Contradiction

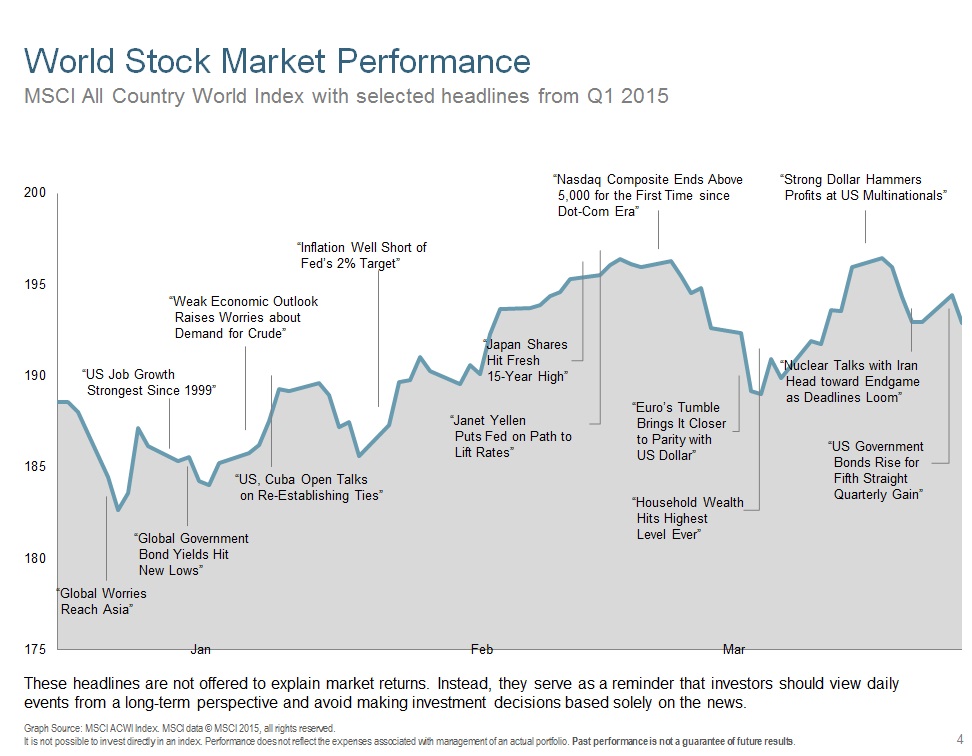

The first quarter of 2015 was a study in contradictions. It was not a robust period for the US economy, but we saw domestic markets make new highs. Oil prices have plummeted, in spite of increased volatility in the Middle East. The US Dollar surged against most foreign currencies, even as interest rates fell yet again. If I tried to outguess the markets, I would probably be at my wits end.

Thankfully, there is a more sensible approach. We can research the dimensions of expected returns, design highly diverse portfolios that pursue market premiums, and build flexibility into the system so that we efficiently and consistently serve up investment solutions for a wide range of needs, in spite of the seemingly incomprehensible gyrations of short term market movements.

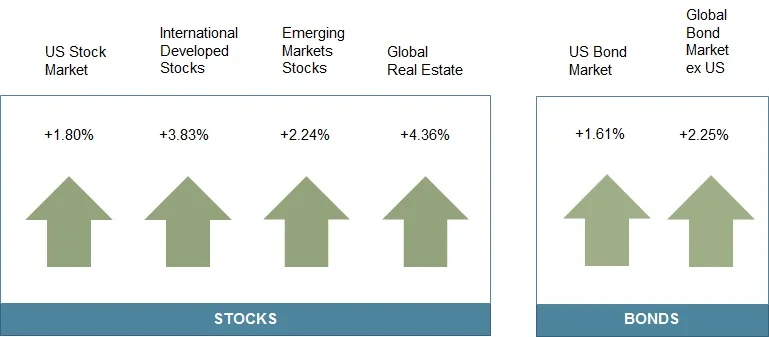

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net div.]), Emerging Markets (MSCI Emerging Markets Index [net div.]), Global Real Estate (S&P Global REIT Index), US Bond Market (Barclays US Aggregate Bond Index), and Global Bond ex US Market (Citigroup WGBI ex USA 1−30 Years [Hedged to USD]). The S&P data are provided by Standard & Poor's Index Services Group. Russell data © Russell Investment Group 1995–2015, all rights reserved. MSCI data © MSCI 2015, all rights reserved. Barclays data provided by Barclays Bank PLC. Citigroup bond indices © 2014 by Citigroup.

