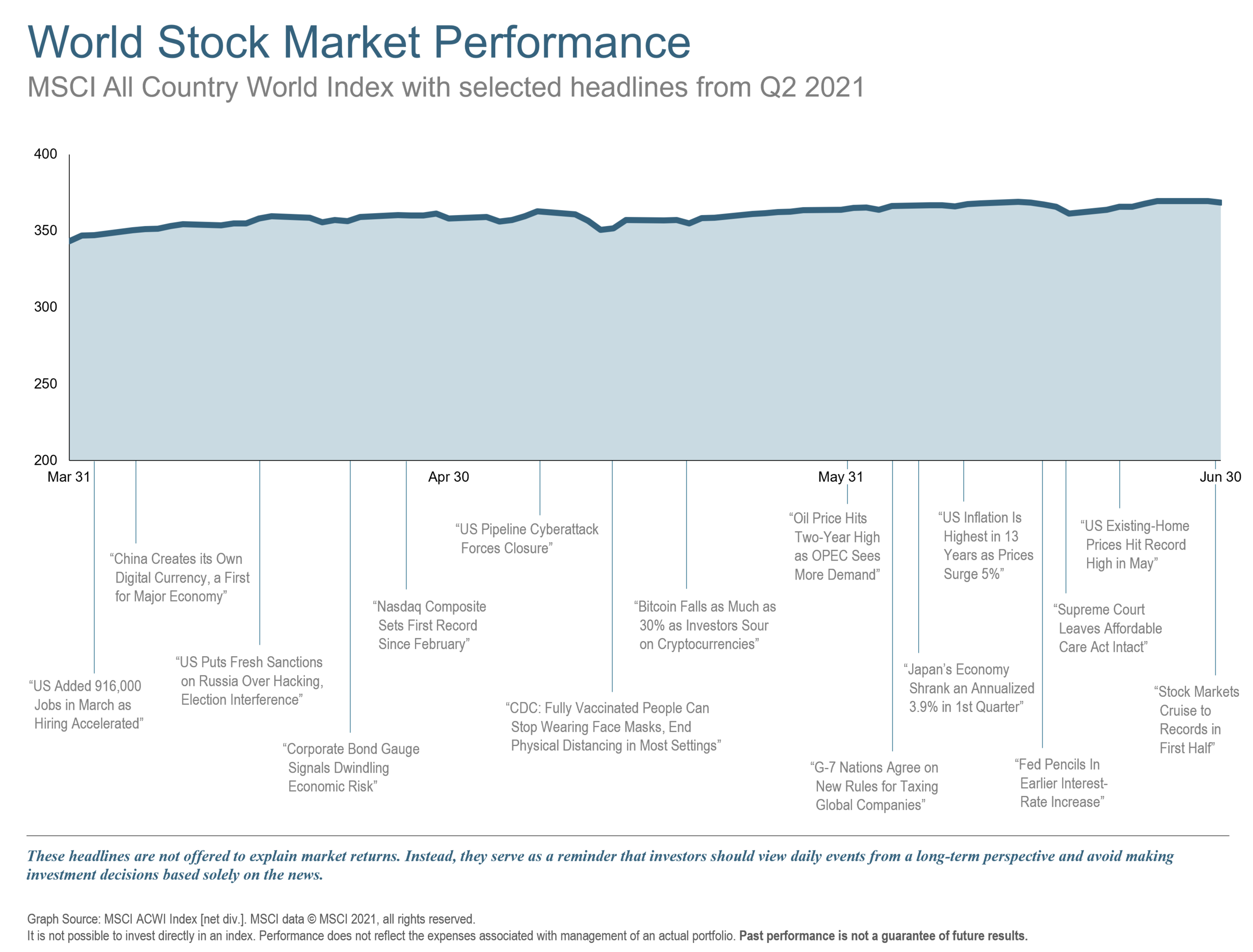

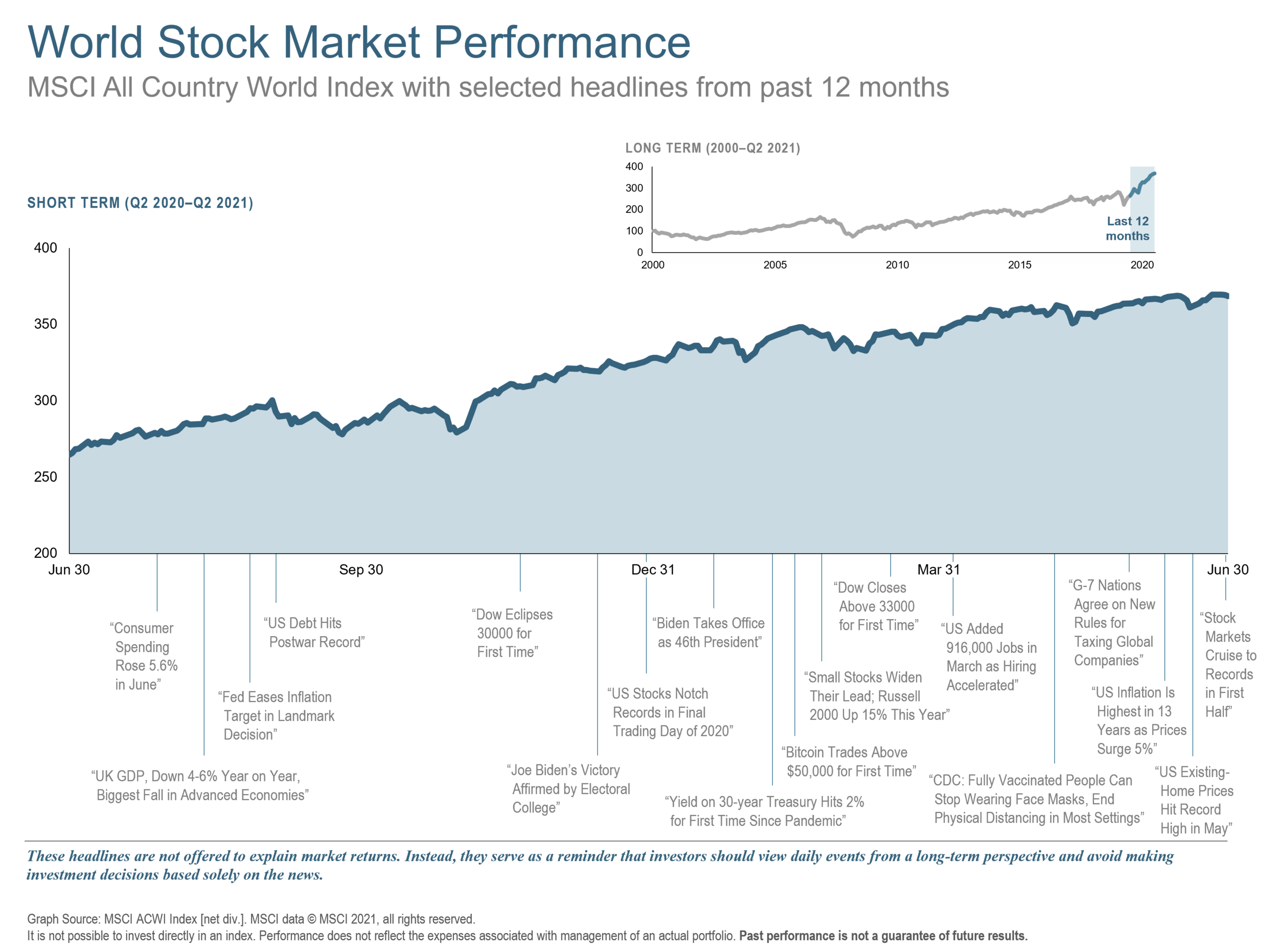

World economies have done the Texas Two Step (one step forward and two steps back) for much of the year as global stock and bond markets were broadly higher in Q2, supported by the accelerating roll-out of Covid-19 vaccines. Meanwhile, cryptocurrencies crashed, oil & gas soared, home prices sizzled, and the G7 spendthrifts, prompted by President Biden, sought to raise corporate tax rates across the globe.

In June, the Biden administration secured a deal on an infrastructure package worth about $1 trillion to upgrade roads, bridges and broadband networks. The agreement fell short of the $2.3 trillion plan that the President proposed but represented a rare bipartisan agreement in a very divided Congress.

The Federal Reserve’s rate-setting meeting brought no change to policy but the minutes showed that “indicators of economic activity and employment had strengthened” and even segments of the economy most impacted “had shown improvement”. There was an acknowledgment of rising inflation, but they said that higher prices are “largely reflecting transitory factors”. The market reacted negatively, though subsequent comments by Fed officials seemed to allay concerns over tightening monetary policy too quickly.

