Volatility

Q2 ended with the long heralded return of the loathsome "V" word, volatility. For what feels like the song that never ends, Greece still can't make a minimum payment on their credit cards. Now, it appears that Puerto Rico has gotten themselves into a similar pickle.

The Chinese, after defying Neptune by raising land from the sea, have been reminded by Sir Isaac Newton that gravity is the strongest force in the universe.

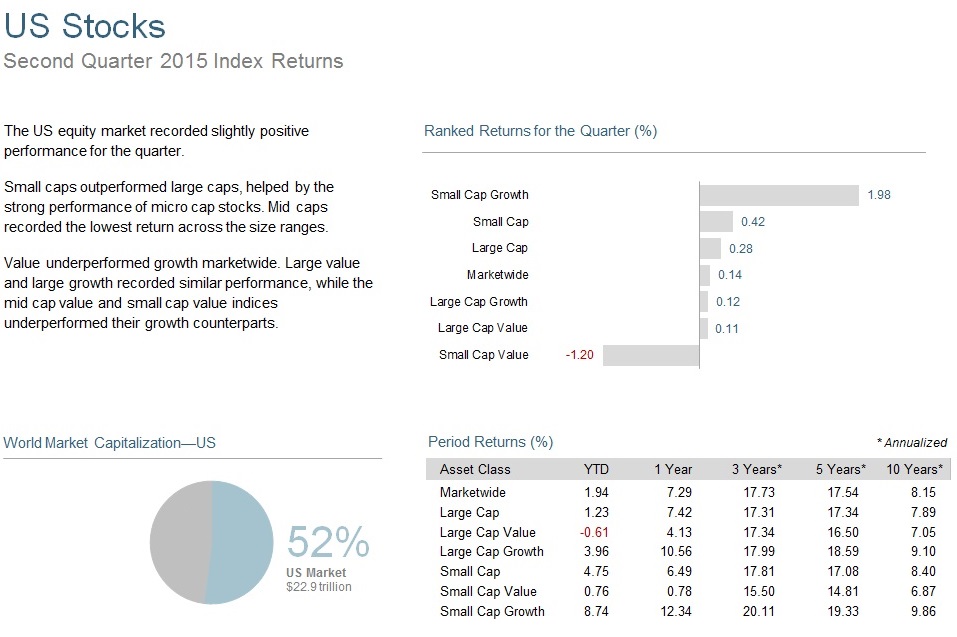

Markets have experienced significant volatility, as if any of the above catalysts were really that surprising, but maybe not for the reasons it appears. The most impacted parts of the market have been interest sensitive areas such as dividend paying consumer stocks, utilities, real estate, and bonds. Why would these seemingly "safe" areas sell off with all of the uncertainty?

Mainly because the economy appears to be getting better, and that will increase the demand for money which will drive up interest rates.

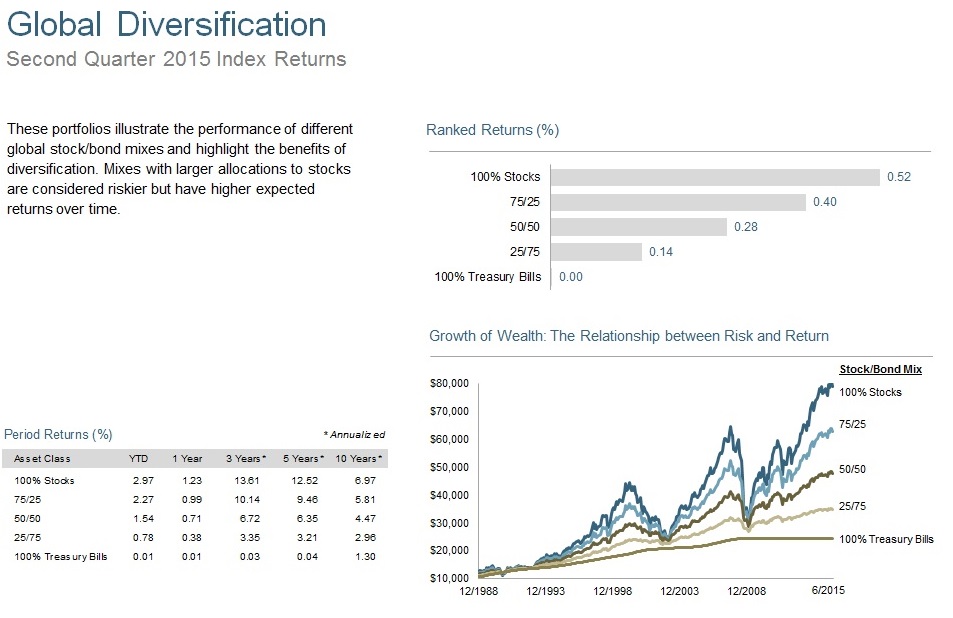

Make sense? It hardly ever does. That's why we practice disciplined allocation using evidenced-based principles as our core philosophies. If you are having trouble sleeping as a result of the recent market chop, we should discuss your goals and risk tolerance, not try to guess what lane to switch to next.

Knowledge is power, and understanding what HAS happened (i.e. the evidence) can help us make better sense about what may happen next.

Please enjoy the ATX Portfolio Advisors Q2 2015 Market Update.

