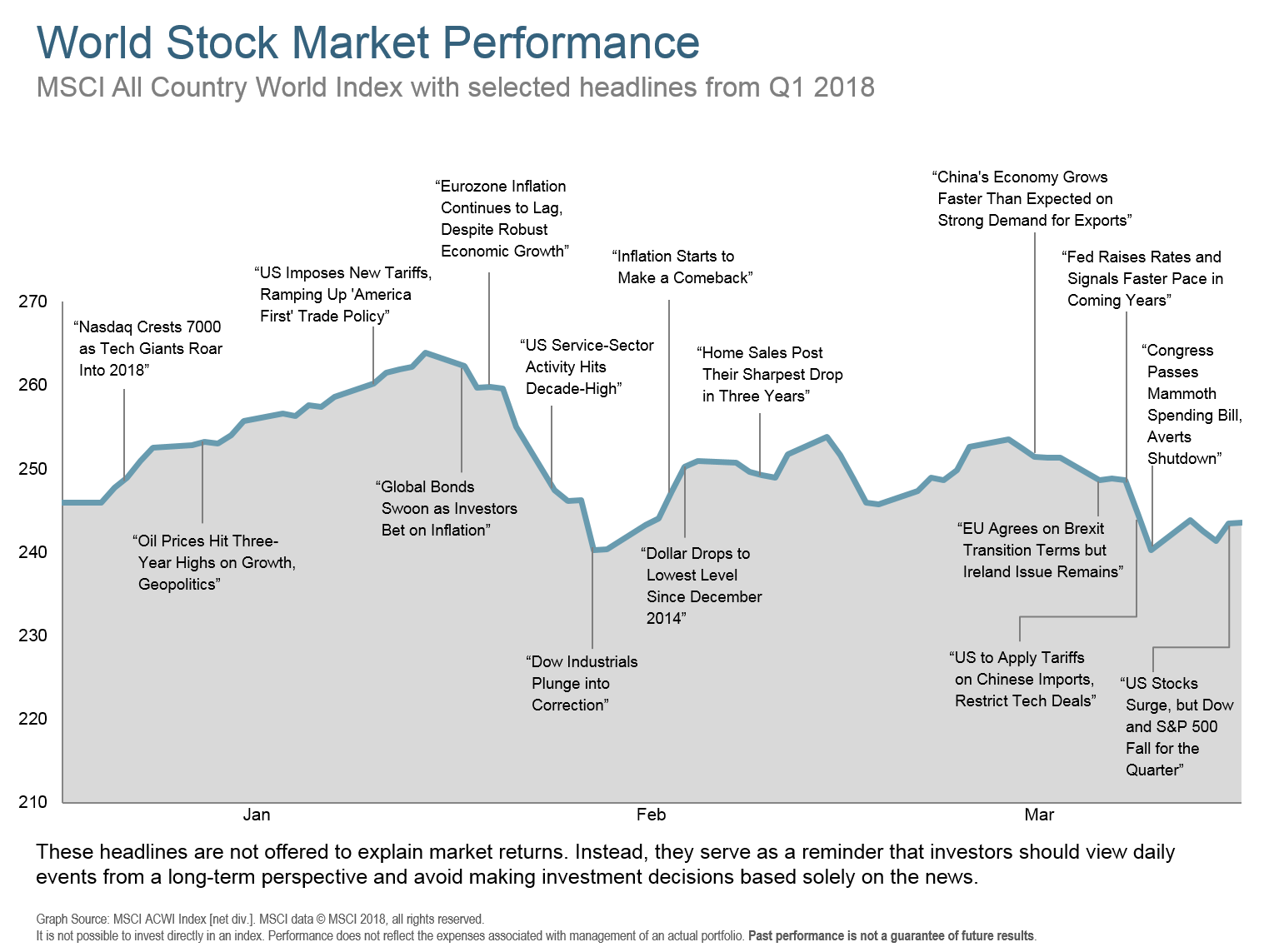

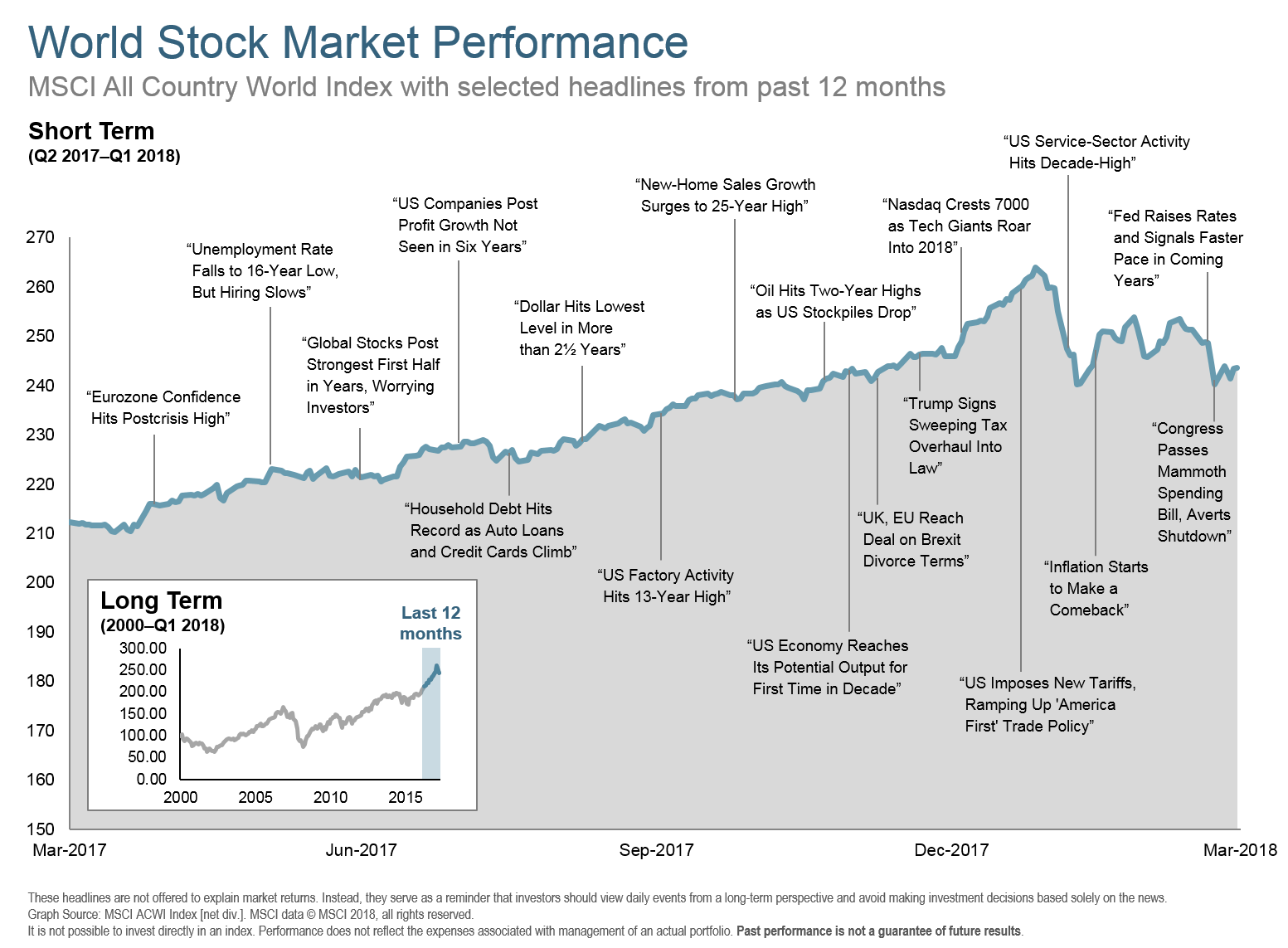

Remember that thing called gravity? After last year's steady climb, it is understandable that some of us may have taken some laws of physics for granted. But in Q1, many markets peaked, at least temporarily. Since then, Isaac Newton’s famous observation that, “What goes up must come down,” has seemed to rule the day. (Albeit, this principle definitely has not applied to markets over the long term.)

The year began much as the last ended, with stocks rallying. But many crested in January, with several markets now in correction territory (10%+ drops), although we are largely just below where we began 2018. Most attribute the selloff to concerns over the MAGAnomics policies of imposing tariffs on many imports and impending trade wars between the US and countries such as Canada, China, and Mexico. An increasingly hawkish Fed, who raised rates in March while indicating more increases are coming at a faster pace, is also weighing on investors’ minds.