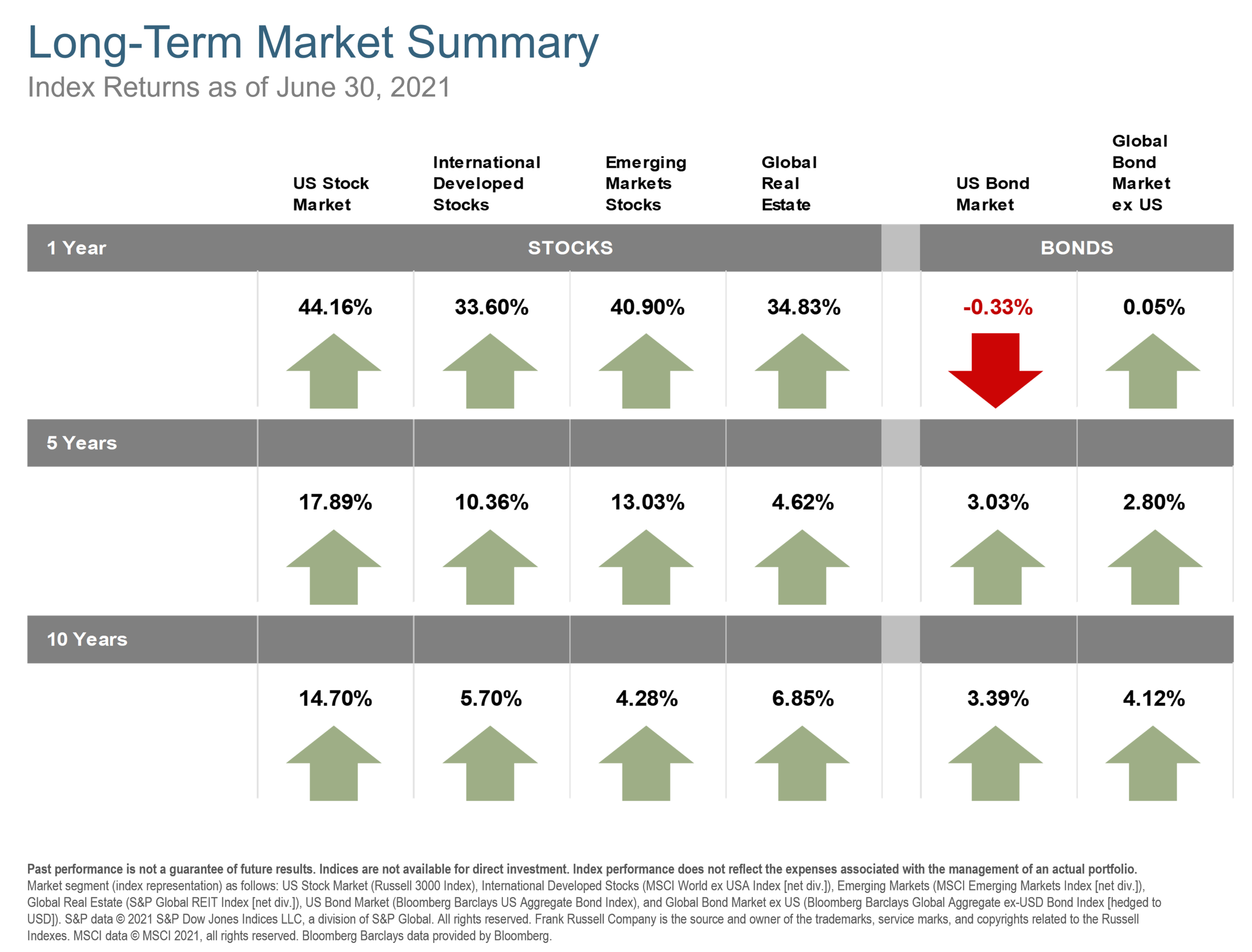

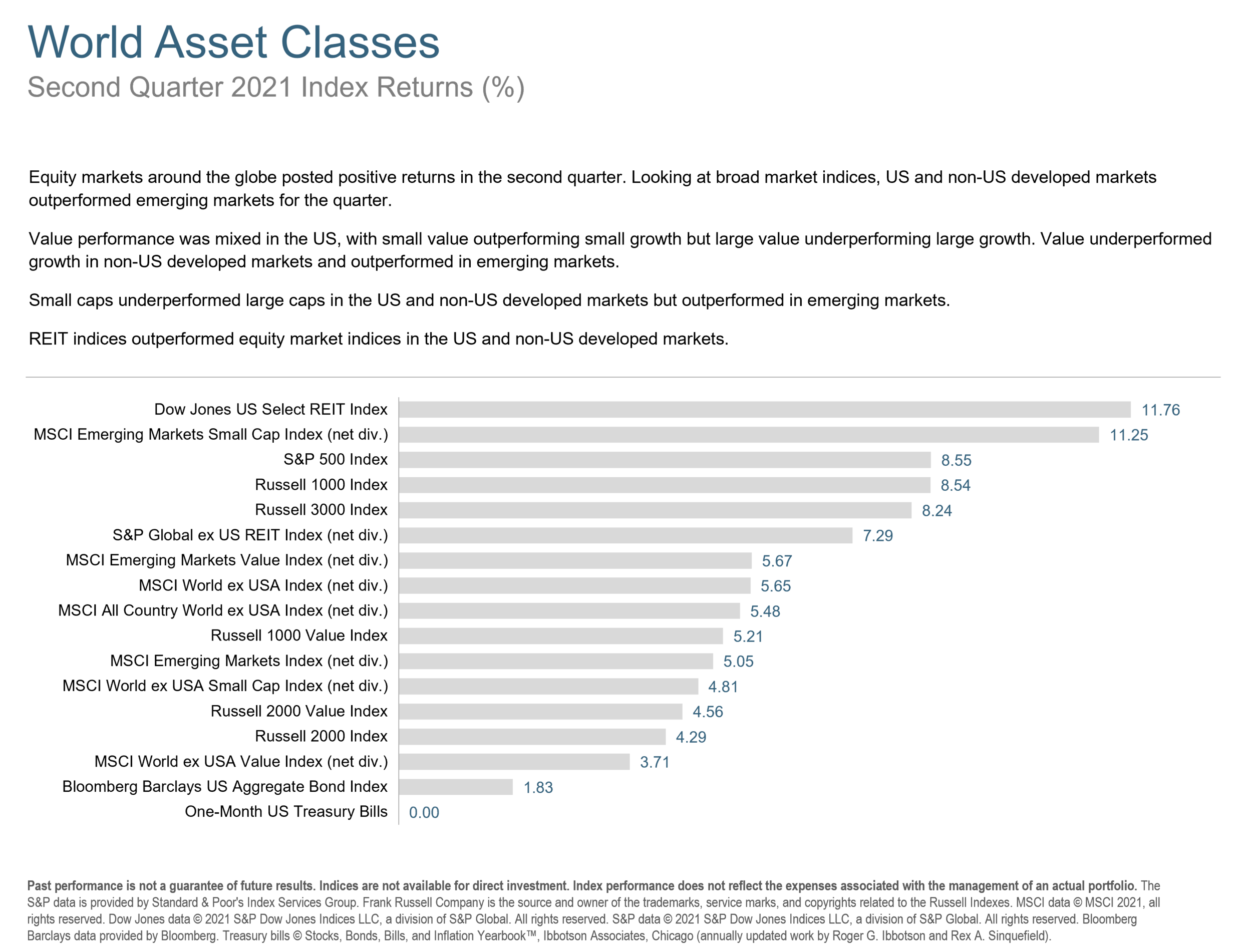

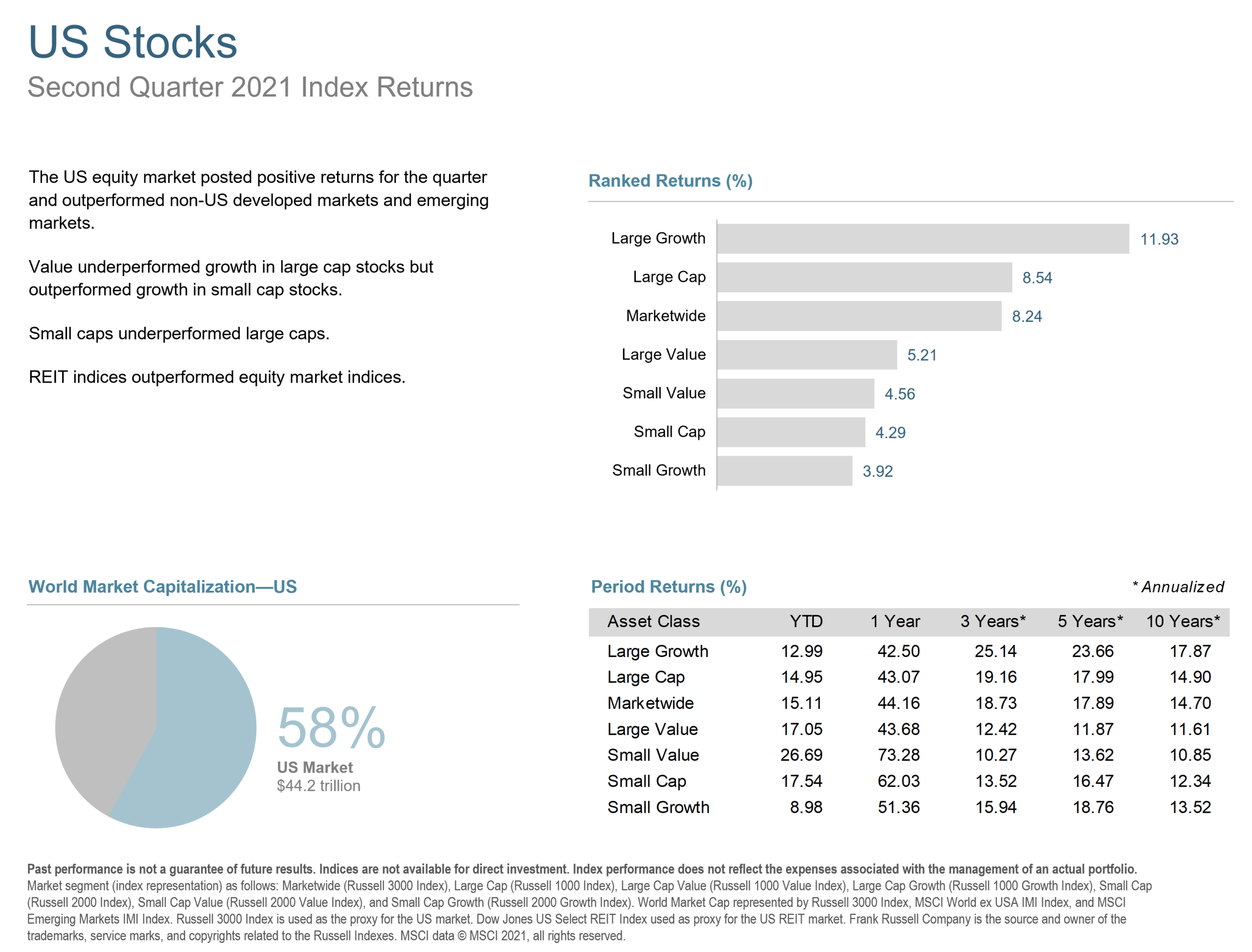

US equity markets posted strong returns for the quarter, outperforming non-US developed markets and emerging markets. Value stocks underperformed growth in large cap stocks and but outperformed in small cap stocks. Small caps underperformed large caps. REITs outperformed equity indices.