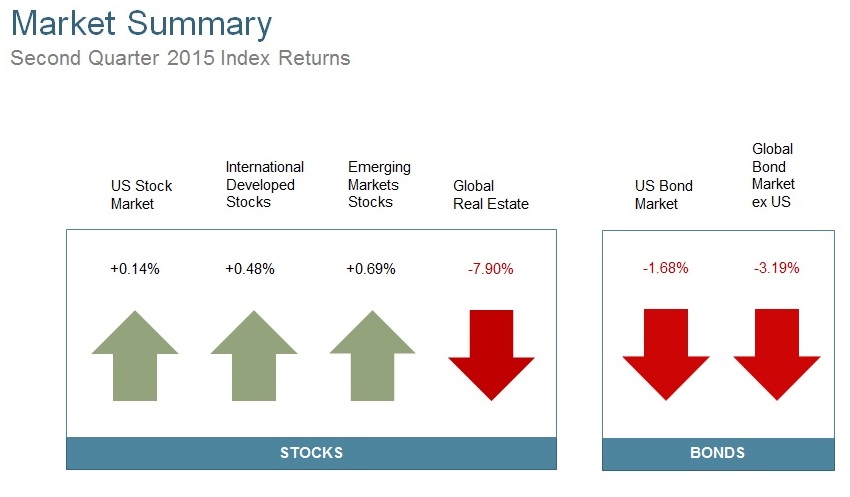

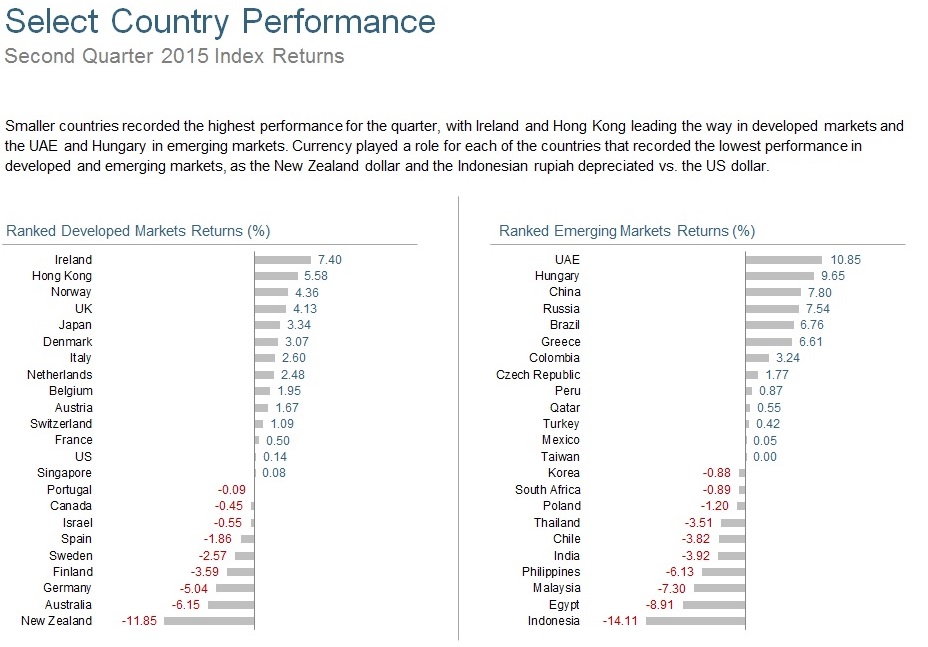

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net div.]), Emerging Markets (MSCI Emerging Markets Index [net div.]), Global Real Estate (S&P Global REIT Index), US Bond Market (Barclays US Aggregate Bond Index), and Global Bond ex US Market (Citigroup WGBI ex USA 1−30 Years [Hedged to USD]). The S&P data are provided by Standard & Poor's Index Services Group. Russell data © Russell Investment Group 1995–2015, all rights reserved. MSCI data © MSCI 2015, all rights reserved. Barclays data provided by Barclays Bank PLC. Citigroup bond indices © 2014 by Citigroup. All index returns are net of withholding tax on dividends. Securities and commodities data provided by Bloomberg.

Yield curve data from Federal Reserve. State and local bonds are from the Bond Buyer Index, general obligation, 20 years to maturity, mixed quality. AAA-AA Corporates represent the Bank of America Merrill Lynch US Corporates, AA-AAA rated. A-BBB Corporates represent the Bank of America Merrill Lynch US Corporates, BBB-A rated. Barclays data provided by Barclays Bank PLC. US long-term bonds, bills, inflation, and fixed income factor data

© Stocks, Bonds, Bills, and Inflation (SBBI) Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield). Citigroup bond indices © 2014 by Citigroup. The BofA Merrill Lynch Indices are used with permission; © 2014 Merrill Lynch, Pierce, Fenner & Smith Incorporated; all rights reserved. Merrill Lynch, Pierce, Fenner & Smith Incorporated is a wholly owned subsidiary of Bank of America Corporation.

Asset allocations and the hypothetical index portfolio returns are for illustrative purposes only and do not represent actual performance. Global Stocks represented by MSCI All Country World Index (gross div.) and Treasury Bills represented by US One-Month Treasury Bills. Globally diversified allocations rebalanced monthly, no withdrawals. Data © MSCI 2015, all rights reserved. Treasury bills © Stocks, Bonds, Bills, and Inflation Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield).