World stock markets were flat to down in Q3, but it can be argued that they had a better summer than Joe Biden. In Washington DC, spinsters sold the debacle in Kabul as a “tactical success” and the $3.5 trillion price tag of turning the US into a EU style social welfare utopia as “free”. Equity investors, however, weren’t quite as willing to rebrand slowing growth and inflation any differently than they were in the 1970’s when the “Stagflation” term was originally coined.

Remember back in June when the Biden administration secured a deal on an infrastructure package worth about $1 trillion to upgrade roads, bridges and broadband networks (and paid leave, child care, and caregiving)? Leftist Democrats have refused to vote for that unless their massive $3.5 trillion welfare state expansion is considered as a package deal. Investors have paid attention as the spendthrifts have gleefully leaked their plans for higher capital gains taxes, higher corporate taxes that will be passed to consumers, and less incentives to save as retirement vehicles such as Roth IRAs are cynically targeted as “unfair” tax dodges.

To add wind to the bow, the Federal Reserve announced at their September meeting that GDP growth was lower then previously estimated (5.9% vs 7% for 2021) while inflation will be higher (4.2% vs their previous estimate of 3.4%). In addition, they indicated that the punch bowl may be getting low and that they are going to slow down their asset purchases (also known as quantitative easing). Oh, and did I mention that there are also increasing indications they may need to raise rates more aggressively than previously thought? Apparently the “transitory inflation” supposedly caused by supply chain disruptions is becoming more than a temporary blip.