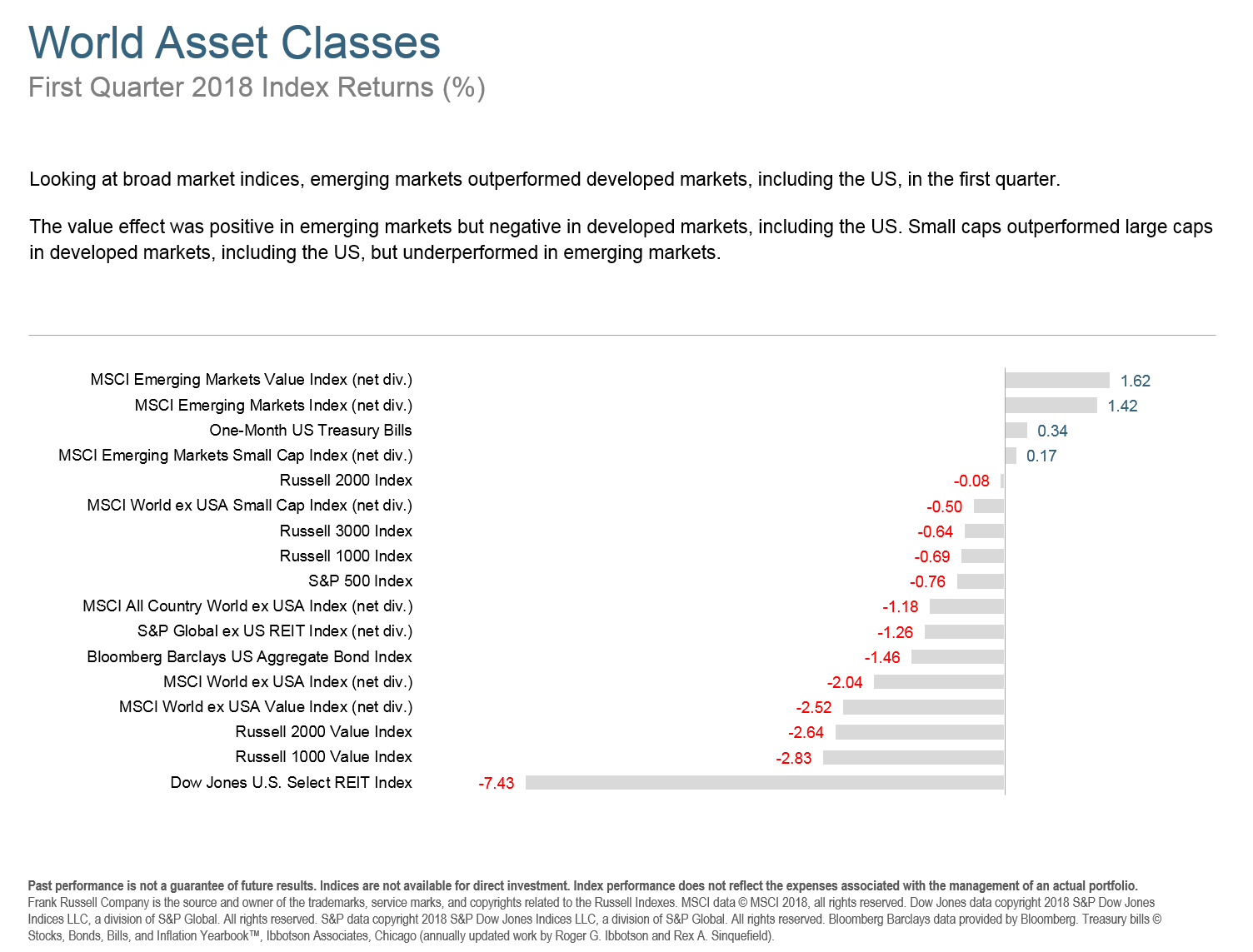

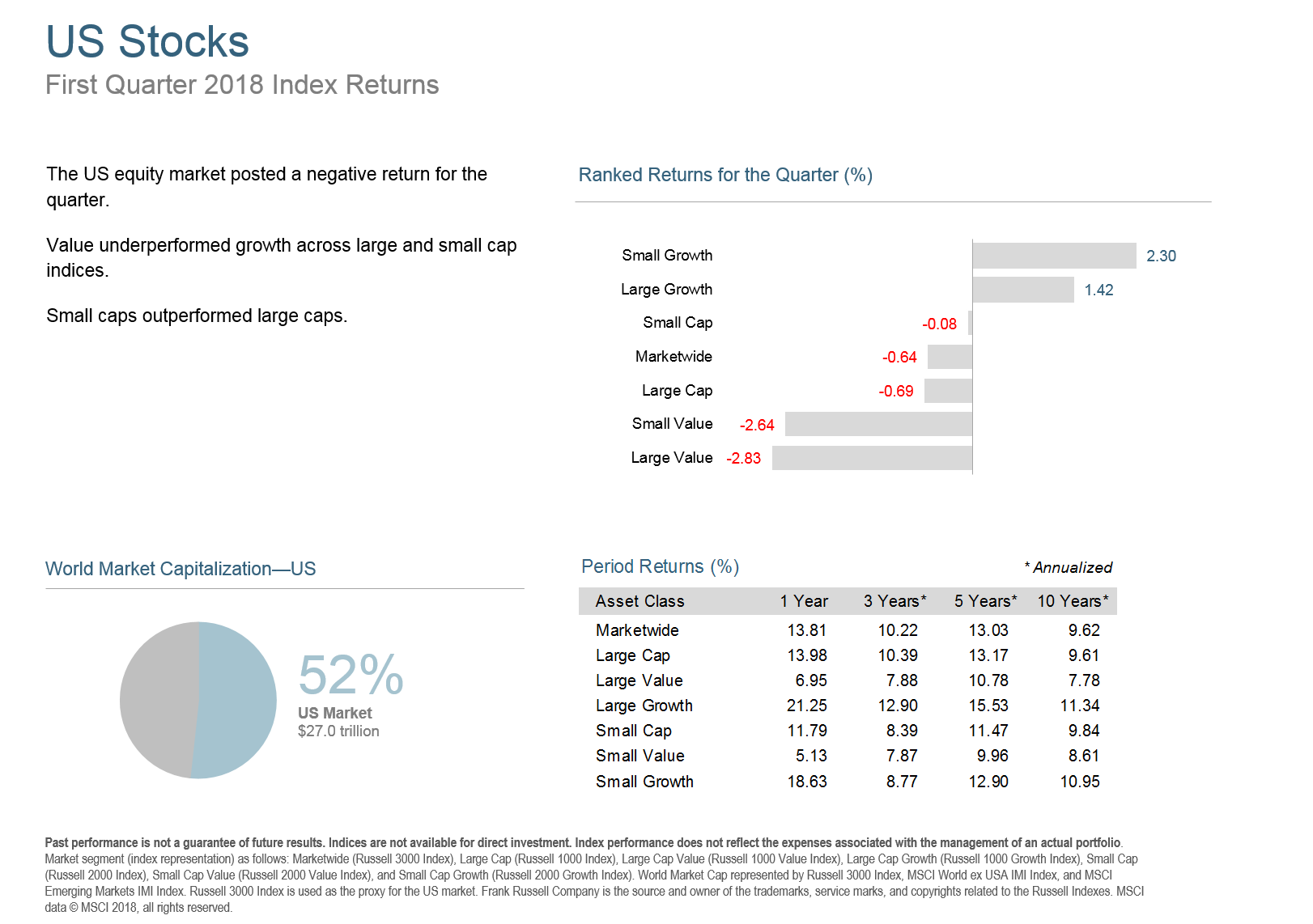

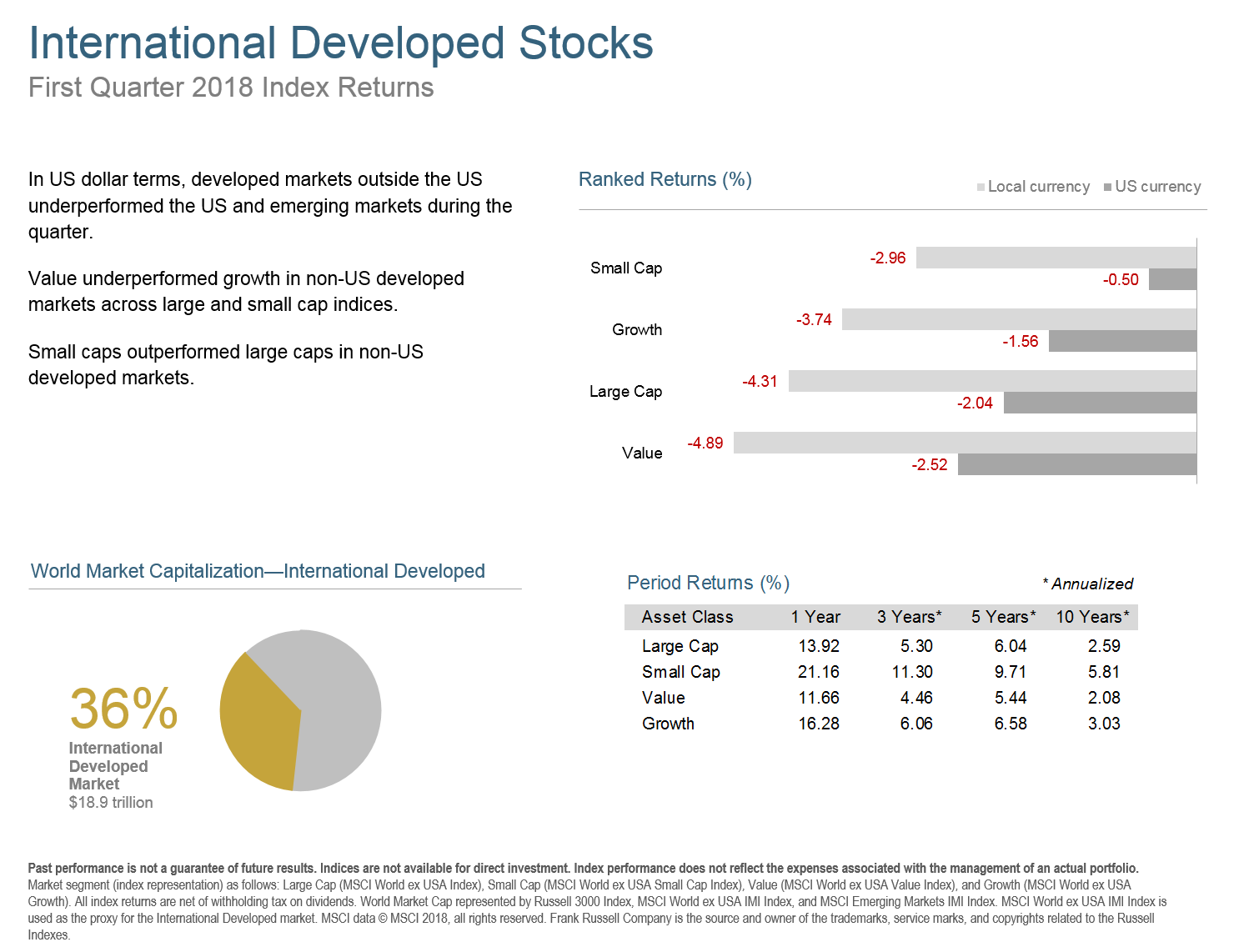