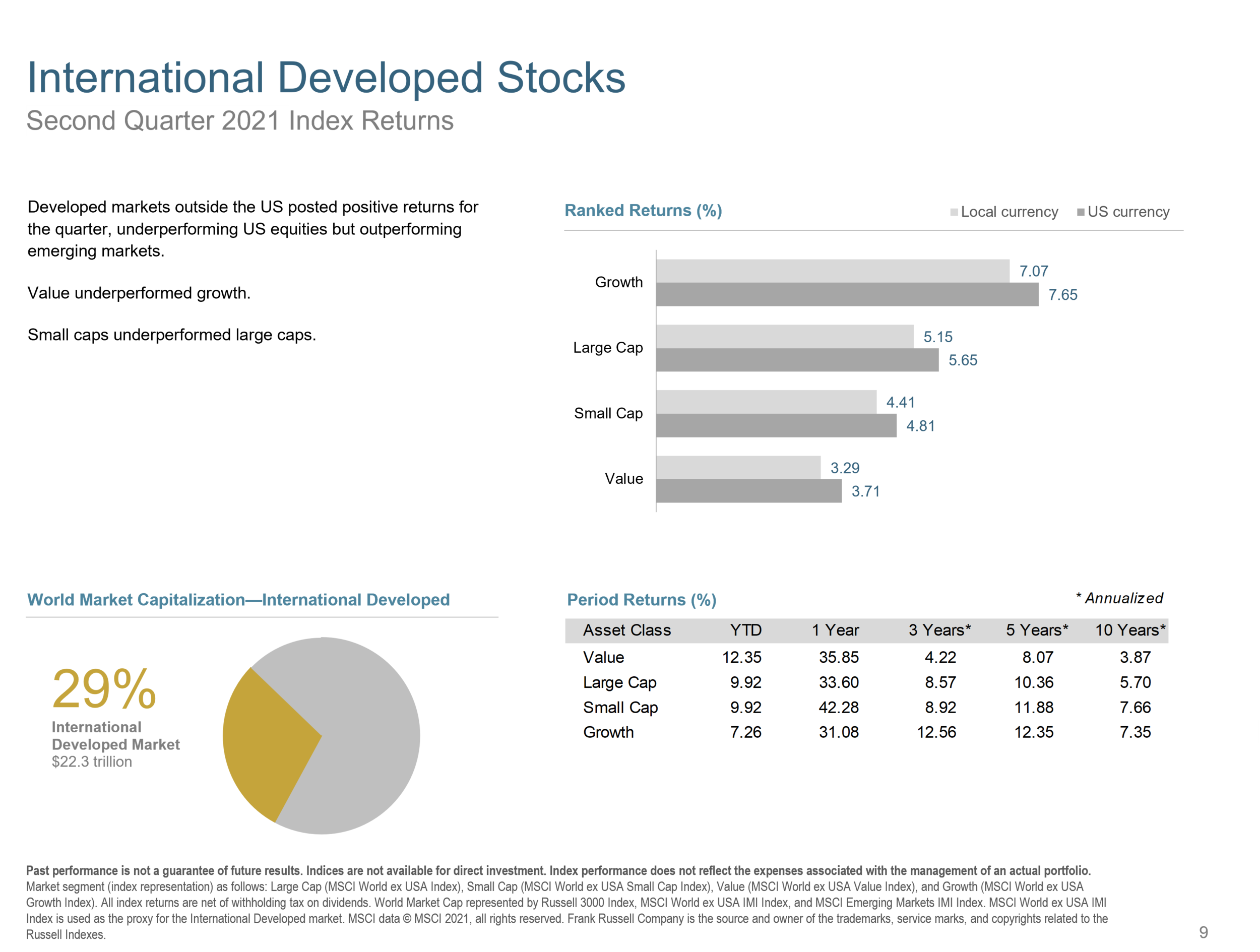

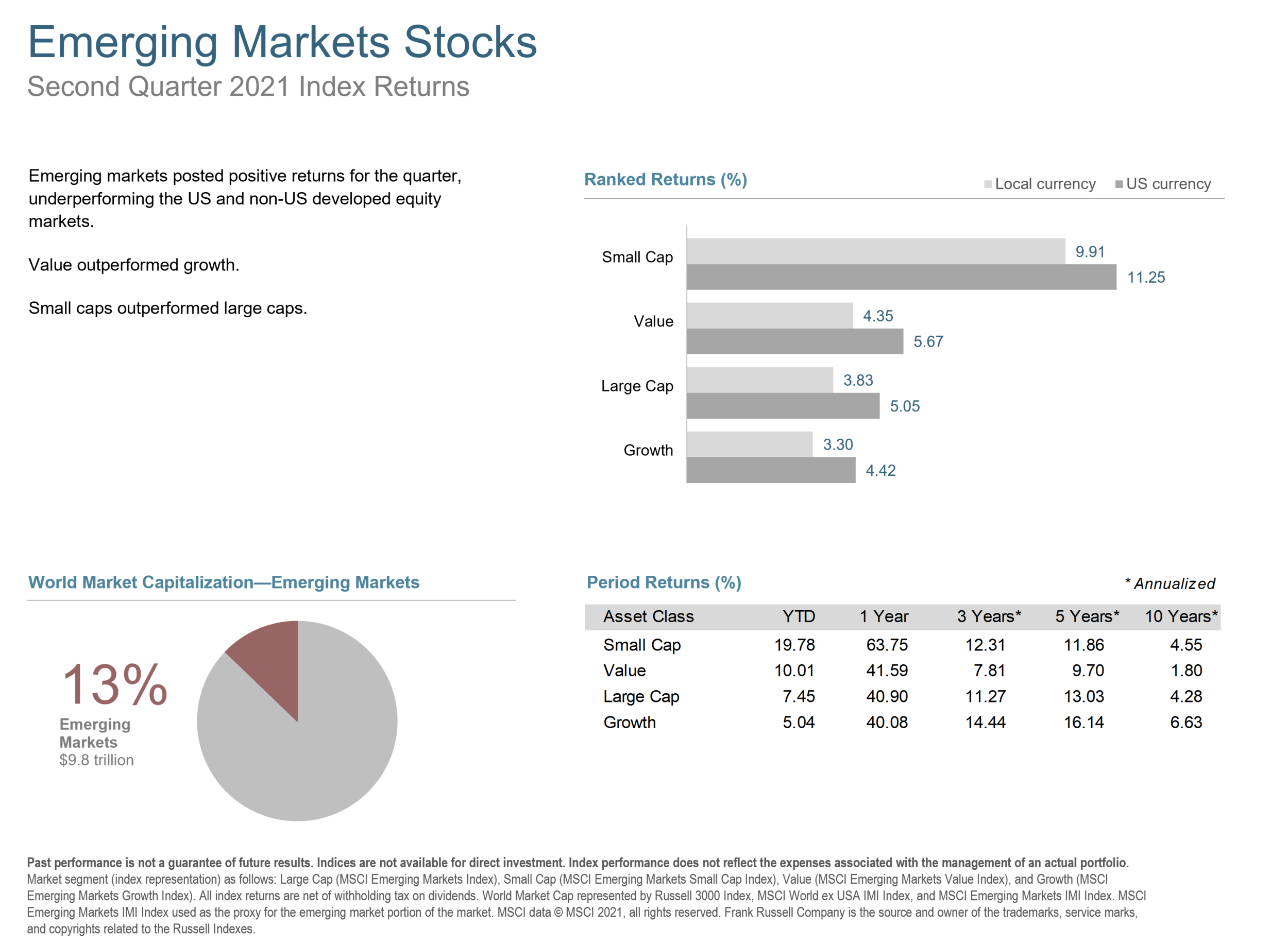

Equity markets around the globe also posted positive returns in the quarter. Looking at broad market indices, developed markets outside the US were up for the quarter, underperforming US equities but outperforming emerging markets. Value underperformed growth and small caps underperformed large caps. REITs outperformed equity market indices in both non-US developed and emerging markets.