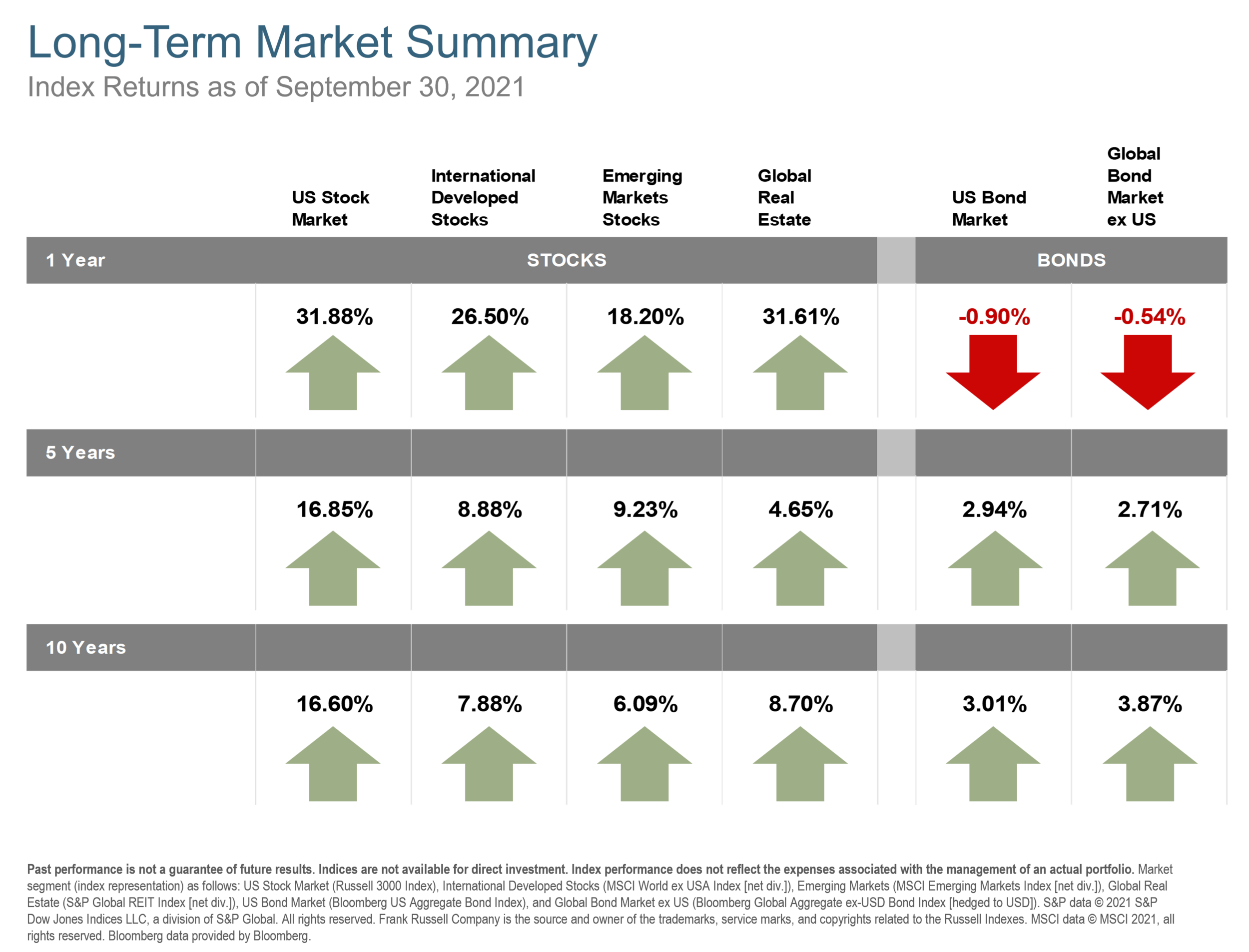

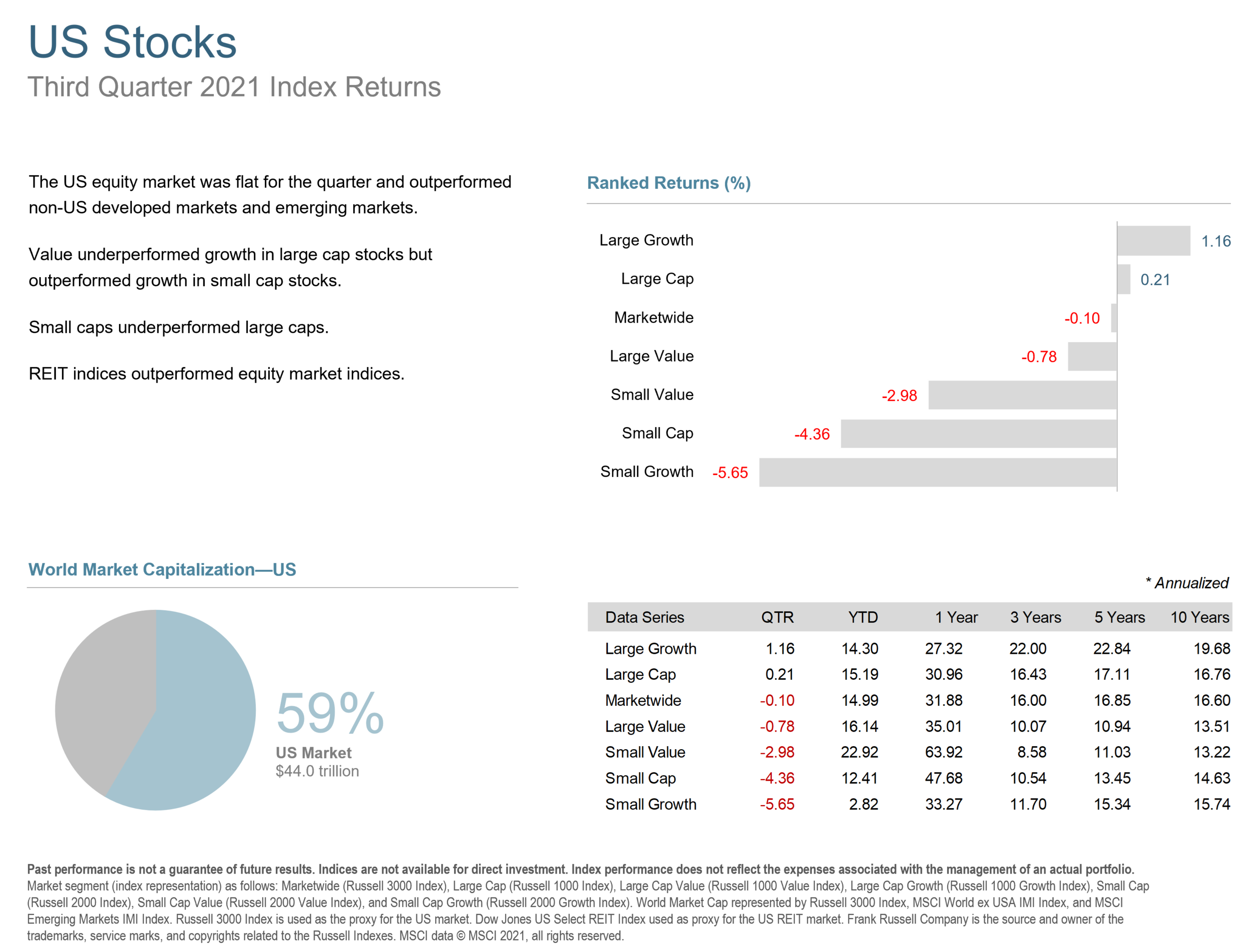

The US equity market was flat for the quarter but outperformed non-US developed markets and emerging markets. Value underperformed growth in large cap stocks but outperformed growth in small cap stocks. Small caps underperformed large caps. REIT indices outperformed equity market indices.

