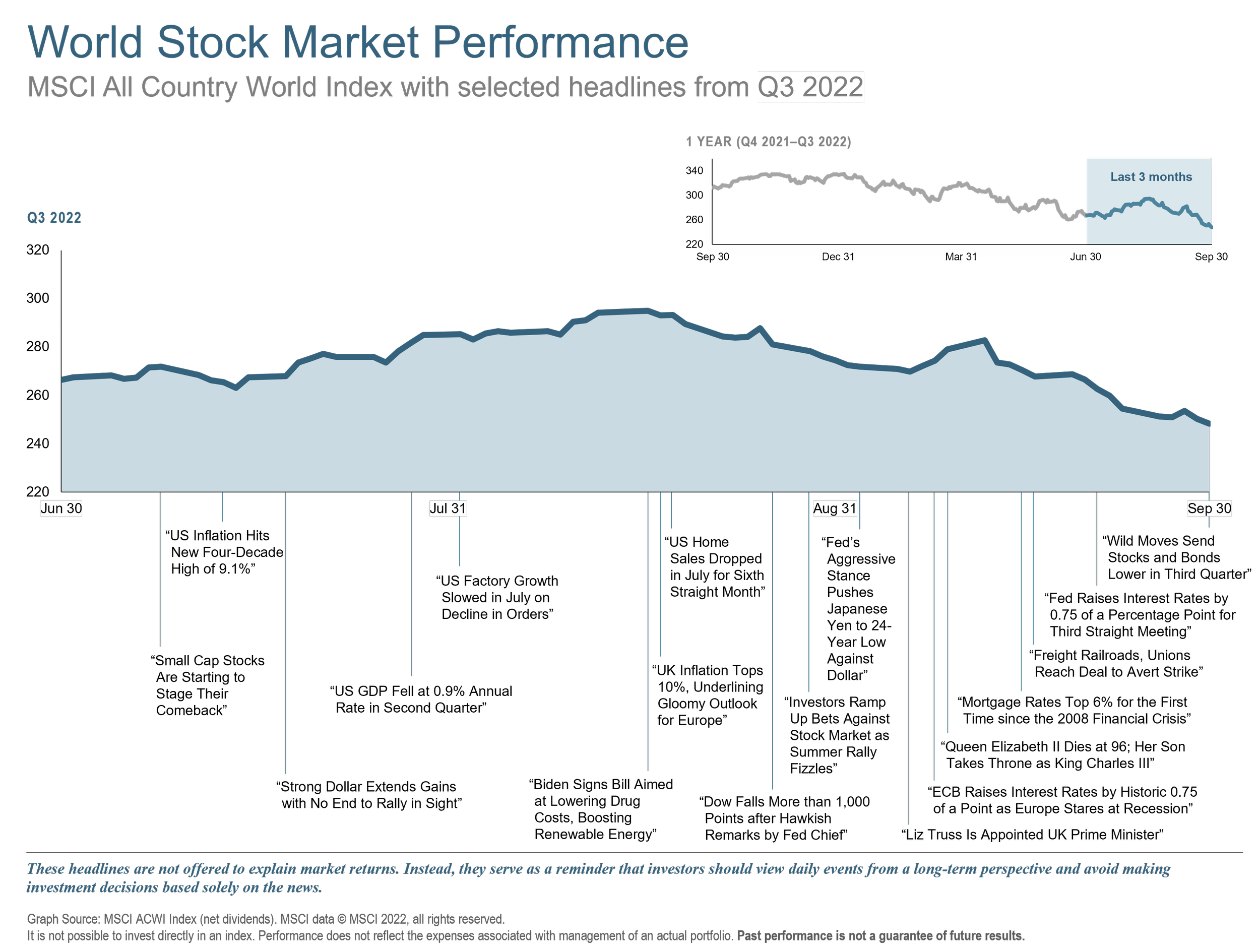

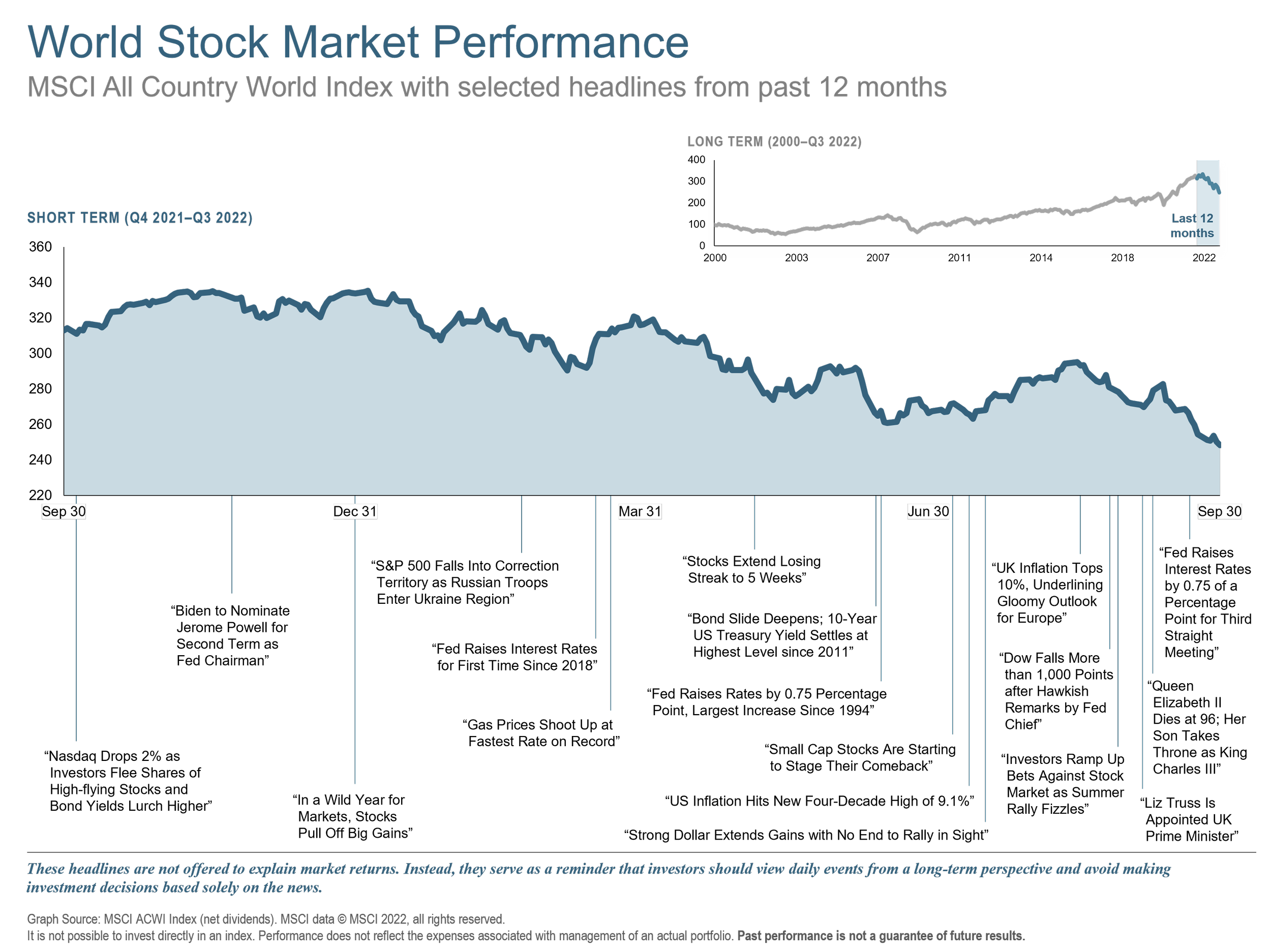

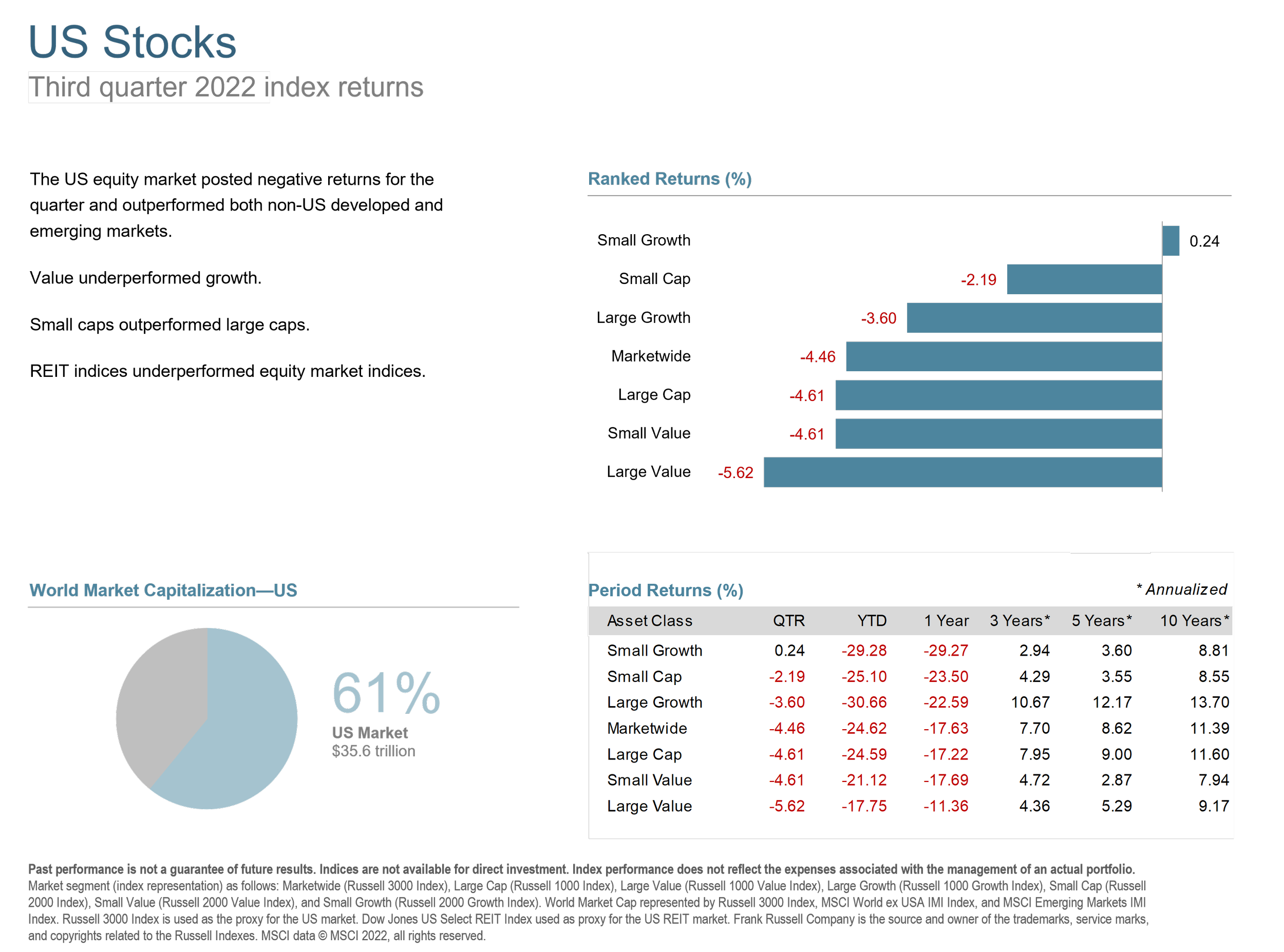

Q3 of 2022 continued the rough start we saw in the first half of the year as the Federal Reserve’s war on inflation, Ukraine’s war against Russian aggression, and recession fears all increased in their intensity. Despite a bear market rally that