"Every single human being" should short treasuries.

So said Nassim Nicholas Taleb, speaking at a conference in Moscow on February 4, 2010. Taleb, you may recall, rose to fame with his 2007 book, "The Black Swan". In the book , he discusses the impact of unpredictable, low probability events and our tendency to oversimplify explanations for them after the fact. The timing of the publication, just before the mortgage crisis and stock market meltdown, resulted in Taleb being a frequent commentator in the financial press. His views most often represented cynical spins on markets and the economy.

He also recommended buying gold in that same speech.

To his credit, in a recent commencement address at American University of Beirut, he also said,

"I hesitate to give advice because every major single piece of advice I was given turned out to be wrong and I am glad I didn’t follow them....

...If you give advice, you need to be exposed to losses from it."

While hindsight is 20/20, history teaches us that making these kind of prognostications are just as likely to make you infamous as they are to make you famous. Let's look at how Taleb's thoughts on US Treasury Bonds worked out.

I used Kwanti Portfolio Labs portfolio analytics software to compare three hypothetical investments results made on the day of his Moscow presentation through yesterday, 9/1/16. The investments were DFA Intermediate Government Fixed Income Portfolio (DFIGX), the Barclays US Treasury Long Index, and the Gold Spot price. As you can see from the chart below, gold was the worst performer of the bunch. Had you been short treasuries, those returns would have been essentially THE INVERSE (plus borrowing costs) of what you see reflected.

All of this is not to pick on Mr. Taleb. He is one of a handful of reliable pessimists that any "half empty glass" world view TV show, magazine writer, or forum will put in front of microphone when that perspective is desired. There are just as many "sunshine pumpers" alternately offered for opposing views.

The criticism I offer is that much less exciting, yet evidenced based, approaches have shown that the main factors influencing the price of bonds are the length of maturity (term) and the underlying credit quality (credit). Pursuing strategies that seek to take advantage of these premiums have been effective, especially when real returns (after inflation) have been negative in many countries for the past few years.

The following "Issue Brief" from DFA delves into this a little further.

Negative Real Returns

September 2016

Nominal interest rates are currently below zero in many countries, including Germany, Denmark, Switzerland, Sweden, and Japan.

These levels have turned the common belief that zero is the lower bound for such rates on its head. While negative nominal rates are a relatively new phenomenon, periods of widespread negative real returns across countries have been quite common.

WHY CARE ABOUT REAL RATES OF RETURN?

In 1970, a loaf of bread cost 25 cents. A gallon of gas cost 36 cents. Today, an average loaf of bread and a gallon of gas each cost around two dollars.[1] When the prices of goods and services increase, consumers can buy fewer of them with every dollar they have saved. This is called inflation, and it eats into investors’ returns.

Real rates of return are adjusted for inflation, so they account for changes in the purchasing power of a dollar over the life of an investment. Because inflation affects the cost of living, investors must consider the inflation-adjusted—or real—return of their investments. When inflation outpaces the nominal returns on an investment, investors experience negative real returns and actually lose purchasing power.

BRIEF HISTORY: TREASURY BILL RETURNS

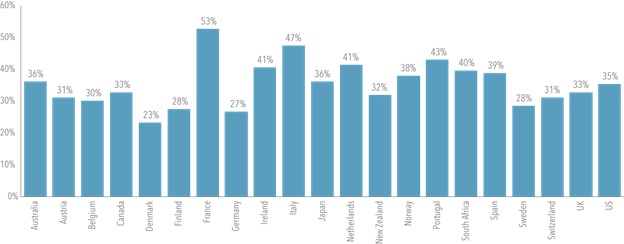

Exhibit 1 shows the annual real returns on one-month US Treasury bills. From 2009 to 2015, the annual real return was negative. This circumstance is not unprecedented. Since 1900, the US has had negative real returns in over a third of those years. And negative real returns on government bills are not exclusive to the US. All countries listed in Exhibit 2 have had negative real returns on their respective government bills in at least one out of every five years from 1900 to 2015.

Exhibit 1. Annual Real Returns of One-Month US Treasury Bills

Source: Dimson, Marsh, and Staunton (DMS); Morningstar.

Exhibit 2. Percent of Years with Negative Real Returns on Government Bills, 1900–2015

Source: Dimson, Marsh, and Staunton (DMS); Morningstar.

BOND INVESTORS MAY GET MORE THAN THE BILL RETURN

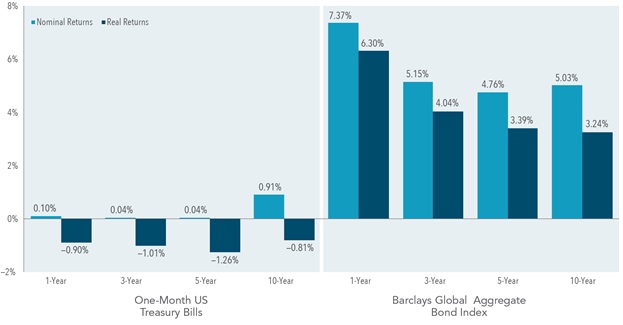

In the current low-yield environment, rolling over short-term bills may not seem appealing to investors keen on protecting their purchasing power. Exhibit 3 shows that the return of one-month US Treasury bills has not kept pace with inflation[3] over the past 10 years. But even when the real return on bills is negative, a relatively common occurrence, bond investors may still achieve positive expected real returns by broadening their investment universe. The bond market is composed of thousands of global bonds with different characteristics. Many of those bonds allow investors to target global term and credit premiums, which in turn may provide positive real returns even in low interest rate environments. Exhibit 3 also shows that the Barclays Global Aggregate Bond Index has outpaced inflation while maintaining low real return volatility of 3.4% annualized over the past 10 years.

Exhibit 3. Trailing Annualized Returns

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Trailing returns are as of June 2016. The Barclays Global Aggregate Bond Index is hedged to USD. Real Return = [(1 + Nominal Return)/(1 + Inflation)] − 1. Sources: Barclays, Morningstar. Barclays indices copyright Barclays 2016.

Global diversification is often thought of as a tool for reducing risk. However, when it comes to fixed income, global portfolios can also play an important role in the pursuit of increased expected returns. Even if the expected real returns of bonds in one country are negative, another yield curve may provide positive expected real returns. The flexibility to pursue higher expected returns by investing in bonds around the world can be an important defense against low, and even negative, yields.

SUMMARY

The goal of many investors is to grow some (or all) of their savings in real terms. Even in a low interest rate environment, there may be bond investments that can still achieve this goal. In particular, investors who target global term and credit premiums should be better positioned to pursue higher expected returns.

[1]. Source: Bureau of Labor Statistics.

[2]. Measured as changes in the Consumer Price Index (CPI), which is defined by the US Department of Labor, Bureau of Labor and Statistics.

[3]. Measured as changes in the Consumer Price Index (CPI), which is defined by the US Department of Labor, Bureau of Labor and Statistics.

Source: Dimensional Fund Advisors LP.

All expressions of opinion are subject to change. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Past performance is no guarantee of future results. There is no guarantee an investing strategy will be successful. Diversification does not eliminate the risk of market loss.