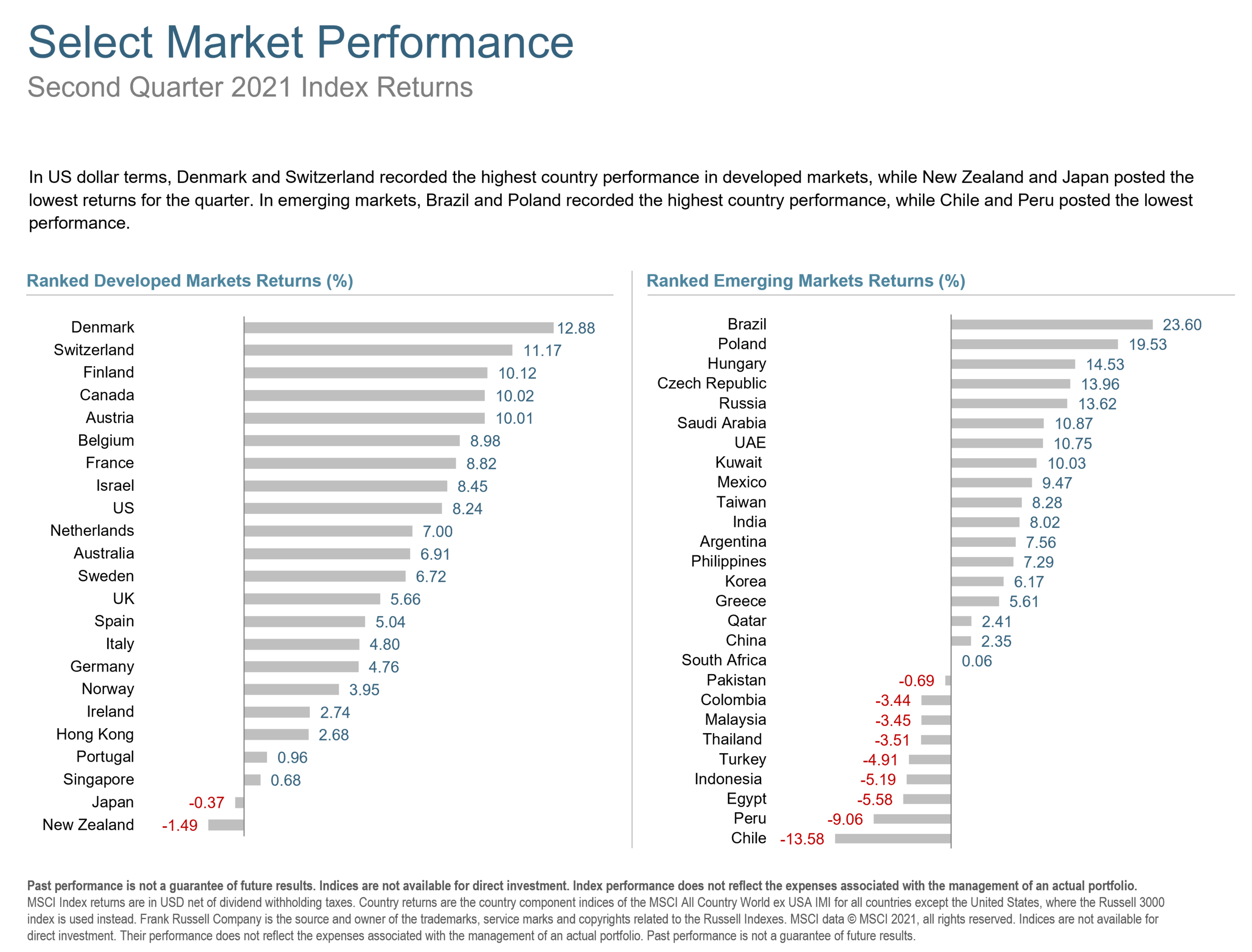

In US dollar terms, Denmark and Switzerland recorded the highest country performance in developed markets, while New Zealand and Japan posted the lowest returns for the quarter. In emerging markets, Brazil and Poland recorded the highest country performance, while Chile and Peru posted the lowest performance.

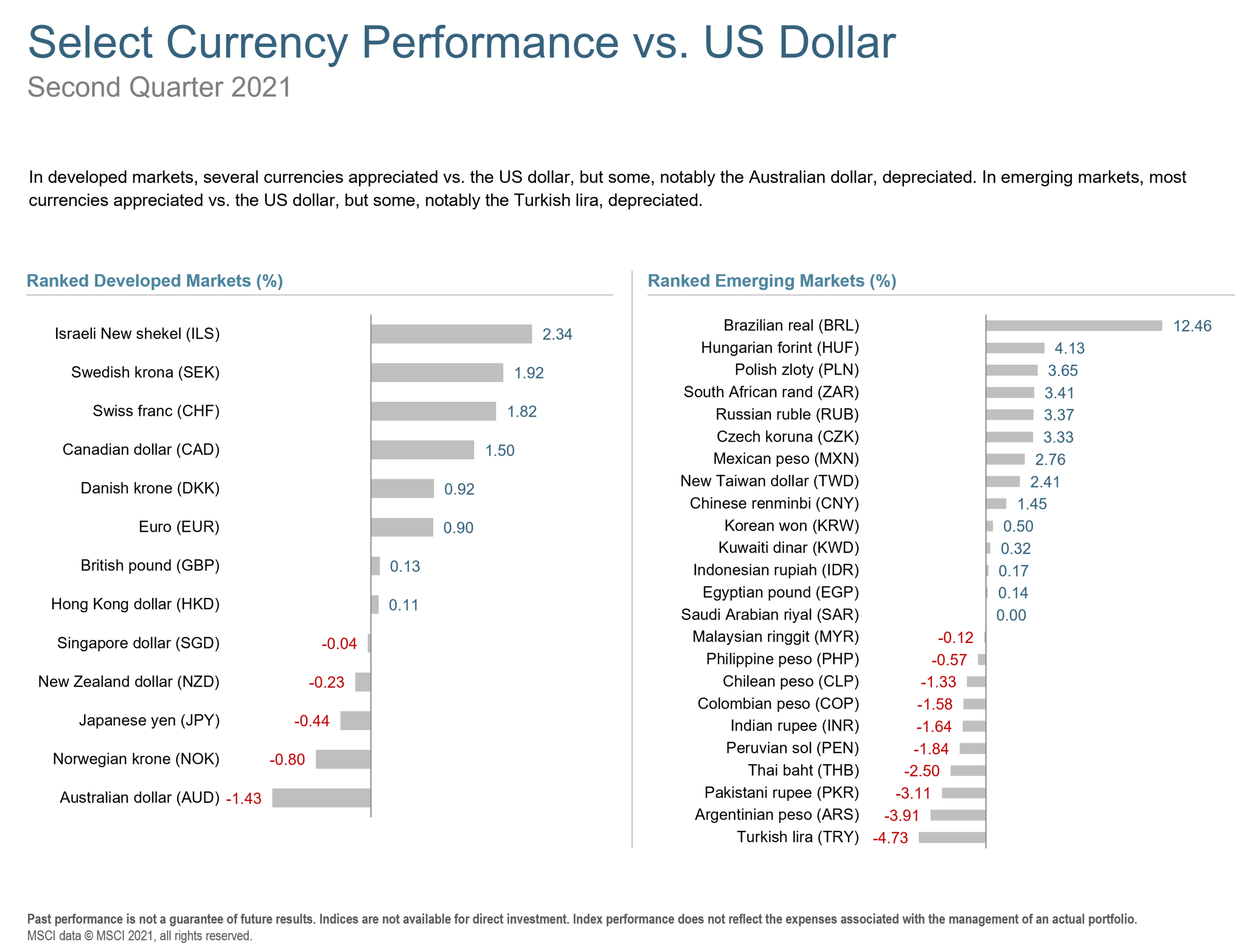

In developed markets, several currencies appreciated vs. the US dollar, but some, notably the Australian dollar, depreciated. In emerging markets, most currencies appreciated vs. the US dollar, but some, notably the Turkish lira, depreciated.

