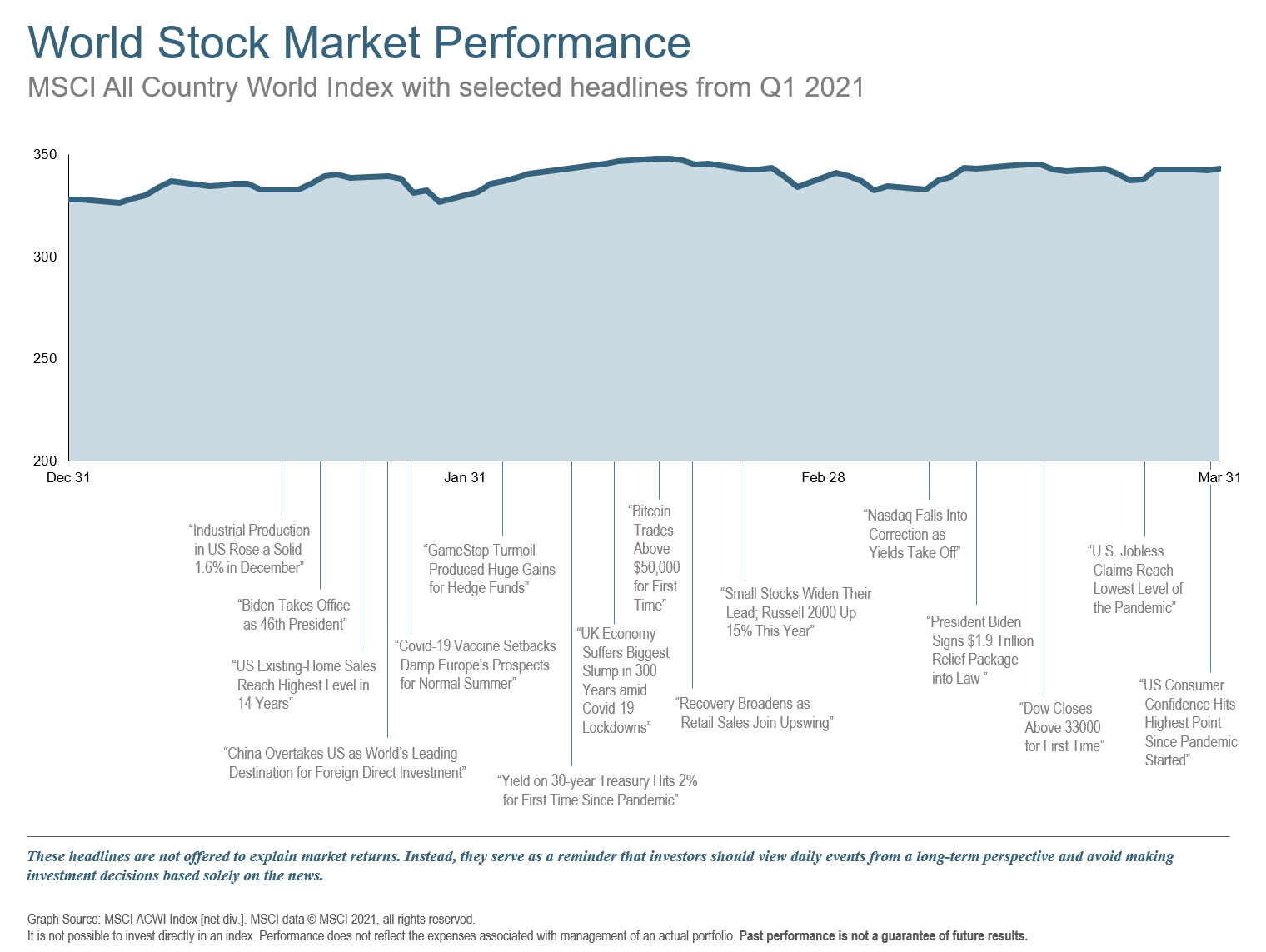

Equity markets marched steadily higher in the first quarter of 2021. Extreme volatility from a handful of “meme stocks” occupied headlines with social media brigades hyping out of favor companies such as Gamestop. While the idea of small investors sticking it to big greedy hedge funds makes for good media quotes (i.e. “You only live once!”), it was the energy and financial sectors that were the best performers overall and led the stock charge.