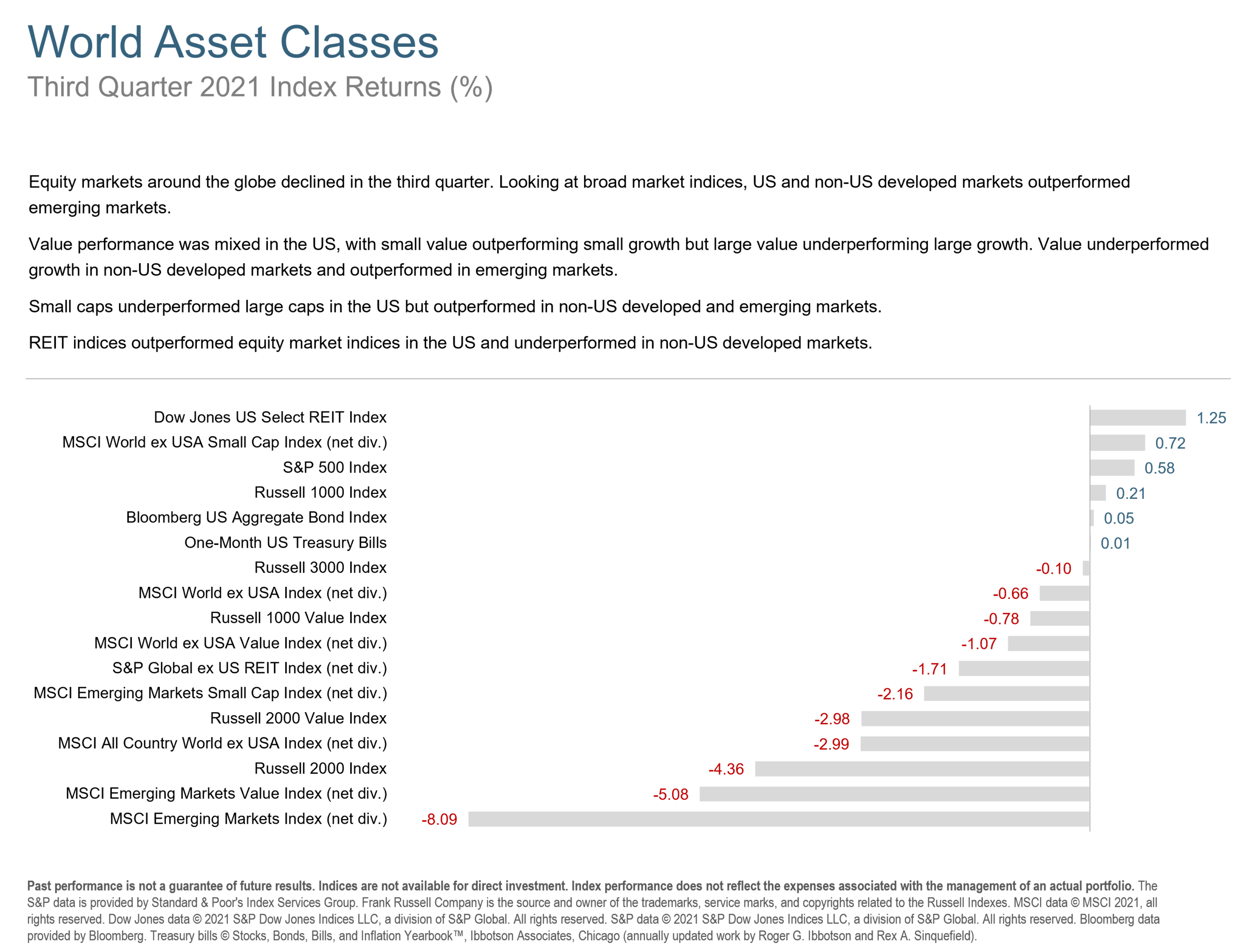

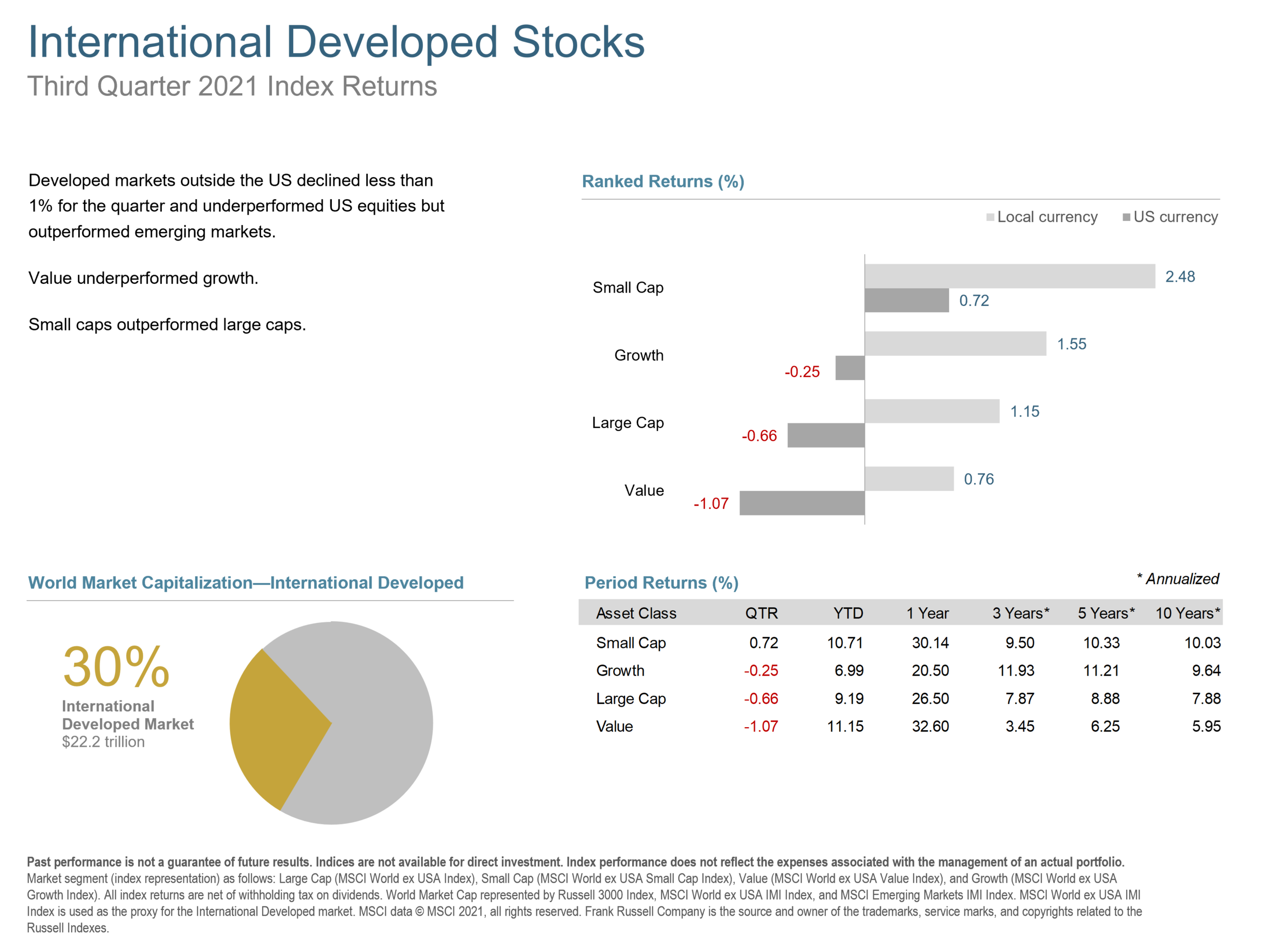

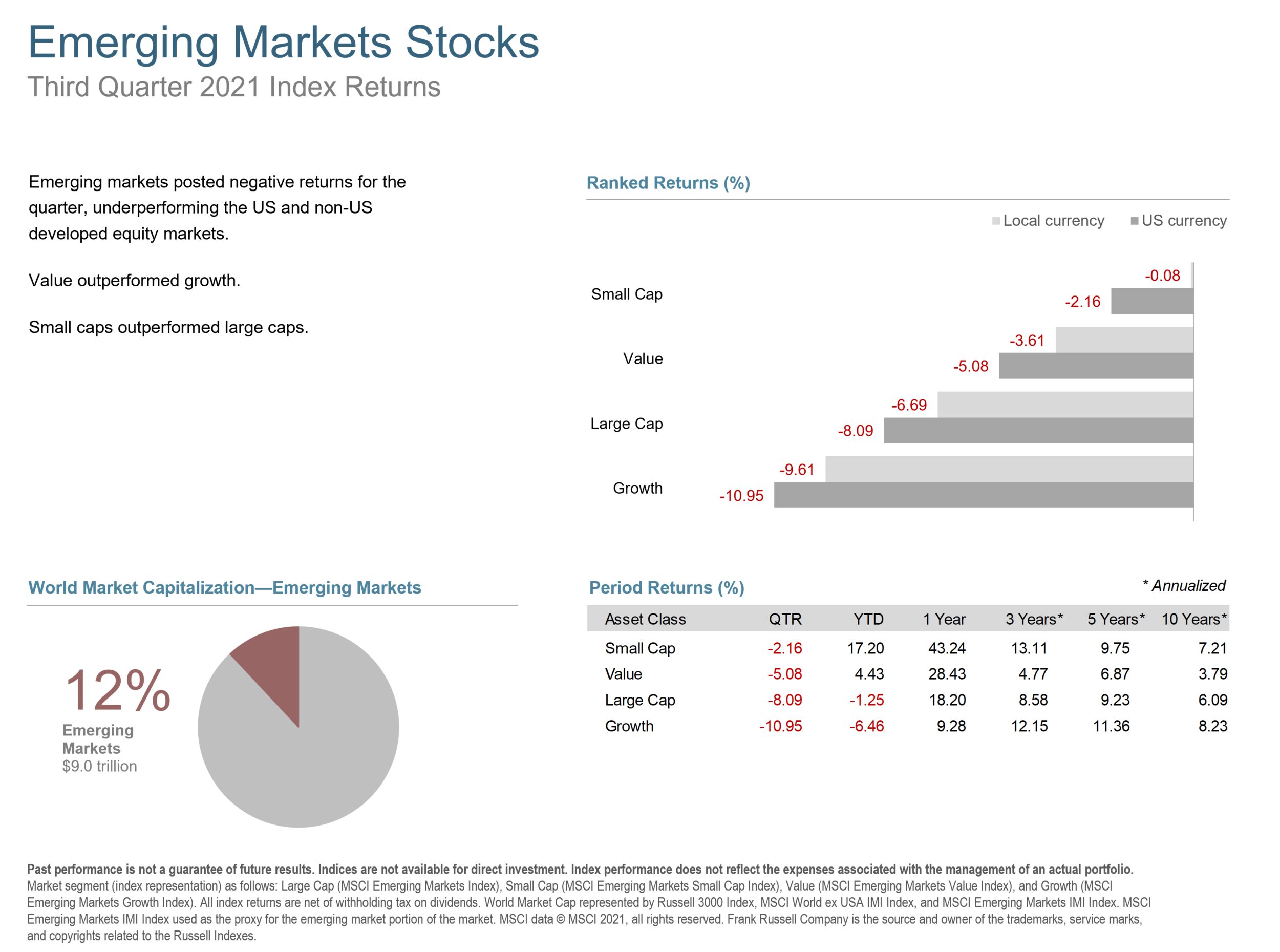

Equity markets around the globe declined in the third quarter. Looking at broad market indices, US and non-US developed markets outperformed emerging markets. Value performance was mixed in the US, with small value outperforming small growth but large value underperforming large growth. Value underperformed growth in non-US developed markets and outperformed in emerging markets. Small caps underperformed large caps