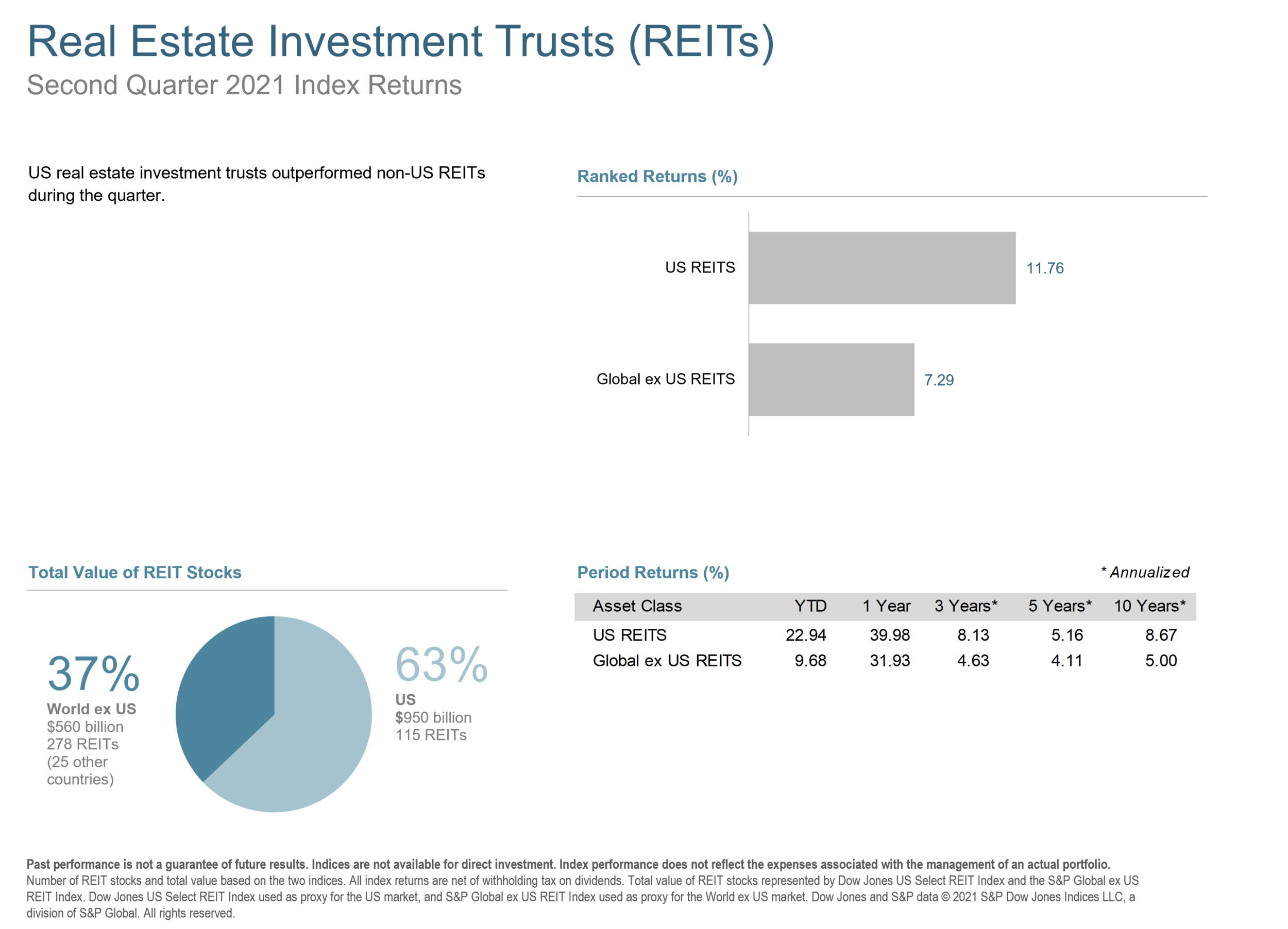

US real estate investment trusts outperformed non-US REITs during the quarter.

