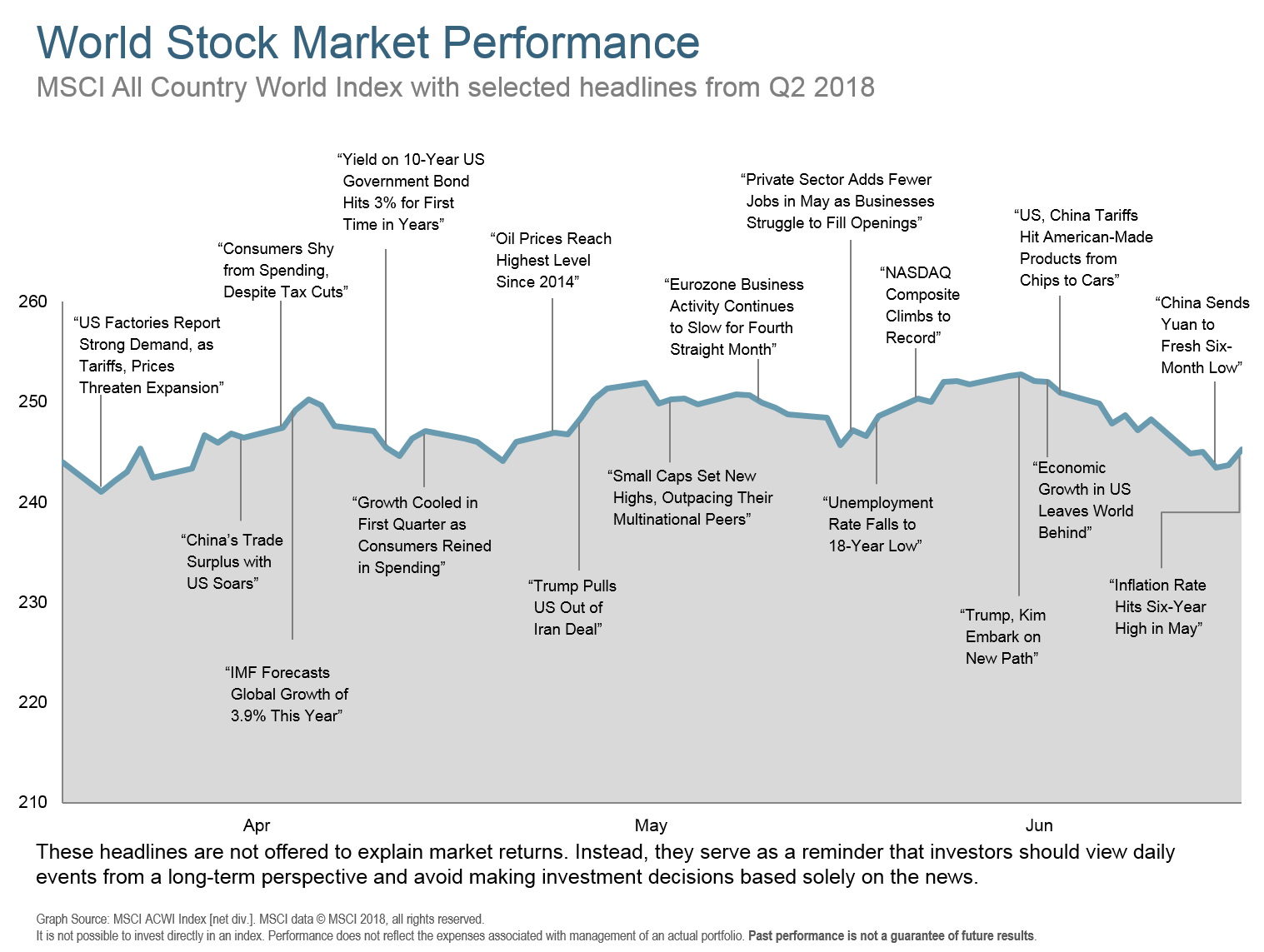

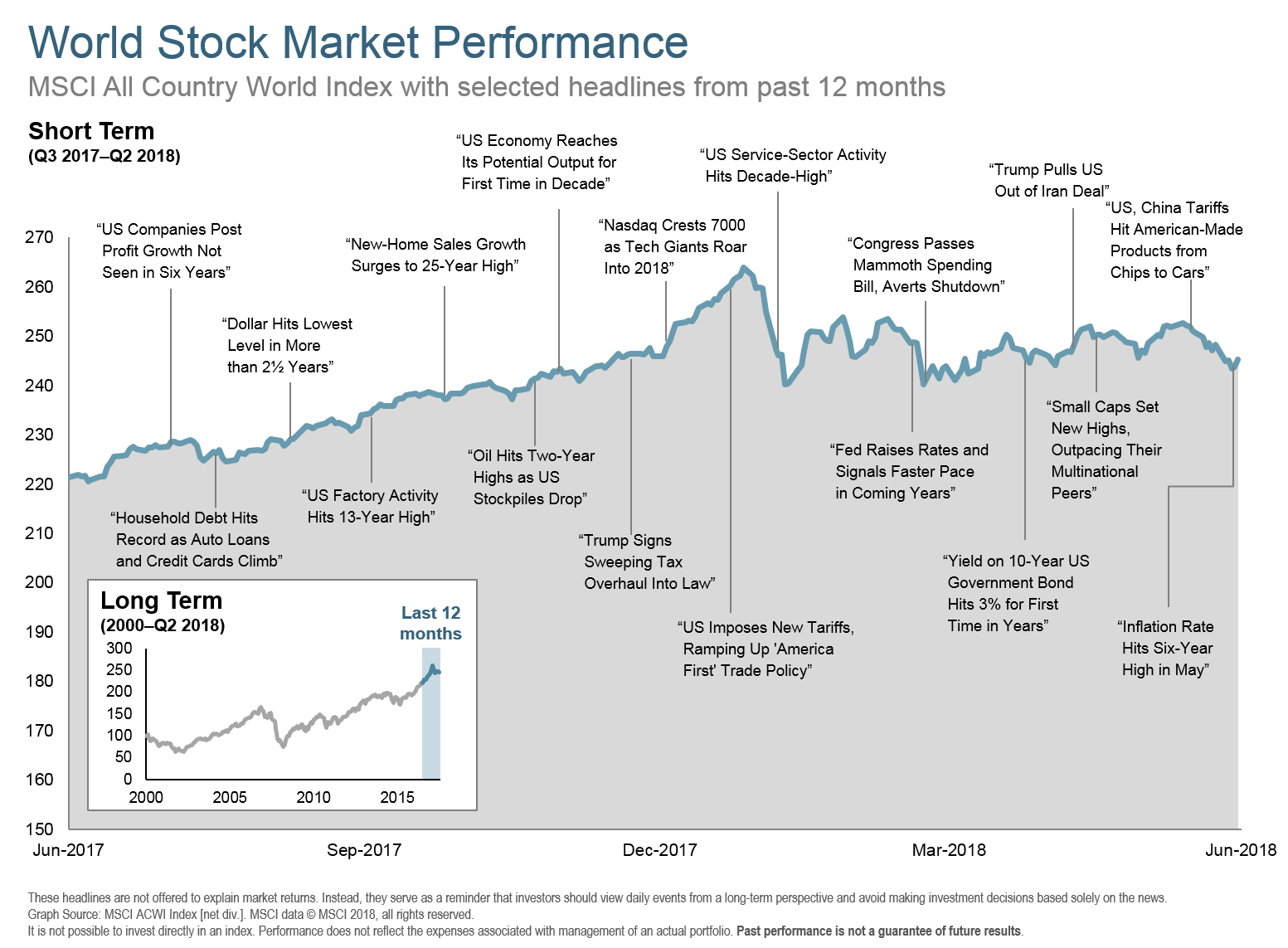

Trade wars, sanctions, a rising dollar, increasing costs at the pump, and weakness in emerging markets characterized Q2 2018. With a constant stream of policy and mood Tweeting adding to the information processing machine that is otherwise known as stock and bond markets, a sense of rising uncertainty seemed to be the theme as of late.