in the US but outperformed in non-US developed and emerging markets. REIT indices outperformed equity market indices in the US and underperformed in non-US developed markets.

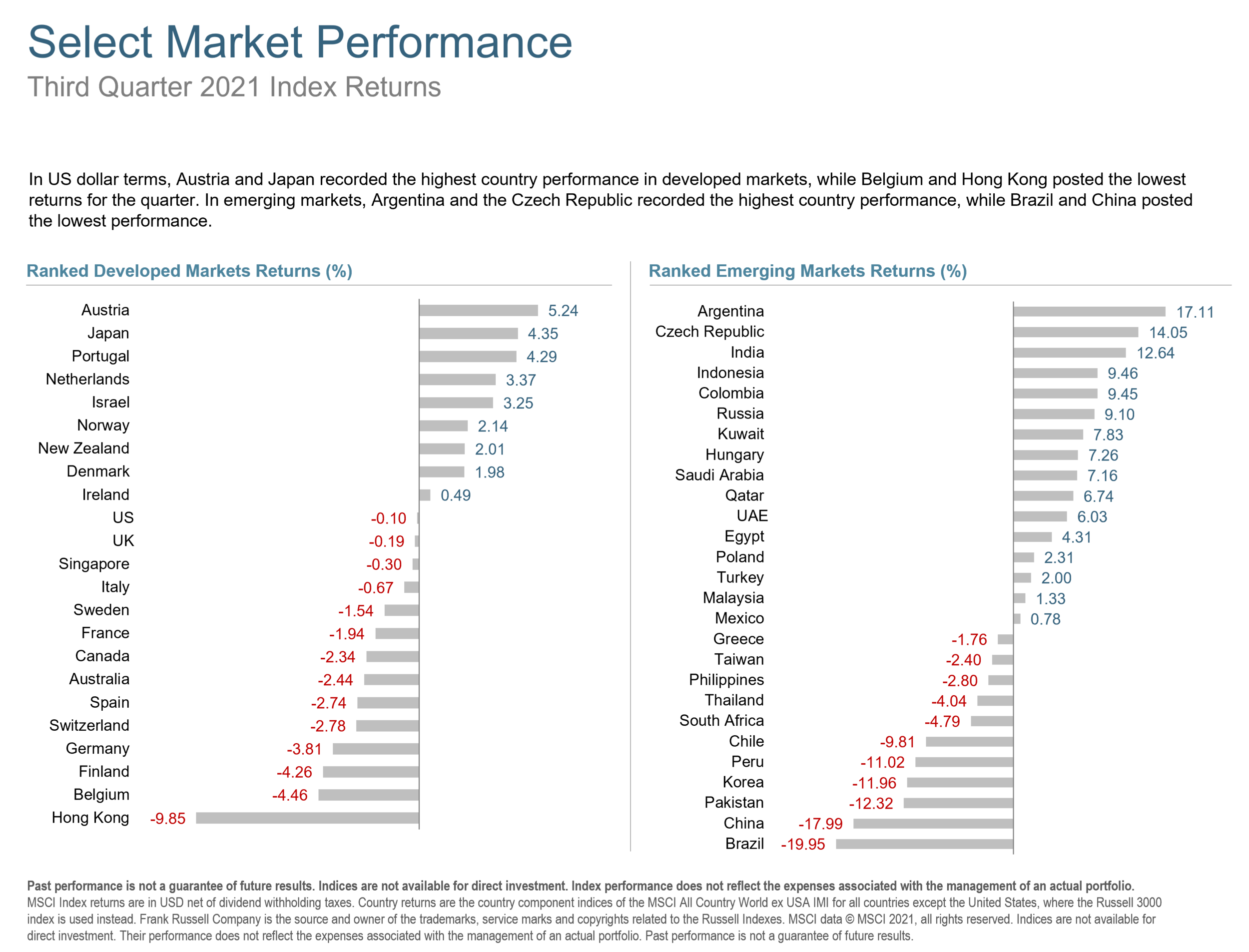

In US dollar terms, Austria and Japan recorded the highest country performance in developed markets, while Belgium and Hong Kong posted the lowest returns for the quarter. In emerging markets, Argentina and the Czech Republic recorded the highest country performance, while Brazil and China posted the lowest performance.