World Asset Classes

Looking at broad market indices, developed markets outside the US outperformed both the US and emerging markets during the quarter. US REITs outperformed US broad equity market indices. Growth indices outperformed value indices across all size ranges in the US and in non-US and emerging markets. Small cap indices outperformed large cap indices in all regions, particularly in the US.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

The S&P data is provided by Standard & Poor's Index Services Group. Russell data © Russell Investment Group 1995–2015, all rights reserved. MSCI data © MSCI 2015, all rights reserved. Dow Jones data (formerly Dow Jones Wilshire) provided by Dow Jones Indexes. Barclays data provided by Barclays Bank PLC.

US Stocks

The US equity market recorded positive performance for the quarter. Small caps outperformed large caps, helped by the strong performance of small cap growth stocks. Value indices under-performed across all size ranges.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: Marketwide (Russell 3000 Index), Large Cap (S&P 500 Index), Large Cap Value (Russell 1000 Value Index), Large Cap Growth (Russell 1000 Growth Index), Small Cap (Russell 2000 Index), Small Cap Value (Russell 2000 Value Index), and Small Cap Growth (Russell 2000 Growth Index). World Market Cap represented by Russell 3000 Index, MSCI World ex USA IMI Index, and MSCI Emerging Markets IMI Index. Russell 3000 Index is used as the proxy for the US market. Russell data © Russell Investment Group 1995–2015, all rights reserved. The S&P data are provided by Standard & Poor's Index Services Group.

International Developed Stocks

Developed markets outside the US outperformed both the US and emerging markets indices in US dollar terms. Small caps slightly outperformed large caps. Value indices under-performed growth indices, particularly in large caps. The Swiss franc was the only major developed markets currency to outperform the US dollar. The Swiss central bank removed the three-year currency cap to the euro.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: Large Cap (MSCI World ex USA Index), Small Cap (MSCI World ex USA Small Cap Index), Value (MSCI World ex USA Value Index), and Growth (MSCI World ex USA Growth). All index returns are net of withholding tax on dividends. World Market Cap represented by Russell 3000 Index, MSCI World ex USA IMI Index, and MSCI Emerging Markets IMI Index. MSCI World ex USA IMI Index used as the proxy for the International Developed market. MSCI data © MSCI 2015, all rights reserved.

Emerging Markets Stocks

As a group, emerging markets earned positive returns in US dollar terms, despite the US dollar appreciating vs. most emerging markets currencies during the quarter. Small cap indices outperformed large cap indices. Value indices under-performed growth indices across all size ranges.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: Large Cap (MSCI Emerging Markets Index), Small Cap (MSCI Emerging Markets Small Cap Index), Value (MSCI Emerging Markets Value Index), and Growth (MSCI Emerging Markets Growth Index). All index returns are net of withholding tax on dividends. World Market Cap represented by Russell 3000 Index, MSCI World ex USA IMI Index, and MSCI Emerging Markets IMI Index. MSCI Emerging Markets IMI Index used as the proxy for the emerging market portion of the market. MSCI data © MSCI 2015, all rights reserved.

Real Estate Investment Trusts (REITs)

US REITs outperformed the broad US equity market during the quarter. In contrast, REIT indices outside the US under-performed broad market non-US equity indices.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Number of REIT stocks and total value based on the two indices. All index returns are net of withholding tax on dividends. Total value of REIT stocks represented by Dow Jones US Select REIT Index and the S&P Global ex US REIT Index. Dow Jones US Select REIT Index used as proxy for the US market, and S&P Global ex US REIT Index used as proxy for the World ex US market. Dow Jones US Select REIT Index data provided by Dow Jones ©. S&P Global ex US REIT Index data provided by Standard and Poor’s Index Services Group © 2014.