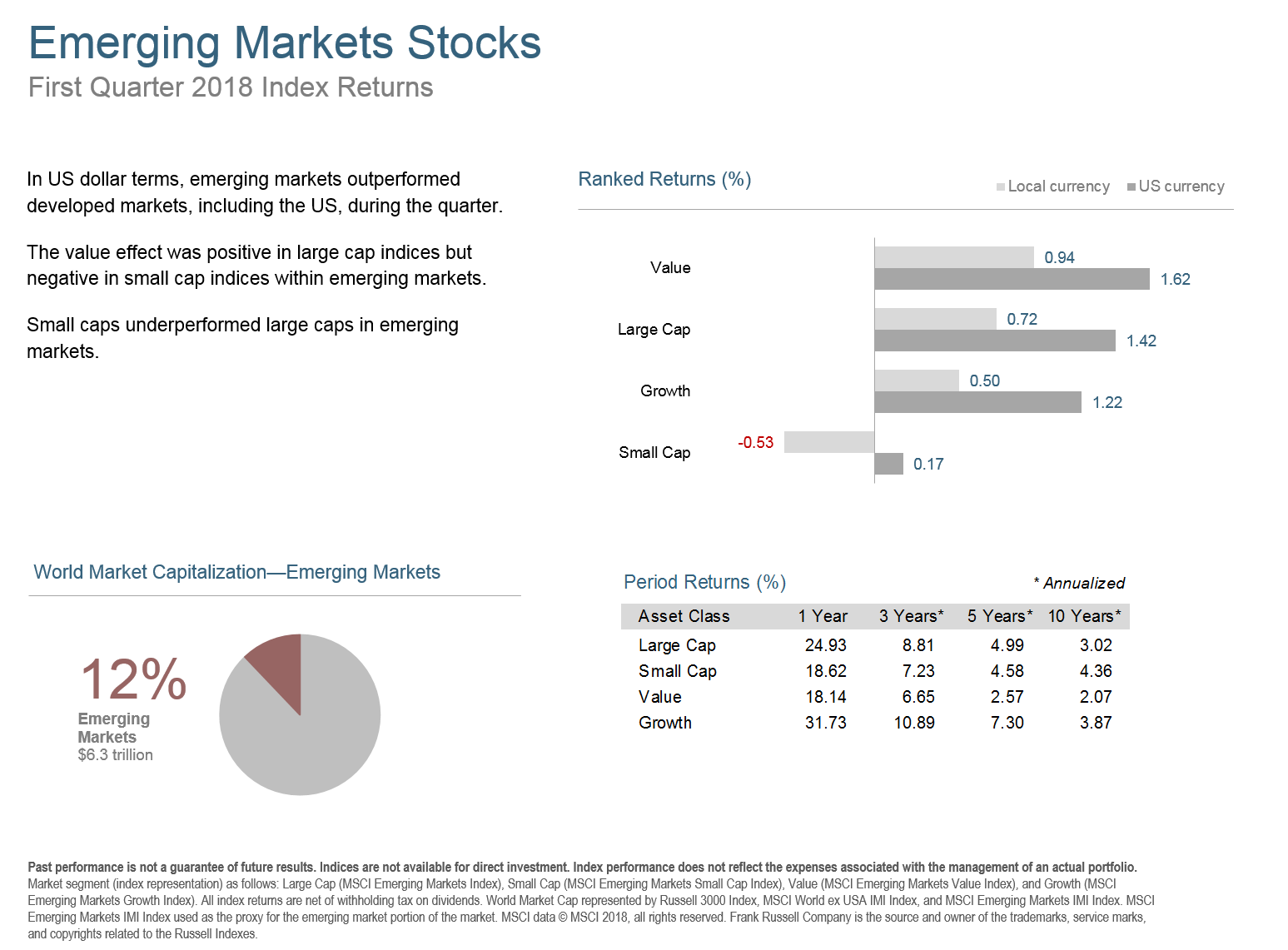

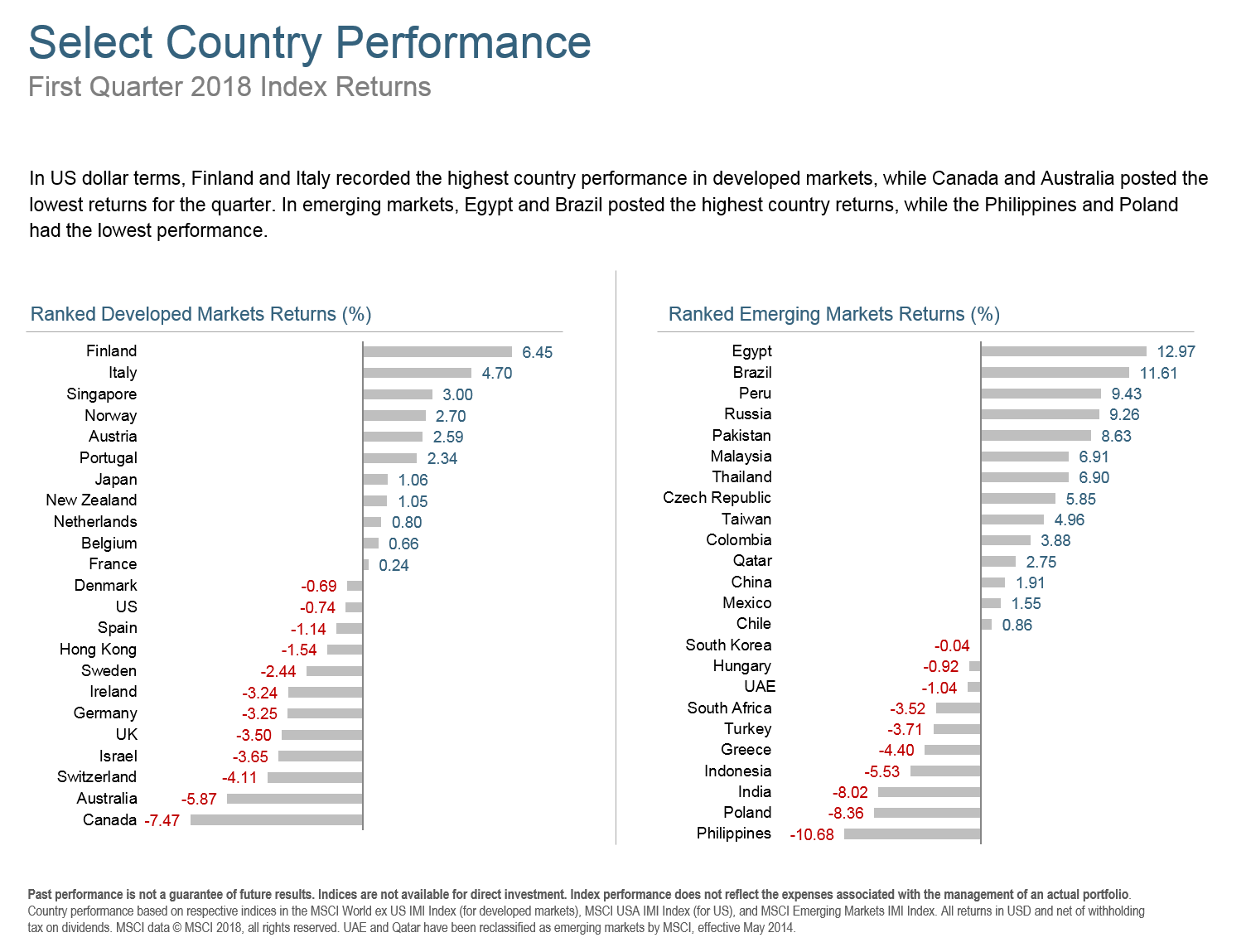

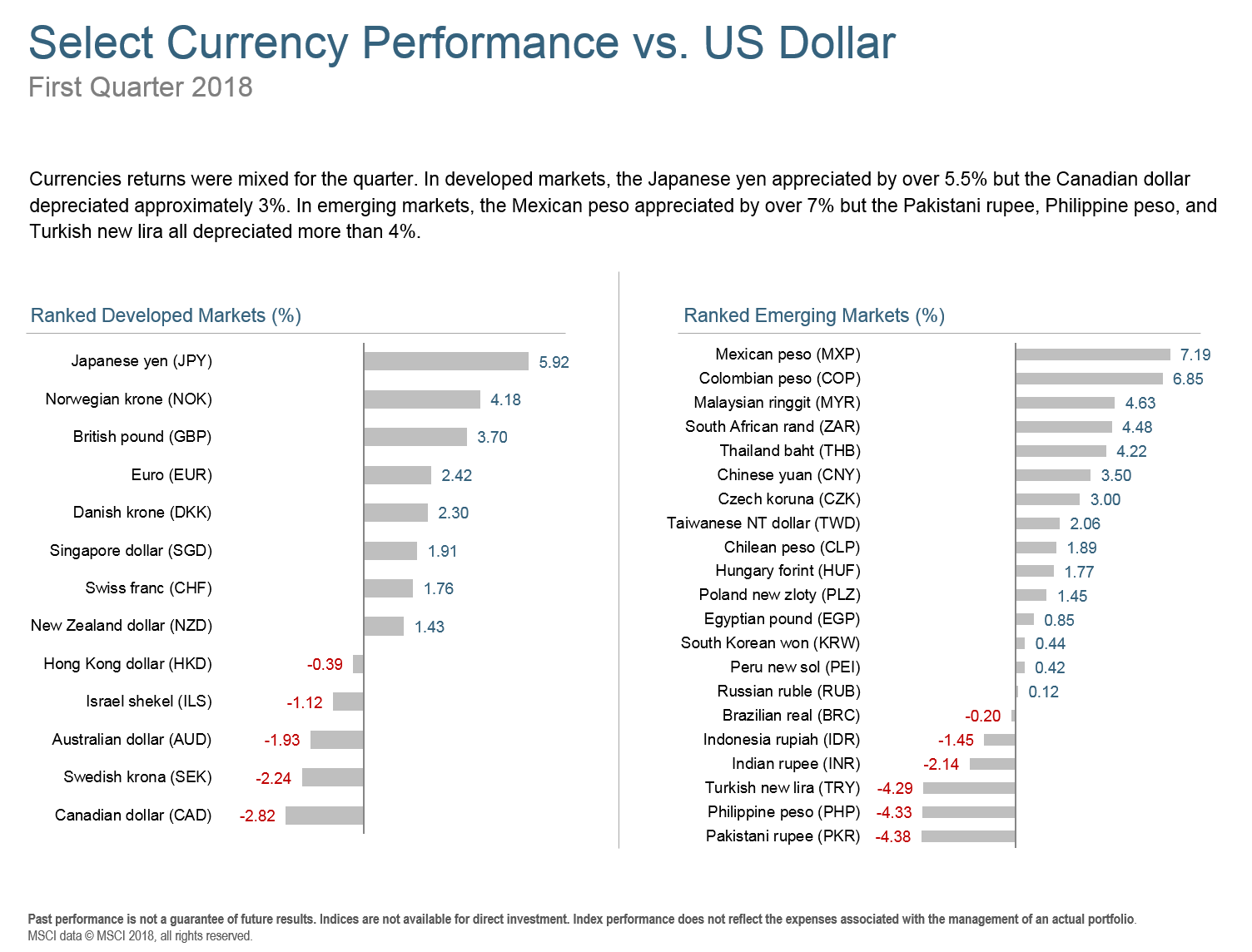

Emerging markets, global bonds, and cash were the only areas that offered positive returns in the quarter. Relatively speaking, small company stocks outperformed large companies and growth stocks bested value. The US, though, was generally down less than developed international markets.