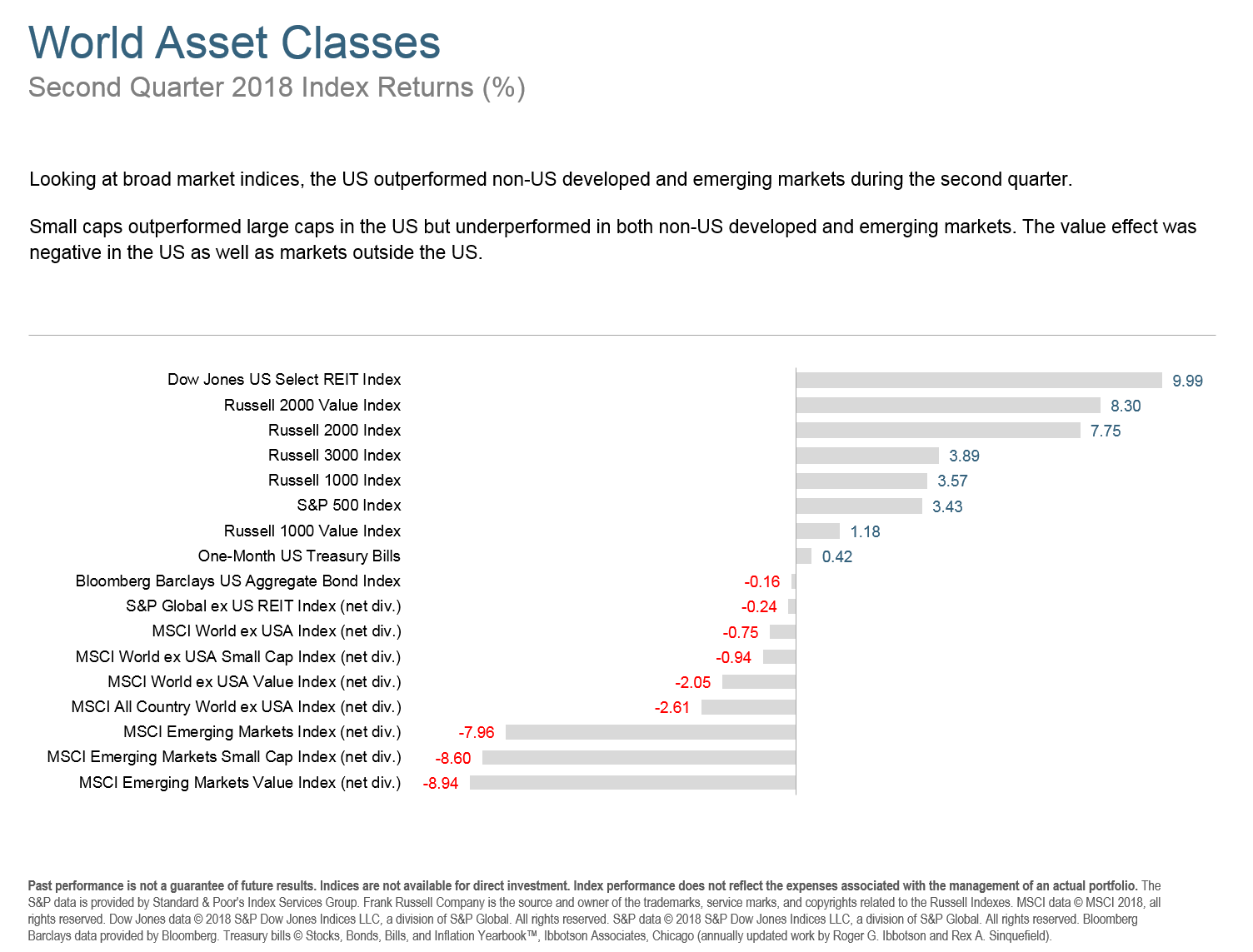

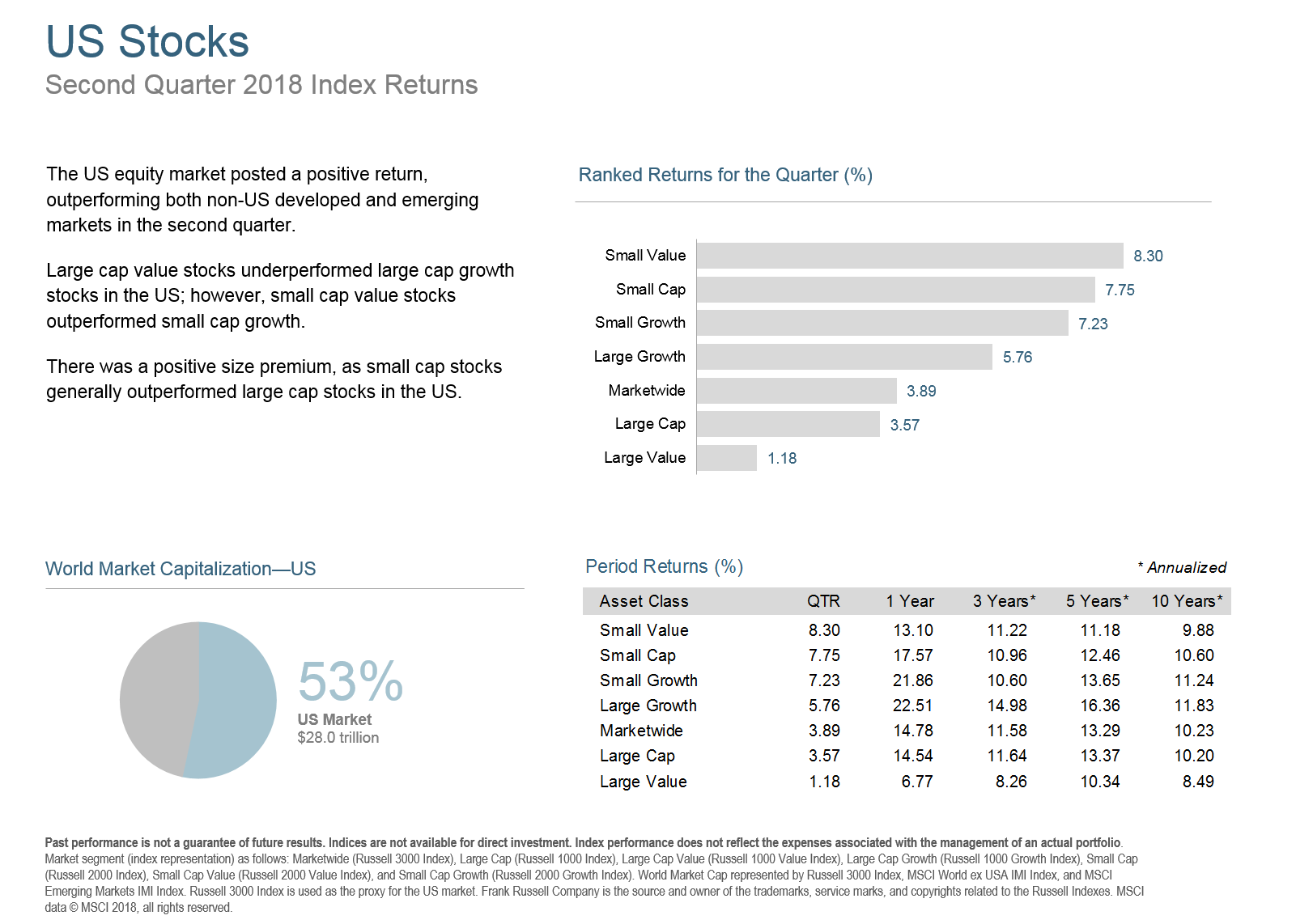

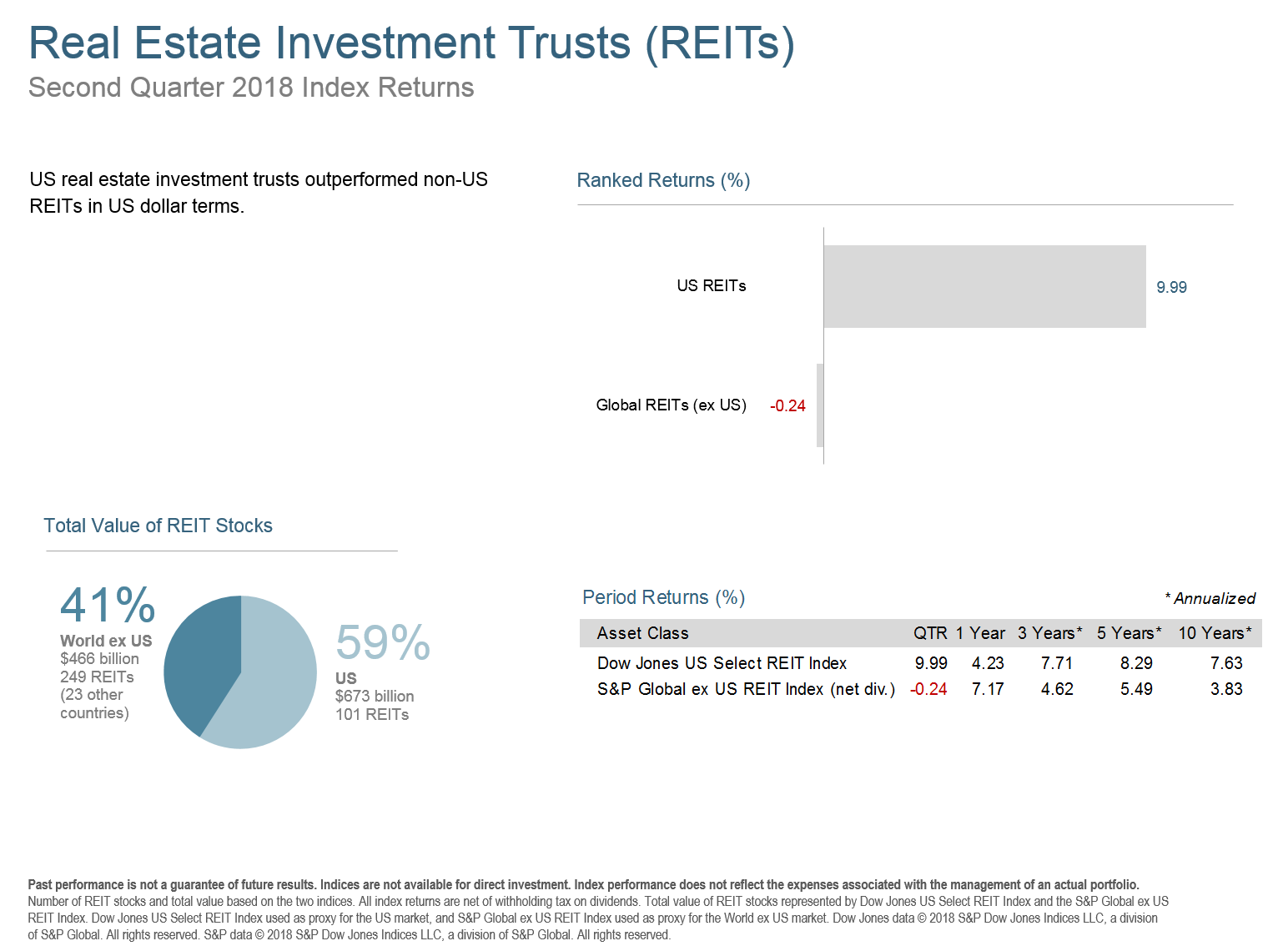

US REITs and small company stocks were the big winners of the quarter. Concerns over trade policies that may impose new tariffs on imports, and the inevitable responses from trading partners , both allies and foes, have continued to dominate the attention of investors, however. Adding to that uncertainty, in June, the Fed raised rates for the second time this year. After years of goosing the economy, it appears their discussions have shifted to not just normalizing interest rates but also keeping the economy from overheating. In other words, expect more increases later this year.

