Yesterday, the Dow Jones Industrial Average fell 1.2%, the S&P 500 shed 1.5%, and the Nasdaq Composite dropped 1.9%. It marked the end of a 63-day stretch where volatility has been remarkably absent. In fact, the last time we saw a streak of trading days with fewer 1% moves in either direction was in 1995.

Whether this is the start of a new period of increased volatility, or just a temporary blip on the screen, the tendency can be to react. That’s why it can be helpful to also study the history of mistakes that investors tend to make and the lessons we have learned.

Back in 2010, the Library of Congress’s Federal Research Division prepared a report titled Behavioral Patterns and Pitfalls of US Investors. The report identified common investment mistakes as cited by academics and professionals across several fields including business, economics, finance, psychology, and sociology.

The report identified nine common mistakes, which were also used as the basis for an Investor Bulletin from the SEC in 2014. The good news is that I think you can avoid making all nine of these mistakes in three relatively easy ways.

First, let's look at the mistakes.

The Mistakes

- Active Trading: An investor using an active trading investment strategy engages in regular, ongoing buying and selling of investments. This kind of investor purchases investments and continuously monitors their activities in order to take advantage of profitable conditions in the market. The Report concludes that active trading generally results in the underperformance of an investor’s portfolio.

- Disposition Effect: The disposition effect is the tendency of an investor to hold on to losing investments too long and sell winning investments too soon. In the months following the sale of winning investments, these investments often continue to outperform the losing investments still held in the investor’s portfolio.

- Focusing on Past Performance of Mutual Funds and Ignoring Fees: When deciding to purchase shares in a mutual fund, the Report indicates that some investors focus primarily on the mutual fund’s past annualized returns and tend to disregard the fund’s expense ratios, transaction costs, and load fees, despite the harm these costs and fees can do to their investment returns.

- Familiarity Bias: Familiarity bias refers to the tendency of an investor to favor investments from the investor’s own country, region, state or company. Familiarity bias also includes an investor’s preference for “glamour investments;” that is, well-known and/or popular investments. Familiarity bias may cause an investor’s portfolio to be inadequately diversified, which can increase the portfolio’s risk exposure.

- Manias and Panics: Financial “mania” or a “bubble” is the rapid rise in the price of an investment, reflecting a high degree of collective enthusiasm or exuberance regarding the investment’s prospects. This rapid rise is usually followed by a contraction in the investment’s price. The contraction, or “panic” occurs when there is wide-scale selling of the investment that causes a sharp decline in the investment’s price.

- Momentum Investing: An investor using a momentum investing strategy seeks to capitalize on the continuance of existing trends in the market. A momentum investor believes that large increases in the price of an investment will be followed by additional gains and vice versa for declining values.

- Naïve Diversification: Naïve diversification occurs when an investor, given a number of investment options, chooses to invest equally in all of these options. While this strategy may not necessarily result in diminished performance, it may increase the risk exposure of an investor’s portfolio depending upon the risk level of each investment option.

- Noise Trading: Noise trading occurs when an investor makes a decision to buy or sell an investment without the use of fundamental data (that is, economic, financial, and other qualitative or quantitative data that can affect the value of the investment). Noise traders generally have poor timing, follow trends, and overreact to good and bad news in the market.

- Inadequate Diversification: Inadequate diversification occurs when an investor’s portfolio is too concentrated in a particular type of investment. Inadequate diversification increases the risk exposure of an investor’s portfolio.

Three Ways to Avoid Them

1. Let the markets work for you. Outsmarting other investors is tough, especially when you add in transaction costs. Invest in the broad markets, keep your transaction costs down, and structure your portfolio around expected dimensions of returns.

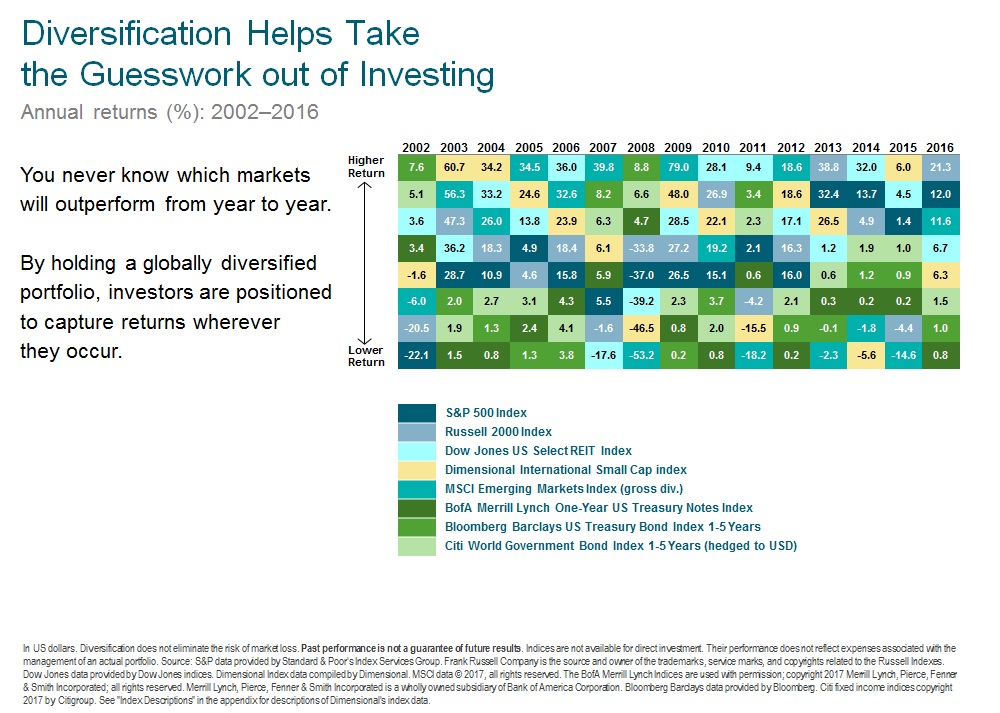

2. Diversify smartly. Diversification reduces risk that don't add to expected returns. Nearly half of the world's opportunities are outside the US.

3. Have a plan. Investors are people that are subject to normal emotions. Having a plan in place that you can review when the going gets tough can make the difference in achieving your goals or not. Markets reward discipline.

That's it, employ those three solutions and you will be well on your way to being a successful investor. Need help? Get in touch for a free review of your plan and portfolio.