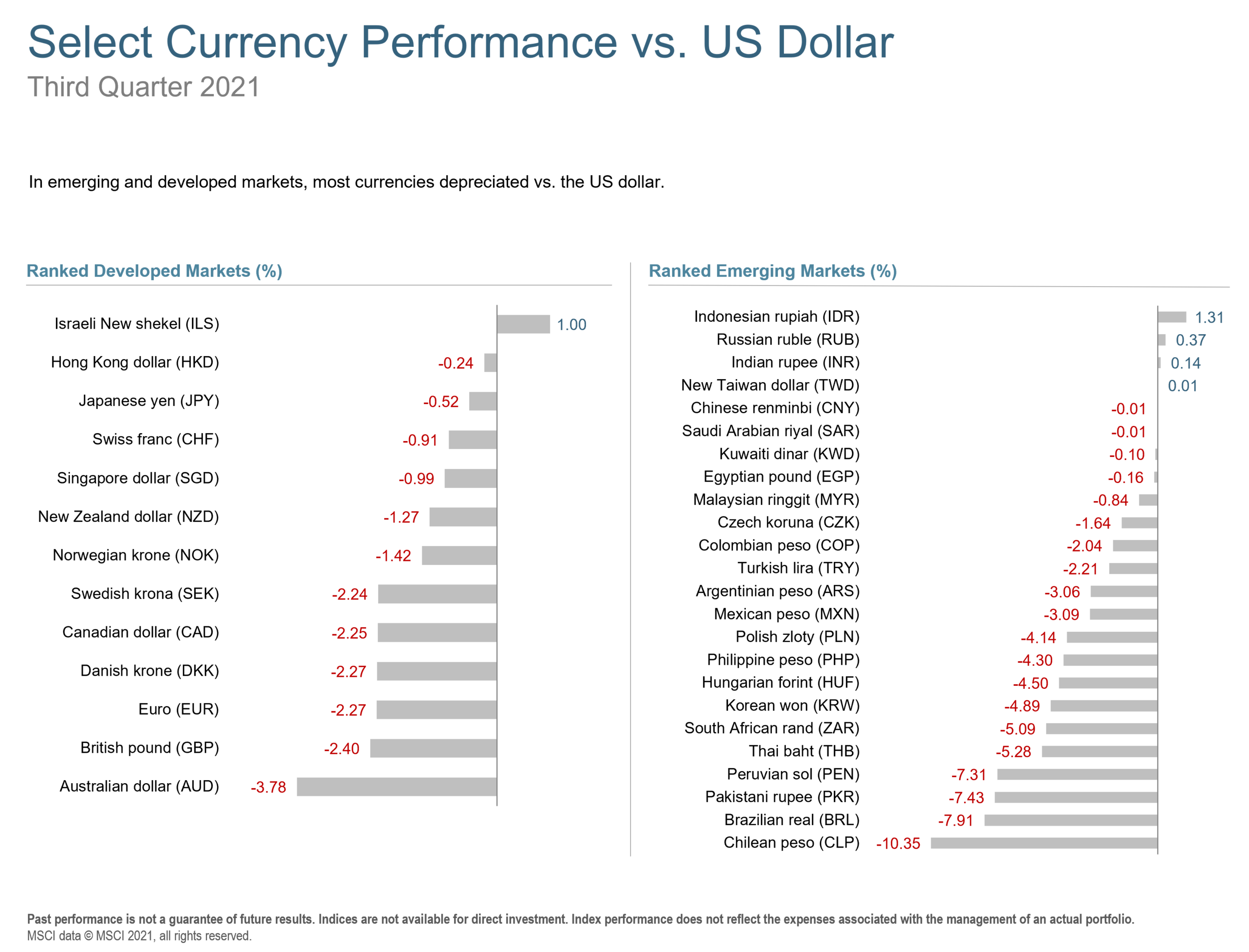

In emerging and developed markets, most currencies depreciated vs. the US dollar.

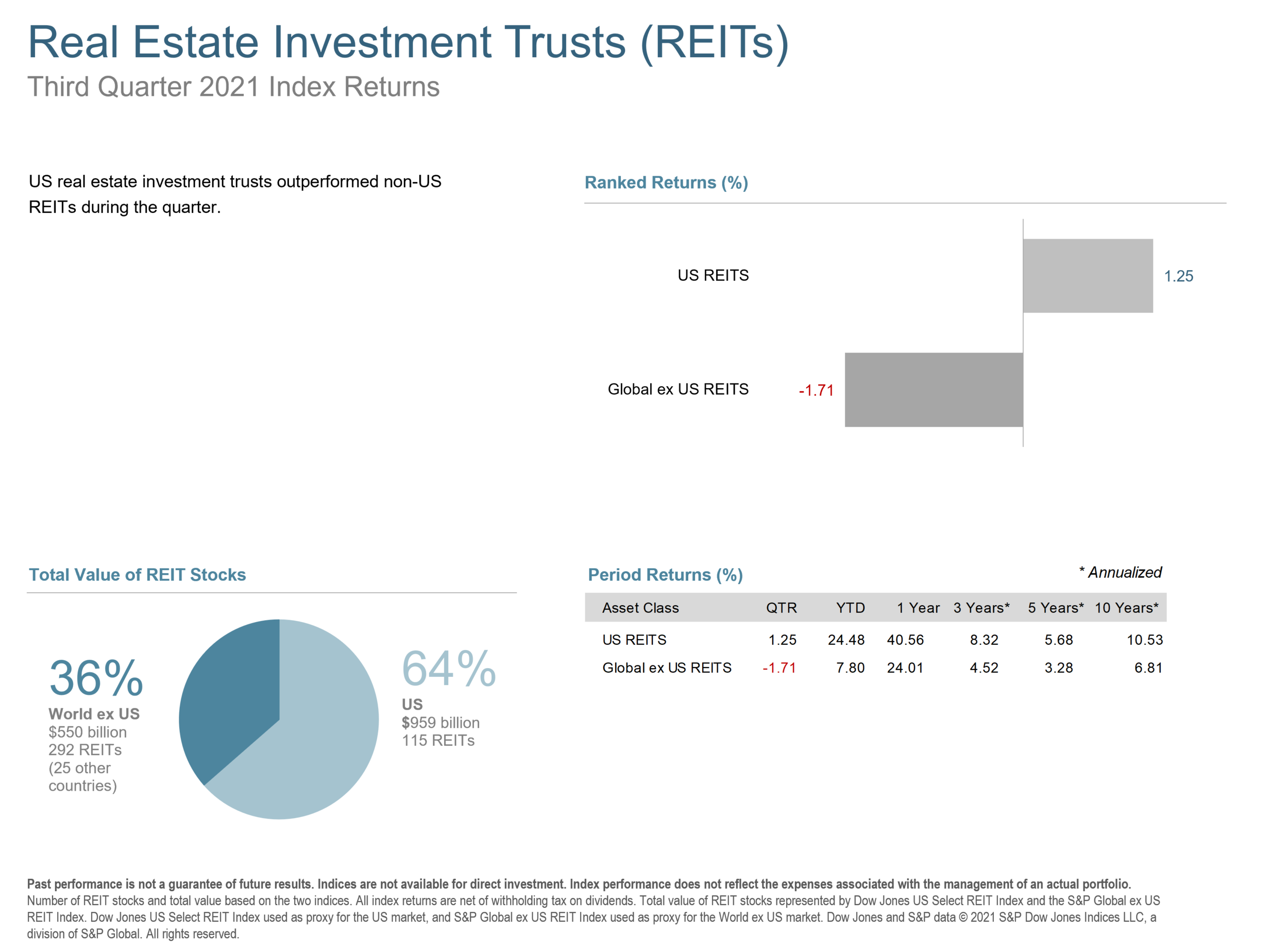

US real estate investment trusts outperformed non-US REITs during the quarter.

