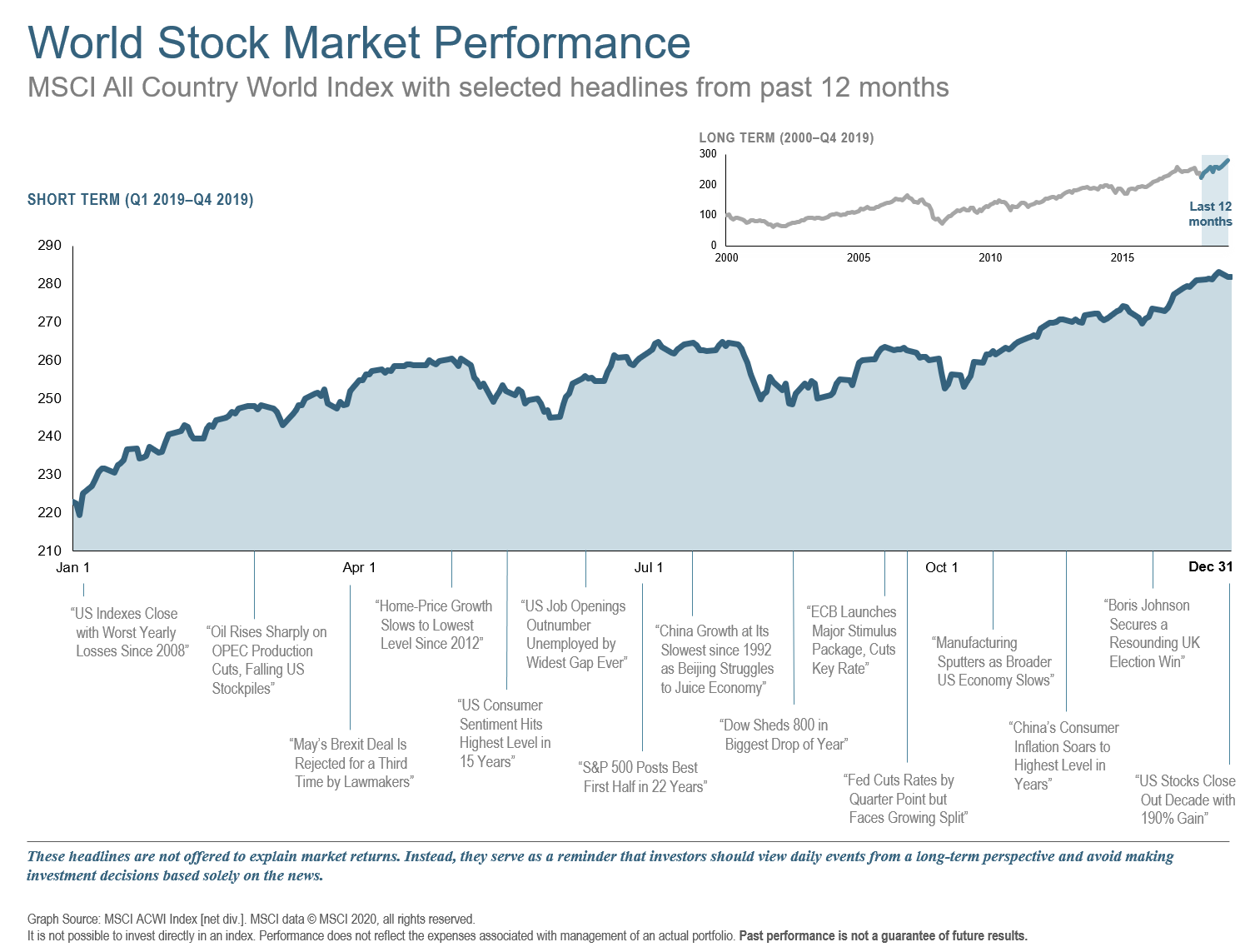

2019 was the best year for stocks since the Dot.com era of over twenty years ago. It was a fitting end to a decade where US stocks gained about 190%! Would you have predicted that back in 2010? (For more detail on the last 10 years, read DFA’s “The 2010s: A Decade in Review”.)