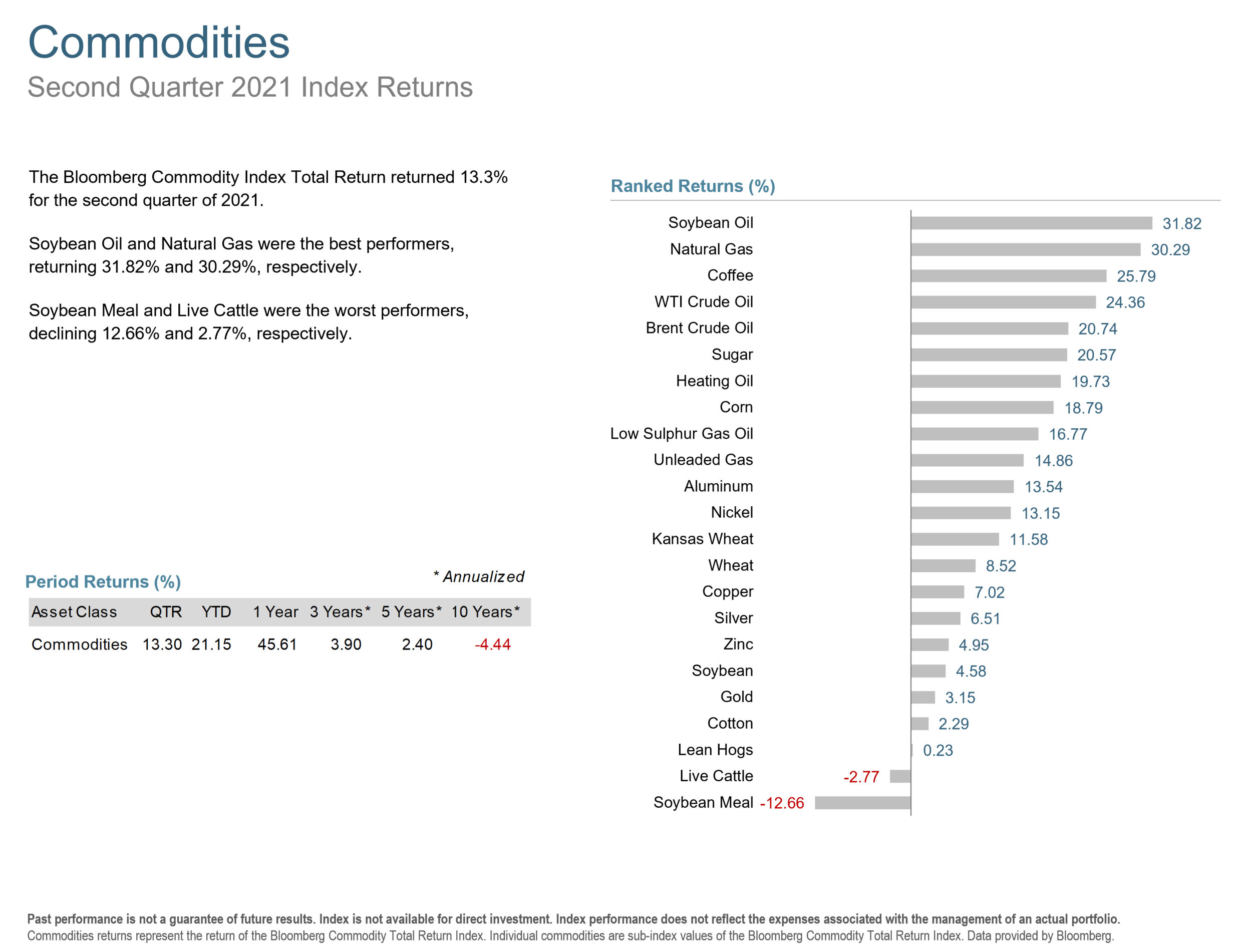

The Bloomberg Commodity Index Total Return returned 13.3% for the second quarter of 2021. Soybean Oil and Natural Gas were the best performers, returning 31.82% and 30.29%, respectively. Soybean Meal and Live Cattle were the worst performers, declining 12.66% and 2.77%, respectively.

Changes in interest rates in the US Treasury fixed income market were generally mixed during the second quarter of 2021. The yield on the 5-Year Treasury note decreased 7 basis points (bps) to 0.88%. The yield on the 10-Year T-note decreased 28 bps to 1.46%. The 30-Year Treasury bond yield declined 35 bps to 2.04%.

On the short end of the yield curve, the 1-Month US Treasury bill yield remained unchanged at 0.05%, and the 1-Year T-bill yield increased 2 basis point to 0.10%. The 2-Year Treasury note increased 10 bps to 0.25%.