peaked in August, major indices such at the NASDAQ and S&P 500 ended the quarter at or below the lows we saw in June of this year. To add insult to injury, bond markets also were in the red. Q3 marked the third consecutive quarter of negative returns in stocks and bonds, which has only happened about 9% of the time over the past 40 years.

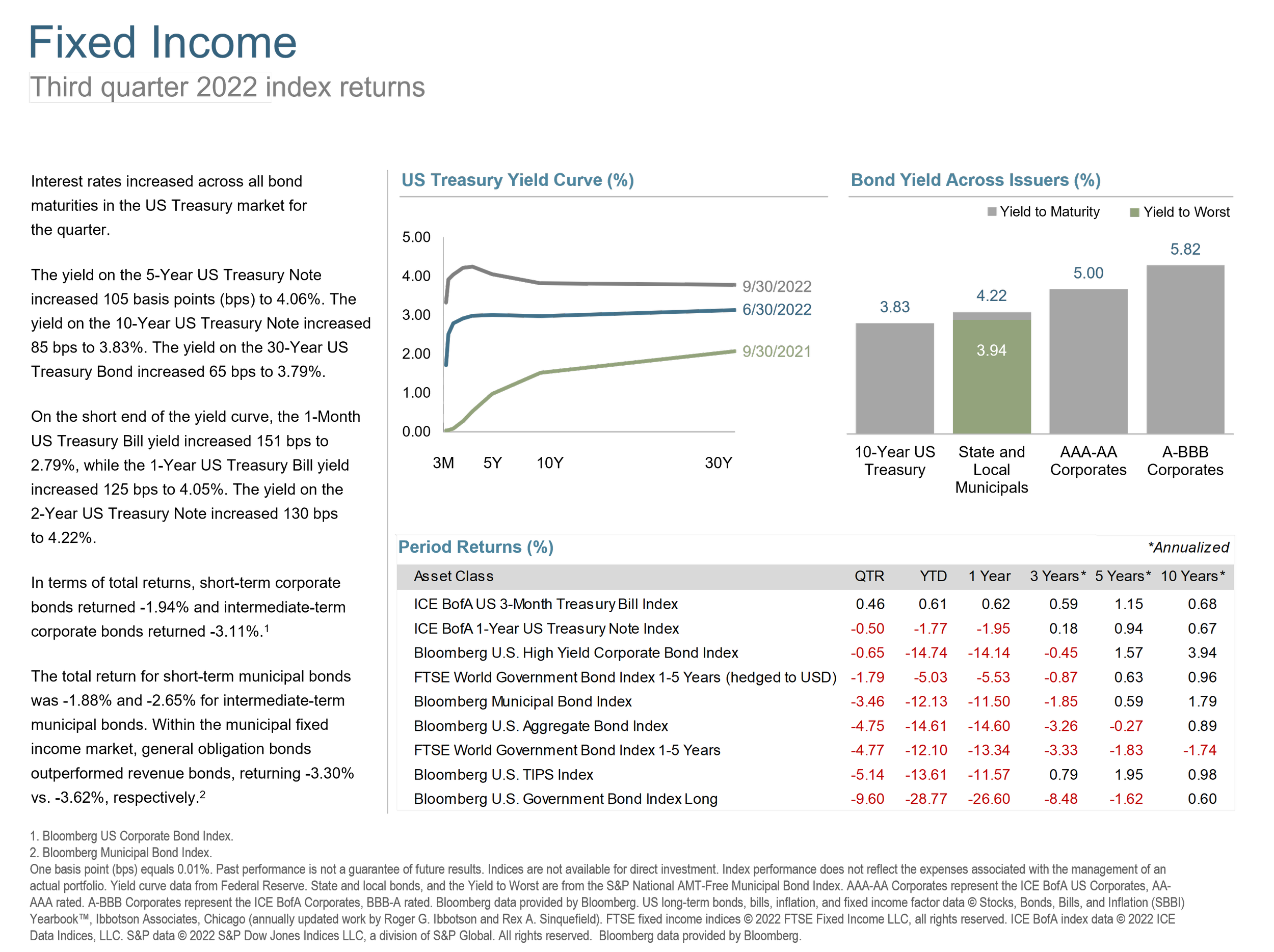