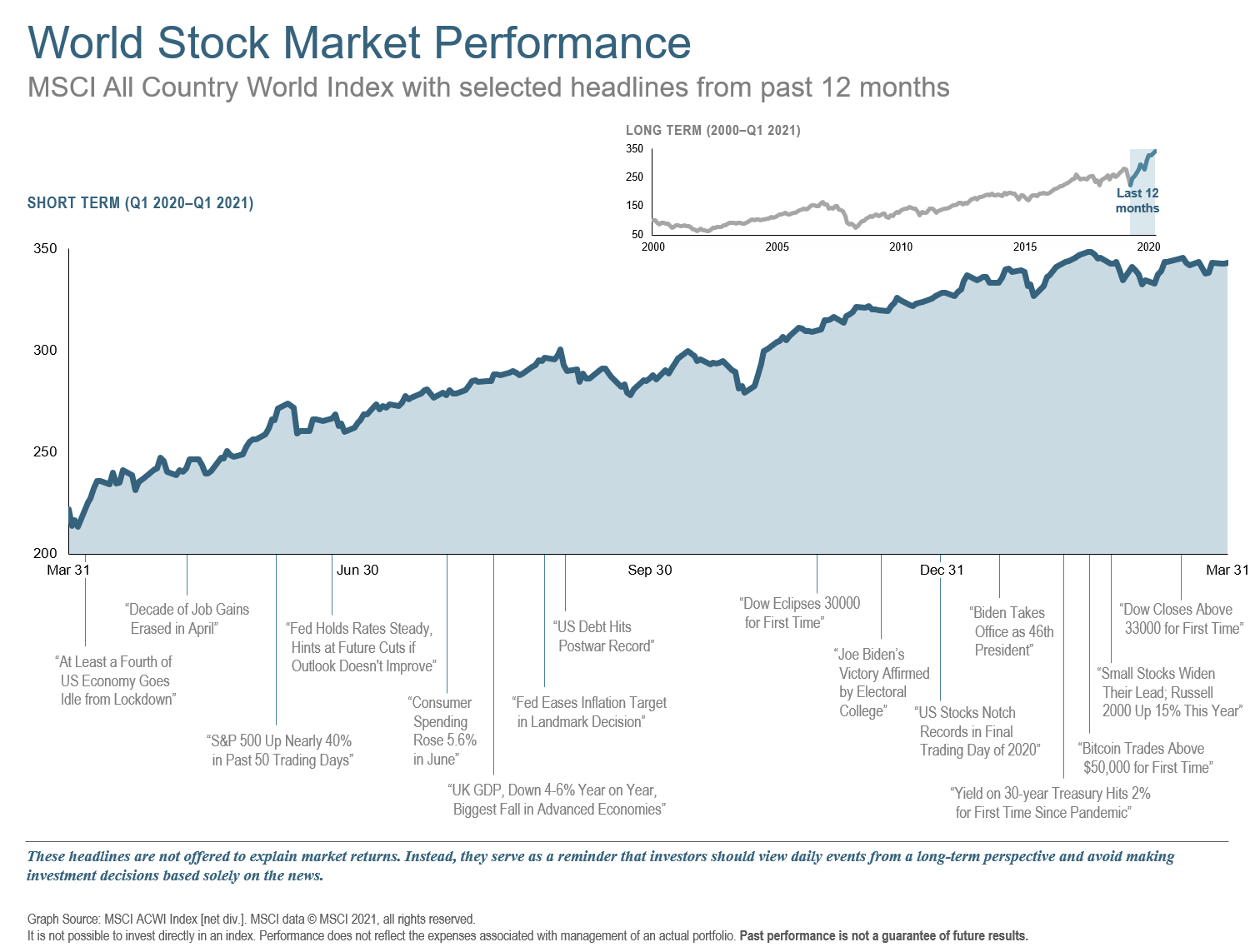

Looking back at last year’s Q1 2020 Market Review offers an even better perspective of the massive recovery in markets after logging pandemic lows. We have seen the US market rally over 60% with international benchmarks up of 50%, supported by the roll-out of several Covid-19 vaccines and news of further US fiscal stimulus.

Both the Trump and Biden administrations have pumped trillions of dollars into the economy in the past year, with the latest package of $1.9 trillion potentially being followed by $2 trillion in infrastructure spending.

The Federal Reserve has also continued their accommodative spirit, with most Federal Open Market Committee members signaling that rates will remain near zero through 2023. That is in addition to the $120 billion a month of asset purchases they have had in place since last year.

