Do you love numbers? I mean, really have a strong attraction to them? For the 52% of Americans that own stocks[i], there may have been some arithmophilia (defined as a strong attraction to, or love of numbers) this week. After over a month of close calls, the Dow Jones Industrial Average finally closed above 20,000 on Wednesday. While you may be hard pressed to find anyone that would describe the mood of the markets as exuberant, there is definitely a different vibe to the beginning of this year versus last.

In his recent Down to The Wire article, DFA’s Weston Wellington focused on last year’s case of numerophobia. Okay, he actually didn't get into some people's irrational fear of numbers, but he did explore the foreboding theme that seemed prevalent for much of 2016. He also shows that while scaling last year’s “Wall of Worry”, the stock market had a pretty good year. Funny how that works.

Over the past couple of years, I’ve also written several Accountable Updates that focused on staying the course during some of the more fearful periods. A few examples:

What all of these pieces offer now is good perspective of the benefits of discipline and letting the markets work for us. If you did a good job of managing your fear and avoiding the temptation to sell during some of the rough patches, congratulations. Now comes the challenge of keeping those positive feelings in check and not letting recent performance lure you into taking on more risk than you should.

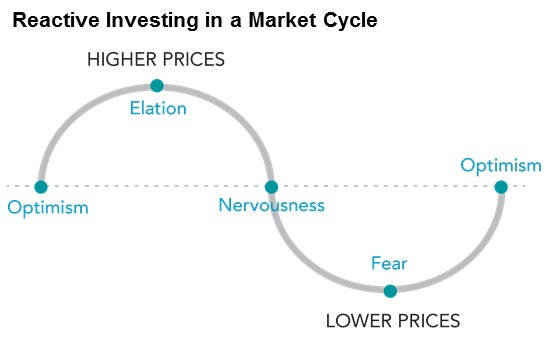

Controlling our emotions can be easier said than done, but it’s not our feelings we need to reign in. It is perfectly normal to feel nervousness, fear, optimism, and elation as markets gyrate. However, the actions we take as the result of those emotions is manageable. So, if you find yourself suddenly loving an investment idea that would have kept you up at night not so long ago, now is probably a good time for therapy.

At the very least, it may be time to get in touch for a free portfolio review. That shouldn't be too scary.

[i] http://www.gallup.com/poll/190883/half-americans-own-stocks-matching-record-low.aspx