In August, the US Consumer Price Index (CPI) “moderated” to 8.3% year-over-year, but stubbornly remained around a 40 year high. Low unemployment, which perversely has been bad for the market when good numbers are reported, remained strong in September at 3.5%. The tight labor market and persistent inflationary pressures pushed The Federal Reserve to raise its key interest rate by 0.75% for the third time in a row as it races to get ahead of inflation that is sapping the wallets of American consumers. In addition, The Federal Reserve’s quantitative tightening program ramped up in September, increasing from $47.5 billion to $95 billion per month.

Bear markets are an inevitable but painful part of being an investor. As I mentioned last quarter, we share in the pain at ATX Portfolio Advisors. We have waived our fees for most of our “Fee Only When You’re Up” clients throughout the year, and for those that have been charged, we earn less as account balances fall. Believe me when I say, no one would like to see the market turn positive than more than I. We always inform investment decisions through financial planning that anticipates this type of occasional volatility. Our hope is that those plans allow our clients to stay the course during challenging conditions such as we have experienced this year.

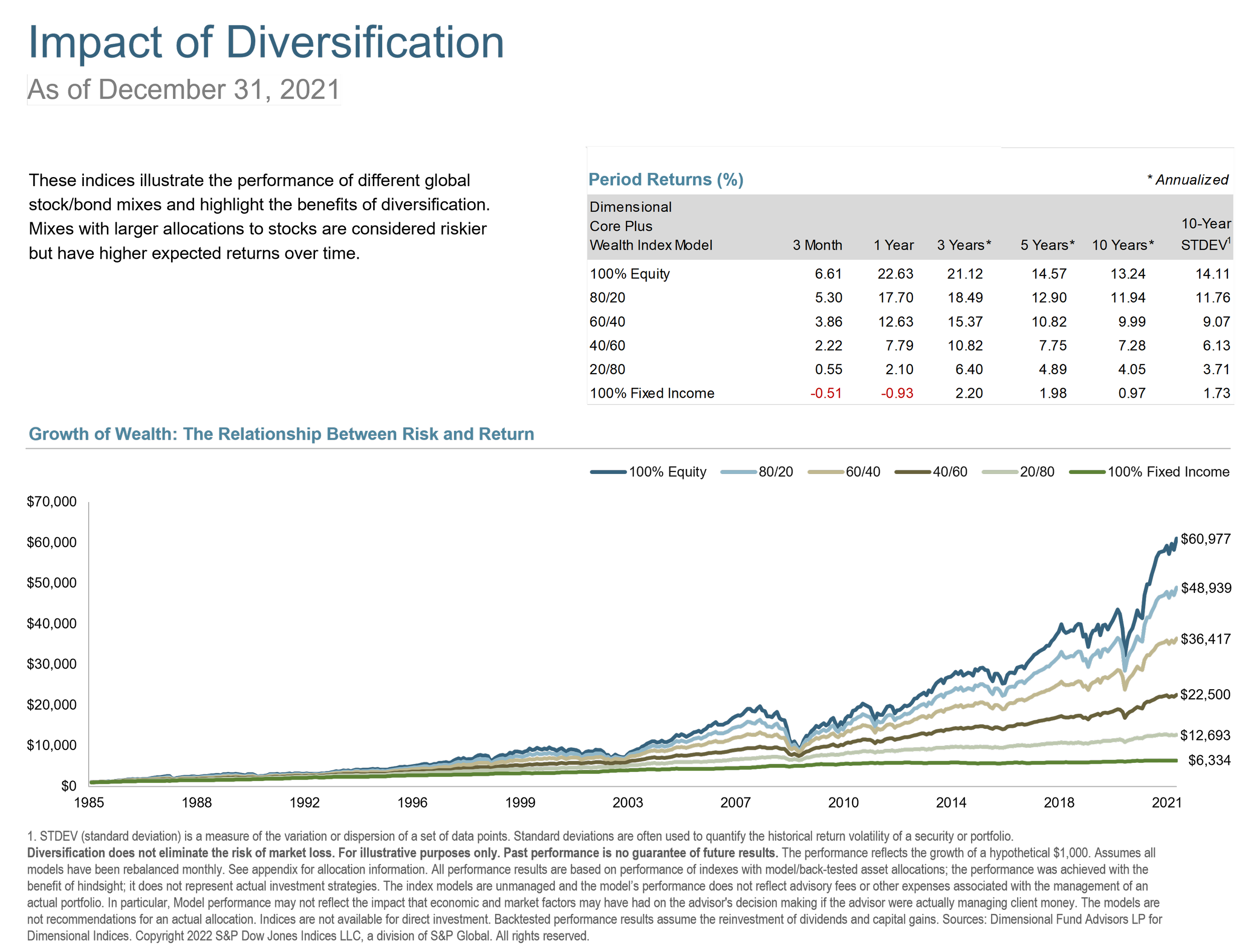

Finally, remember that all bad things eventually come to an end, especially bear markets. If there were any trading strategies