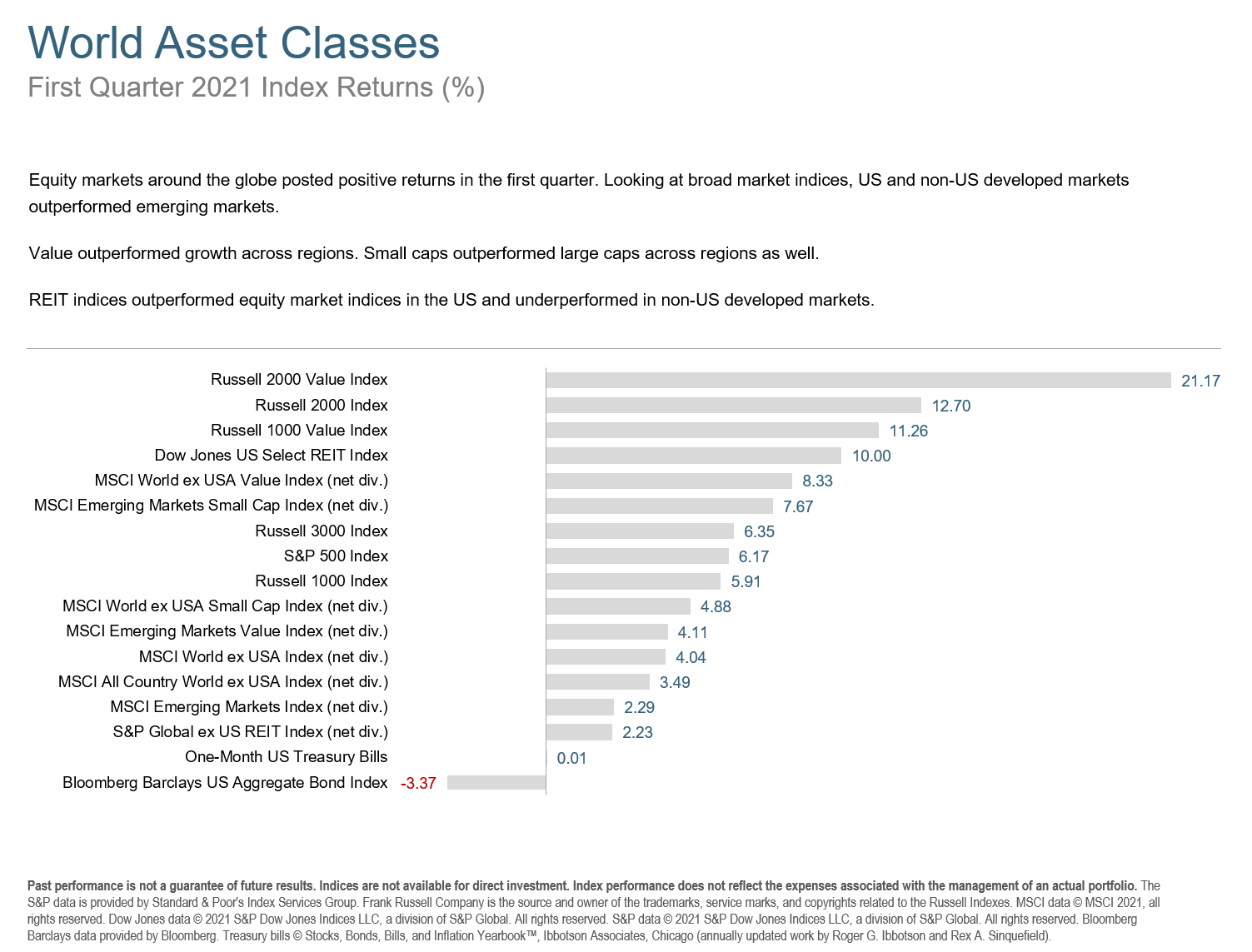

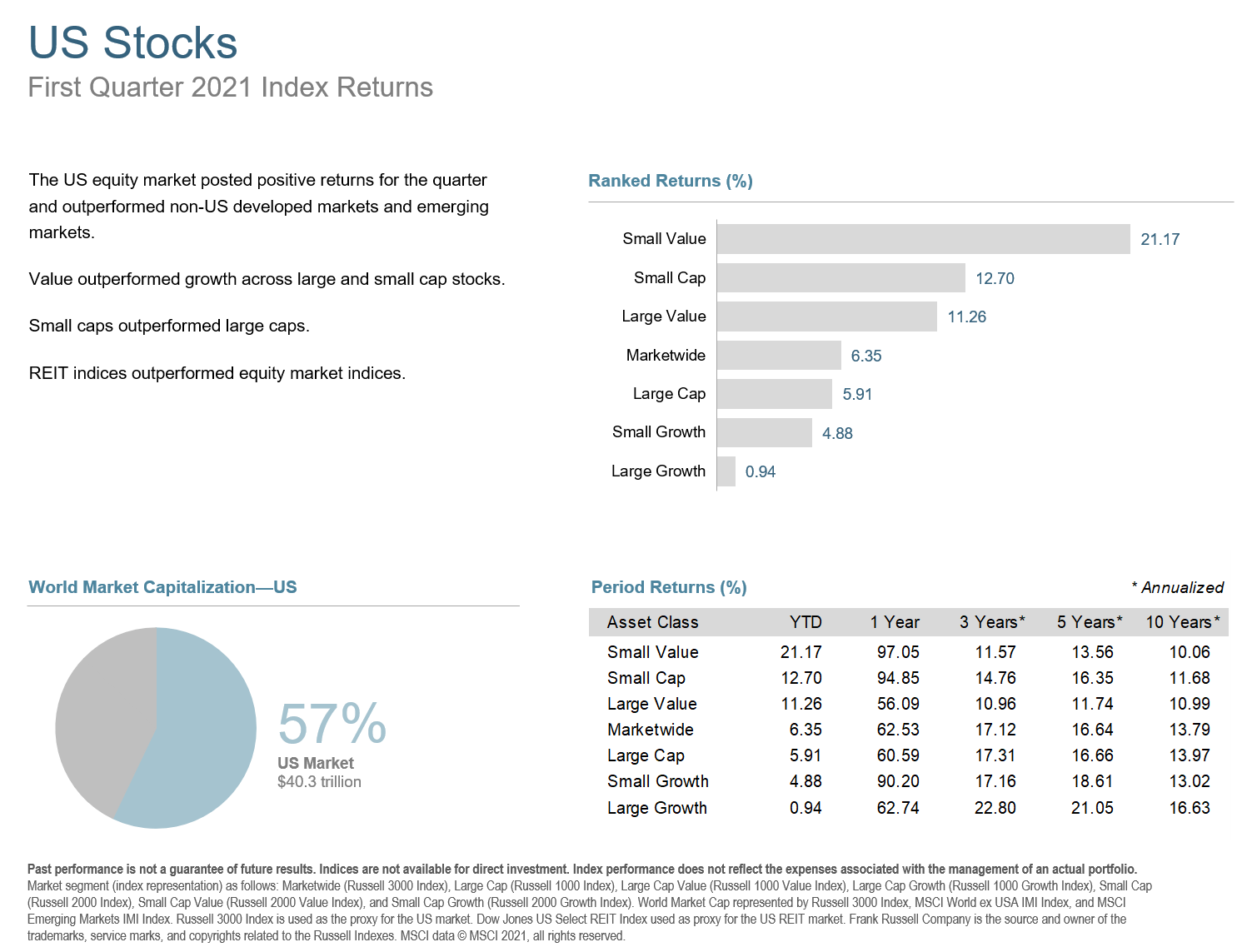

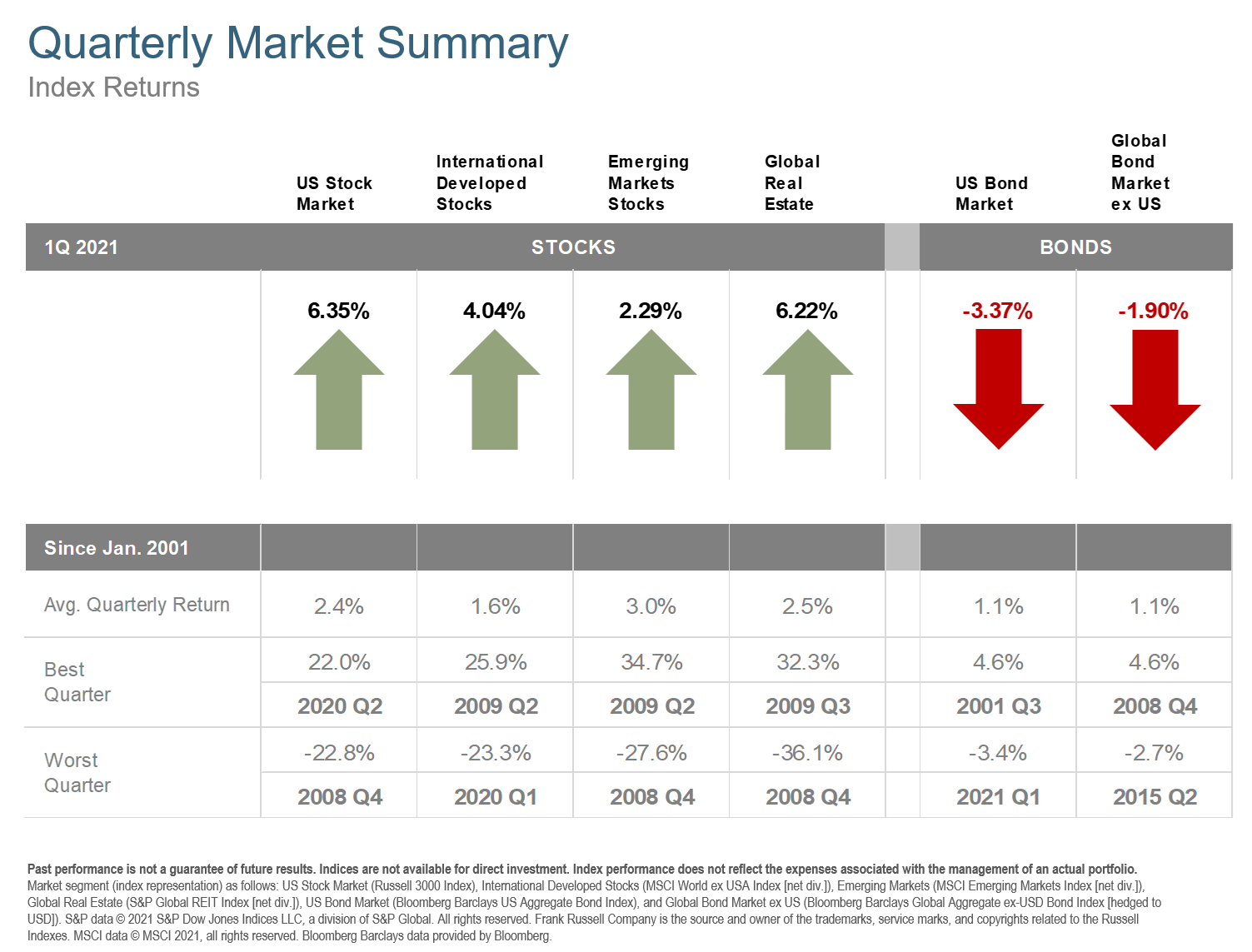

US equity markets posted strong returns for the quarter, outperforming non-US developed markets and emerging markets. Value stocks outperformed growth across large and small cap stocks. Small caps outperformed large caps. REITs outperformed equity indices.