In terms of total returns, short-term corporate bonds gained 0.70%. Intermediate-term corporate bonds returned 1.70%.

The total return for short-term municipal bonds was 0.30%, while intermediate-term munis returned 0.80%. Revenue bonds outperformed general obligation bonds.

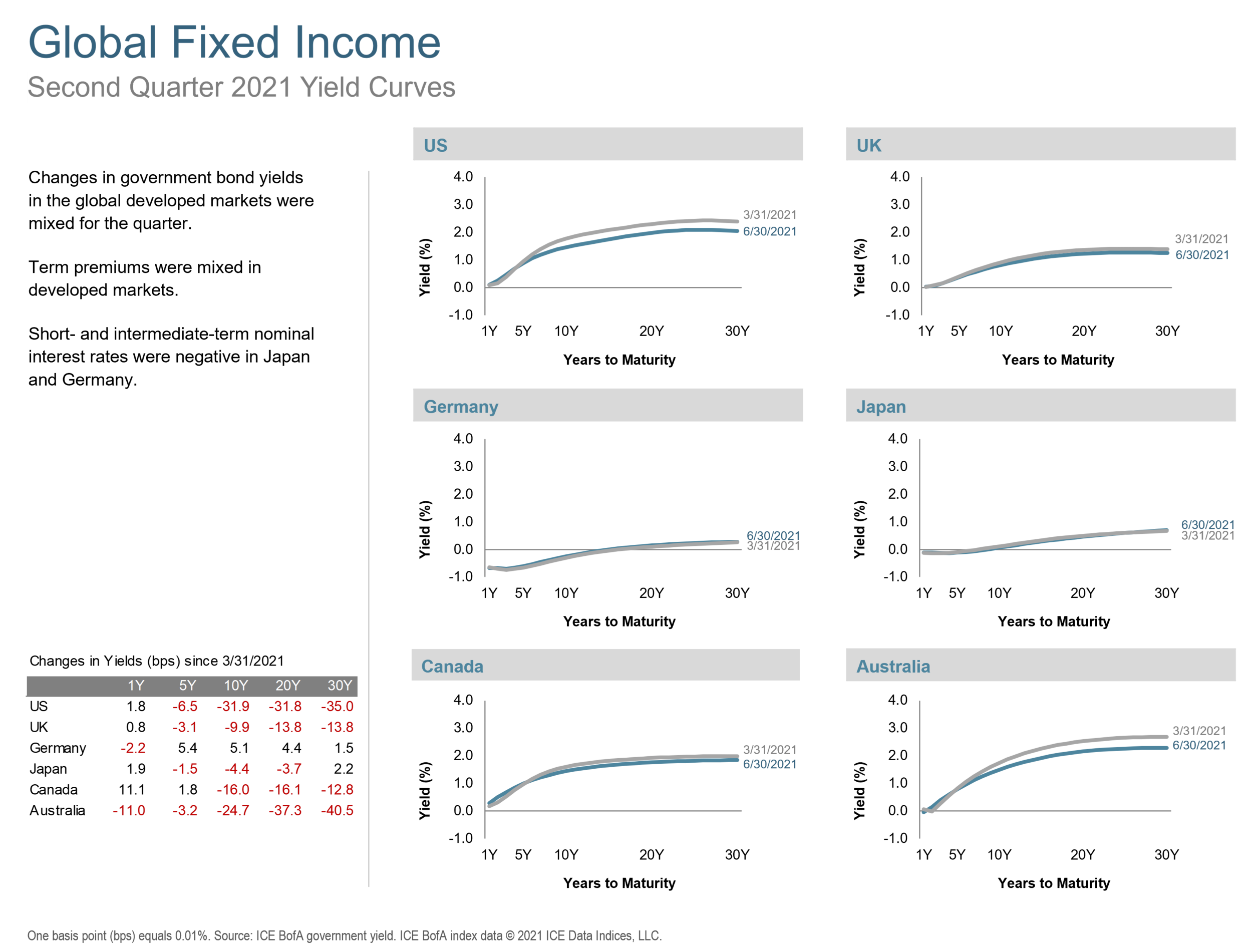

Changes in government bond yields in the global developed markets were mixed for the quarter. Term premiums were mixed in developed markets. Short- and intermediate-term nominal interest rates were negative in Japan and Germany.

The Q2 2021 Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

With any market condition, a sound plan makes the ups and downs much more manageable. Get in touch if you would like to review your plan.