Sometimes investing can feel like a day at the fair, with crowded lines, rich food, and the occasional realization that too much fun can have painful consequences. The third quarter offered a wild ride for investors that had feasted on one too many deep fried FAANGs.

The major large cap stock indices were overcrowded in July and made new highs, followed by a wave of risk-off selling in August, then rebounded through a rally in value stocks in September. Uncertainty fueled by the ongoing trade war with China has seemingly been the market’s biggest driver although the most common friend/foe of stocks, the Federal Reserve, began a new easing cycle with two rate cuts. This was followed by historic declines in long term bond yields and a temporary inversion 10 year and 2 year Treasury yields for the first time in more than a decade.

In spite of President Trump’s boast that he could weaken the dollar “in two seconds if I want to”, the greenback rallied against most other currencies. Also of note, despite a wave of drone and missile attacks against Saudi Arabia’s energy infrastructure, oil prices weakened.

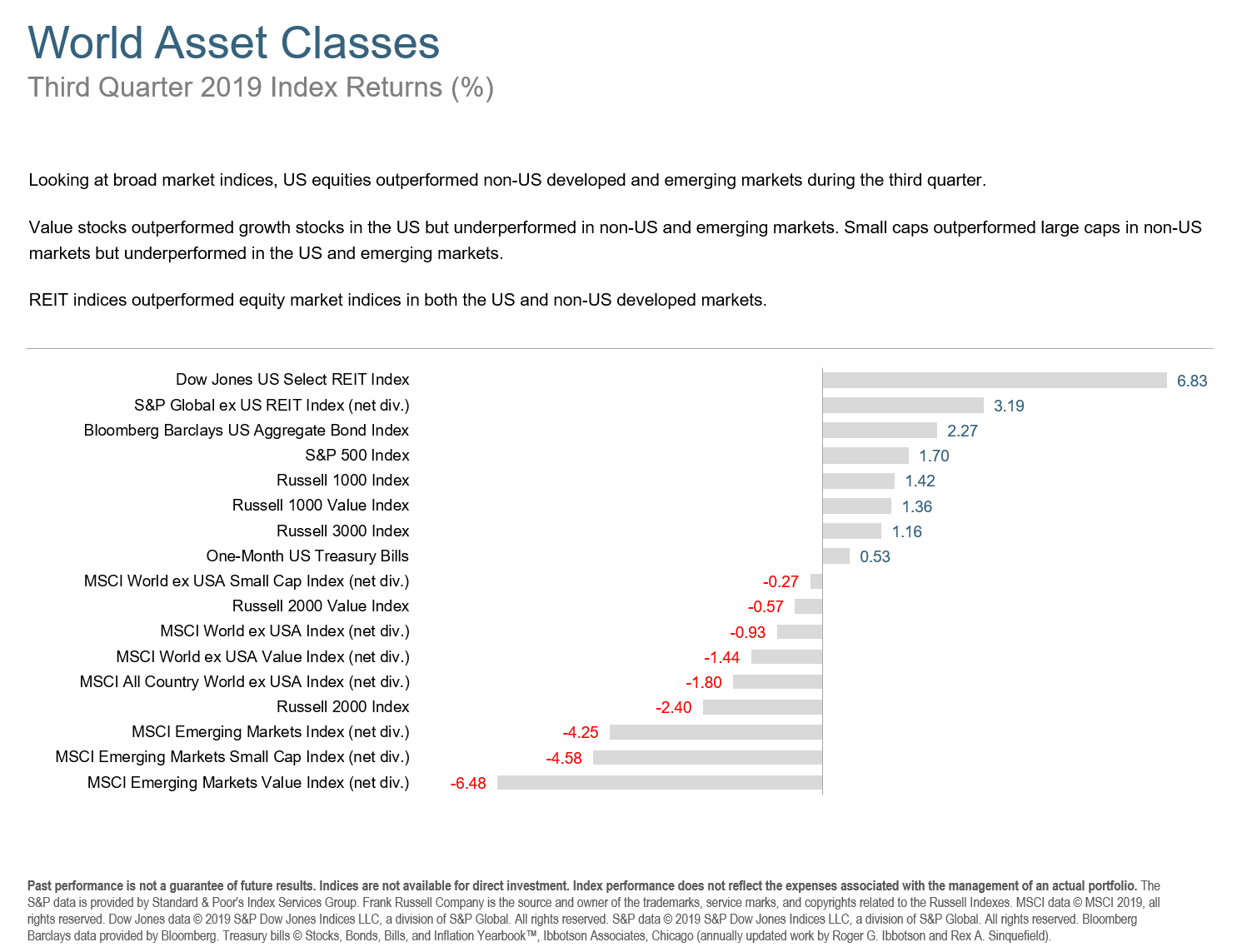

Equity markets around the globe posted mixed returns in Q3. Looking at broad market indices, US equities outperformed non-US developed and emerging markets during the quarter. Value stocks beat growth on a market wide basis in the US, but under-performed in developed and emerging non-US markets. Small caps out-performed large caps in developed non-US markets but under-performed in the US and emerging markets.

Real Estate Investment Trust (REIT) indices out-performed equity markets in both the US and non-US developed markets, with US REITs having a little better showing than the non-US.

US stocks continued what has been about a decade of out-performance of international developed and emerging markets equities. In US dollar terms, developed markets stocks outside the US outperformed emerging markets equities in Q3. Small caps out-performed large caps in non-US developed markets. Growth stocks out-performed value across large and small cap stocks.

Emerging markets trailed developed markets, while growth stocks generally outperformed value stocks and large caps bested small caps.

Belgium and Japan recorded the highest country performance in developed markets, while Hong Kong and Singapore posted the lowest returns for the quarter. There was a wide dispersion in returns across emerging markets. Turkey recorded the highest country performance with a gain of 11.3%, while Poland posted the lowest performance, declining 12.74%.

In both developed and emerging markets, currencies were mostly weaker against the US dollar.

Commodities lagged as the Bloomberg Commodity Index Total Return declined 1.84% in the quarter. Nickel and silver led performance, returning 34.75% and 9.92%, respectively. Coffee and Kansas wheat were the worst performers, declining by 10.76% and 13.66%, respectively.

As previously mentioned, interest rates decreased in the US Treasury market, with the the yield on the 5-year Treasury note declining by 21 basis points (bps), ending at 1.55%. The yield on the 10-year Treasury note fell by 32 bps to 1.68%. The 30-year Treasury bond yield decreased by 40 bps to finish at 2.12%.

On the short end of the curve, the 1-month Treasury bill yield decreased to 1.91%, while the 1-year T-bill yield fell to 1.75%, a 17 bps drop. The 2-year T-note yield finished at 1.63%, decreasing 12 bps.

In terms of total returns, short-term corporate bonds increased by 1.17% and intermediate-term corporate bonds rose by 1.74%. The total return for short-term municipal bonds was .33%, while intermediate munis returned 1.02%. Revenue bonds outperformed general obligation bonds.

Interest rates in the global developed markets generally fell during the quarter. Just as in the US, longer-term bonds generally outperformed shorter-term bonds in those markets. Short- and intermediate-term nominal interest rates again were negative in Germany and Japan.

The Q3 2019 Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.