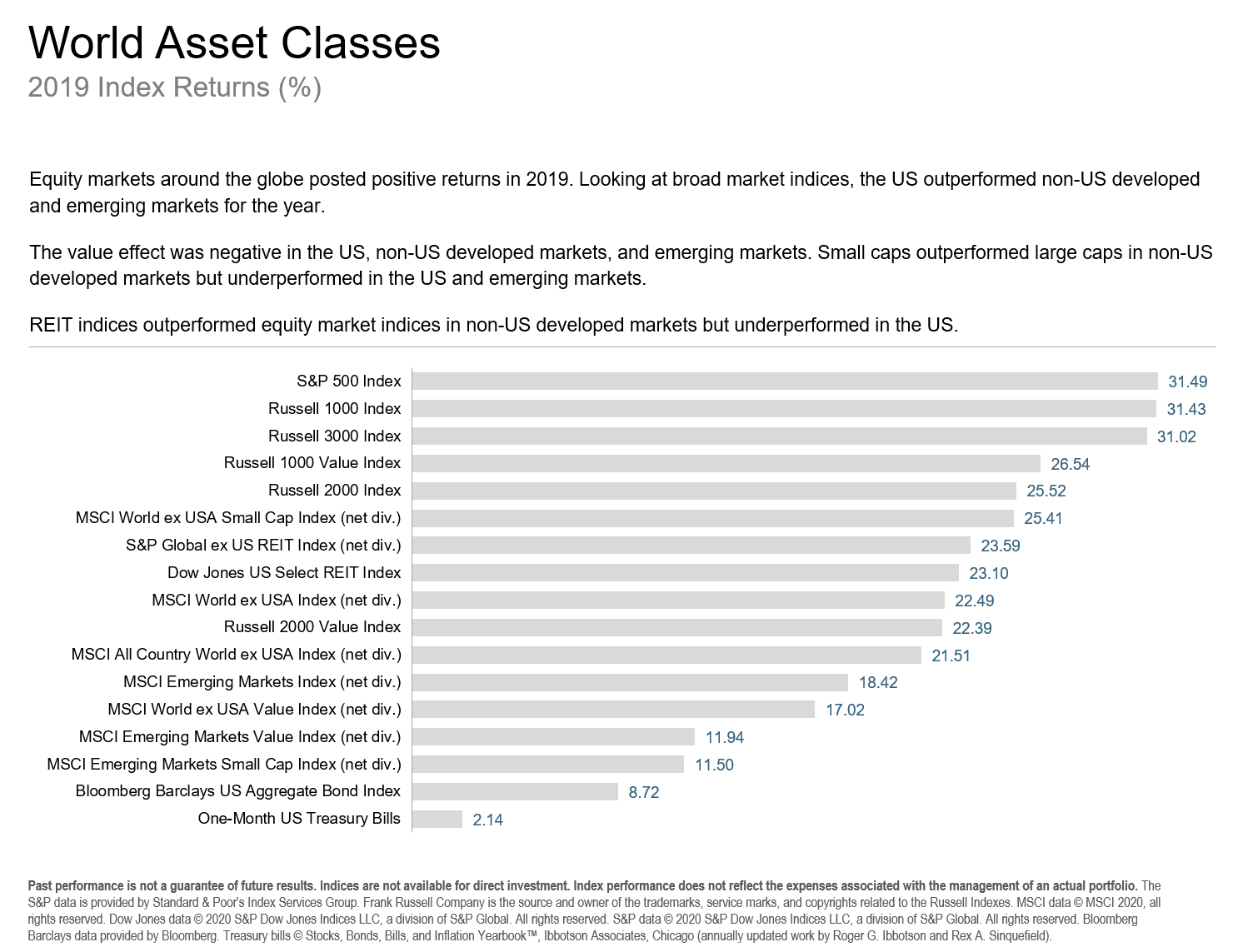

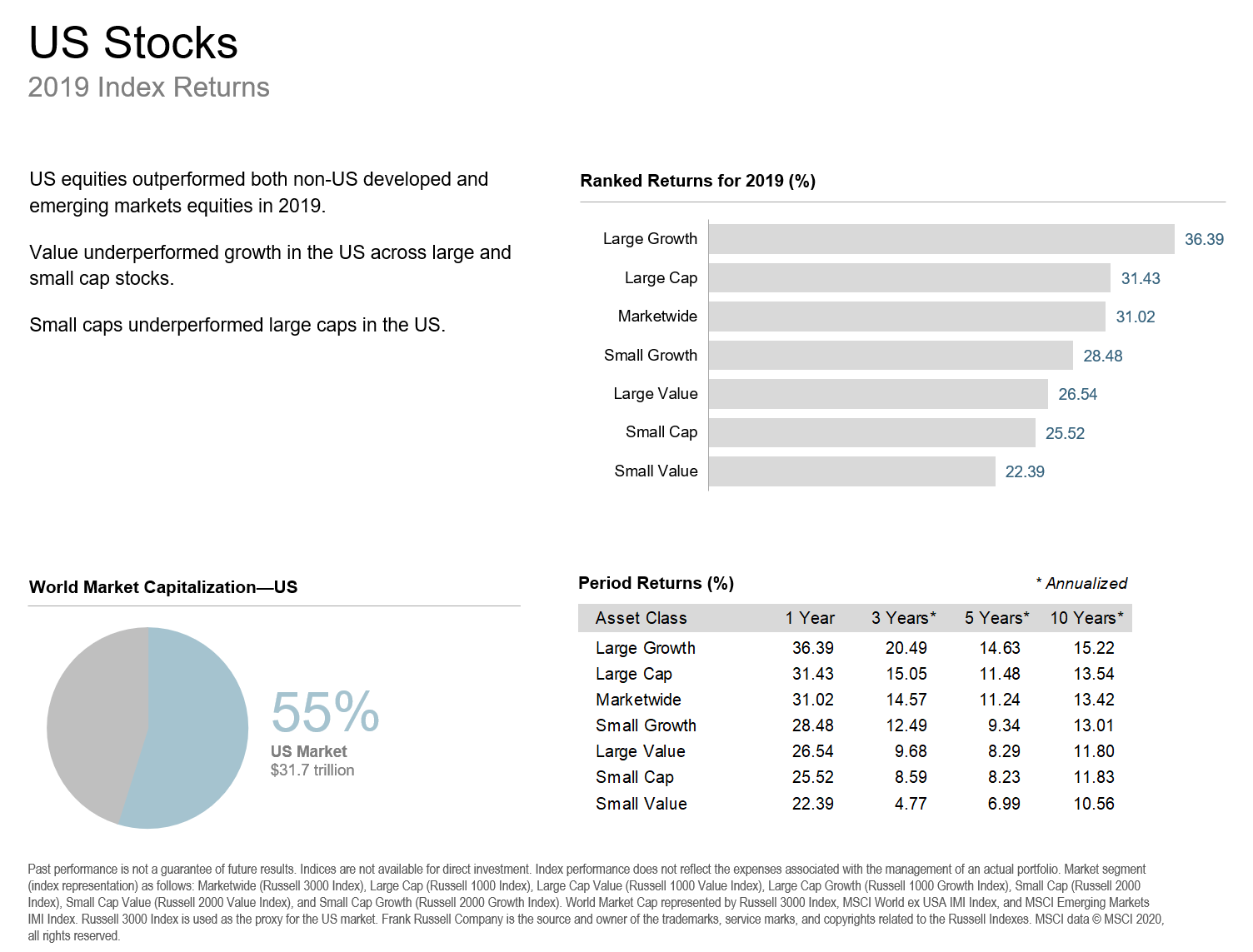

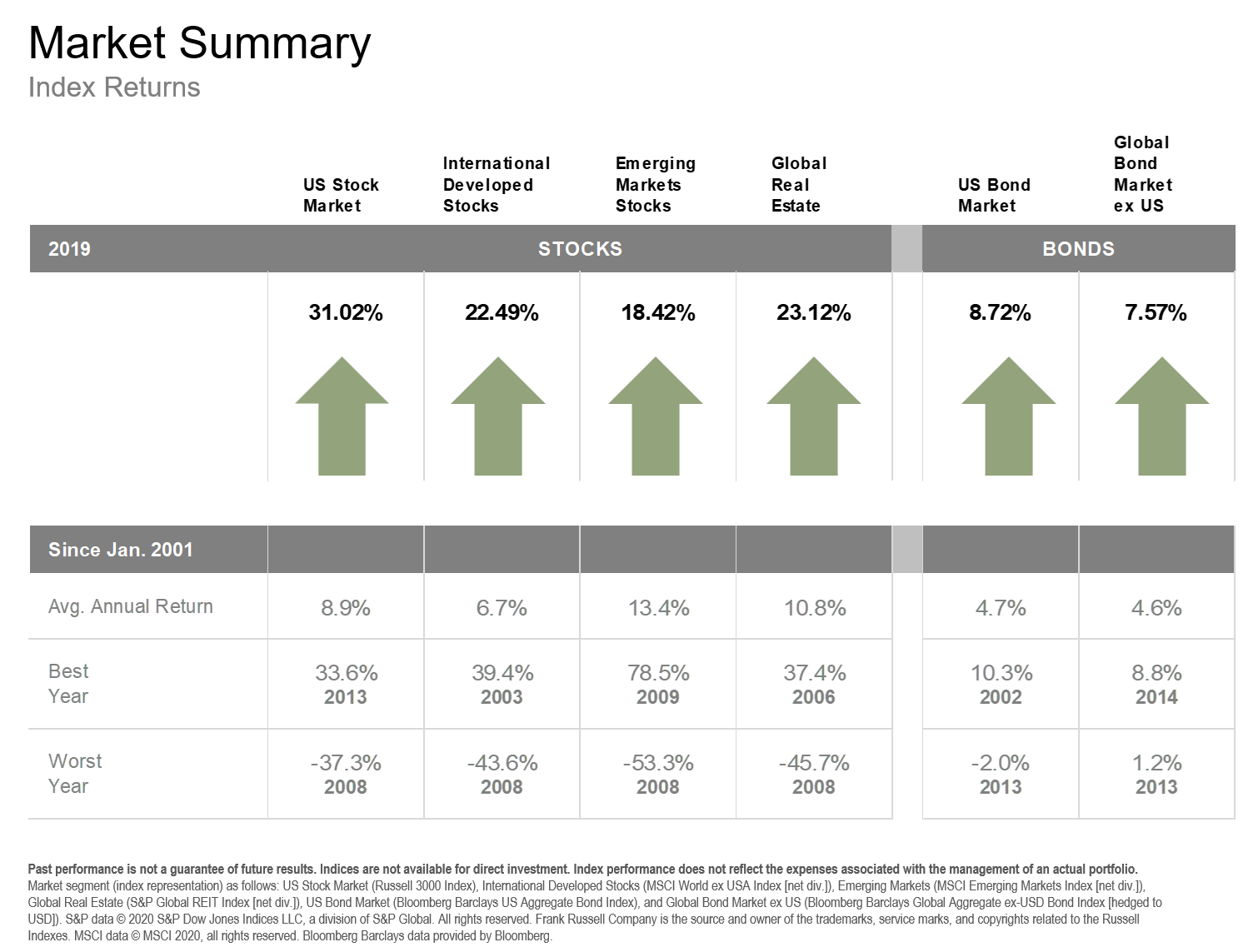

Just over a year ago, the glass is half-empty crowd seemed firmly in control as US markets swooned nearly 20% in December of 2018. Even though 2018 ended on the heels of the worst stock market losses since 2008, in 2019 US stocks made an abrupt and steep recovery with more than a 30% run to new all-time highs. It wasn’t just US stocks that rallied, though, as virtually every asset class saw impressive gains during the year.

Some lingering issues, such as the Brexit drama, continued adding uncertainty. A deal for an orderly exit of the UK from the EU was rejected a third time by the British Parliament, ultimately leading to the resignation of Prime Minister, Teresa May.

The issue that seemed to dominate investors’ minds, however, was the ongoing trade war with China. As the year drew to a close, it became clear that China was not only battling the Trump administration in a tit for tat tariff fight but was also struggling with inflation and a slowing economy (a.k.a. stagflation) at home. Perhaps that is why China seemed more conciliatory to a “Phase One” trade deal as the year drew to a close.

On the other hand, the employment picture in the US grew increasingly rosy as job openings outnumbered the unemployed by the largest gap ever. This contributed to some of the highest US consumer sentiment in over 15 years. Tailwinds were added by the US Federal Reserve, the European Central Bank, and China all making efforts to juice their respective economies through rate cuts and/or other stimulus measures.

