We Have Liftoff!

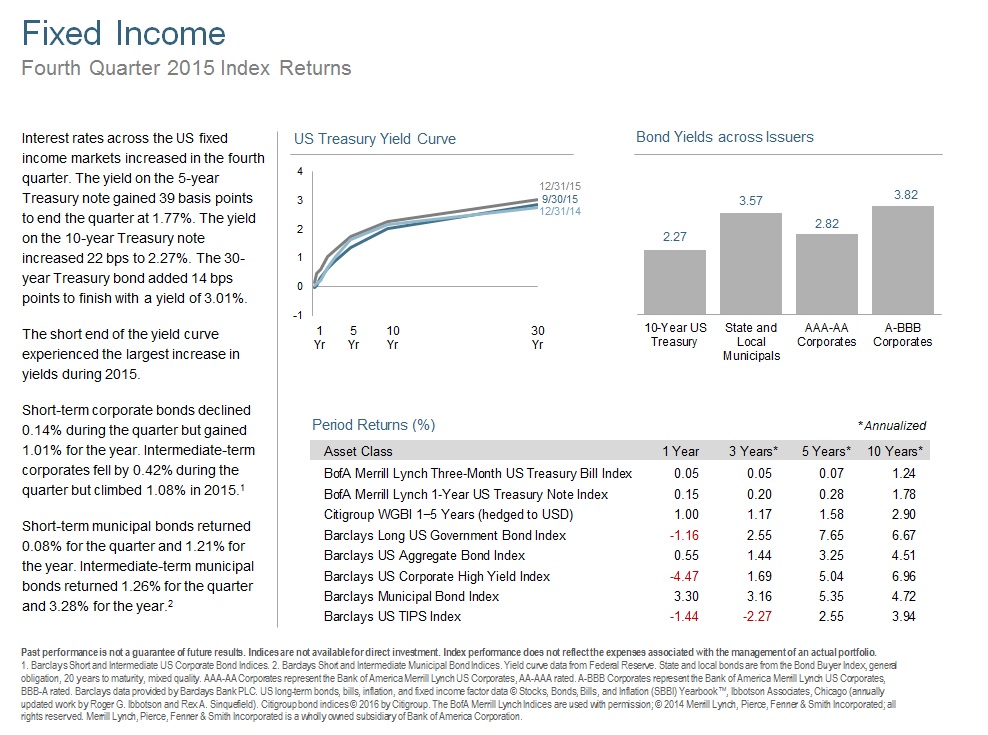

In our Q3 Market Review, we asked if it was time for "Liftoff", a.k.a. the rise in short-term interest rates expected when the Federal Reserve raised rates for the first time since 2006. The focus on that event, however, may have obscured the increase in short-term rates that occurred throughout the year.

The yield on the 2-Year US Treasury note more than doubled in 2015, rising from 0.45% in January to 1.06% at year end[1].

The yield on the 1-Year US Treasury note more than quintupled, from 0.15% to .65% over the same period. The 6-Month US Treasury bill’s yield rose from a low of 0.03% in May to .49% on December 31. Yet, despite the higher rates, we have not experienced the corresponding financial storm that many predicted in the fixed income market.

The question of how far the Fed will go in raising its overnight target rate is still open. Similarly, we can ask ourselves a more complex question: Is the market leading the Fed or is the Fed leading the market?