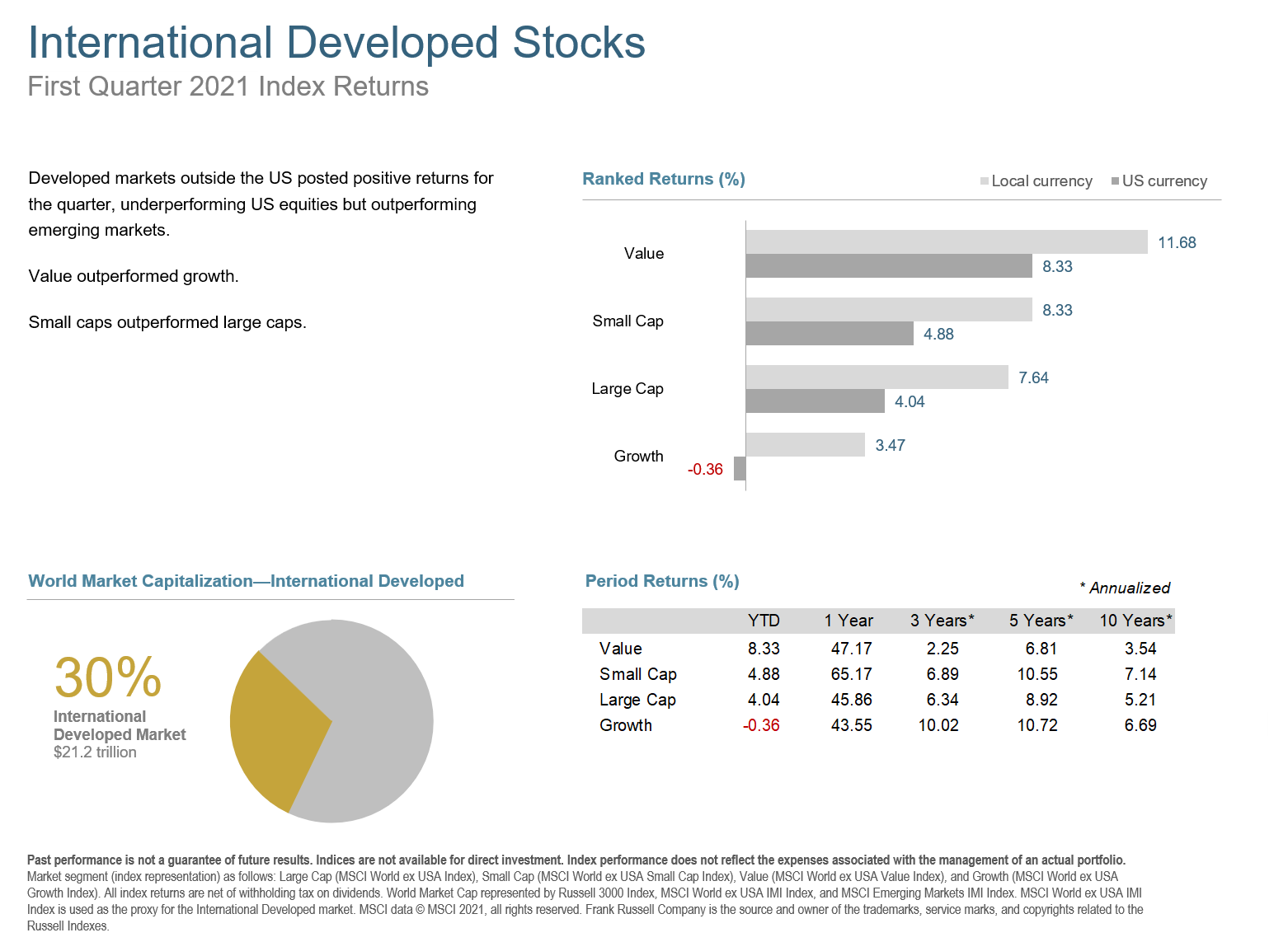

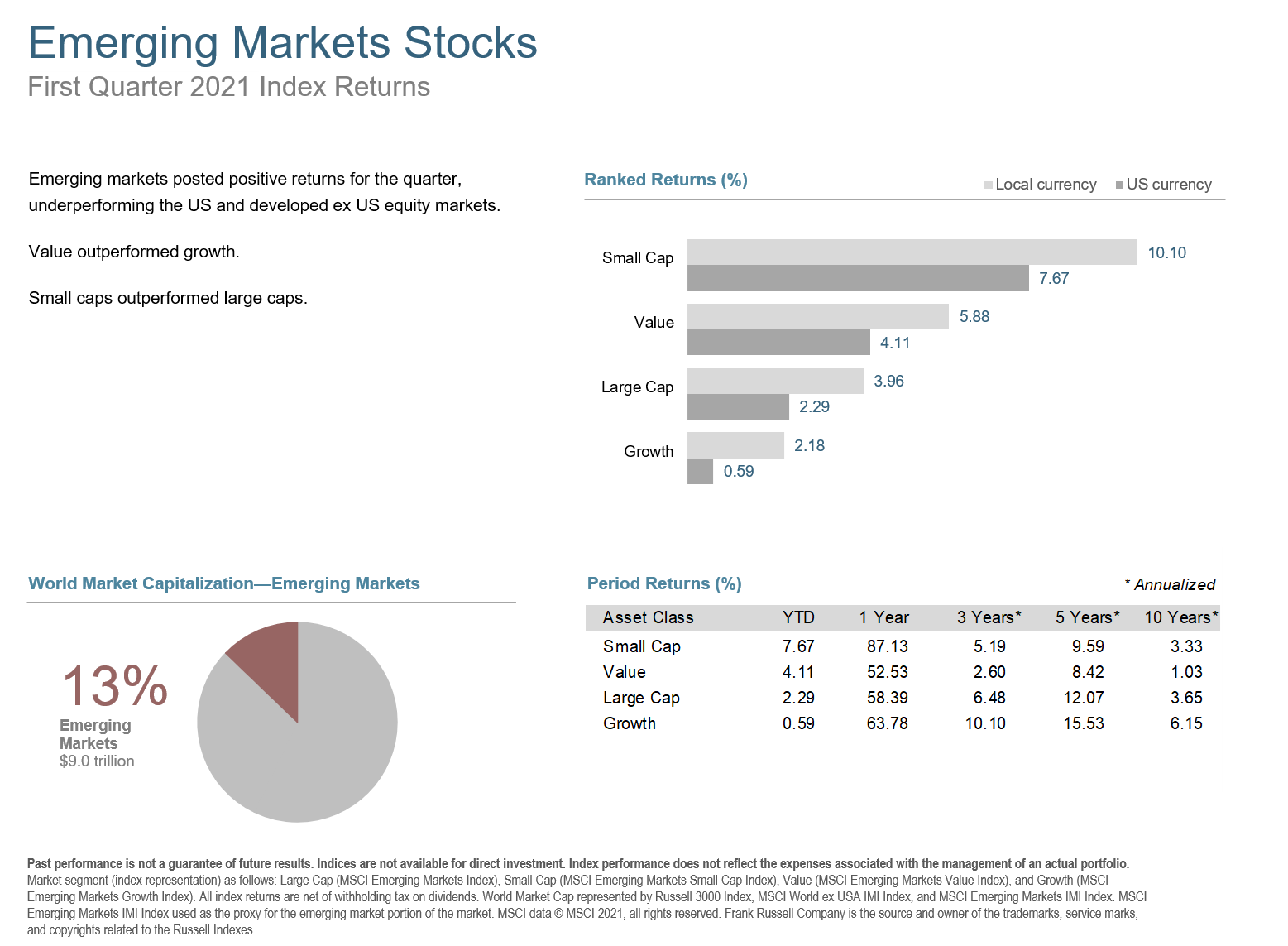

Equity markets around the globe also posted strong returns in the quarter. Looking at broad market indices, developed markets outside the US posted positive returns for the quarter, underperforming US equities but outperforming emerging markets. Value outperformed growth and small caps outperformed large caps. REITs underperformed equity market indices in both the US and non-US developed markets.

In US dollar terms, the Netherlands and Austria recorded the highest country performance in developed markets, while New Zealand and Portugal posted the lowest returns for the quarter. In emerging markets, Saudi Arabia and Chile recorded the highest country performance, while Colombia and Turkey posted the lowest performance.