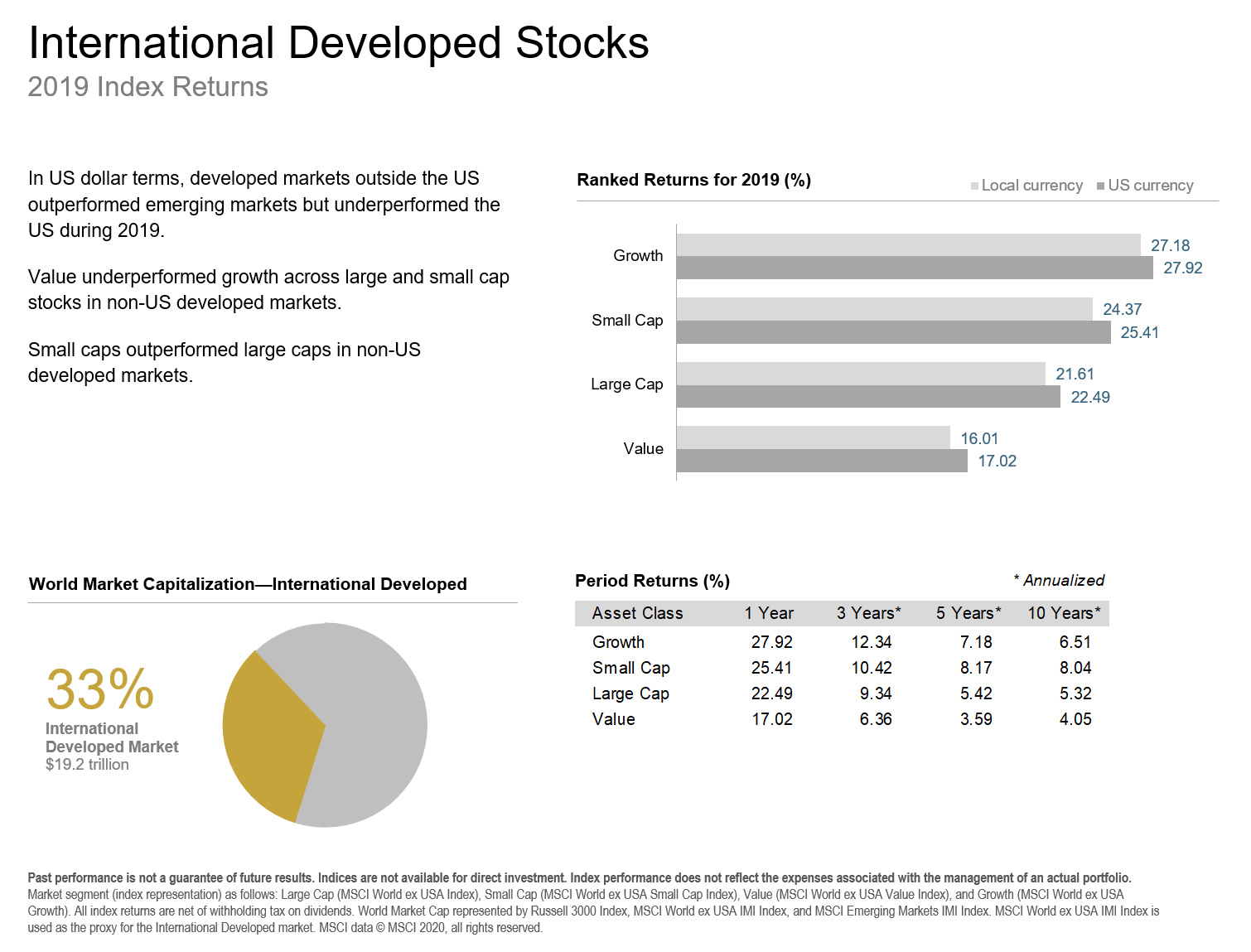

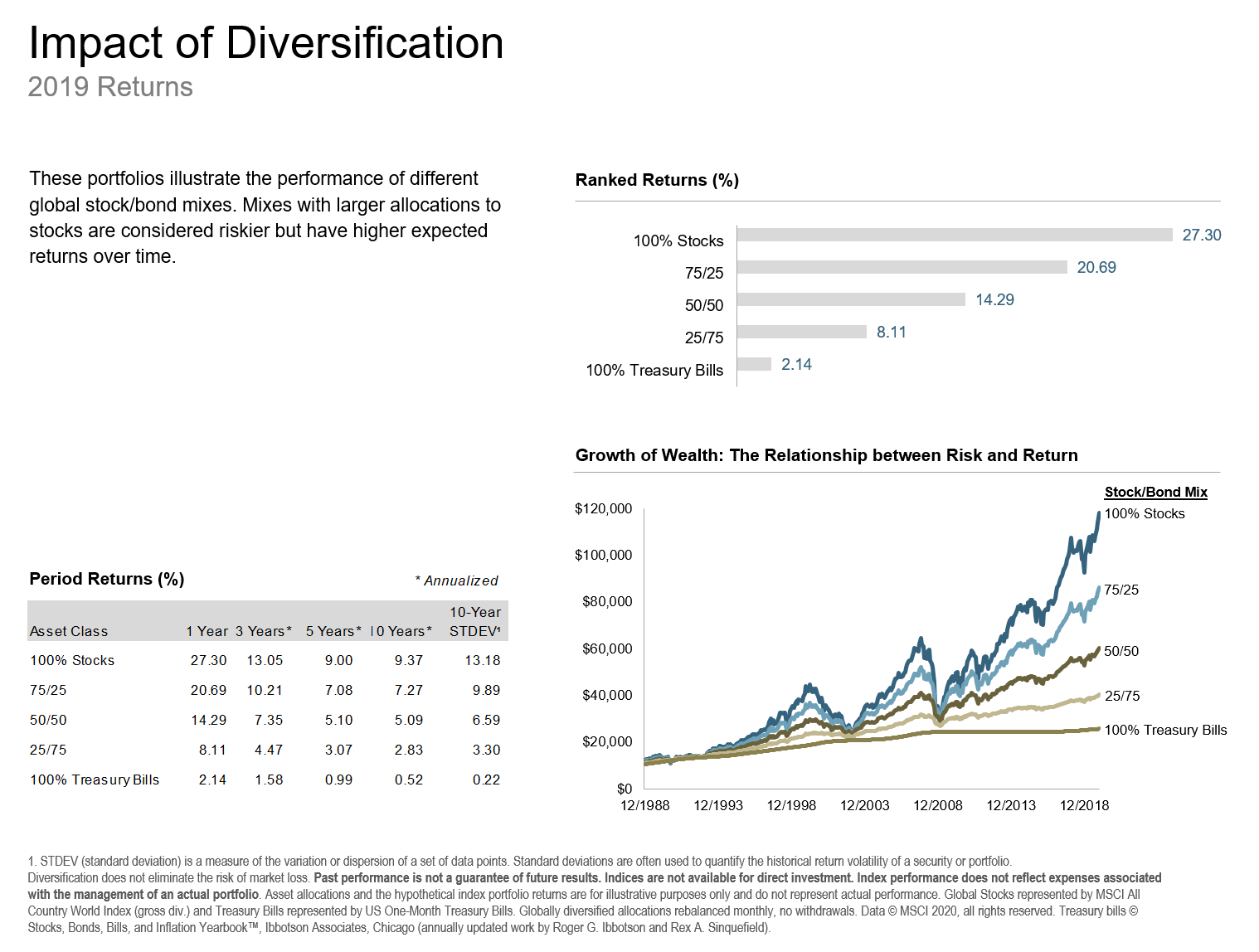

Equity markets, led by large company US growth stocks, posted strong returns around the globe in 2019. ATX Portfolio Advisors’ clients participated in these returns but performance was hindered by our neutral approach to international stocks on a market capitalization basis. While it is our belief that broad diversification domestically and internationally improves your long term chances of capturing higher returns and reducing volatility, in hindsight, last year definitely favored US investors that kept more of their money closer to home.

Research shows that there are robust return premiums associated with small stocks, value stocks, and stocks in companies with higher profitability. These premiums have persisted across different time periods and in markets around the world. However, 2019 was a year that many of those tilts in our portfolios led to lagging returns. While we continue to believe that pursuing those premiums is sensible, we’ll also continually stay abreast of the latest research when deciding how to allocate our clients’ portfolios. For some perspective on how one of those factors recent performance compares historically, see DFA’s “Value Judgments: Viewing the Premium’s Performance Through History’s Lens”.