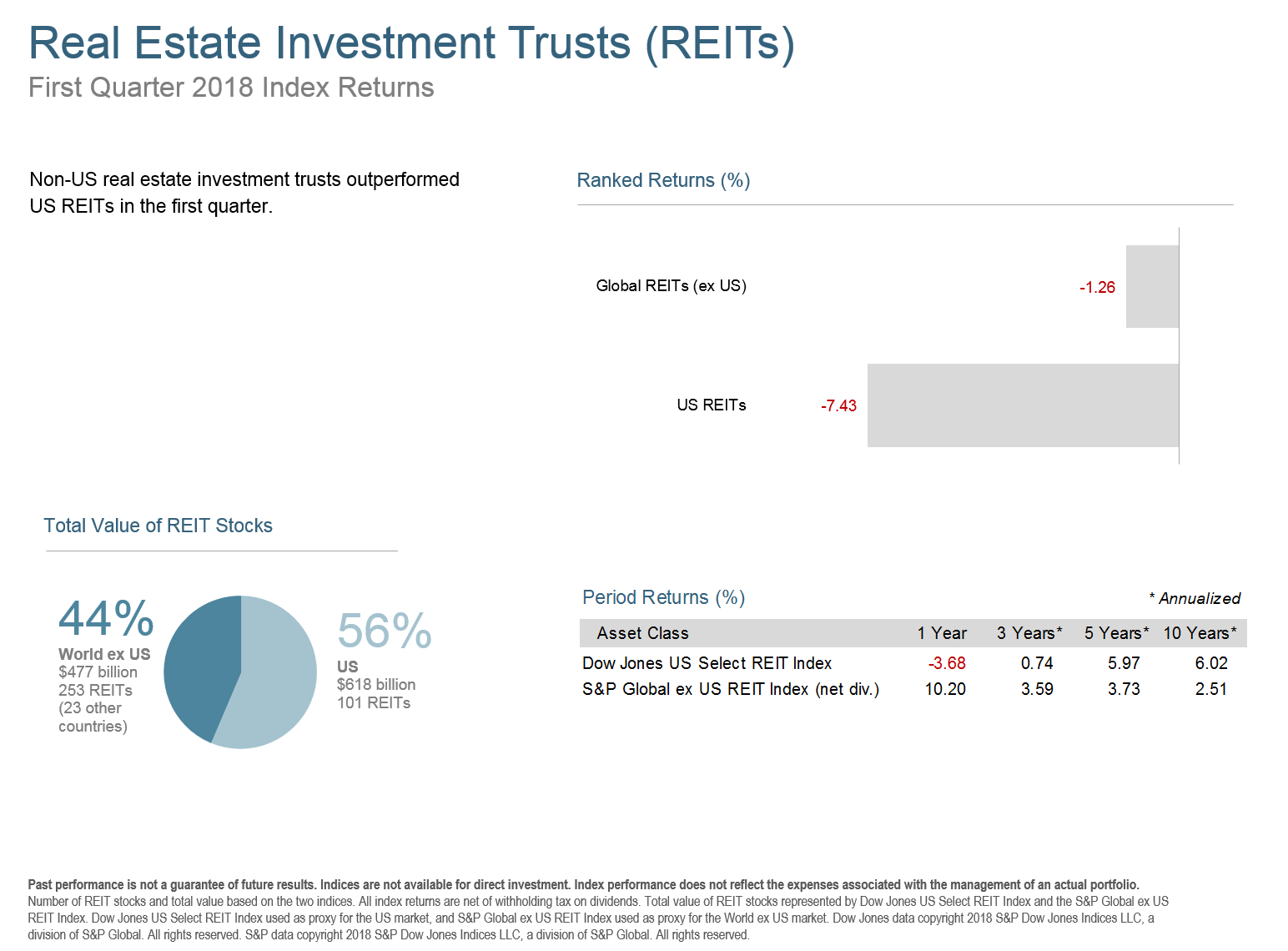

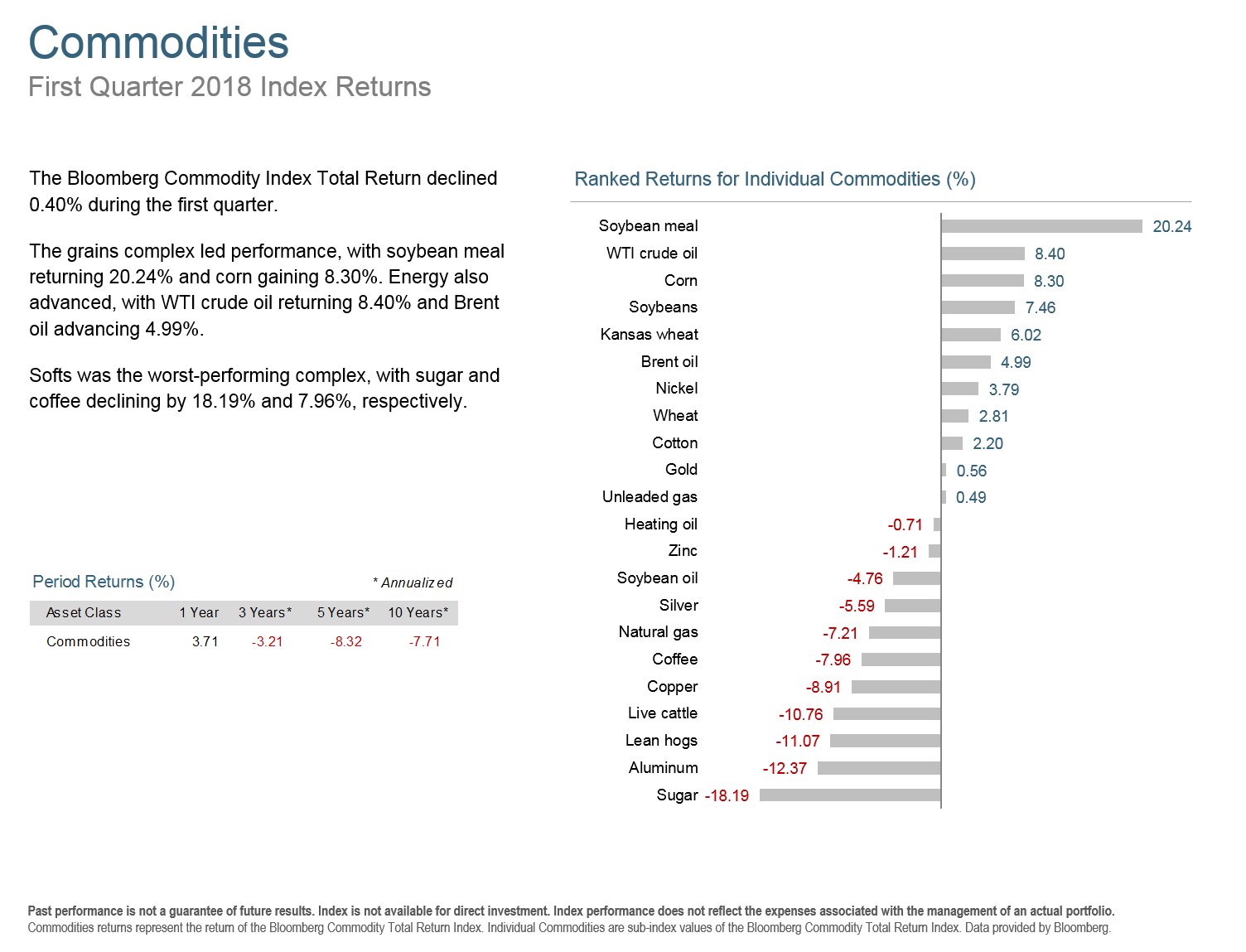

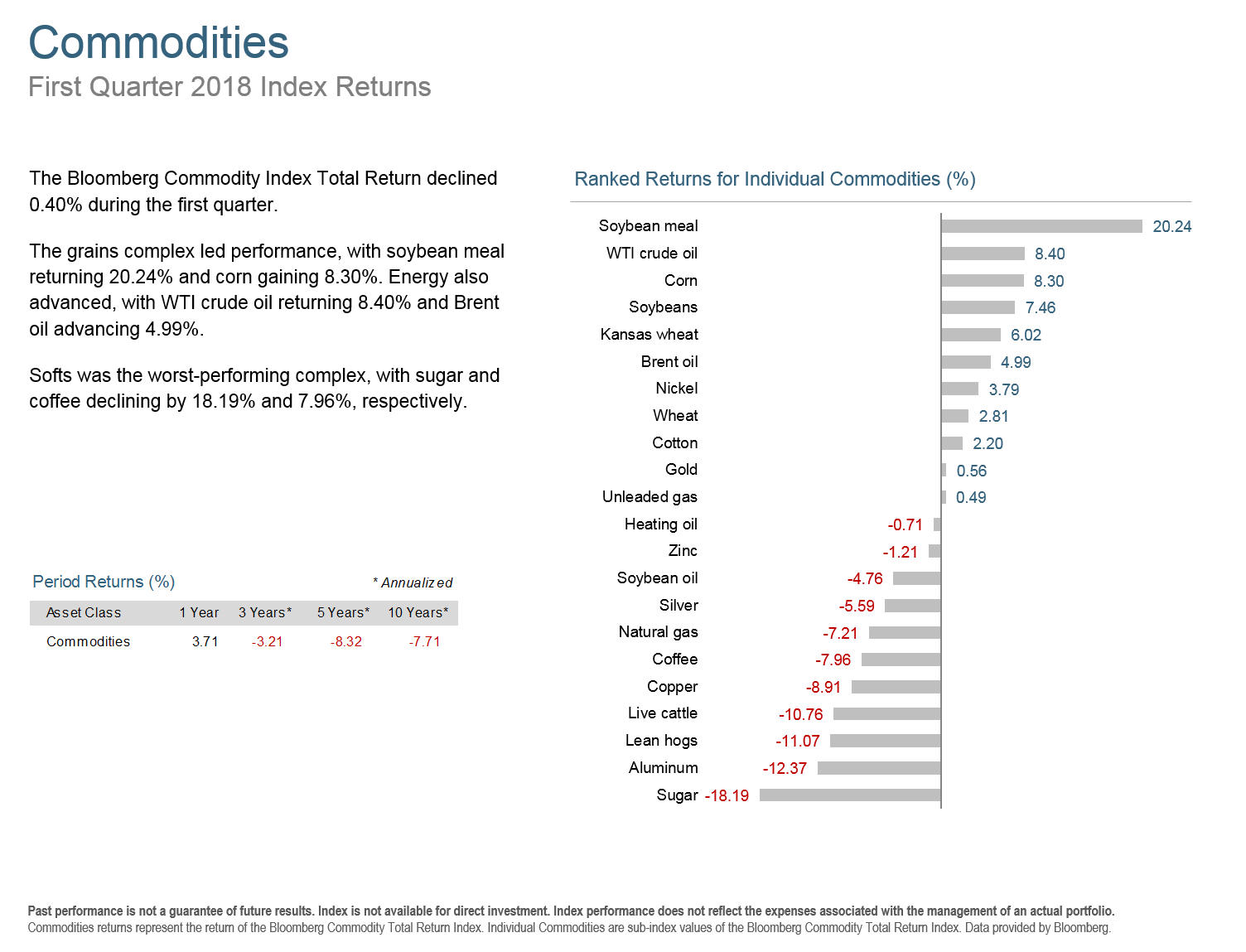

Rising interest rates in the US were the main contributing factor to global bonds beating their domestic counterparts, as well as interest sensitive REITs being the worst performers of Q1 2018. Commodities were down slightly.