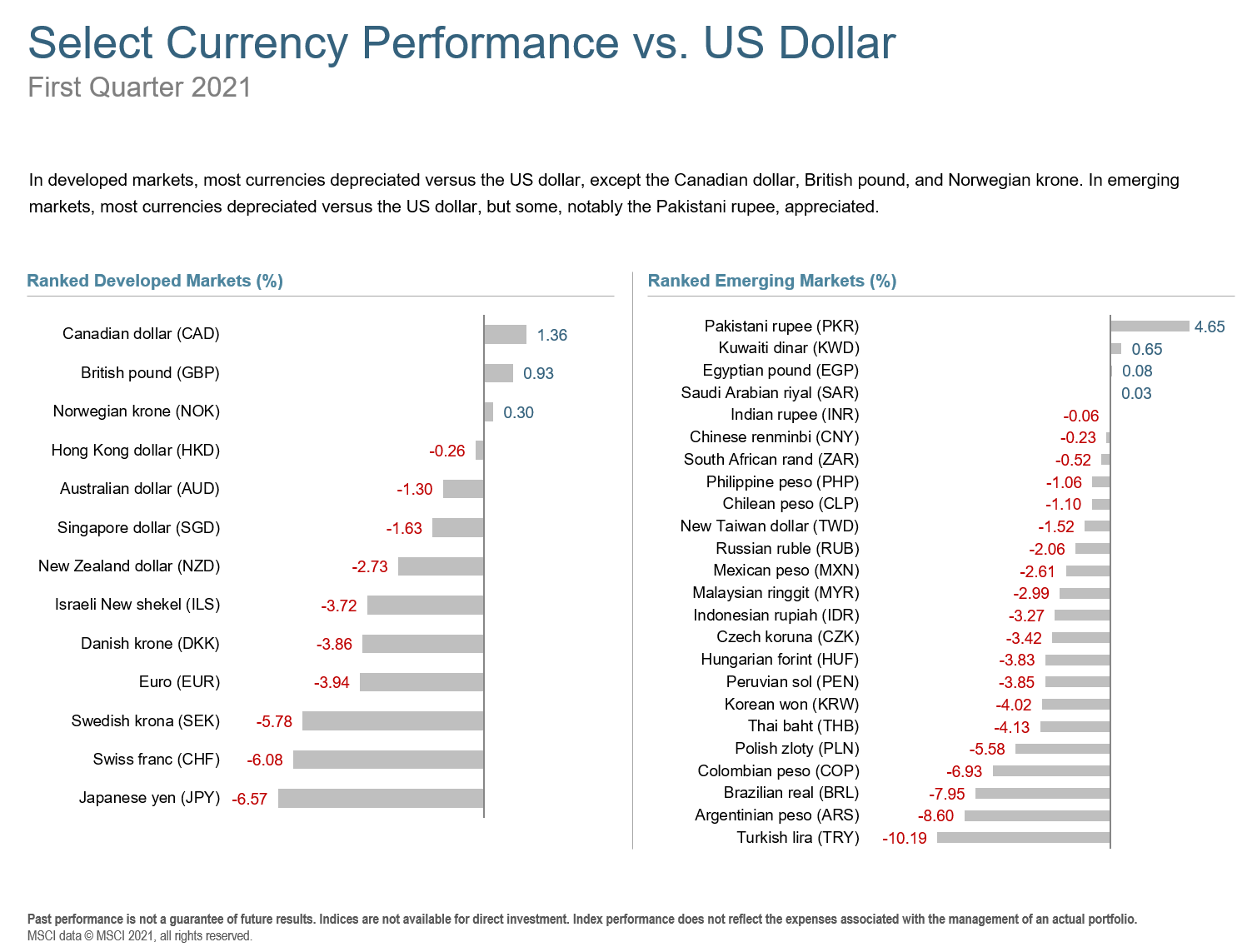

In developed markets, most currencies depreciated versus the US dollar, except the Canadian dollar, British pound, and Norwegian krone. In emerging markets, most currencies depreciated versus the US dollar, but some, notably the Pakistani rupee, appreciated..

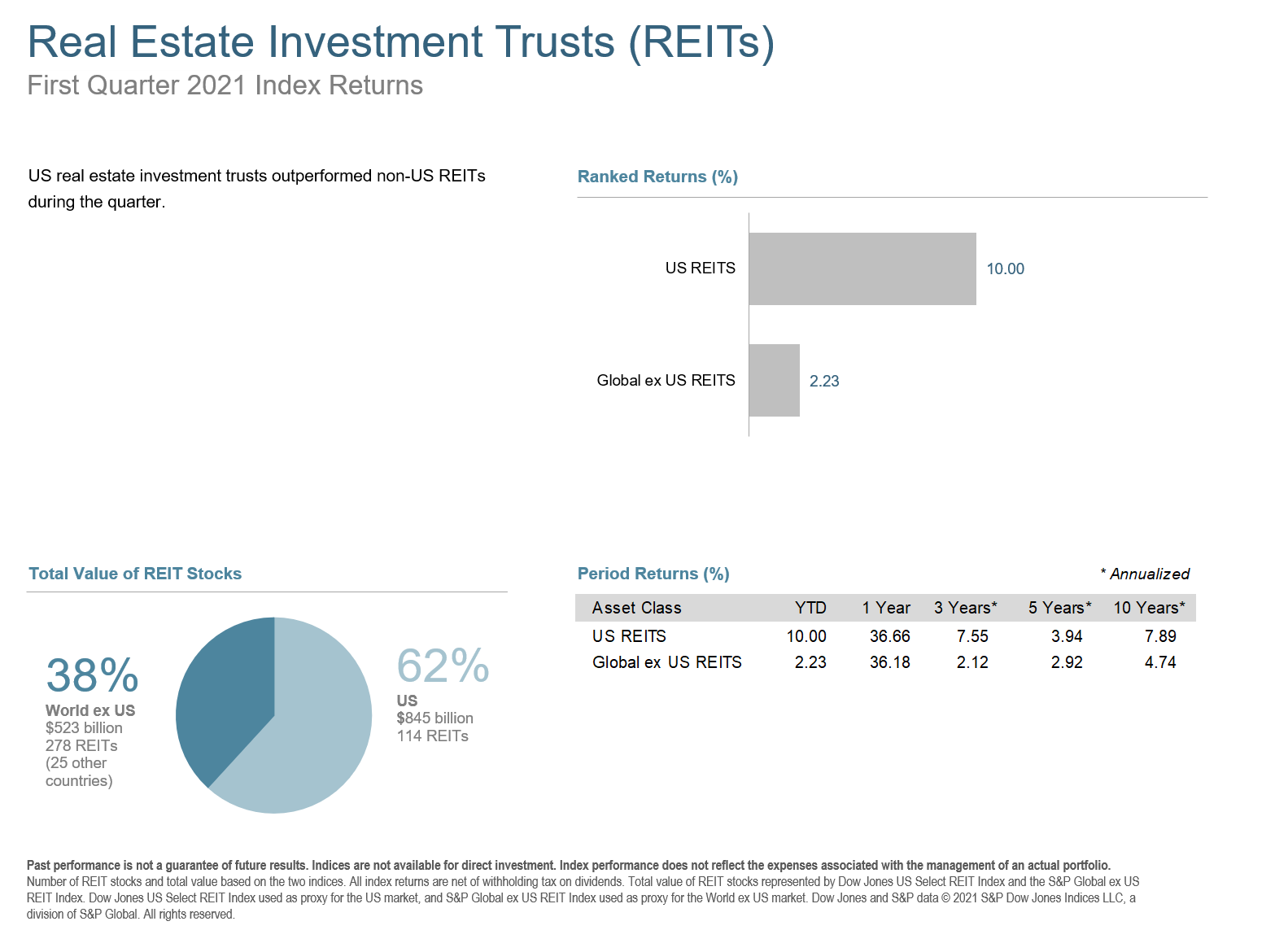

US real estate investment trusts outperformed non-US REITs during the quarter.