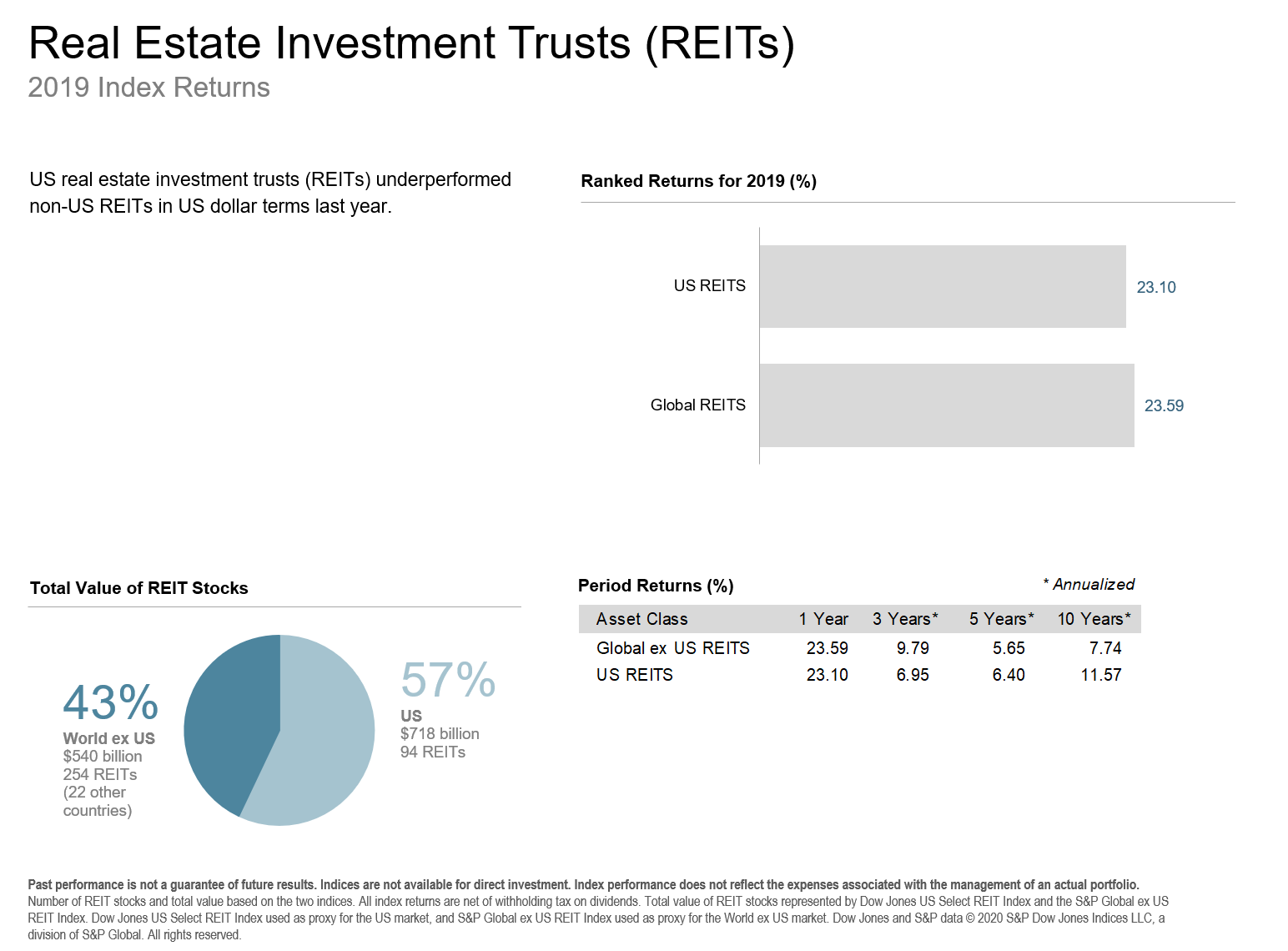

Another diversifier found in our portfolios, Real Estate Investment Trusts (REITs), had strong returns but also under-performed equity markets in the US. Domestic and international REITs had similar returns to one another and both outperformed developed and emerging market international stocks.

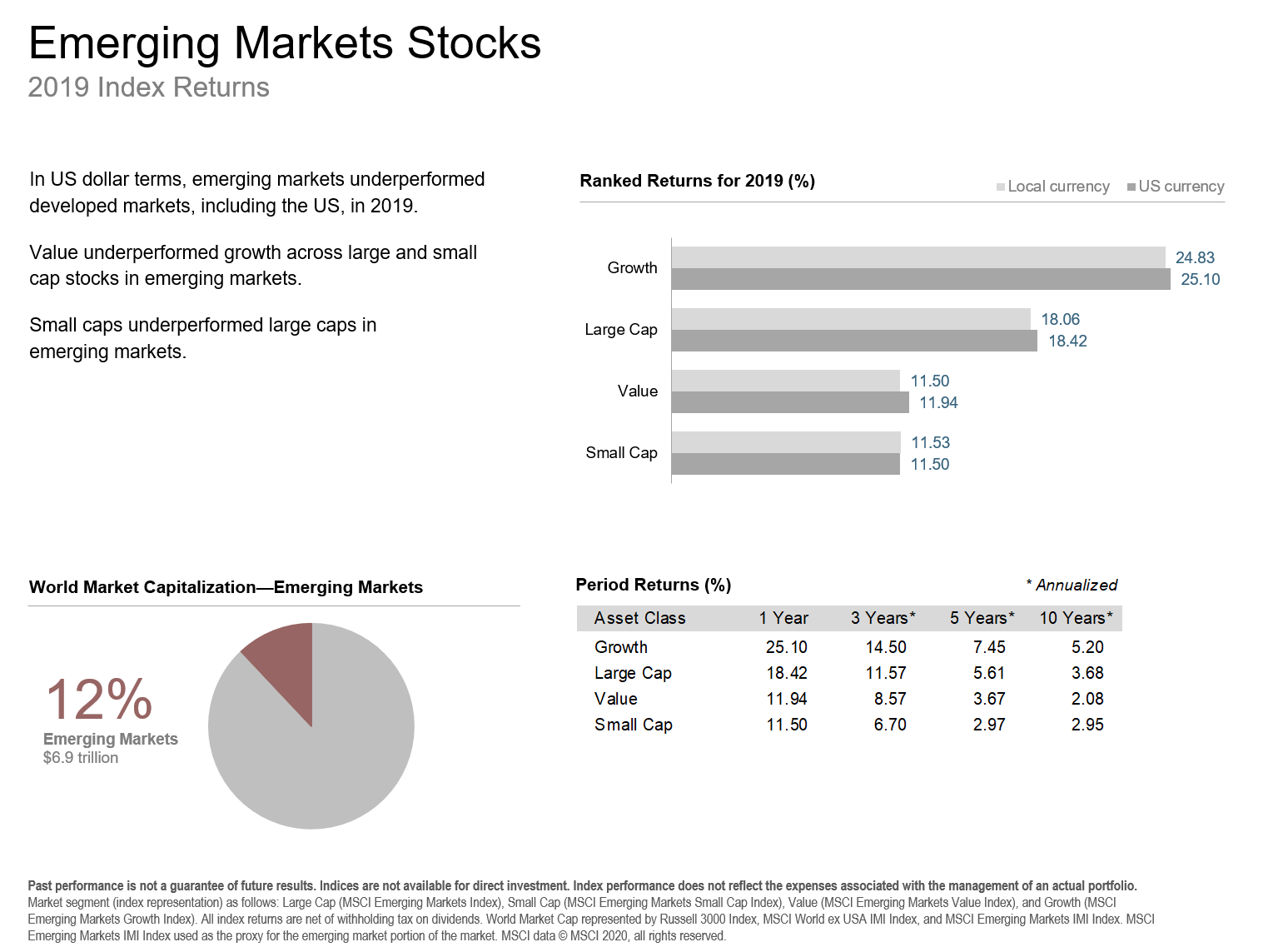

US stocks concluded what has been about a decade of outperformance of international developed and emerging markets equities. In US dollar terms, emerging markets stocks underperformed developed non-US markets equities in 2019. Small caps out-performed large caps in non-US developed markets but under-performed in emerging markets. Growth stocks outperformed value across developed and emerging international large and small cap stocks.

