The US stock markets posted impressive gains in Q1 2017 as the “Trump Rally” that began the day after his surprise victory in November of last year showed few signs of losing steam. Expectations of lower taxes, less regulation, and increased infrastructure spending have continued to provide the fuel to propel stocks higher.

The Federal Reserve raised its benchmark interest rate a quarter of a point to 1%, the second increase in three months, with indications of further rate hikes to come. Rising rates are generally an impediment to growth and rising stock prices, but the increase also signals improving confidence in the economy. It also was largely in-line with expectations. If anything, the fear has been that the Fed would raise rates even higher or more often.

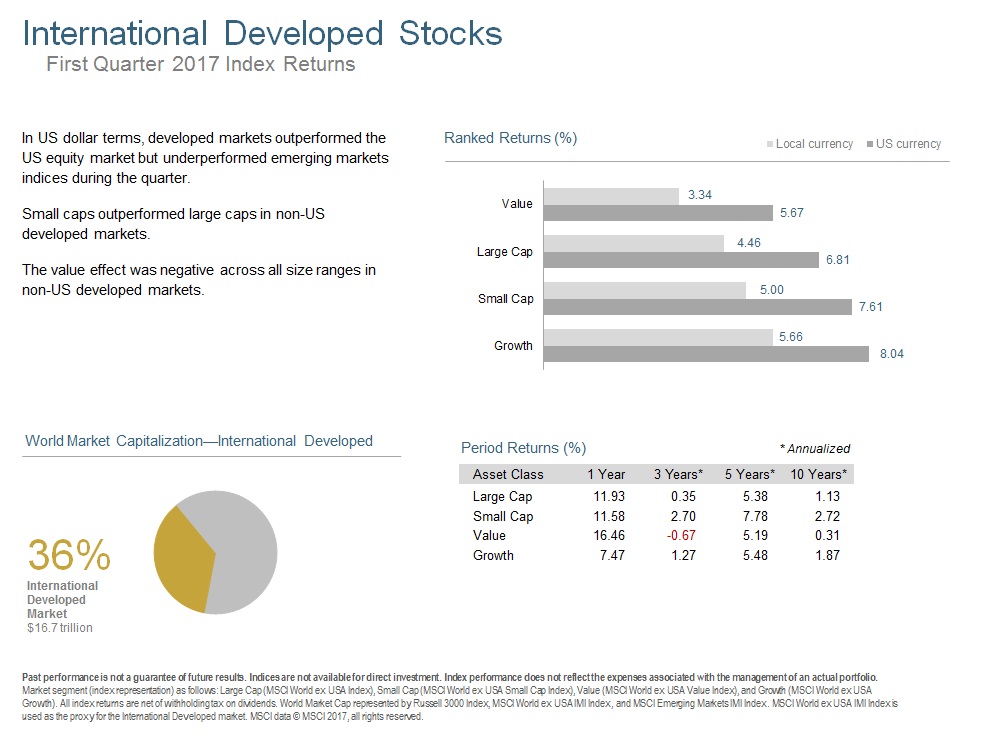

International markets, both developed and emerging, posted even stronger gains while commodities, REITs, and bonds lagged. In the fixed income space, domestic bonds outpaced foreign, and municipals did slightly better than government or corporate bonds.

US Large cap stocks and value stocks outperformed small and growth segments.

If you weren’t paying close attention, you may have missed the significant rally in emerging markets stocks. This is just another example of an out of favor asset class turning when you may have least expected it, given the protectionist tenor and anti-globalist rhetoric coming from Washington DC. Believe it or not, the Mexican Peso was the top performing global currency versus the US Dollar!

This is another reminder of why we practice disciplined asset allocation based on your goals, risk tolerance, and risk capacity instead of trying to outguess the markets. It also serves to illustrate that there is a world of opportunity out there, and staying too close to home can cause us to miss out.

The Q1 2017 Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

As always, if current markets have you concerned about your portfolio, please get in touch for a free review.