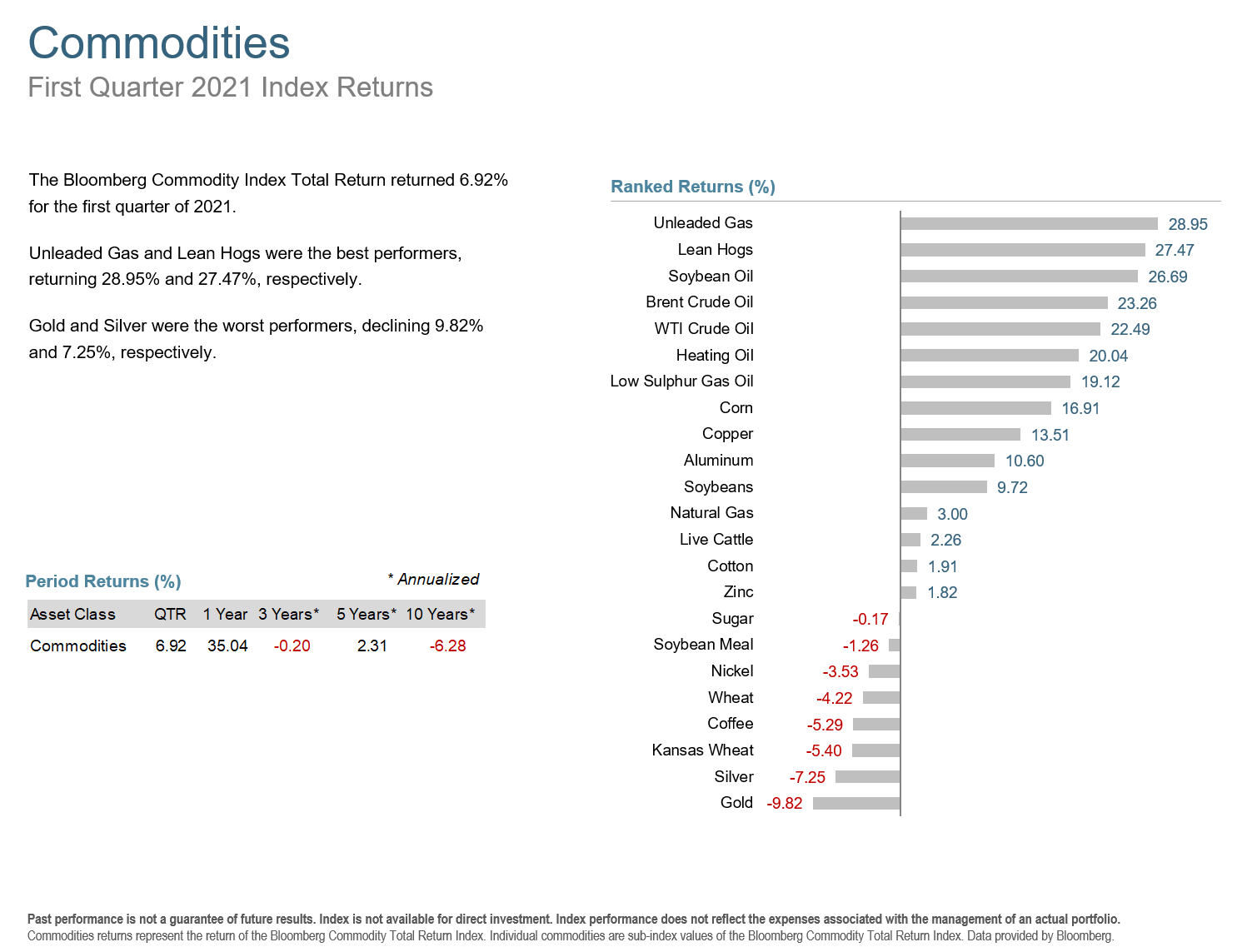

The Bloomberg Commodity Index Total Return returned 6.92% for the first quarter of 2021. Unleaded Gas and Lean Hogs were the best performers, returning 28.95% and 27.47%, respectively. Gold declined 9.82% and Silver fell 7.25% and were the worst performers.