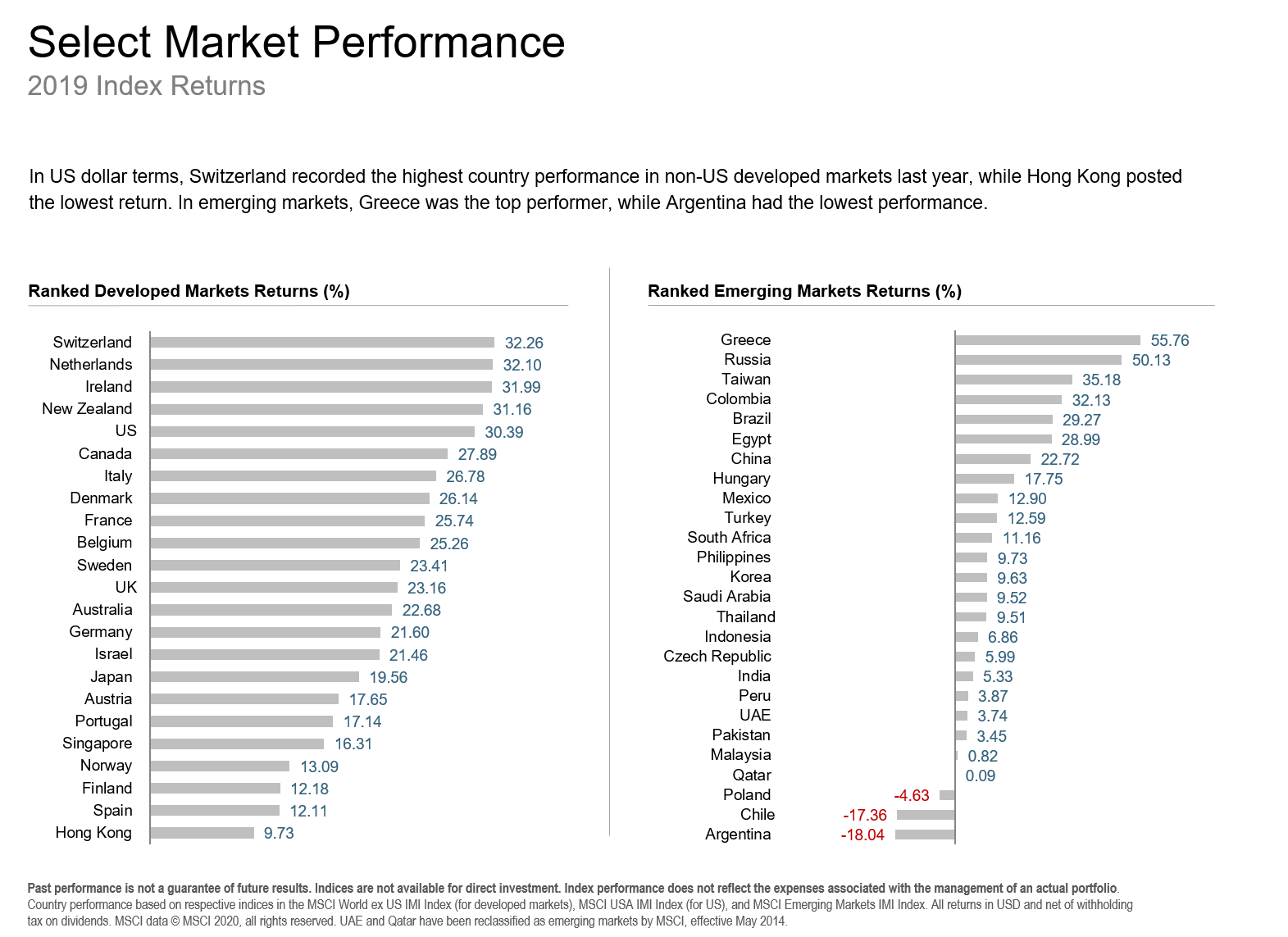

Switzerland and Netherlands recorded the highest country performance in developed markets, while Hong Kong and Spain posted the lowest returns for the year. There was a wide dispersion in returns across emerging markets. Greece recorded the highest country performance with a gain of 55.76%, while Argentina posted the lowest performance, declining 18.04%.

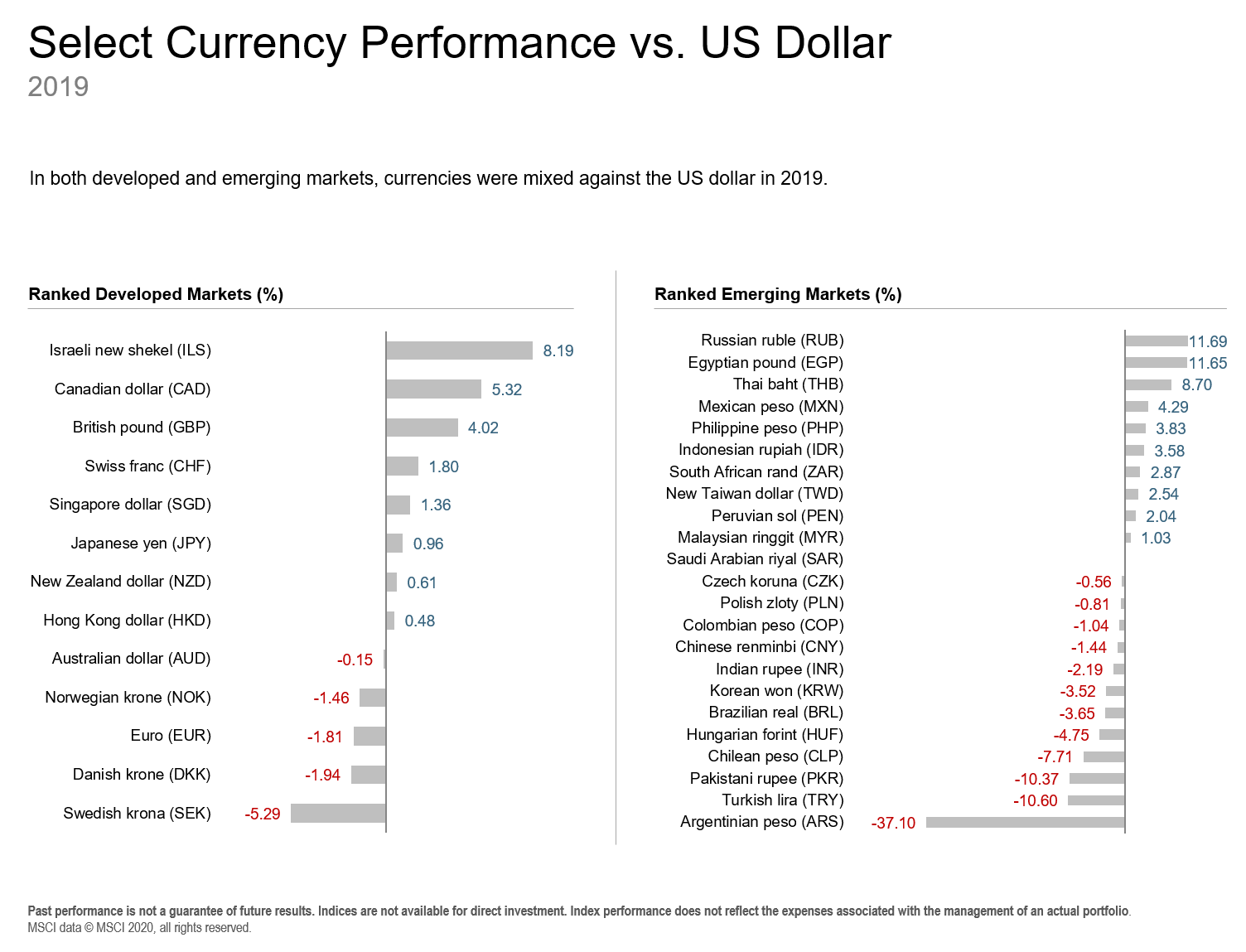

In both developed and emerging markets, currencies were mixed against the US dollar.

