Photo by frankieleon

“7th round! That's five players from Westlake in “The League” next year!”

That was a text from a buddy shortly after the NFL’s draft last spring. Westlake is the Austin, TX community in which my family and I reside. Our school district is frequently ranked among the best performers in just about everything. Whether its academics, athletics, or other extra-curricular activities, the achievements of our children are a source of pride throughout the community.

With summer coming to a close and fall football practice already underway, I was reminded of that text message and was curious just how impressive of a feat producing that many professional players really was.

According to the NCAA 2013-14 High School Athletics Participation Survey, there were 1,093,234 participants in high school football in 2013-14. This year, there were 255 draft slots in the National Football League. Since those participants range across four classes, about 1020 will ultimately be drafted over the four year period starting in 2018. That’s around .009%, or in this case, 1 out of 1072.

Those are pretty low odds, but how much better are the chances at a high school that has had arguably one of the best records around of producing NFL talent? I looked up the biographies of those five current players and determined that they graduated high school between 1997 and 2011. Then I looked at last year’s rosters for the Westlake High School teams (Freshman, Junior Varsity, and Varsity) and counted 280 total players. Extrapolated over the fourteen year period of 1997-2011, I estimated 3,920 had suited up for the Chaps in that timeframe. Five of those making it to the pros equates to 1 out of 784, or about .01%.

Now that is better than the national average, but still ample reason to encourage our young athletes to study hard after practice.

You are probably wondering what does this have to do with investing? For the same reasons we encourage our children to plan to make a living with their brains, statistics suggest we should do the opposite with our investments. That's right, less time and thought about what we buy and sell.

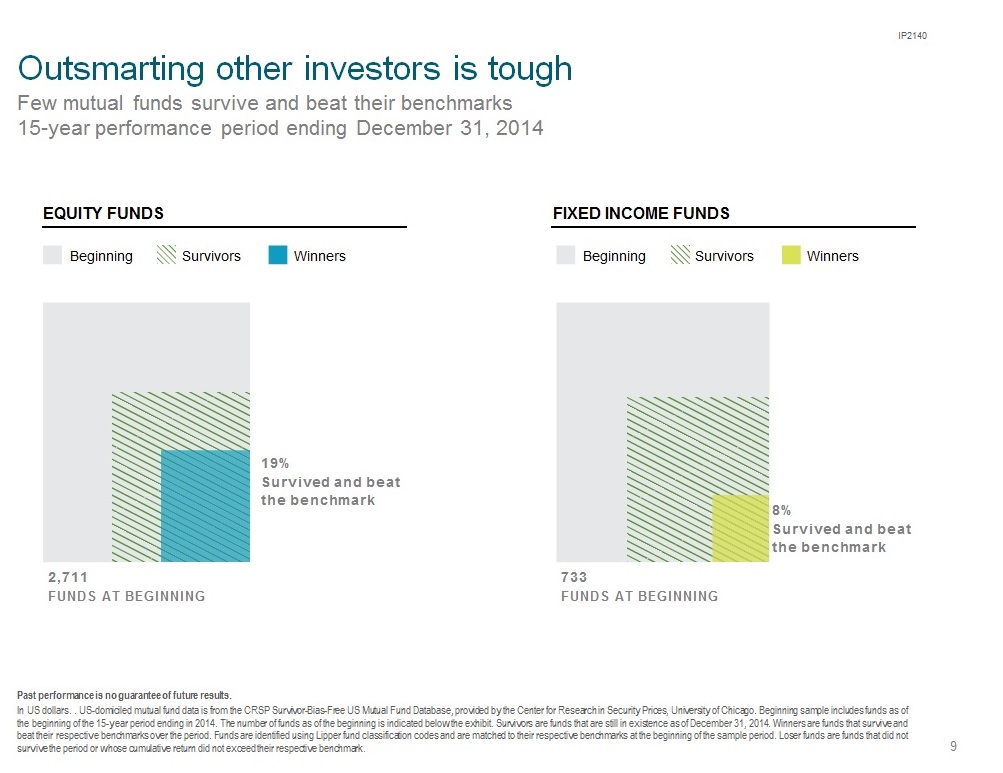

Over the ten years ending in 2014, only 18% of actively managed stock funds (the ones where really smart people spend a lot of time studying what to invest in) outperformed their respective benchmarks. Looking at it from a slightly different angle, in the year 2000 there were 2,711 actively managed equity funds, according to CRSP Survivor-Bias-Free Us Mutual Fund Database. 682 of those (25%) beat their respective benchmarks over the ten years ending in 2009. So certainly, your odds would improve if you just focused on buying the last decade’s winners, right?

Barely! Of those 682 “winners”, only 28% beat their respective benchmarks over the following five years ending in 2014.

The next ten years won’t necessarily look like the last but even if active managers have twice as much success as they had over the past decade, the odds would still be about the same as a coin flip. While that’s substantially greater than Junior’s chances of suiting up with pads and helmet on Sundays, it’s not enough evidence to convince us to try and outguess the market.

That should leave plenty of time for homework and watching football.