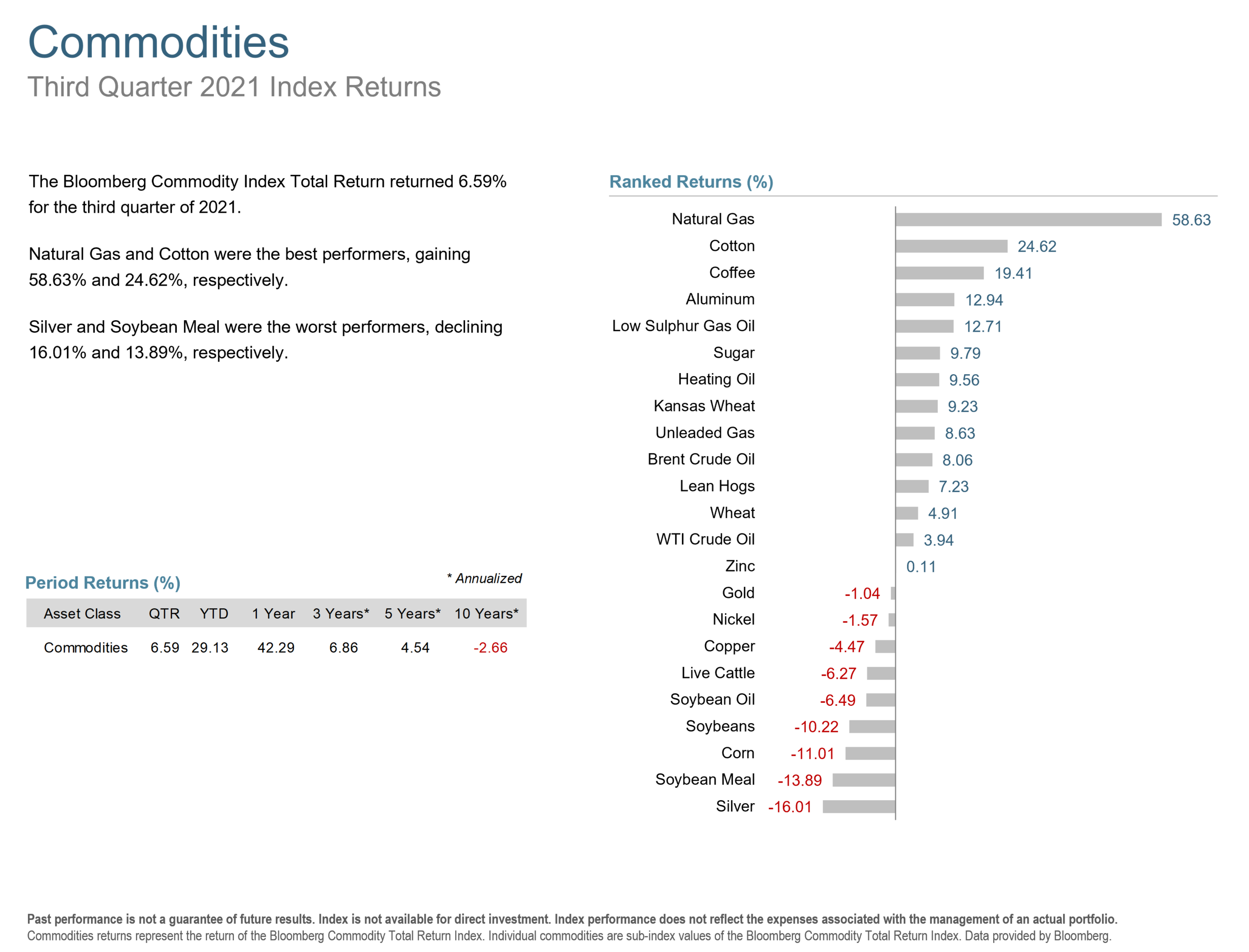

The Bloomberg Commodity Index Total Return returned 6.59% for the third quarter of 2021. Natural Gas and Cotton were the best performers, gaining 58.63% and 24.62%, respectively. Silver and Soybean Meal were the worst performers, declining 16.01% and 13.89%, respectively.