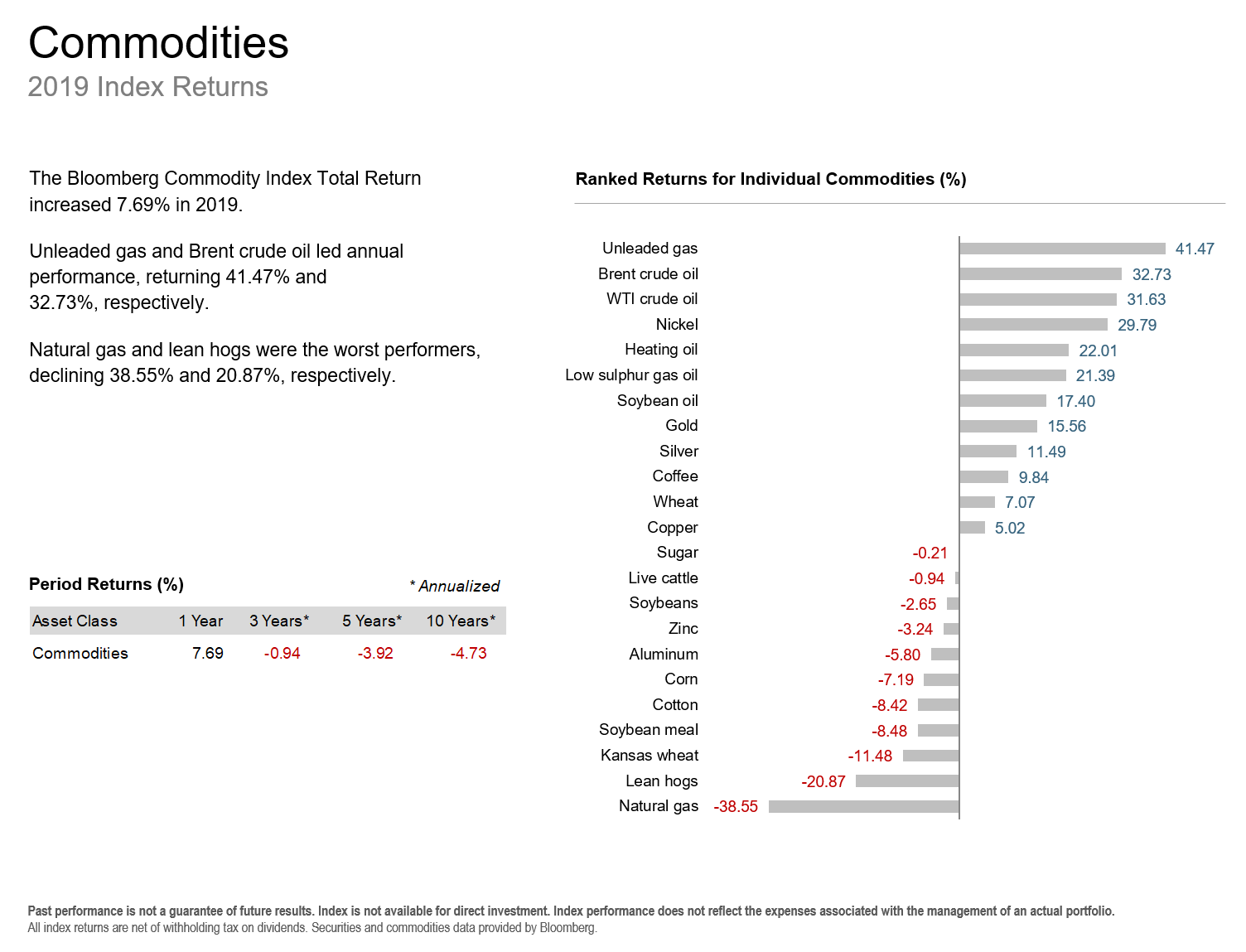

Commodities also lagged in 2019 but the Bloomberg Commodity Index Total Return rose 7.69% in the year. Unleaded gas and Brent crude oil led performance, returning 41.47% and 32.73%, respectively. Natural gas and Lean hogs were the worst performers, declining by 38.55% and 20.87%, respectively.