Select Country Performance

Russia rebounded from its double-digit negative returns in the fourth quarter, recording the highest emerging markets return as the ruble climbed against the dollar and Russian energy stocks posted strong performance. Greek financial stocks influenced the performance of the local market, which recorded the lowest return among emerging markets countries. Despite the fall in the Danish krone, Denmark produced the highest return among developed markets countries.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Country performance based on respective indices in the MSCI World ex US IMI Index (for developed markets), Russell 3000 Index (for US), and MSCI Emerging Markets IMI Index. All returns in USD and net of withholding tax on dividends. MSCI data © MSCI 2015, all rights reserved. Russell data © Russell Investment Group 1995–2015, all rights reserved. UAE and Qatar have been reclassified as emerging markets by MSCI, effective May 2014.

Commodities

Commodities were broadly negative during the first quarter. The Bloomberg Commodity Index fell 5.94%. Lean hogs led the decline, shedding 23.73%, while coffee and nickel followed by losing 21.59% and 18.55%, respectively.

Within the energy complex, WTI crude oil fell 14.87% and natural gas declined 11.02%.

Silver was the biggest gainer, returning 6.13%, and cotton followed with a gain of 4.25%.

Past performance is not a guarantee of future results. Index is not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

All index returns are net of withholding tax on dividends. Securities and commodities data provided by Bloomberg.

Fixed Income

Interest rates across the US fixed income markets generally declined in the first quarter. The 5-year Treasury note dropped 28 basis points to end the period yielding 1.38%. The 10-year Treasury note declined 24 basis points to finish at 1.93%. The 30-year Treasury bond fell 21 basis points to finish with a yield of 2.54%.

On the short end of the curve, the 2-year Treasury note shed 12 basis points to finish at 0.66%. Securities within one year to maturity were relatively unchanged.

Long-term corporate bonds returned 3.29% for the quarter. Intermediate-term corporate bonds followed by adding 1.89%.

Municipal revenue bonds (1.13%) slightly outpaced municipal general obligation bonds (0.87%). Long-term muni bonds outgained all other areas of the muni curve, returning 1.58%.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Yield curve data from Federal Reserve. State and local bonds are from the Bond Buyer Index, general obligation, 20 years to maturity, mixed quality. AAA-AA Corporates represent the Bank of America Merrill Lynch US Corporates, AA-AAA rated. A-BBB Corporates represent the Bank of America Merrill Lynch US Corporates, BBB-A rated. Barclays data provided by Barclays Bank PLC. US long-term bonds, bills, inflation, and fixed income factor data

© Stocks, Bonds, Bills, and Inflation (SBBI) Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield). Citigroup bond indices © 2014 by Citigroup. The BofA Merrill Lynch Indices are used with permission; © 2014 Merrill Lynch, Pierce, Fenner & Smith Incorporated; all rights reserved. Merrill Lynch, Pierce, Fenner & Smith Incorporated is a wholly owned subsidiary of Bank of America Corporation.

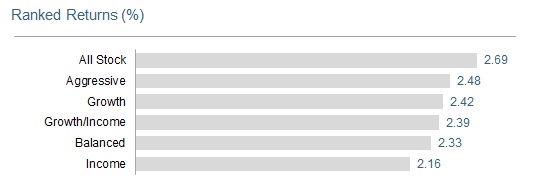

Accountable Portfolios℠

The Accountable Portfolios℠ illustrate the performance of different global stock/bond strategies and highlight the benefits of diversification. Mixes with larger allocations to stocks are considered riskier but have higher expected returns over time.

Q1 2015 (After expenses)

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Hypothetical model portfolio returns are for illustrative purposes only and do not represent performance of an actual portfolio. For illustrative purposes, the portfolios are models that are re-balanced monthly with all dividends reinvested. Expenses are calculated at .75% annualized, but are waived during any month of negative returns. Inception of the Accountable Portfolios℠ was 1/1/15. Results are not audited.