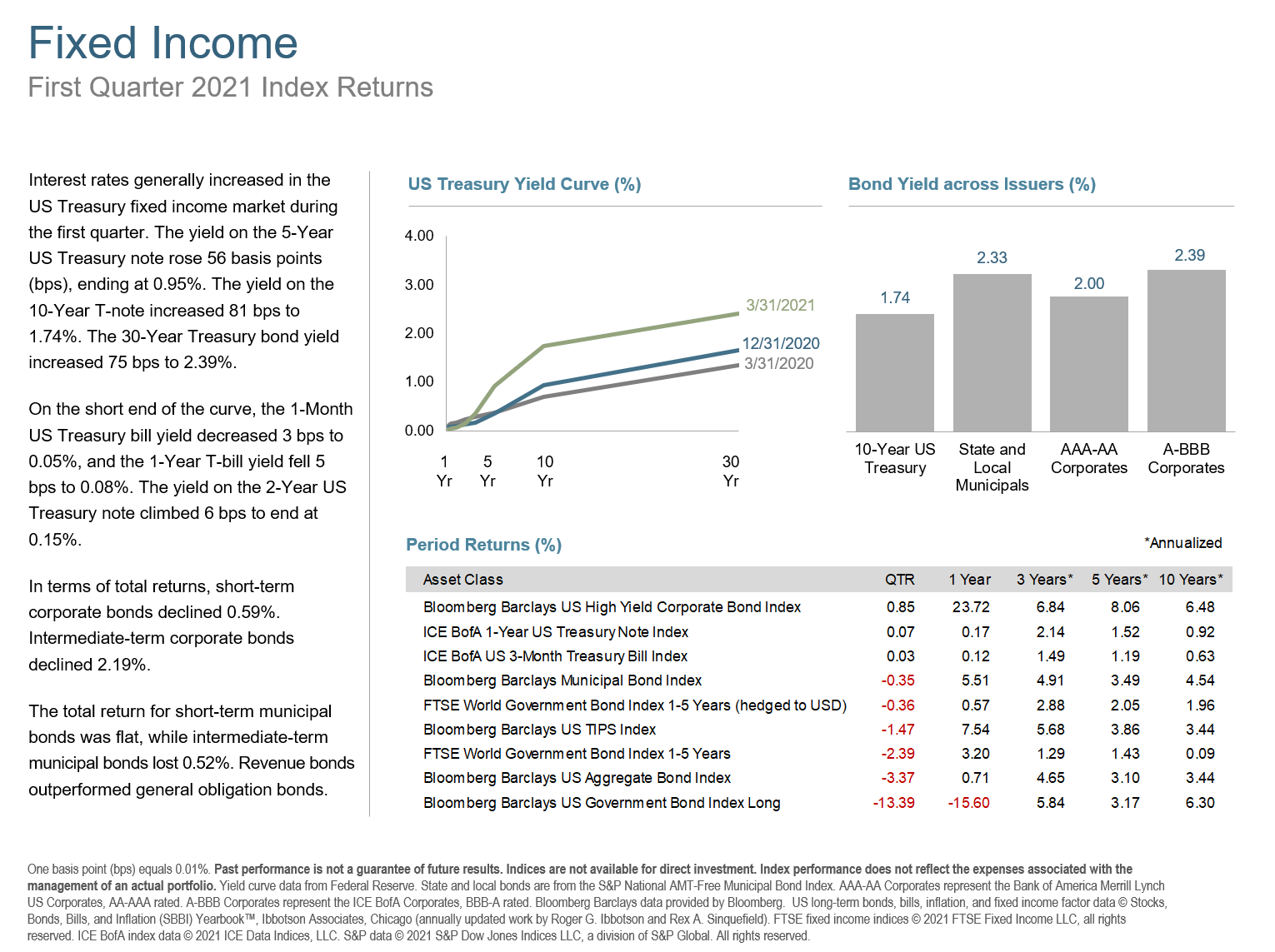

Interest rates generally increased in the US Treasury fixed income market during the first quarter. The yield on the 5-Year US Treasury note rose 56 basis points (bps), ending at 0.95%. The yield on the 10-Year T-note increased 81 bps to 1.74%. The 30-Year Treasury bond yield increased 75 bps to 2.39%.

On the short end of the curve, the 1-Month US Treasury bill yield decreased 3 bps to 0.05%, and the 1-Year T-bill yield fell 5 bps to 0.08%. The yield on the 2-Year US Treasury note climbed 6 bps to end at 0.15%.

In terms of total returns, short-term corporate bonds declined 0.59%. Intermediate-term corporate bonds declined 2.19%.

The total return for short-term municipal bonds was flat, while intermediate-term municipal bonds lost 0.52%. Revenue bonds outperformed general obligation bonds.

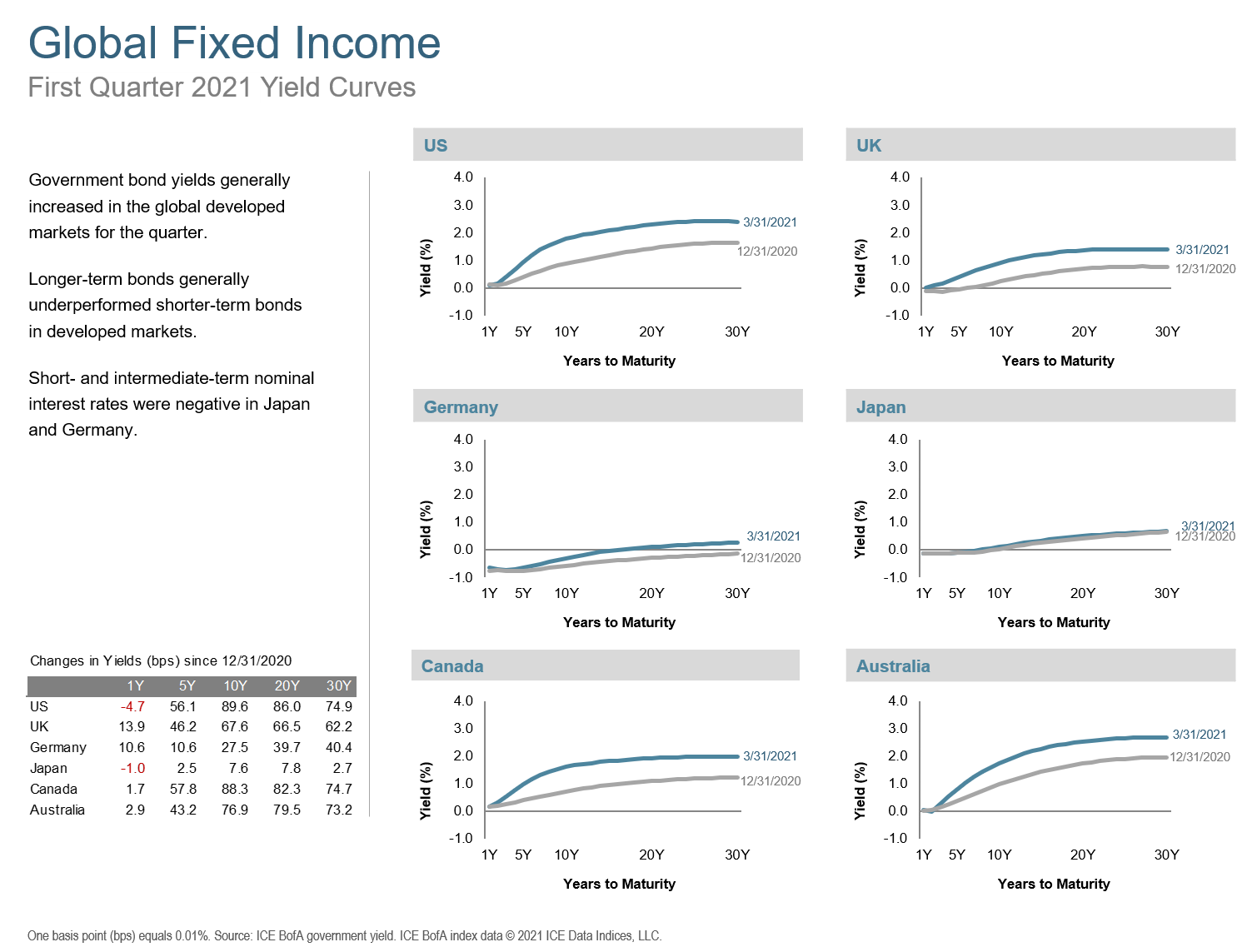

Government bond yields generally increased in the global developed markets for the quarter. Longer-term bonds generally underperformed shorter-term bonds in developed markets. Short- and intermediate-term nominal interest rates were negative in Japan and Germany.

The Q1 2021 Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

With any market condition, a sound plan makes the ups and downs much more manageable. Get in touch if you would like to review your plan. YOLO!