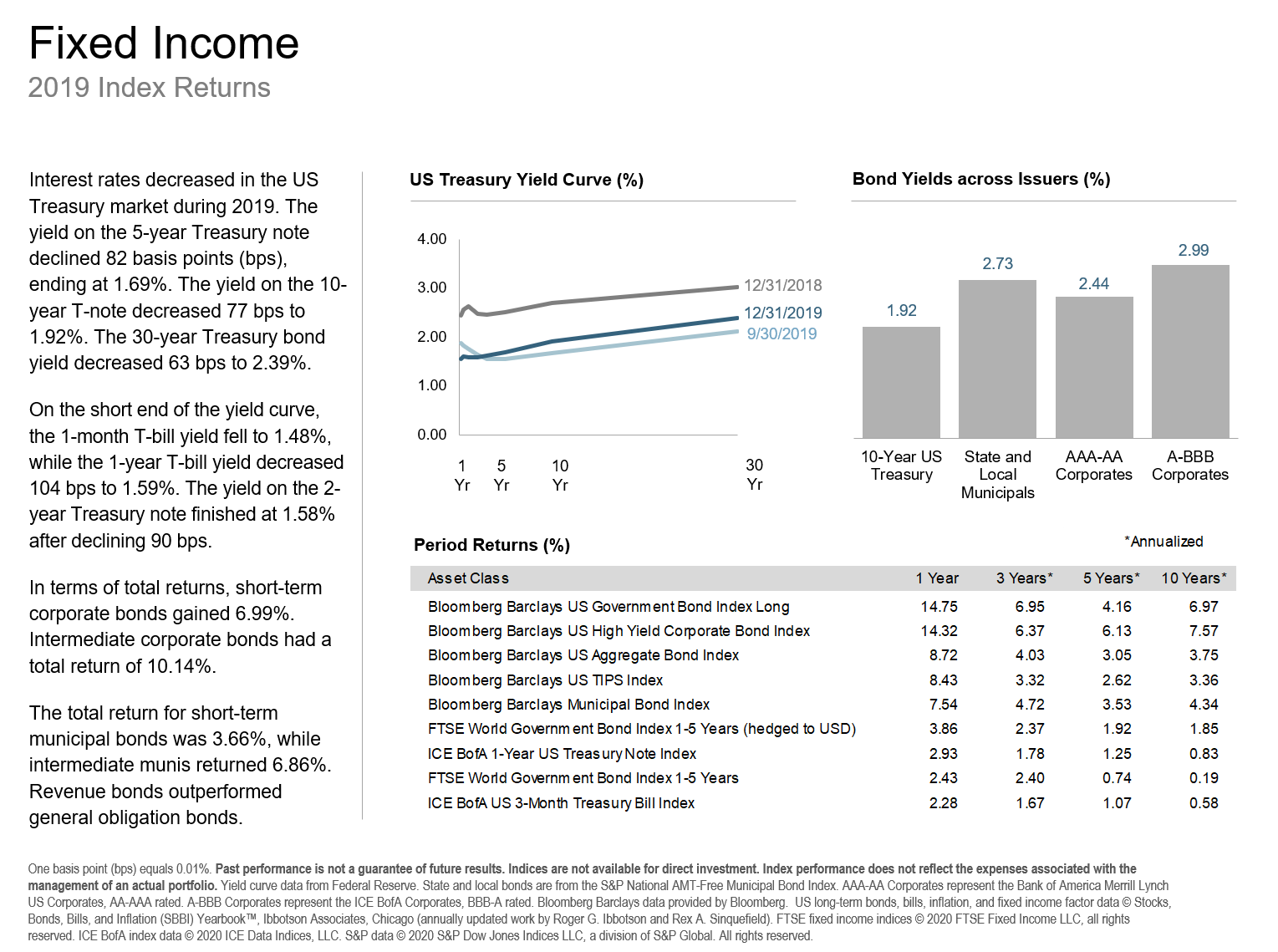

Bond returns were strong both domestically and internationally with prices rising while interest rates dropped worldwide. In the US Treasury market, the the yield on the 5-year Treasury note declined by 82 basis points (bps), ending at 1.69%. The yield on the 10-year Treasury note decreased by 77 bps to 1.92%. The 30-year Treasury bond yield fell by 63 bps to finish at 2.39%.

On the short end of the curve, the 1-month Treasury bill yield decreased to 1.48%, while the 1-year T-bill yield dropped to 1.59%, a 104 bps drop. The 2-year T-note yield finished at 1.58%, decreasing 90 bps for the year.

In terms of total returns, short-term corporate bonds gained 6.99% and intermediate-term corporate bonds rose by 10.14%. The total return for short-term municipal bonds was 3.66%, while intermediate munis returned 6.86%. Revenue bonds outperformed general obligation bonds.

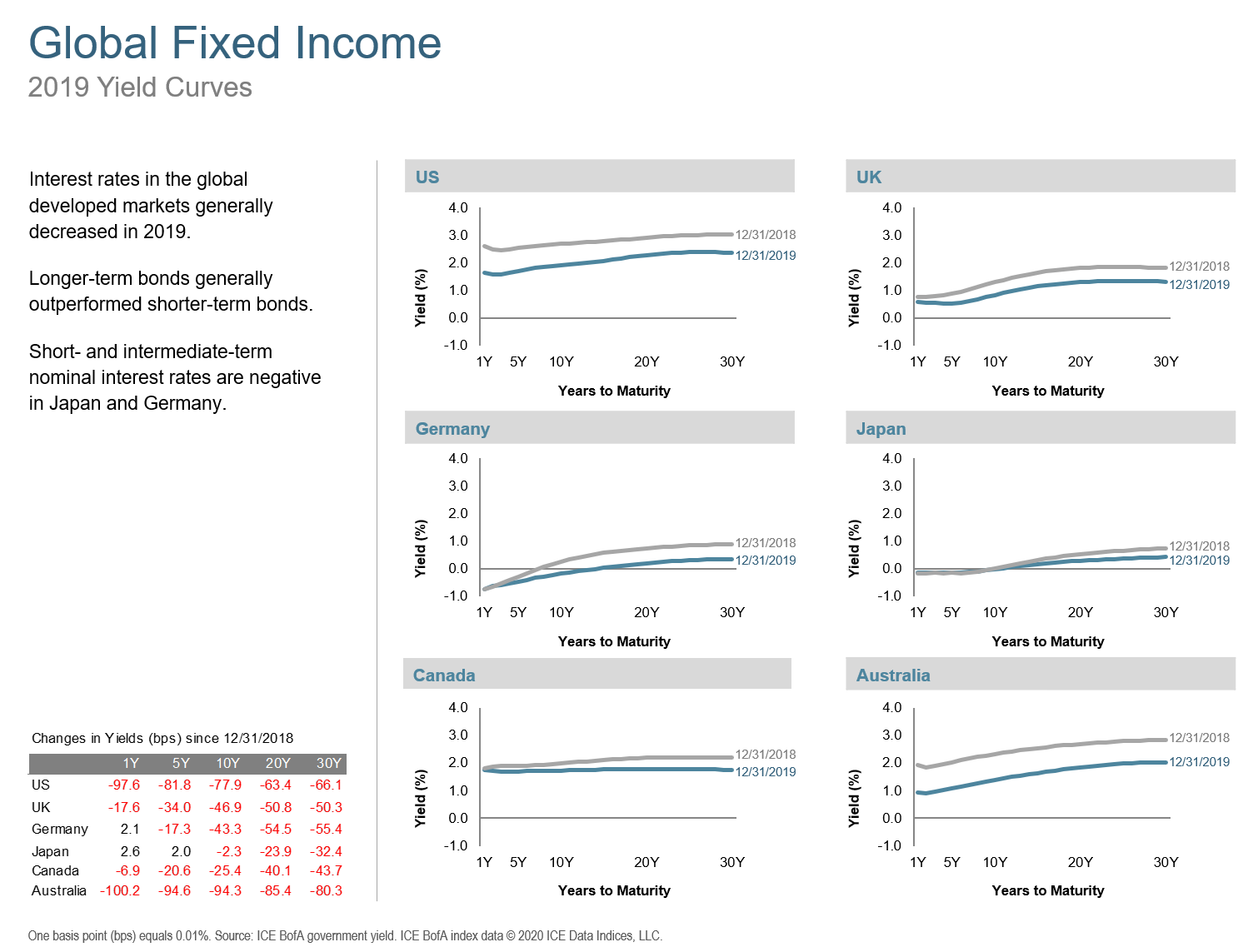

Interest rates in the global developed markets also fell during the year. Longer-term bonds generally outperformed shorter-term bonds in those markets. Short- and intermediate-term nominal interest rates remained negative in Germany and Japan.

The 2019 Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

As with any market condition, a sound plan makes the ups and downs much more manageable. Get in touch if you would like to review your plan.