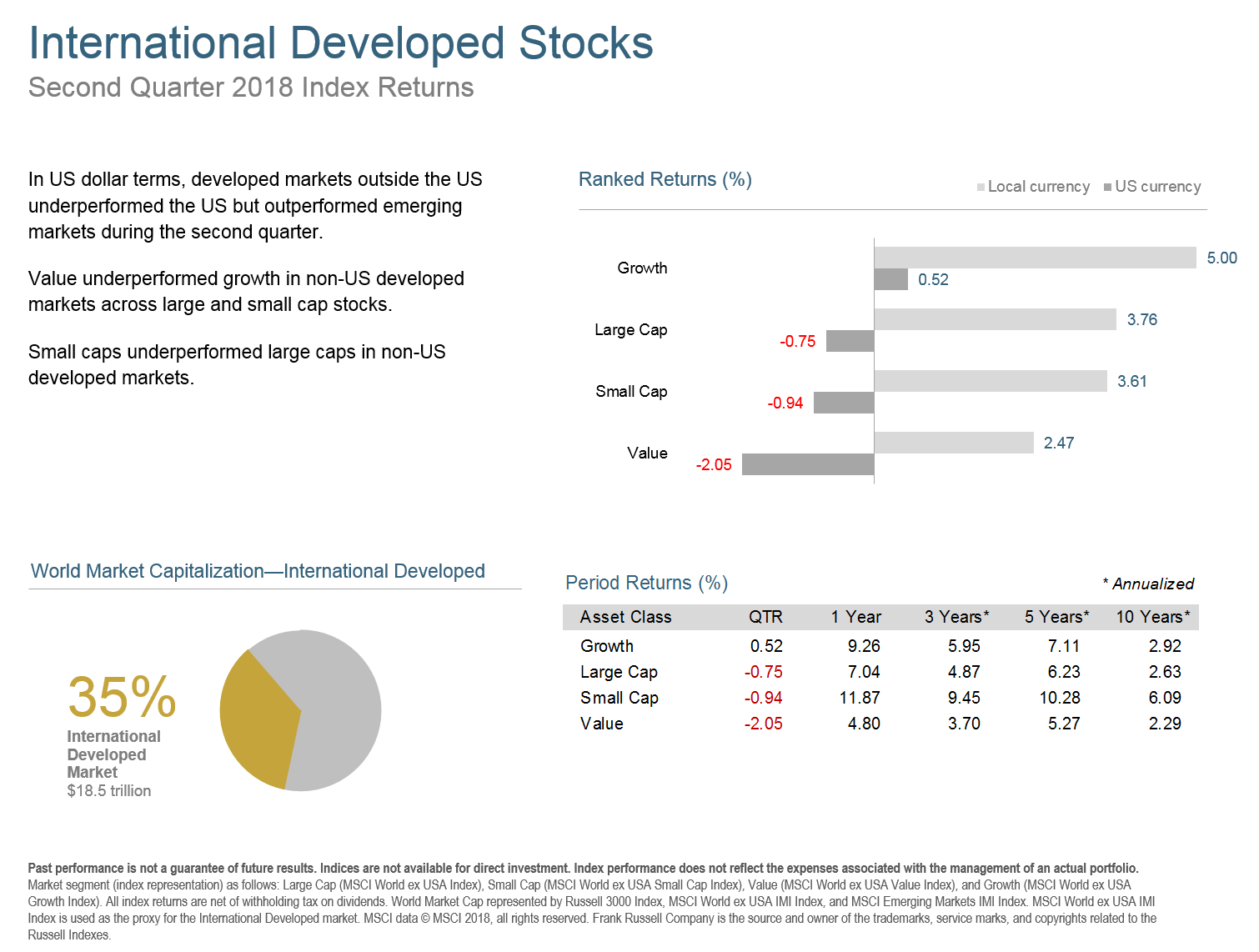

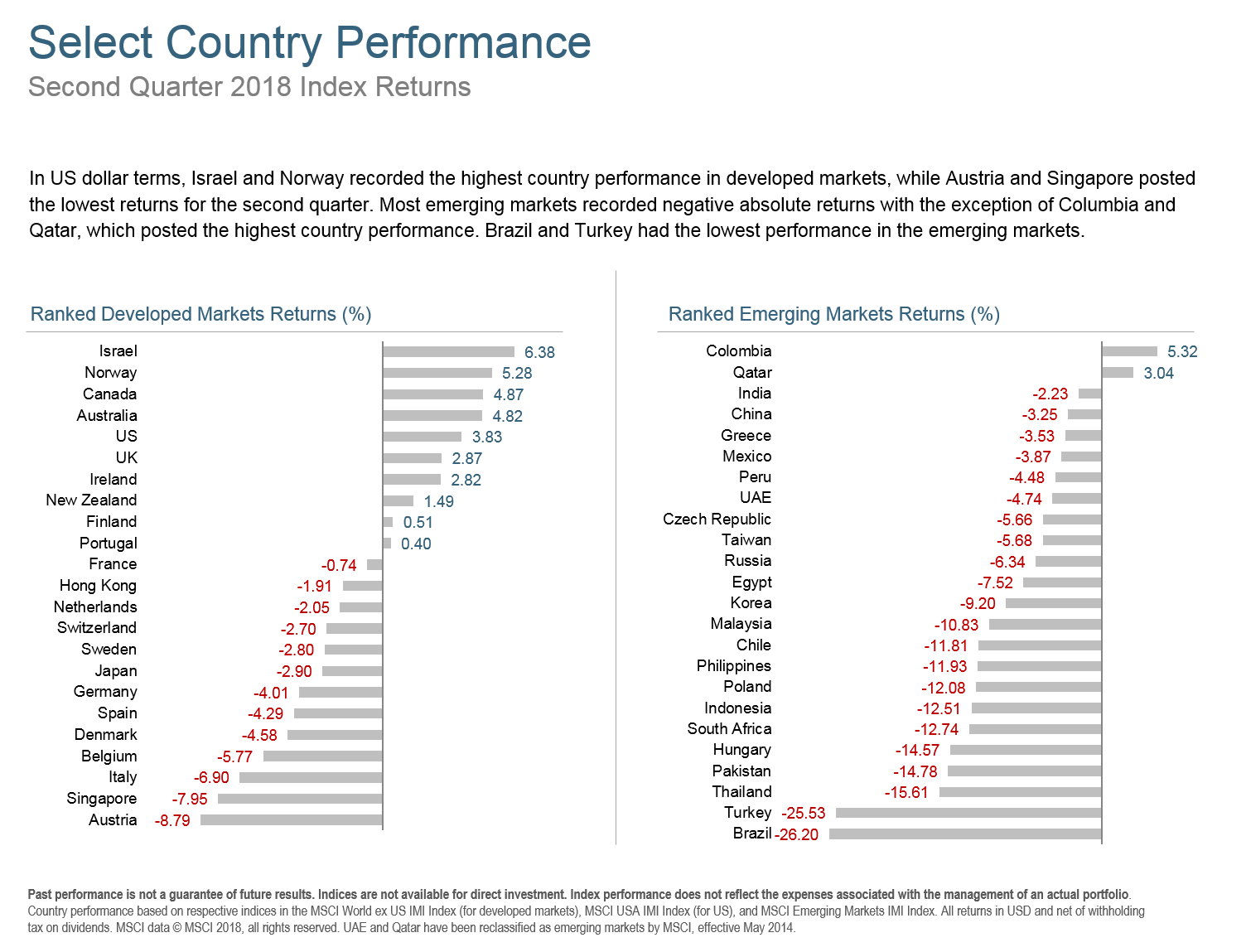

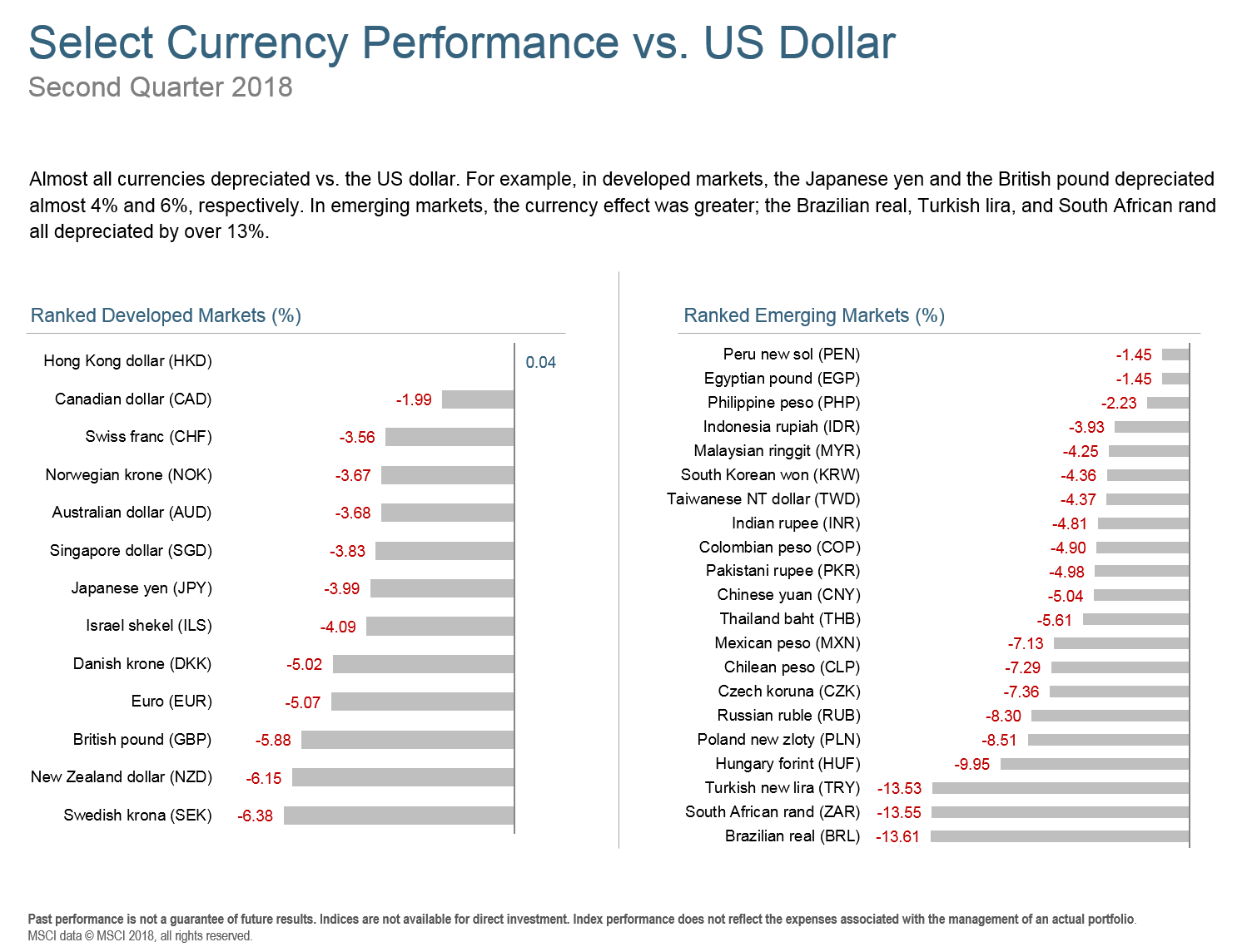

Emerging markets were the biggest victim of all the tariff talk and the rising dollar, with most of those countries showing losses for the quarter. International developed markets were a mixed bag, but mostly outperformed emerging markets while trailing the US.