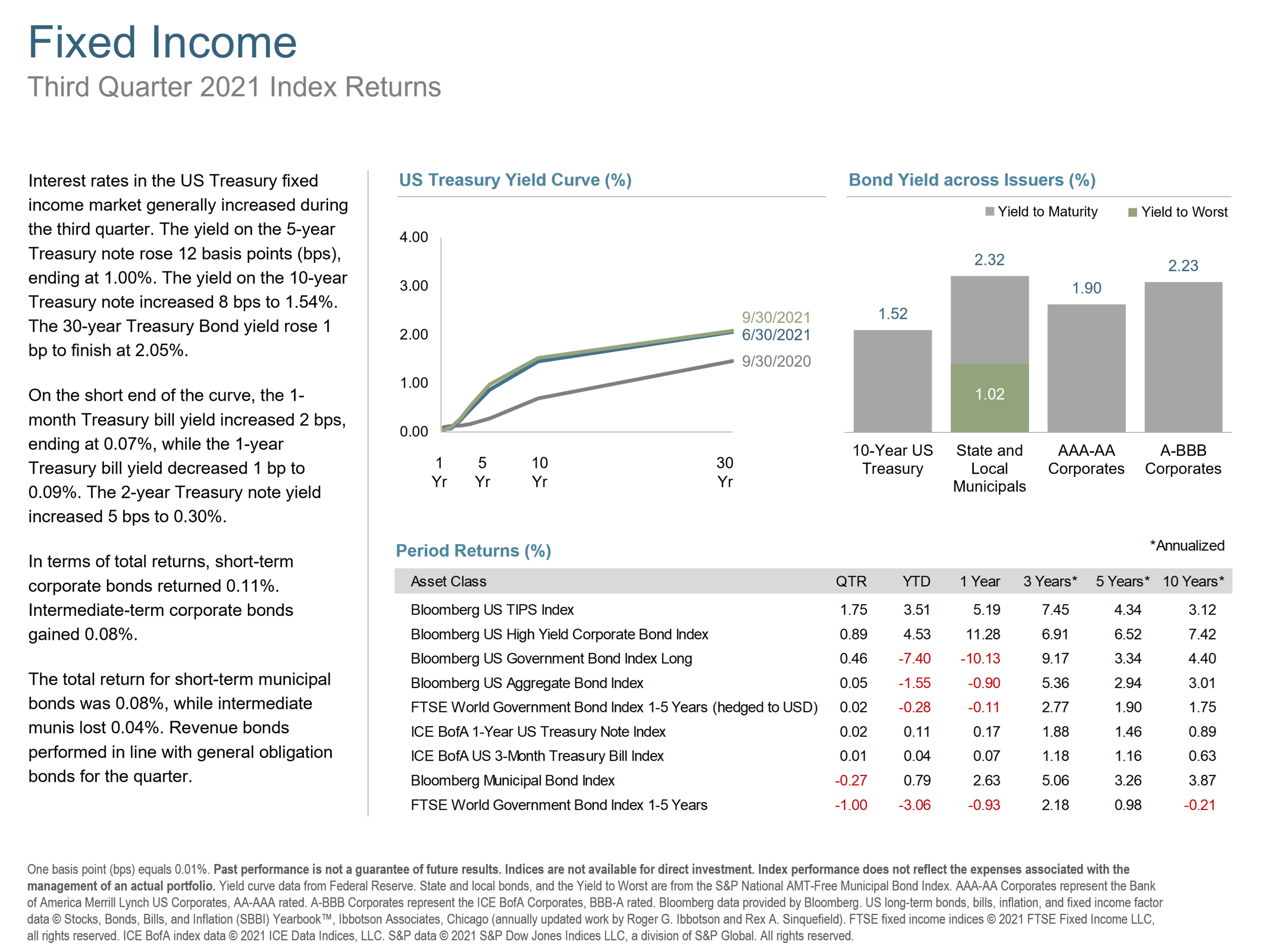

Interest rates in the US Treasury fixed income market generally increased during the third quarter. The yield on the 5-year Treasury note rose .12%, ending at 1.00%. The yield on the 10-year Treasury note increased .08% to 1.54%. The 30-year Treasury Bond yield rose .01% to finish at 2.05%.

On the short end of the curve, the 1-month Treasury bill yield increased .02%, ending at 0.07%, while the 1-year Treasury bill yield decreased .01% to 0.09%. The 2-year Treasury note yield increased .05% to 0.30%.

In terms of total returns, short-term corporate bonds returned 0.11%. Intermediate-term corporate bonds gained 0.08%.

The total return for short-term municipal bonds was 0.08%, while intermediate munis lost 0.04%. Revenue bonds performed in line with general obligation bonds for the quarter.

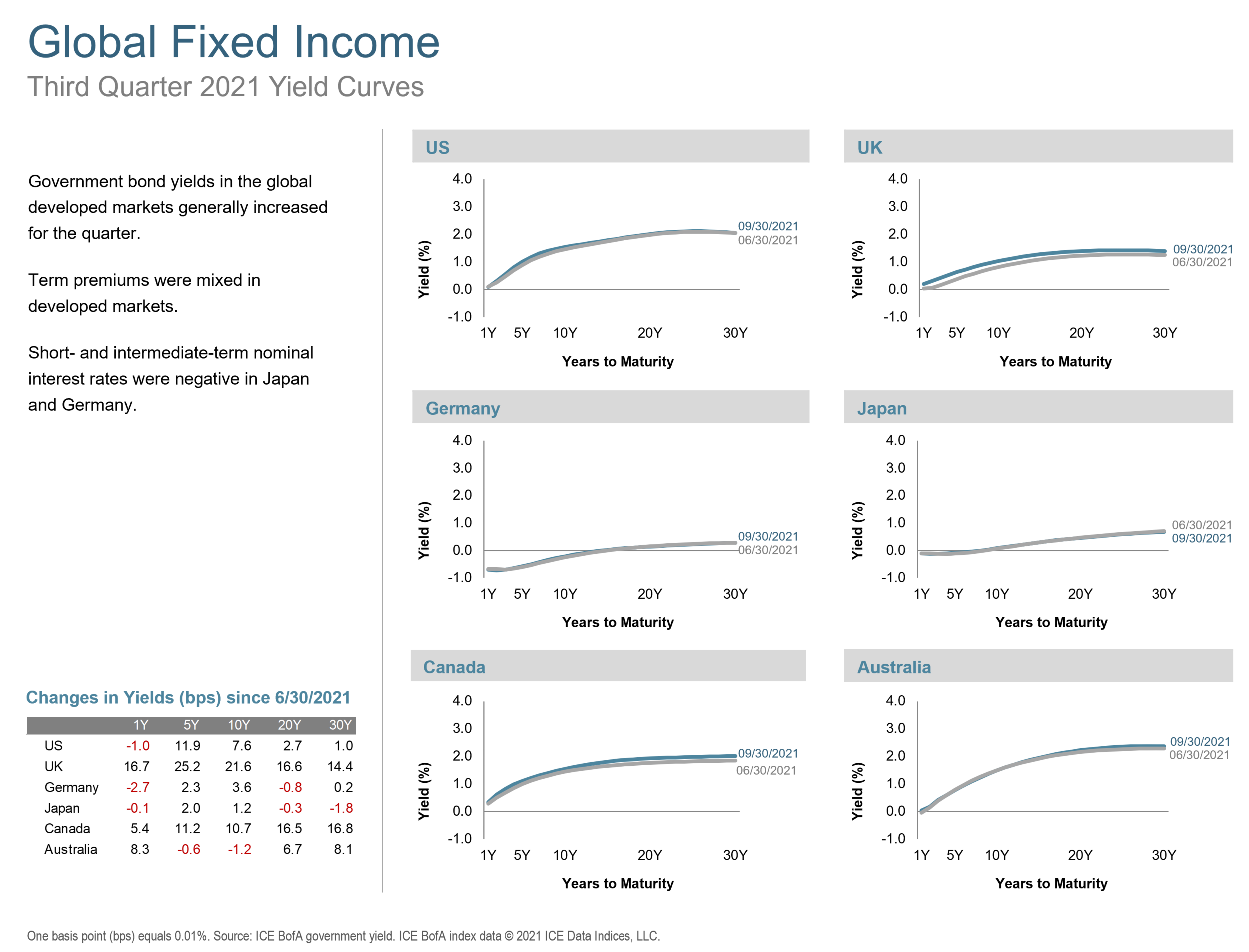

Government bond yields in the global developed markets generally increased for the quarter. Term premiums were mixed in developed markets. Short- and intermediate-term nominal interest rates were negative in Japan and Germany.