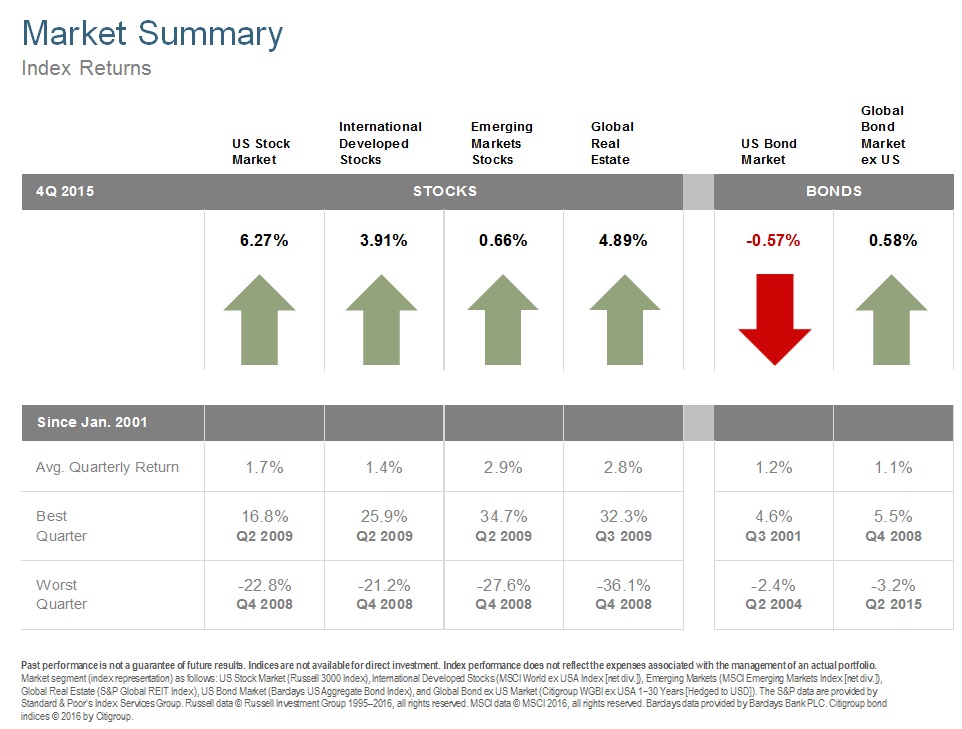

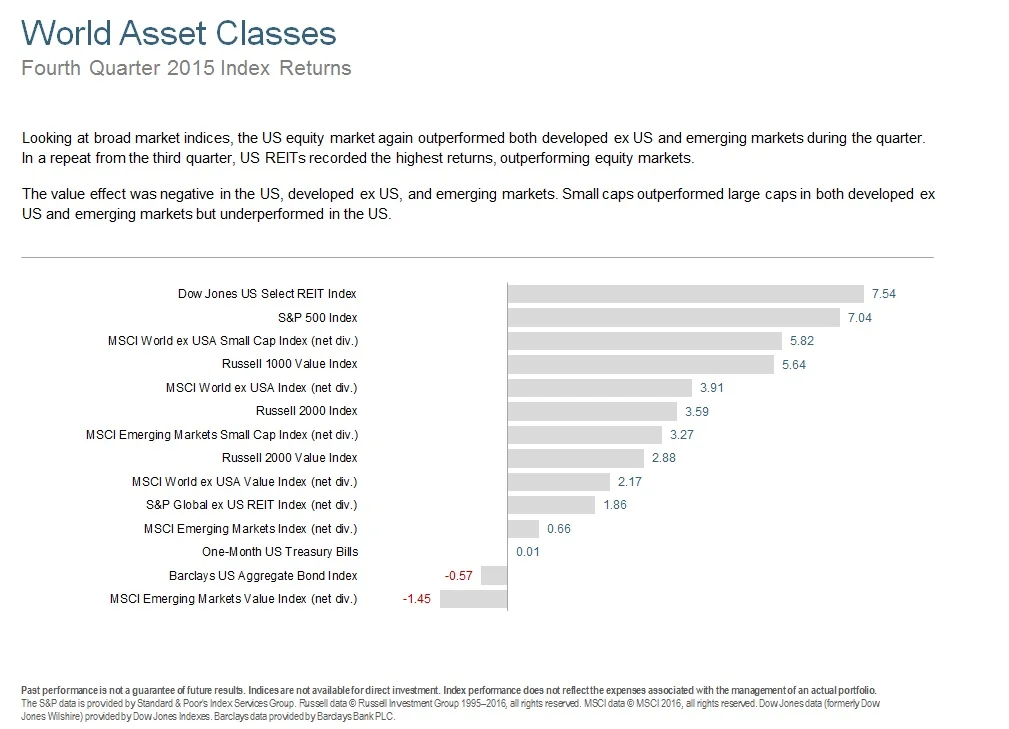

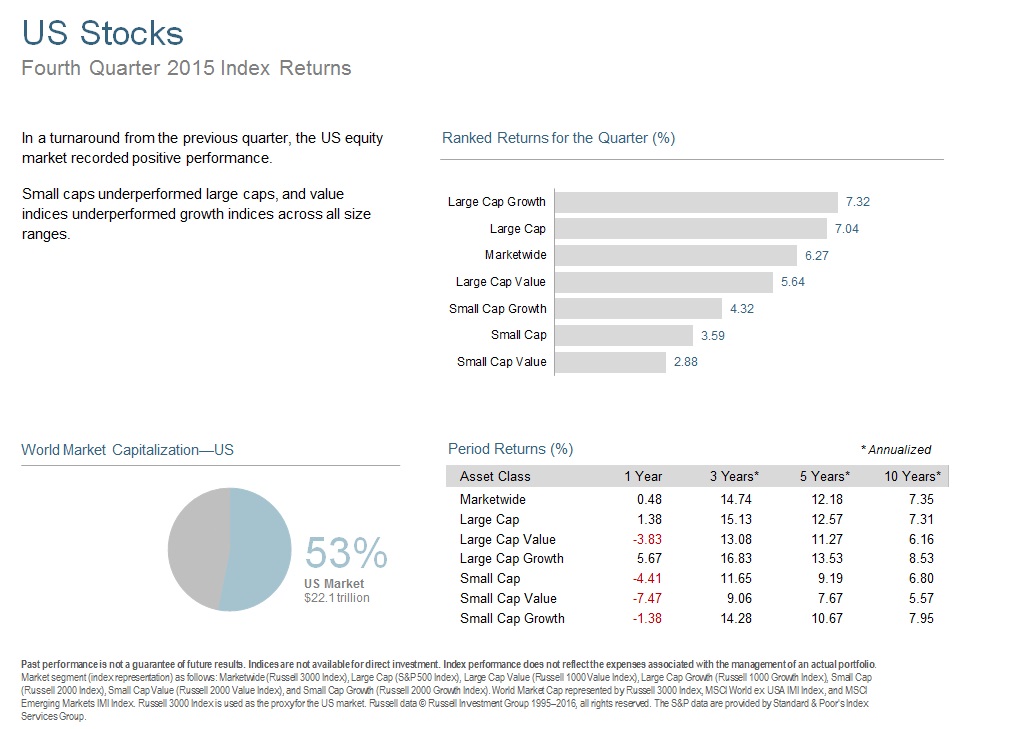

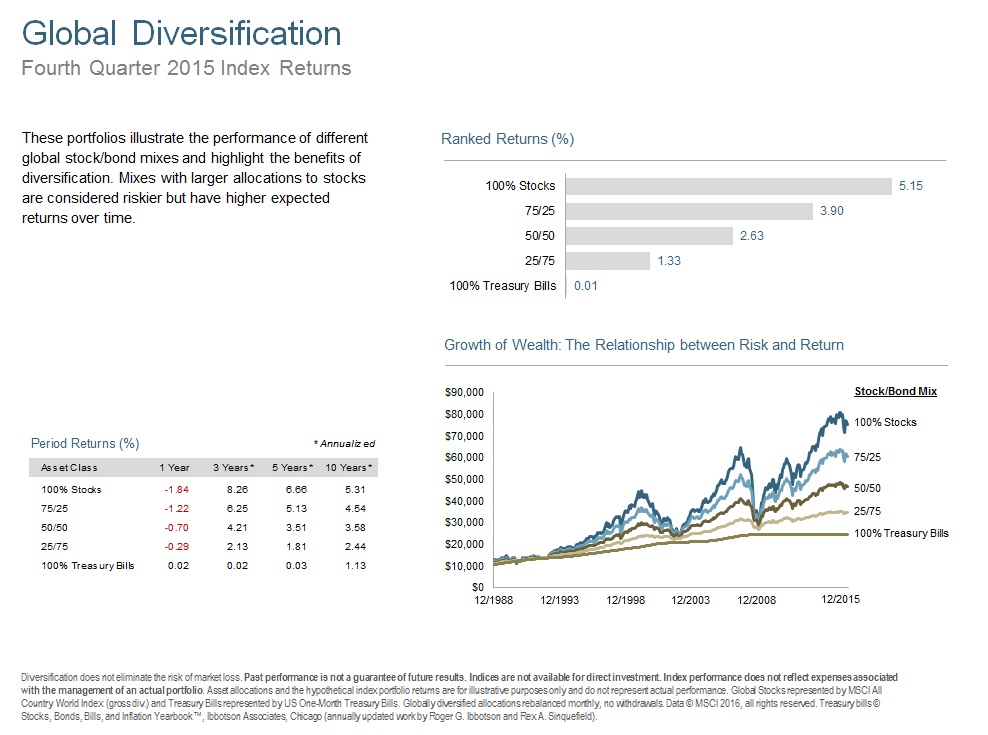

What we do know is that the economy is growing modestly and that inflation remains low in spite of improving labor markets, higher consumer spending, and record vehicle sales. The stock market seemed to acknowledge some of this good news by rallying in October, with the Russell 3000 Index up 6.27% for Q4.

In spite of the rebound, only the first month of the quarter was positive across our models at ATX Portfolio Advisors. The good news for our customers is that our Accountable pricing puts us in your shoes and we only charged advisory fees in the month of October.