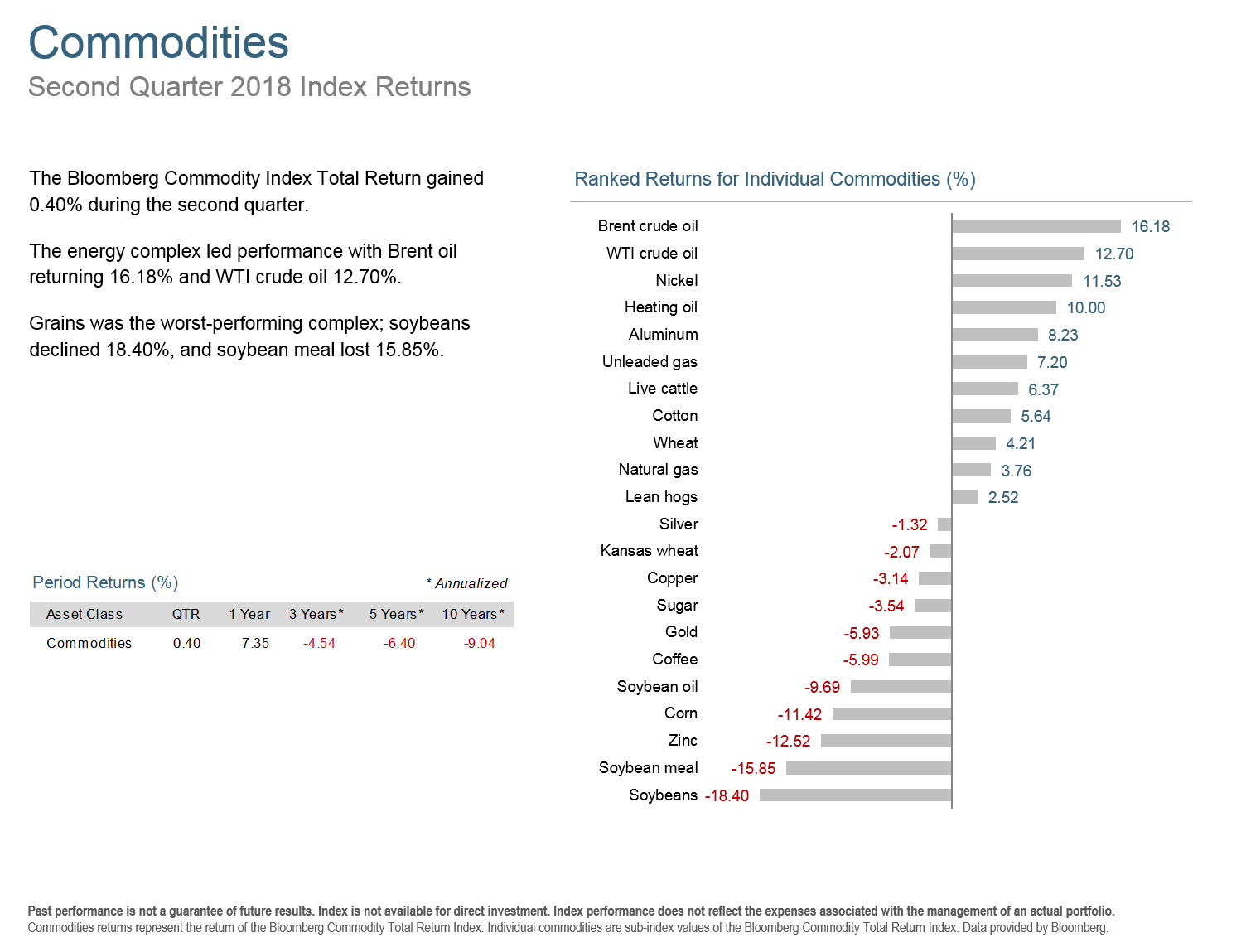

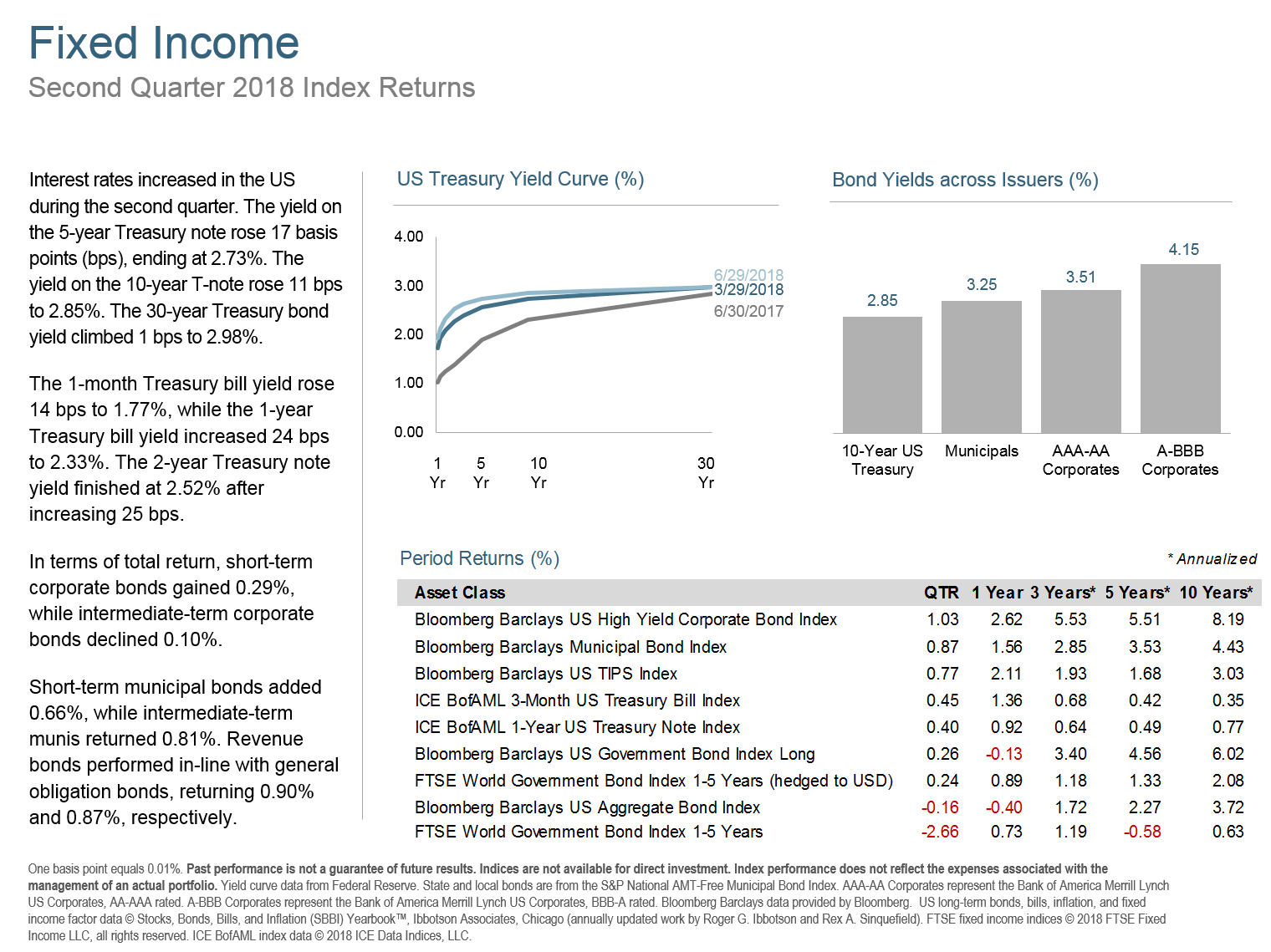

Rising interest rates in the US were the main contributing factor to global bonds beating their domestic counterparts. Commodities, led by rising oil prices, posted modest gains.

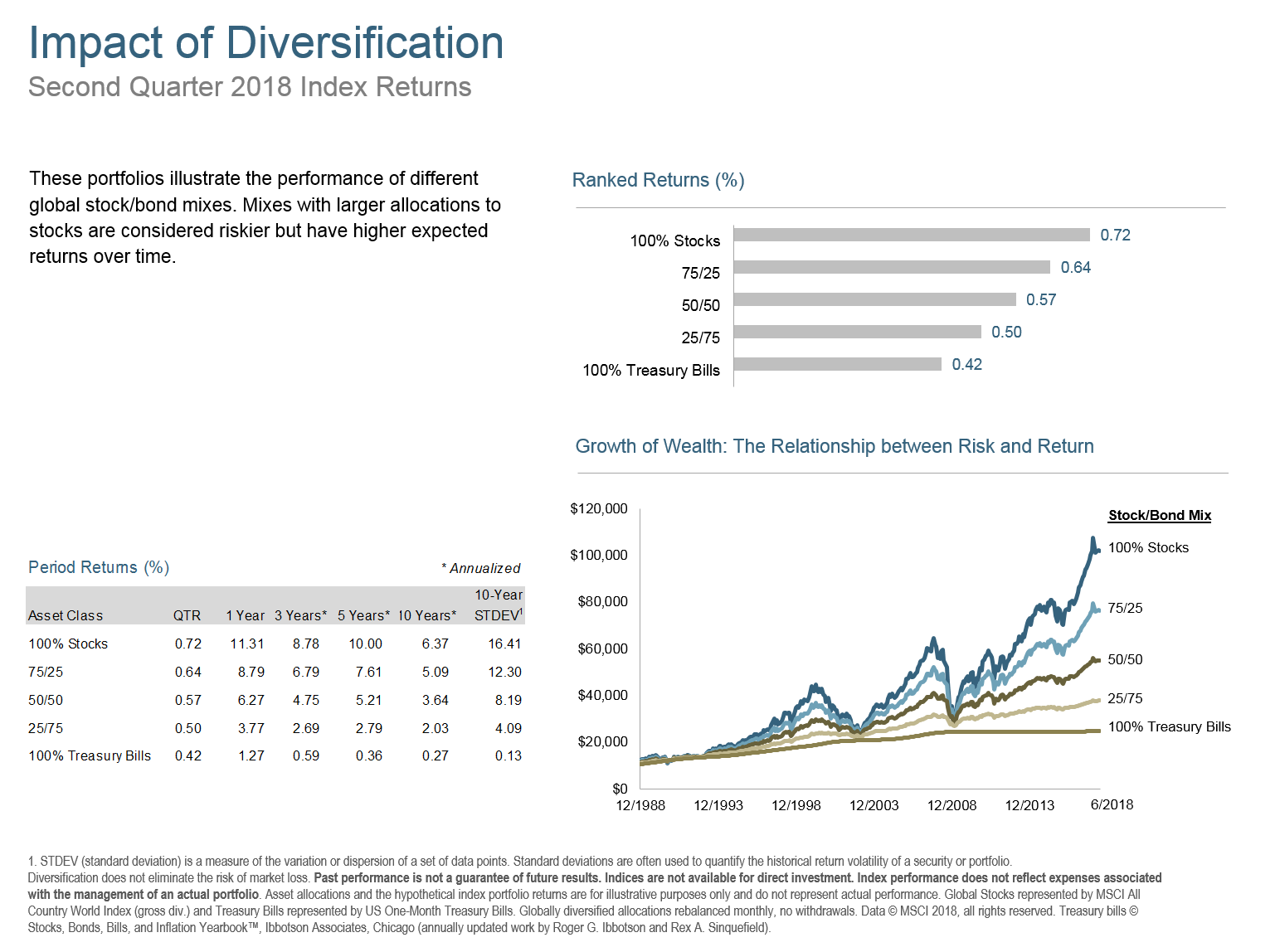

The big question continues to be if we are at the end of an equity bull market or just taking a breath before the next leg up. There are compelling cases to be made for each side, but the real answer is that nobody knows. That us why we will stick with disciplined asset allocation based on your goals, risk tolerance, and risk capacity instead of trying to outguess the markets.

The Q2 2018 Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

As always, if current markets have you concerned about your portfolio, please get in touch for a free review.