Strong US economic growth, escalating trade tensions, Brexit concerns, continued normalization (rate increases) by the Fed, and a selloff in emerging markets characterized Q3 2018. While the focus has seemingly been on the political front, with a contentious Supreme Court nomination and “The Resistance” looking to make gains in the upcoming mid-term elections, the economic news in the US has been very good.

US large company growth stocks were the big winners of the quarter. Concerns over trade policies continue, but increasingly the US is viewed to be well positioned in its hardball negotiations with trading partners and foes. A new trade deal was agreed upon with Canada and Mexico to replace NAFTA, and Chinese markets have been roiled by tariffs as US stocks have roared to new highs. The Fed raised rates for the third time this year and appears to be poised to continue on that path for the foreseeable future. While the rising rates will increase the cost of credit card debt, home equity lines of credit, and other short term borrowing, it is good news for conservative investors that count on interest income from their bond portfolios. The caveat being that inflation historically also rises during economic expansion.

Emerging markets continued to be the biggest victim of the trade tensions, which have been exacerbated by heavy debt loads and falling commodity prices that are both on the wrong side of a strong US dollar. Turkey, Greece, and Egypt had double digit losses in Q3 and the granddaddy of all emerging markets, China, wasn’t far behind. International developed markets, while eking out a small gain overall, largely under-performed the US markets.

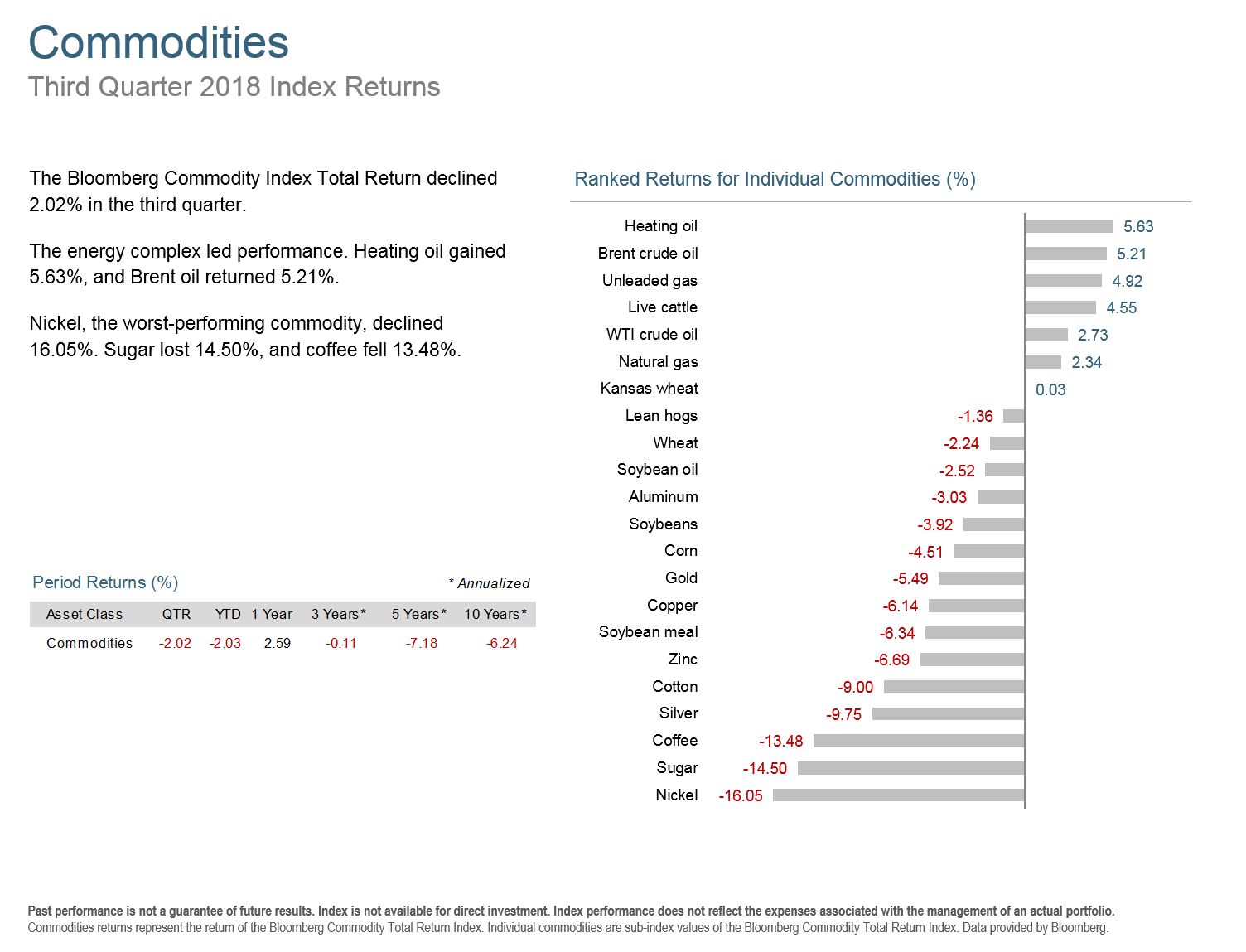

US bonds, in spite of rising rates, were up slightly overall with lower quality “high yield” bonds providing the most gains. Commodities were helped by rising energy costs, but declined overall.

The biggest concern I’m hearing from investors recently has been about performance. With US stocks significantly beating their international counterparts and bonds treading water, globally diversified portfolio returns have lagged. The key to disciplined asset allocation, however, is to stem the urge to overreact to short term anomalies.

The historical returns of domestic stocks are similar to their foreign counterparts over the long term, and the expected returns of many ex-US markets are actually higher today due to their lower valuations. Bonds always offer lower expected returns than stocks, but provide relative safe harbor from volatility. On the other hand, emerging markets have the highest expected returns, but their recent volatility has only served to remind us that returns and risk go hand in hand.

We don’t try to outguess what asset class or market segment is going to outperform, we stick with disciplined asset allocation based on your goals, risk tolerance, and risk capacity instead of trying to outmaneuver the markets. We invest our own assets in exactly the same way as we manage those for our clients, and feel your pain by waiving our fees when you lose money during any month. We are always in this together.

The Q3 2018 Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

As always, if current markets have you concerned about your portfolio, please get in touch for a review.