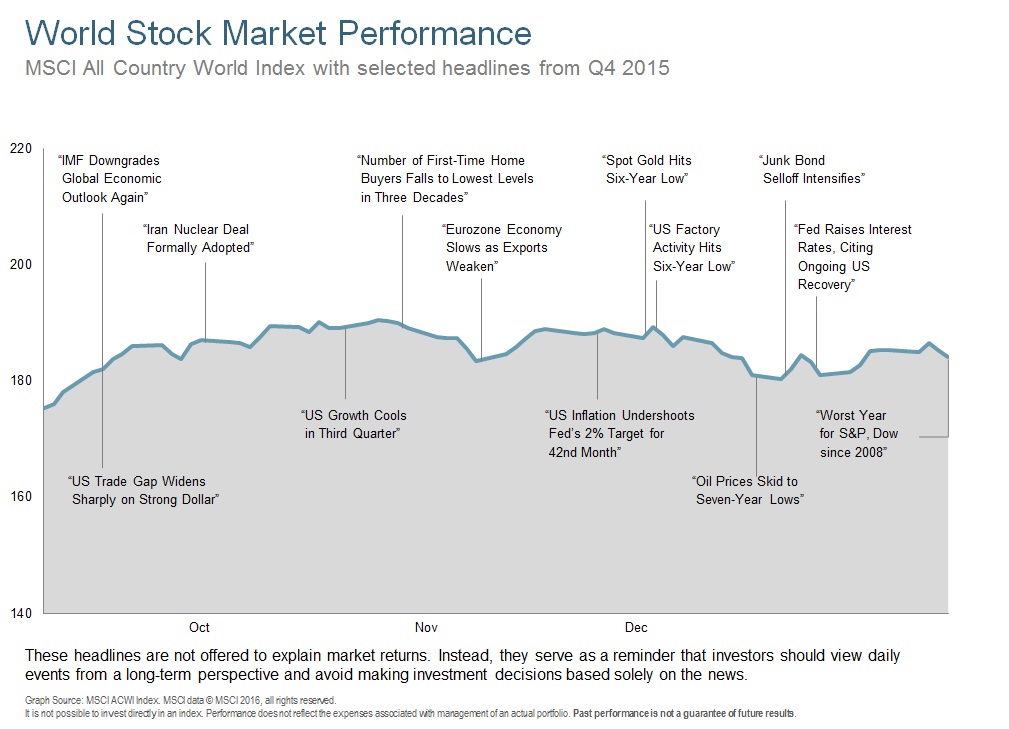

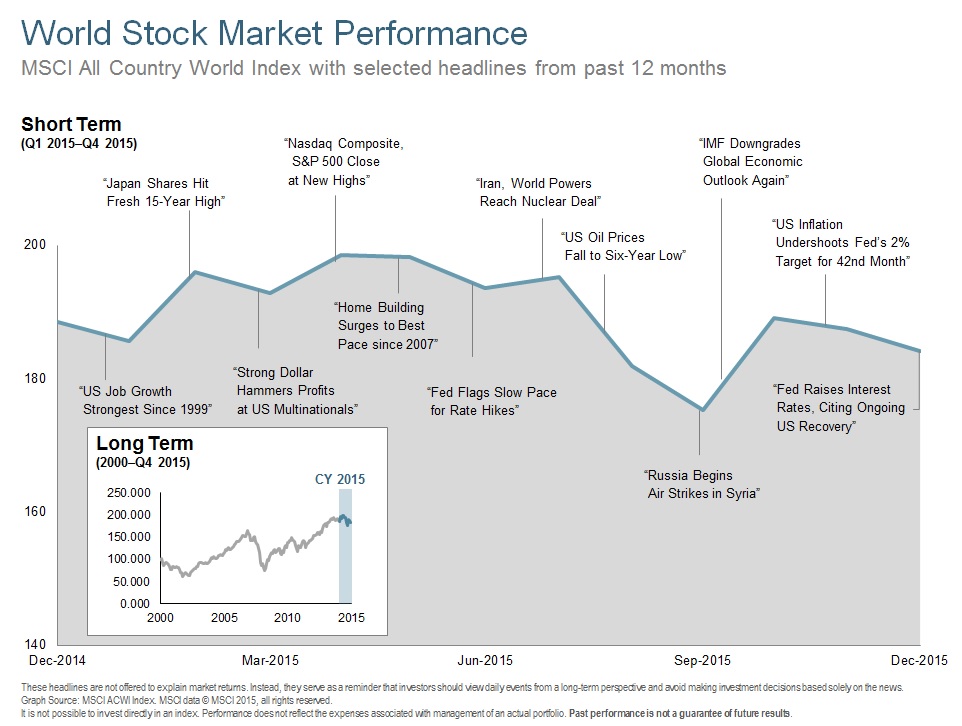

Falling oil prices, the Chinese economy, terrorism, and rising interest rates are just some of the current bricks in the "wall of worry". If you are more worried than normal, it may be a good time to review your plan. Otherwise, have a Happy New Year while you scroll through the Q4 2015 Market Review.

[1]As of December 31, 2015. Source: www.treasury.gov

Fixed income securities are subject to increased loss of principal during periods of rising interest rates and may be subject to various other risks, including changes in credit quality, liquidity, prepayments, and other factors. Sector-specific investments can increase these risks.

All expressions of opinion are subject to change. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.