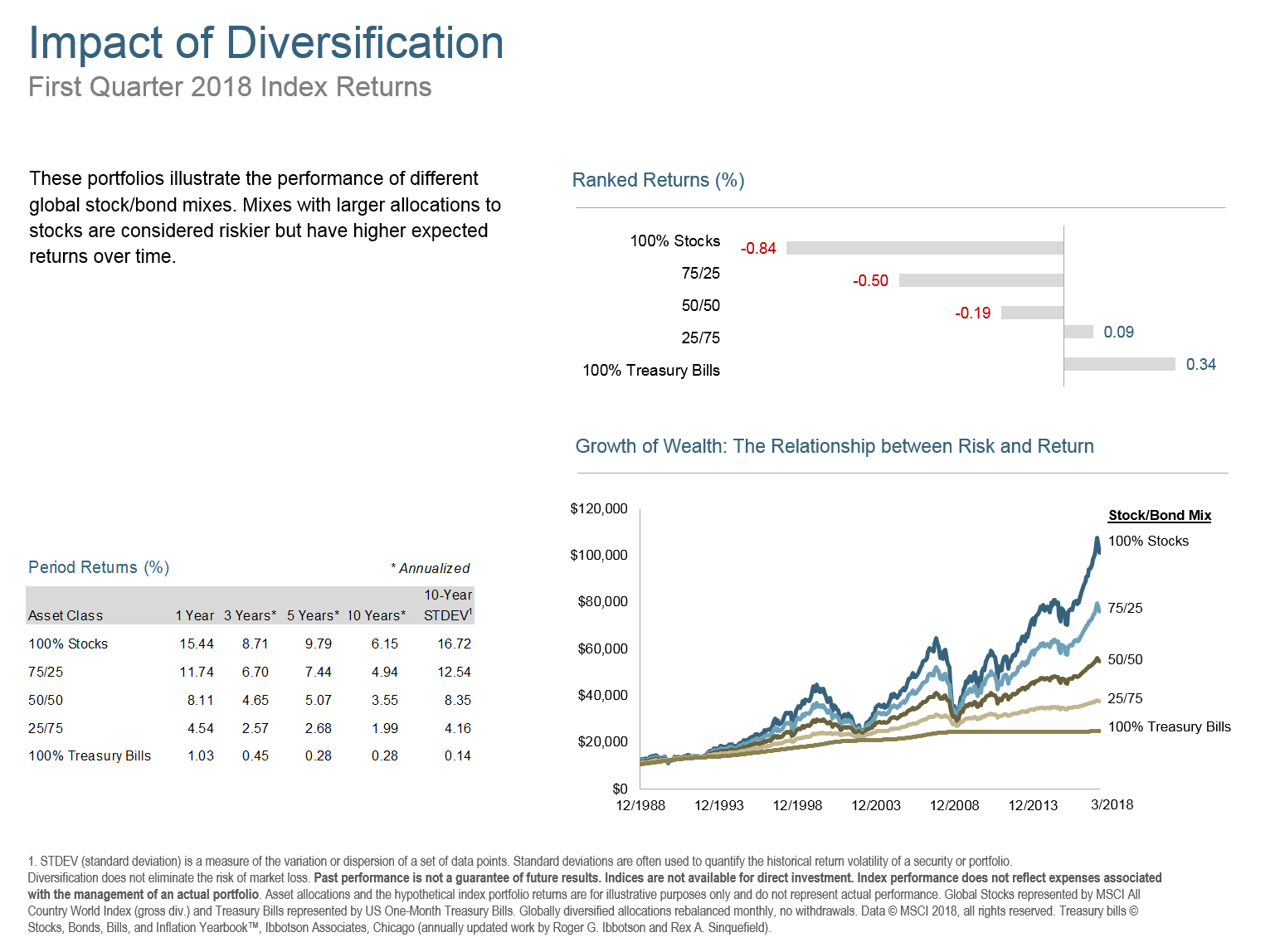

The question on everyone’s mind is if we are at the end of an equity bull market or just taking a breath before the next leg up. There are compelling cases to be made for each side, but the real answer is that nobody knows. That us why we will stick with disciplined asset allocation based on your goals, risk tolerance, and risk capacity instead of trying to outguess the markets.

The Q1 2018 Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

As always, if current markets have you concerned about your portfolio, please get in touch for a free review.