that we felt could help avoid some of this pain, we would gladly embrace them. However, in nearly 30 years in this industry, I have never seen any evidence that anyone can reliably avoid the downside and capture the upside when it inevitably returns. That is mainly because market reversals tend to happen unexpectedly and dramatically, and if we miss that opportunity, we can miss much of the potential gains as seen in the following illustration.

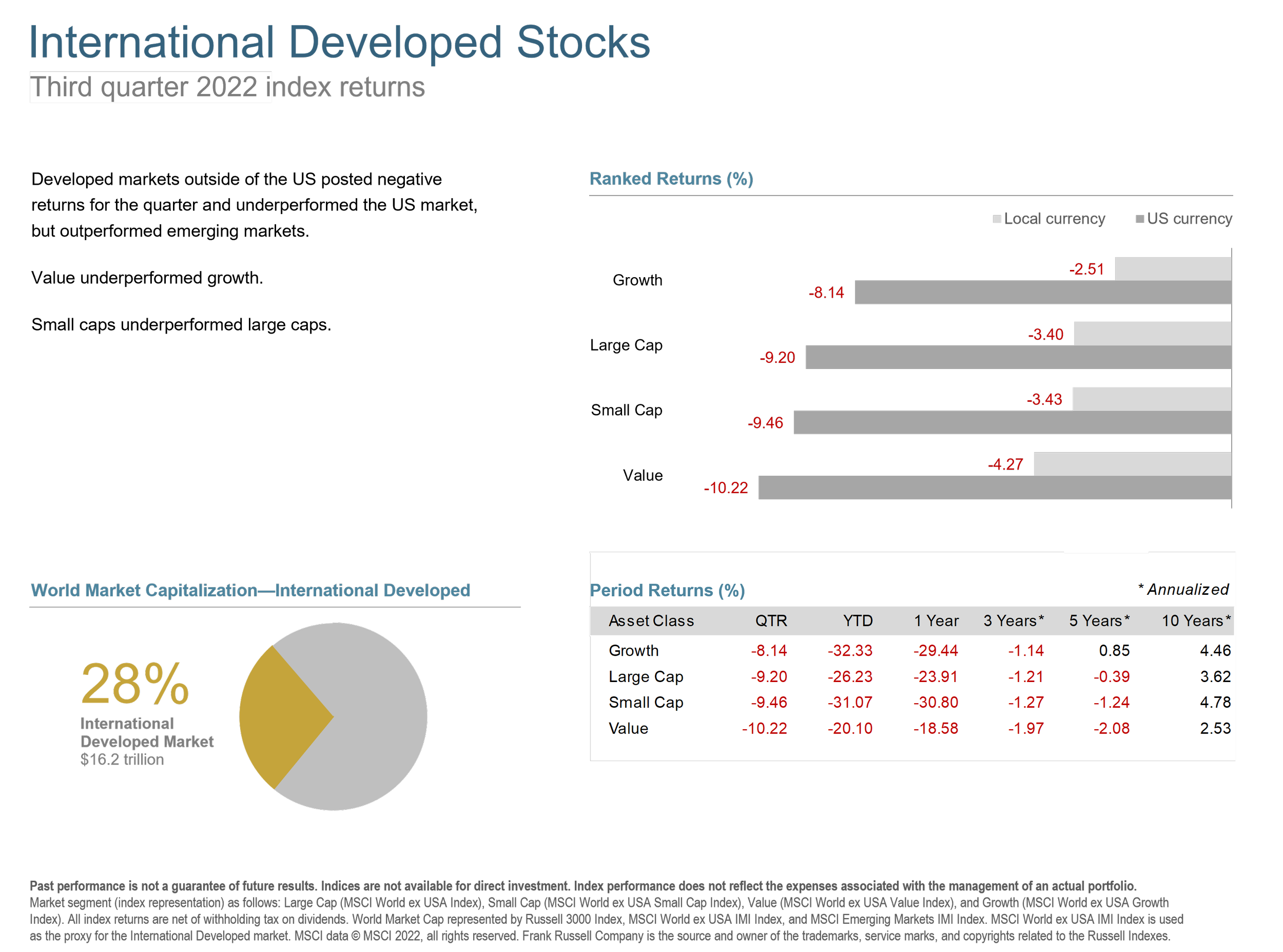

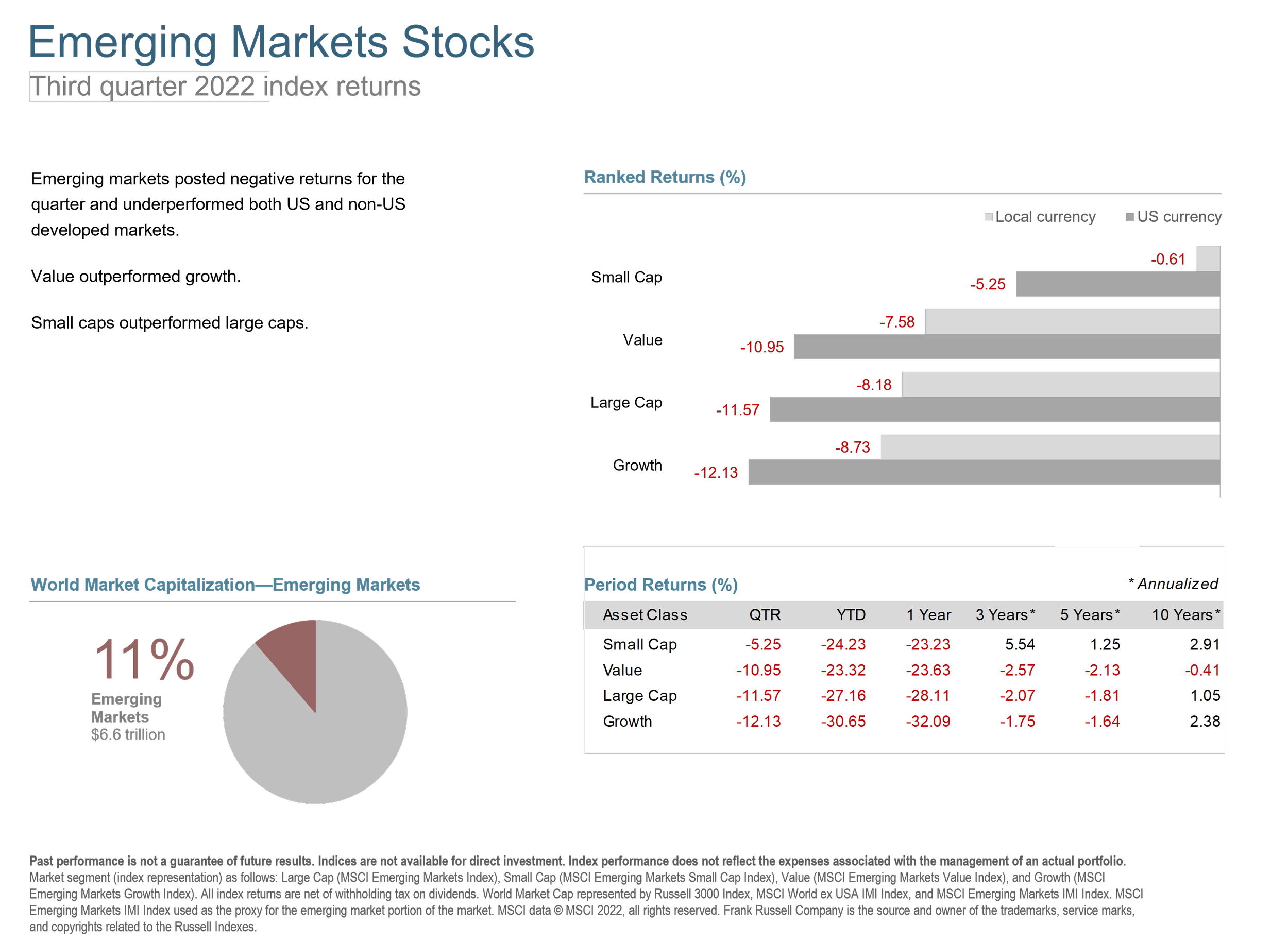

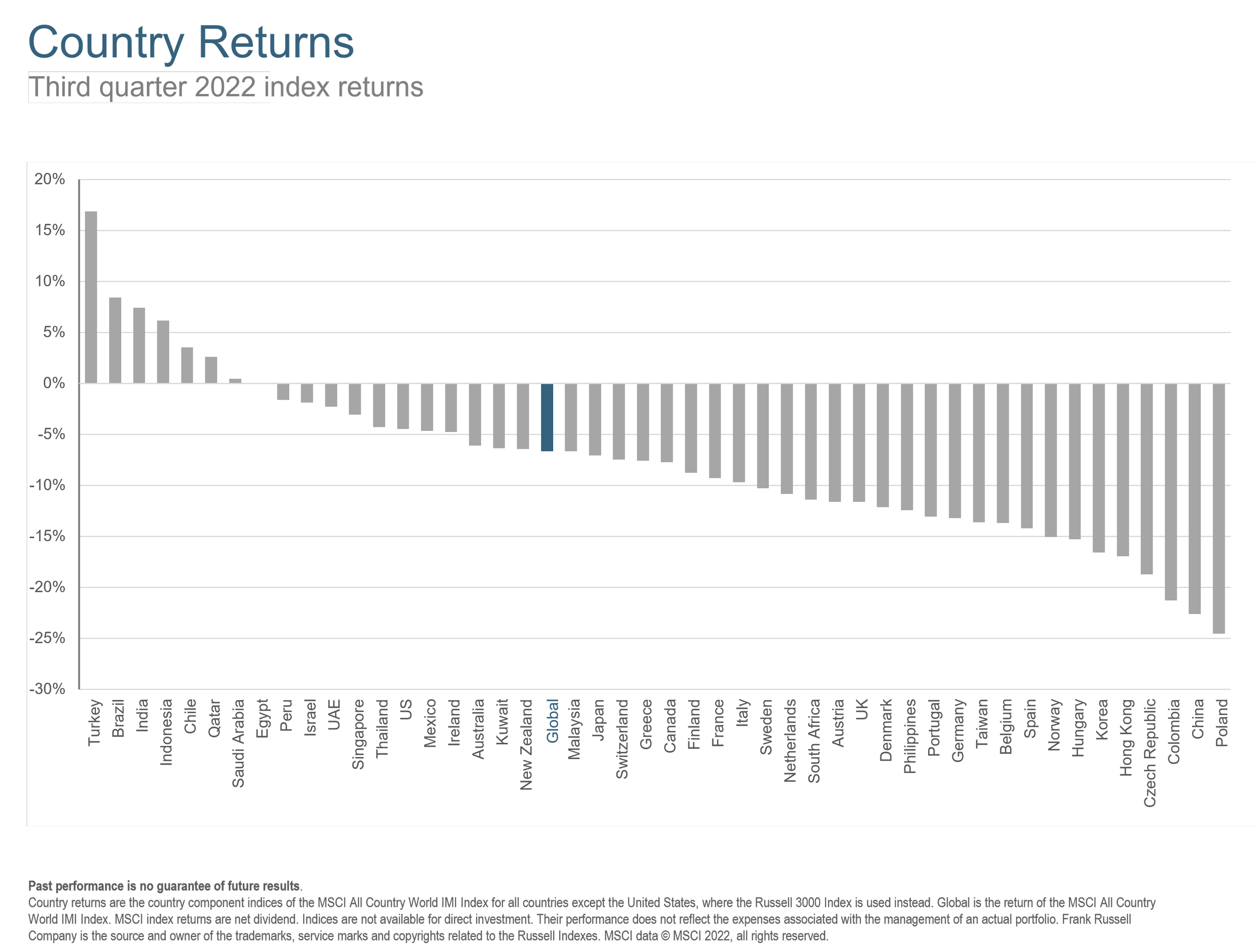

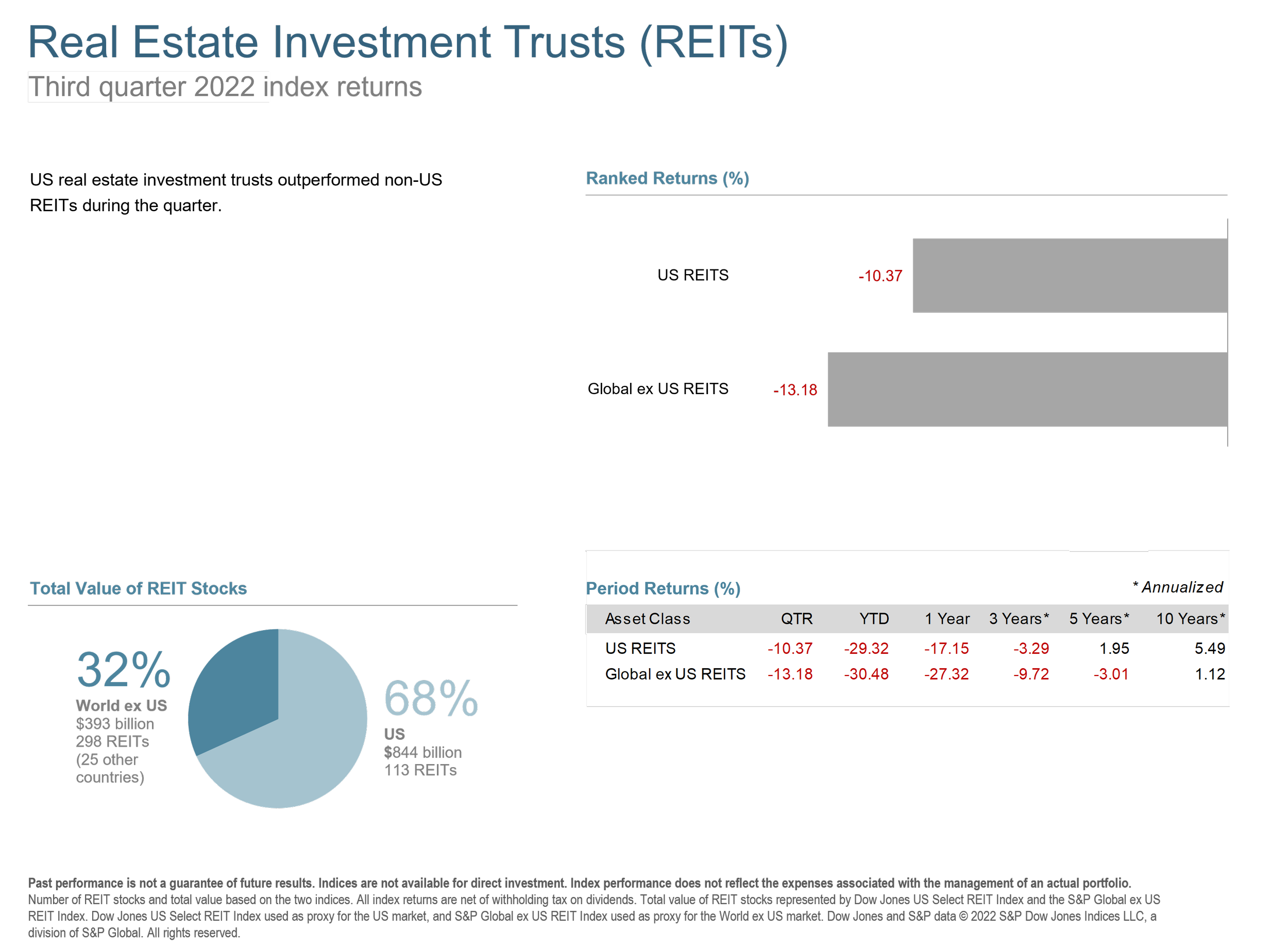

If you would like to review your plan, get in touch. In the meanwhile, you can see the slides below for a review of Q3 2022.