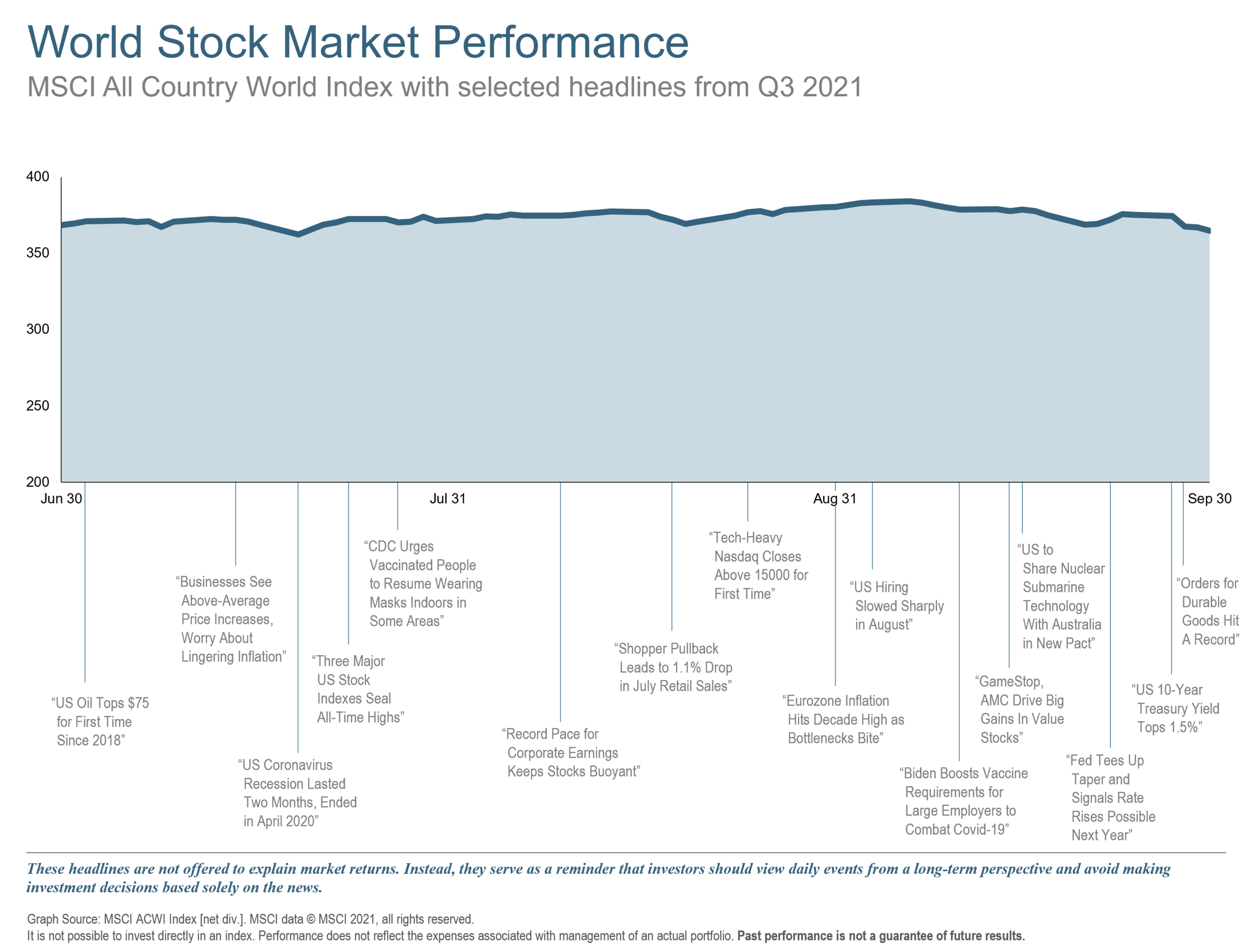

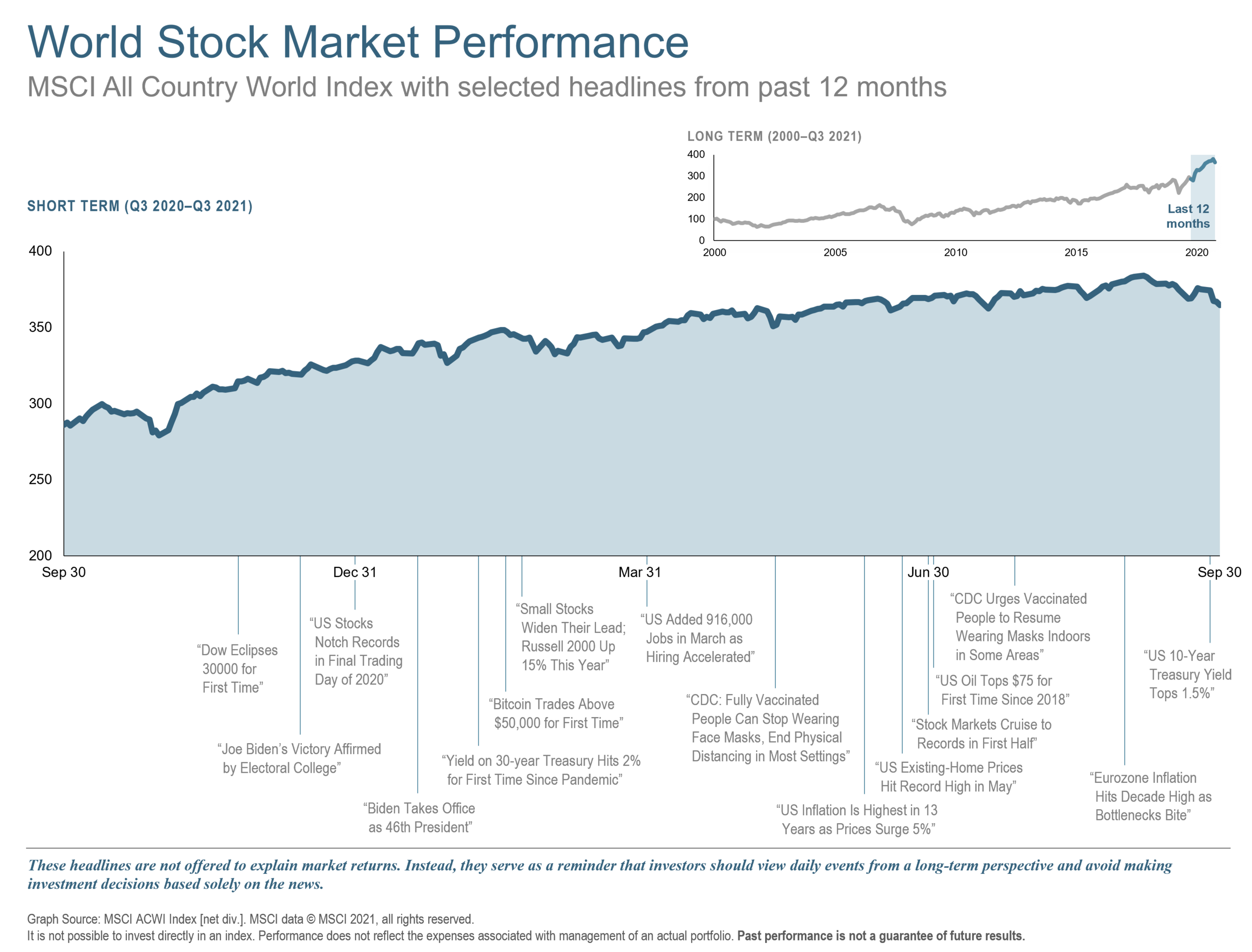

The Q3 2021 Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

With any market condition, a sound plan makes the ups and downs much more manageable. Get in touch if you would like to review your plan.